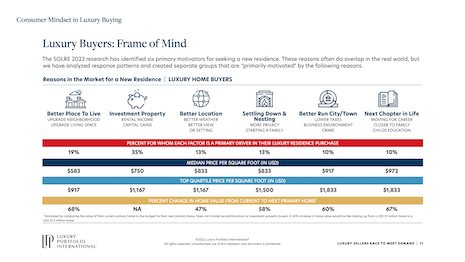

Luxury Portfolio International's State of Luxury Real Estate (SOLRE) 2022 research has identified six primary motivators for seeking a new residence. Source: Luxury Portfolio International

Luxury Portfolio International's State of Luxury Real Estate (SOLRE) 2022 research has identified six primary motivators for seeking a new residence. Source: Luxury Portfolio International Expect to see demand continuing to outstrip supply in the luxury end of the real estate market worldwide, extending a trend from mid-2019 as the COVID-19 pandemic kicked off one of the most spectacular bull runs in the prime residential business worldwide.

What this means is that real estate brokers and agents will have to keep at it to win listings in a highly competitive environment. More creative approaches, better marketing outreach, smarter use of technology and an emphasis on the sphere of influence will help in listings acquisition as potential home-sellers weigh options between different agents, brokerages and networks.

Brokerages will also look to gain market share by poaching top producers from rivals and the commission structure may continue to tilt in the agent’s favor, forcing agencies to develop alternative revenue streams from title and mortgage arms, and stronger value propositions.

Home away from home

Markets with beaches, mountains, lakes, ski slopes and oceans will continue to perform well. But some may become a victim of their own success with resort and second-home locations turning into co-primary or main residences.

Flexible working conditions have led to several affluent consumers making warmer, low-tax, second-home states such as Florida and Texas their primary residence, thus locking up real estate for a far longer period of time.

Beyond North America, affluent consumers – equally seeking safety from the pandemic and not tied too deeply to offices – will continue to seek second or co-primary homes in less densely populated towns close to major urban centers.

Warmer-climate countries such as Spain, Italy and Greece will retain their allure, as will a Middle Eastern financial hub such as Dubai that is fast liberalizing, with citizenship available and a newly adopted Western work week and Saturday-Sunday off.

That said, expect inventory of high-end homes to be tight across key markets. New developments cannot keep pace with the demand, and, in any case, take up to three years to turn from dirt to move-in residences.

Another key driver for continued demand for homes new and old is demographic.

Millennials – consumers born between 1981 and 1996, per the Pew Research Center – are now hitting their key buying stride. On the other hand, the oldest baby boomer turned 75 in 2021, with this group now right-sizing to smaller residences and warmer climes.

Liquid diet

What may help with the listings crunch is the expected rise in interest rates, which in turn will raise the cost of borrowing and refinancing. The U.S. Fed will raise interest rates at least three times in 2022 to curb inflation, which reached almost 7 percent in 2021.

With repeated interest-rate increases, property owners may think it opportune to list properties that they held on to during the height of the pandemic.

Another measure to curb growing inflation is the U.S. Fed’s decision to pull back on buying bonds from the market, amounting to $120 billion a month throughout 2021. That injection of liquidity in the market may have worked to keep the U.S. economy humming along during the pandemic, but now it has led to fears that inflation could derail any progress made.

Long story short, homeowners and investors may think the peak is past and start listing their properties on the market. So that may bring back some balance in the demand-supply situation.

As a corollary, expect the time on market to also increase for luxury properties in key locations as housing inventory grows if the Fed taper and higher interest rates take effect as intended. Expect asking prices to hold, however.

Vicissitudes in international trade will continue to have a domino effect on luxury real estate.

We will continue to see a disruption in the global supply chain. Labor shortages at ports, higher costs of shipping containers, lack of ship-movement data from China, and generally ballooning prices of materials such as lumber, stone, accessories and fittings will plague the real estate industry at all price points.

Add to those supply chain issues the potential for geopolitical surprises.

Home run

Any move from China to invade Taiwan or Russia to send troops into Ukraine may destabilize the financial markets and shut down shipping lanes and air travel if Europe and the United States retaliate with military initiatives and economic sanctions.

The COVID-19 pandemic will continue to cause concern and further lockdowns if the caseload rises dramatically globally. This will obviously again impact cross-border travel and transactions, as well as the ability of several sectors such as hospitality, travel and retail to return to some semblance of normalcy.

In 2022, we expect the home to continue to be at the center of the consumer’s life. Flexible working conditions are here to stay for the next three years or so.

The longer we work from home and maintain high productivity rates, the harder it becomes for corporations and employers to justify 40 hours in a sterile office setting and long commutes other than for culture and collaboration. So, two to three days per week on a staggered, hot-desking schedule may eventually become our common future.

BOTTOM LINE, barring wars, terrorism and a deadlier turn in the COVID-19 pandemic, the real estate industry, especially the luxury end of it, will chug along in 2022 as long as agents are agile in winning listings in a market low on old and new housing stock. Affluent consumers will still insist on quality space, modern amenities and that old staple of luxury homes – location, location, location.