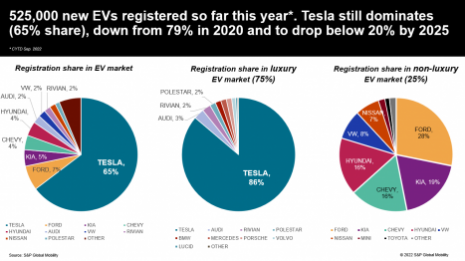

Tesla continues to hold a majority share of the EV market. Source: S&P Global Mobility

Tesla continues to hold a majority share of the EV market. Source: S&P Global Mobility

U.S. automaker Tesla continues to maintain a stronghold in the high-end electric vehicle (EV) market, though several other companies such as Audi, Lexus, Mercedes and BMW are gaining ground.

Tesla accounted for 86 percent of the upmarket electric vehicles registered so far this year, and 65 percent overall. Of the top five EV models by registration, Tesla has four.

“As the overall market transitions to greater EV sales, it is inevitable that Tesla loses market share, though it is likely to remain a top-selling brand,” said Stephanie Brinley, associate director at S&P Global Mobility.

S&P Global Mobility interprets automotive data to provide its customers with insights for business decisions.

No more cruise control

During the first three quarters of 2022, 525,000 EVs were registered, 340,000 of which were manufactured by Tesla.

The brand’s Model Y and Model 3 accounted for 56 percent of EV registrations overall.

The remaining 44 percent of share of overall EV sales is scattered unevenly among several companies, including Hyundai, Chevrolet, Kia and Ford, which are offering options below Tesla’s hefty $50,000 price point.

Though Tesla CEO Elon Musk recently reiterated the company’s plan to release a vehicle at a more affordable price than its Model 3, at present, the vast majority of EVs are from the upper end of the market for consumers with higher incomes.

The company does plan to include two new models within the next three years, including a Cybertruck to debut in 2023 and, eventually, a roadster.

As more consumers show interest in electric vehicles, Ms. Brinley believes that by the end of 2025 the number of EV nameplates will be up more than three times its current number, from 48 to 159. This will outpace Tesla’s ability to add more factories with which to enhance production.

Interestingly, Japanese brands Toyota and Honda have experienced the largest exodus of customers moving toward EVs. The two have been unable to retain customer loyalty to their ICE vehicles while they work on their own transitions to the electric format.

Those consumers were largely captured by Tesla’s Model Y, Model 3, Ford’s Mustang Mach-E, Hyundai’s Ioniq5 and Chevrolet’s Bolt.

Tip top

Still, it will be some time before the mainstream market fully embraces electric vehicles. One factor is the need for further consumer education on the topic.

On the manufacturing end, there is the matter of still-developing infrastructure, and the capacity to produce vehicles at the necessary rate and volume remains limited for the foreseeable future.

Therefore, according to Ms. Brinley, Tesla should still look to maintain its top position for some time to come.

“Profitability and volume growth can continue for [Tesla], and those metrics are more important,” Ms. Brinley said. “We do expect that Tesla will continue to invest in more production capacity and broaden vehicle range to cover more price points, eventually, which can contribute to further growth.

“The EV market is in nascent stages, driven by regulatory requirements and automaker investment as much as consumer demand at this point in time," she said.

"If we transition to an EV-dominant market, which does seem to be the trajectory, there will ultimately be little distinction between the EV market and the light-vehicle market.”