Findings from the 11th-edition Deloitte Swiss Watch Industry Study reflect a sector grappling with weakening global demand. Image credit: Watches of Switzerland

Findings from the 11th-edition Deloitte Swiss Watch Industry Study reflect a sector grappling with weakening global demand. Image credit: Watches of Switzerland

More than 80 percent of Swiss watch industry executives surveyed for a new report from global consulting firm Deloitte expressed concern regarding the negative influence of trade measures on business.

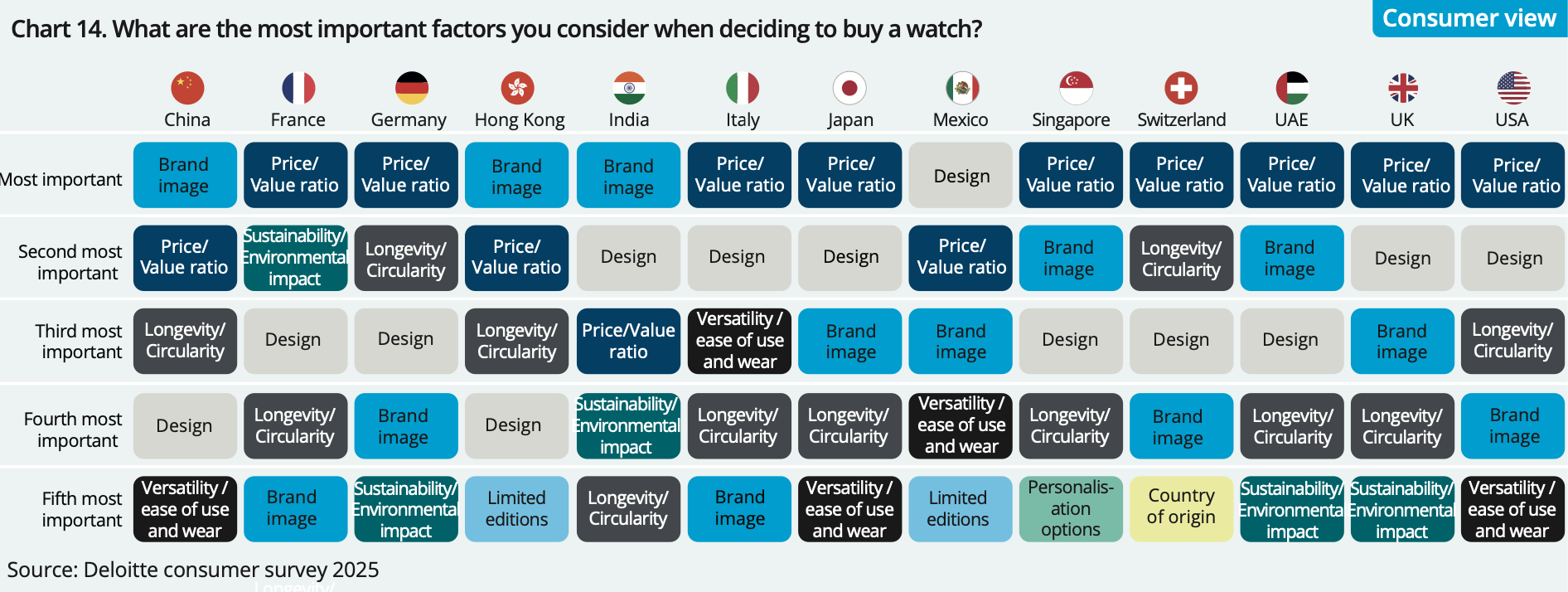

According to the Deloitte Swiss Watch Industry Study 2025, released in October, the sector is grappling with weakening global demand, new tariff barriers and rising price sensitivity among consumers. As pressure builds and export volumes drop worldwide, the profiles of high-growth regions such as India continue to rise; the 11th-edition report additionally includes responses from consumers based in Mexico for the first time.

“Tapping into new growth regions is crucial as a way of cushioning declines in established markets,” said Karine Szegedi, head of consumer and luxury & fashion at Deloitte Switzerland, in a statement.

“Countries like India and Mexico are a source of young, dynamic customers,” Ms. Szegedi said. “These customers are open to innovations, giving the Swiss watch industry the opportunity to expand its global presence in the long term.”

For the report, Deloitte surveyed 111 senior executives and 6,500 consumers across 13 markets between June and July 2025, revealing an industry focused on consolidation and cost management rather than expansion.

