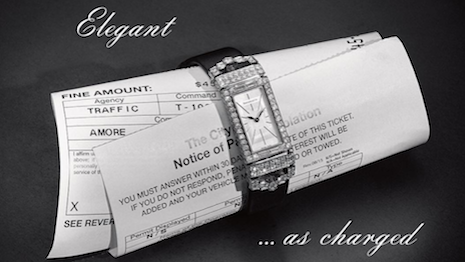

Tiffany & Co.'s modern retelling of an archival ad

Tiffany & Co.'s modern retelling of an archival ad U.S. jeweler Tiffany & Co.’s worldwide net sales rose 1 percent to $900 million during the first quarter of 2017 due to growth in Asia Pacific and an increase in wholesale diamond sales.

Despite the net sales increase worldwide, Tiffany’s comparable store sales for Q1 2017, ended April 30, decreased by 3 percent compared to the year-ago period. Tiffany has seen consistent financial struggles recently and has made a number of strategic moves internally to combat a challenging market for hard luxury goods.

Softness

For Q1 2017, Tiffany saw its fashion and design jewelry collections perform well, but other categories within its offerings showed softness.

By market, Tiffany’s total sales reached $392 million in the Americas, a 3 percent decrease from the prior year. Comparable store sales in the Americas market declined by 4 percent.

Overall, sales in the Americas were impacted by low spending by tourist and local consumers.

The Asia Pacific market performed the best for Tiffany with total sales of $257 million, an 8 percent increase from Q1 2016. Tiffany saw strong growth in Mainland China, but there were noted “degrees of softness” in other markets in the region.

Tiffany’s business in Japan saw a decline of 2 percent compared to the prior year. Total sales for the market were $128 million, attributed to lower Chinese tourist spending.

Similarly, European sales declined 3 percent to $94 million. Continental Europe was “soft,” but Tiffany saw sales growth in the United Kingdom due to local and foreign spending.

Additionally, Tiffany’s sales rose 32 percent to $28 million due to an increase in wholesale diamond sales.

Tiffany & Co.'s latest Hardwear collection

“While these results modestly exceed our near-term expectations, we are focused on executing long-term strategies to achieve stronger and sustainable performance through product introductions, optimization of our store base, effective marketing communications and the delivery of experiences that resonate with our customers,” said Michael J. Kowalski, chairman of the board and interim CEO of Tiffany, in a statement.

“In so doing, we believe Tiffany & Co. is well-positioned to generate an attractive total shareholder return over the long term,” he said.

Back in February, Tiffany worked to improve its performance by adding fresh perspectives to its boardroom.

Tiffany appointed three new independent directors to its board of directors, increasing the headcount from 10 to 13 members.

The jeweler appointed Roger Farah, James Lillie and Francesco Trapani as the newest members of its board. The additions come in light of agreement between activist investor Jana Partners and Mr. Trapani, who together own approximately 5.1 percent of Tiffany’s outstanding shares (see story).