Baby boomers and Gen X will largely stay in the homes they currently live in, even after retiring. Image Credit: Bank of America

Baby boomers and Gen X will largely stay in the homes they currently live in, even after retiring. Image Credit: Bank of America Gen X and baby boomer homeowners in the United States will remain in the homes that they currently live in beyond retirement, according to a new report from Bank of America.

Combined, these two groups make up 70 percent of the 85 million current homeowners in the U.S. This trend contributes to the 50 percent decrease in active home listings – from 1,468,901 in July 2016 to 732,276 in September of 2022.

"Our latest Homebuyer Insights Report flips the notion that large numbers of retirees are spending winter months in warmer locations on its head," said Matt Vernon, head of retail lending at Bank of America.

"While you might imagine retirement as a spot by the beach or lounging by the pool, over two-thirds of homeowners ages 45 to 76 plan to or have retired in the home they already own – meaning they’re staying put," he said.

The study was conducted between Oct. 19 and Oct. 23. More than 1,500 homeowners between ages 45 and 76 were chosen at random via postal mailings.

Charlotte, NC-based Bank of America is one of the largest financial players in wealth management, trading, and corporate and investment banking.

Not moving on

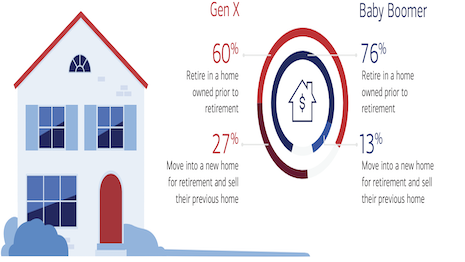

When asked how their homes factor into their plans for retirement, 60 percent of Gen X and 76 percent of baby boomers said that they would retire in a home they had owned prior.

Meanwhile, 27 percent of Gen X and 13 percent of baby boomers said they would move into a new home after they retired and sell the old one.

Participants who are still currently working were asked what they would do if they were to retire immediately. The majority (52 percent) said would stay in their homes. Of these, 32 percent cited wanting to avoid the high prices and interest rates of the current housing market.

Twenty percent said they are taking advantage of their current low mortgage rate, or that they had already paid it off.

A minority of people (10 percent) said they would sell their home in exchange for a home with a lower cost of living, or for the option of leveraging their current home’s equity.

When asked what they would do with the aforementioned equity, 7 percent said they would use it to remodel their home, while 12 percent would invest the earnings in stocks or mutual funds. Sixteen percent said they would use the money to bring their own dreams of retirement to fruition.

Still, they are also thinking of the future of the generations behind them, including those in their own families.

Root and branch

Gen X and baby boomer homeowners plan to support future generations in a number of ways. Nearly 60 percent said they would be willing to offer advice and support regarding home ownership.

That support takes a number of forms.

Thirty-eight percent said they would offer upcoming generations money for a home, or give them their own homes to sell, while 36 percent said they would give their home for the next generation to live in. Twelve percent said they would let the next generation live in their homes alongside them.

Baby boomers and Gen-Xers see owning a home as a worthwhile investment, for both personal and financial reasons. Forty-one percent said it is a place where they have made memories. Thirty-five percent said their homes suit their lifestyle, while 27 percent said it provides them with a feeling of community.

For others, homeownership offers stability in the face of a number of financial variables.

Thirty-eight percent called it a safeguard against the current conditions of the housing market, while 35 percent said it protects them from increasing rent payments.

Overall, it seems there will be room for everyone, no matter where they choose to live.

"This positive conversation and education around the importance of home could influence future generations to have a more optimistic outlook toward purchasing a home of their own," Mr. Vernon said.

"Homeownership in today’s environment may feel like a hard-to-reach goal for some young adults, but maintaining that dialogue with your adult children and being a resource they can turn to will help them make critical decisions that shape their financial future."