Market correction

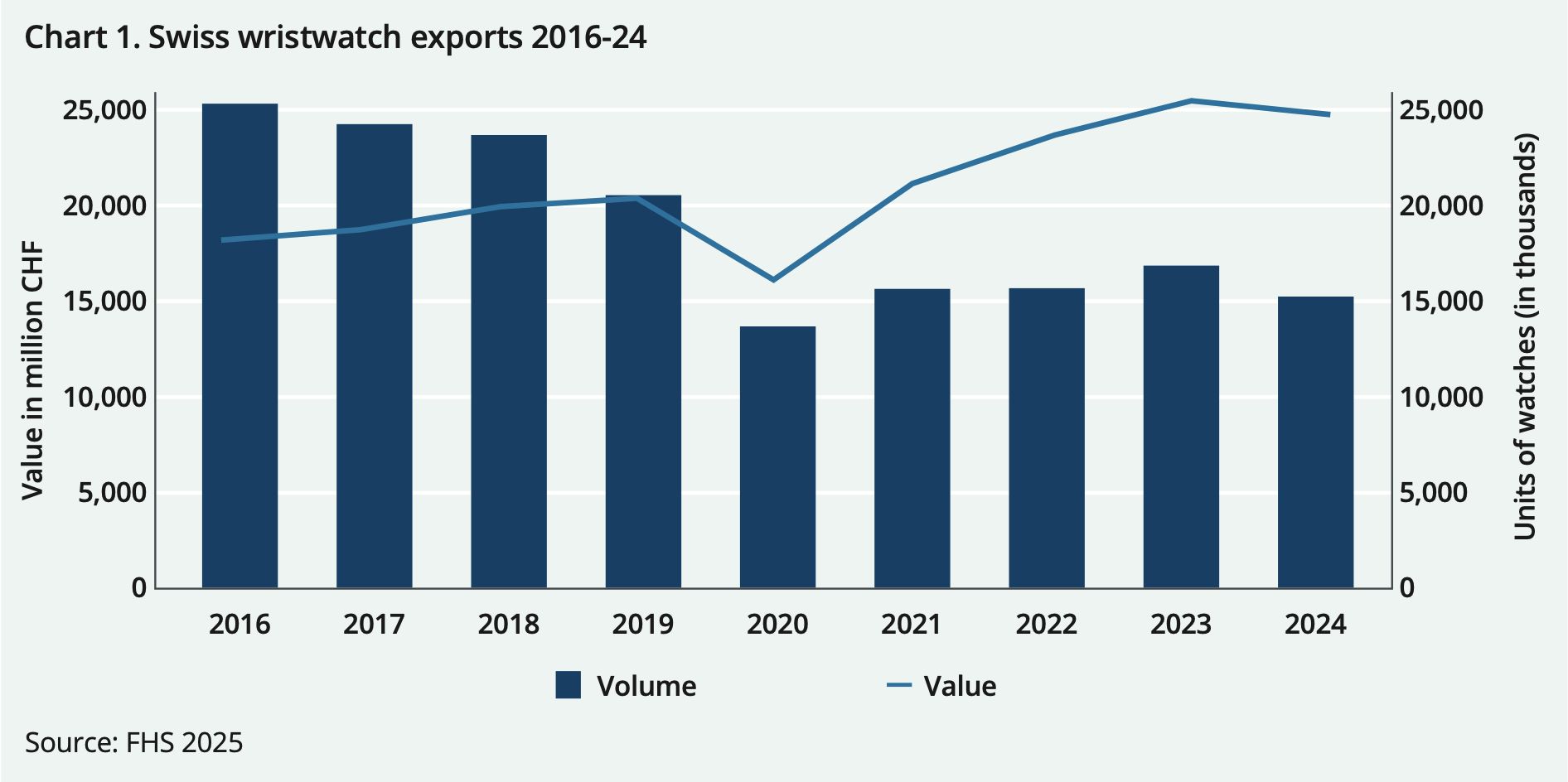

Swiss watch exports reached a post-pandemic record high of approximately $33 billion in 2023, though by early 2024, signs of weakened demand started to show.

Deloitte’s report cites data showing total export earnings dropping nearly 3 percent in 2024 compared to the previous year, with export volumes falling 10 percent.

Survey findings show industry sentiment reflects this challenging environment. More than 80 percent of surveyed executives judged trade measures as a negative influence on business, while over 90 percent rated geopolitical tensions as disruptive.

When asked about risks for the coming 12 months, executives cited the strength of the Franc as their top concern, followed by weakening global demand and decreased consumer purchasing power due to inflation. Forty-three percent of executives surveyed hold a negative outlook for main export markets, compared to just 23 percent with a positive view.

The mood varies by price segment: 64 percent of executives view the outlook for high-end watches priced over 50,000 Swiss Francs at retail as positive, while roughly 60 percent rate the outlook as negative for entry-level and mid-range timepieces.

Swiss watch exports reached a post-pandemic record high of approximately $33 billion in 2023, though by early 2024, signs of weakened demand started to show. Image credit: Deloitte

Swiss watch exports reached a post-pandemic record high of approximately $33 billion in 2023, though by early 2024, signs of weakened demand started to show. Image credit: Deloitte

In August 2025, the United States imposed a 39 percent import tariff on Swiss watches, up from an initially announced 31 percent rate. Though the tariffs have significant implications – the U.S. accounted for 16.8 percent of all Swiss watch exports in 2024 – the industry has managed to mitigate risks in the market so far.

Brands and retailers rushed to stock inventory before the tariff increases took effect. Several watchmakers, including Rolex and Patek Philippe, responded by announcing retail price increases in the U.S.

Swiss watch exports to the U.S. surged 150 percent in April 2025 and 45 percent in July compared to the same periods in 2023. Overall activity led to the value of exported watches declining by just 1 percent year on year between January and August 2025; although concern looms in America, it is not the only region leaders are watching.

China and Hong Kong markets are also underperforming: Swiss watch exports to China fell 26 percent year-on-year in 2024, while exports to Hong Kong declined 19 percent. By contrast, India continues to offer a bright spot, with exports rising nearly 7 percent in the first eight months of 2025 compared to the same period in 2024.

This edition of the Deloitte Swiss Watch Industry Study zooms in on Mexico, which has emerged as one of Latin America's strongest watch markets. Switzerland exported more than $400 million worth of watches to Mexico in 2024, representing 49 percent of all Swiss watch exports to Central and South America.

Opportunity areas

The study found that brand leaders are prioritizing new product introductions, with 61 percent planning to focus on this area in the year ahead.

Nearly one-third of executives now plan to use AI to support creative product development, up from 20 percent in 2023. Cost reduction has also become a strong priority, cited by 46 percent of brand executives compared to just 10 percent in 2023.

Physical retail continues to dominate. Two-thirds of brands and retailers report that online channels account for around 10 percent of their sales, while 16 percent sell exclusively through stores (see story).

Looking ahead, 74 percent of executives expect bricks-and-mortar to remain the dominant channel over the next five years. Deloitte points out that, in this environment, the pressure is on for independent multi-brand retailers, which face “dwindling access to key brand portfolios and a weaker market position,” as evidenced by recent acquisitions (see story).

“The in-store shopping experience is a key success factor, particularly in an increasingly digital environment,” Ms. Szegedi said, in a statement.

“Advice, atmosphere and the opportunity to experience products physically create trust in the brand – no online channel can replace these aspects.”

For the study, Deloitte surveyed 6,500 consumers across 13 markets between June and July 2025. Image credit: Deloitte

For the study, Deloitte surveyed 6,500 consumers across 13 markets between June and July 2025. Image credit: Deloitte

The study reveals significant shifts in consumer behavior. Purchase intent for traditional watches is equally strong among men and women, signaling that the female market continues as an essential growth driver.

Forty percent of millennials and Generation Z (see story) respondents said they are likely to purchase a pre-owned watch in the coming year, compared to lower shares among Generation X and baby boomers. Price remains the primary motivation for buying pre-owned, cited by 53 percent of consumers, up from 44 percent in 2021.

One in five consumers says they are most influenced by social media and influencers when buying a watch. Younger consumers are showing particular interest in pre-owned watches.

Regarding the industry's latest high-growth region to watch, consumers based in Mexico show above-average willingness to buy pre-owned watches at 38 percent compared to 33 percent globally.

Social media plays an outsized role in purchase decisions, with 24 percent of Mexican consumers citing it as their primary influence compared to 20 percent globally. Mexican buyers are also twice as likely as the global average to purchase watches directly via social media.