Art Basel brings together art lovers and brands from around the world. Image credit: Art Basel

Art Basel brings together art lovers and brands from around the world. Image credit: Art Basel

Affluent millennials are becoming more active in the art market, helping boost global art sales 6 percent in 2018.

According to the third annual Art Basel and UBS Global Art Market Report, millennials made up nearly half of the high-spenders in the market. The global art market has grown nearly 10 percent in the last decade, reaching an estimated value of $67.4 billion in 2018.

“A very positive finding of the research this year was the dynamism in collecting by global millennials,” said Dr. Clare McAndrew, founder of Art Economics and lead author of the report.

Art lovers

The United States remains the largest art market in the world, accounting for 44 percent of sales by value, and increased its market share by 2 percent year-over-year. Art sales in the U.S. reached $29.9 billion in 2018, their greatest total yet.

Another 40 percent of art sales can be attributed to the United Kingdom and China, respectively the world's second- and third-largest art markets.

Sales at events like Art Basel are up more than 5 percent. Image credit: Shutterstock

Concerns surrounding Brexit did not discourage Britons from spending on art, as sales in the United Kingdom rose by 8 percent to just shy of $14 billion, for a value share of 21 percent. The value of art sales in China declined 3 percent year-over-year to $12.9 billion.

Asian markets saw the highest participation levels from millennial art collectors.

Millennials accounted for 46 percent of art buyers in Singapore and 39 percent in Hong Kong. In contrast, the United States art market is dominated by collectors aged 50 and older.

Nearly one-fifth, 16 percent, of art buyers spent more than $1 million on pieces between 2016 to 2018. Forty-five percent of these high-spenders were millennials, hinting at the market's room for further growth.

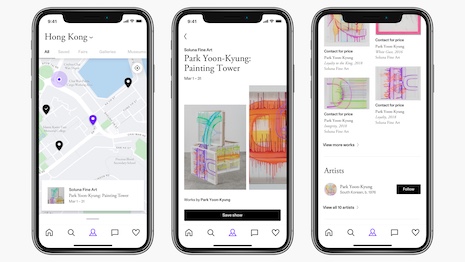

The art ecommerce market is on the rise. Image courtesy of Artsy

While only 4 percent of those high-net-worth collectors made million-dollar art purchases online, the ecommerce market for art still grew 11 percent year-over-year.

Global art platform Artsy is refining the discovery-to-purchase art collecting experience with its updated mobile application. The Artsy mobile application will soon include personalized city guides that encourage users to explore nearby gallery exhibitions, art fairs and museum shows (see story).

Fair investments

At an estimated total cost of $4.8 billion, art fairs are the biggest expenses for businesses operating in the global art and antiques market.

However, the participation is worthwhile as sales at art fairs are estimated to have reached $16.5 billion in 2018, an increase of 6 percent from the previous year.

These events are especially crucial in Asian markets, where more than 90 percent of collectors have made purchases at art fairs.

At Art Basel Hong Kong, luxury labels that produce handbags, jewelry and clothes look to transcend their commercialism through sponsorship and collaborations, reaching prospective customers on a higher level than can be achieved in a traditional retail setting.

Last year, noting the interest among China’s “art-lennials” generation in combining luxury and art, the leading auction house Sotheby’s transformed itself into a premier global luxury platform and partnered with influencers and pop personalities (see story).

Stateside, contemporary art fair Frieze took place in Los Angeles for the first time earlier this year, helping expose galleries and luxury brands to West Coast affluents and art lovers.

German automaker BMW, retailer MatchesFashion and Swiss beauty group Valmont were among the brands that participated in the inaugural Los Angeles edition of the event. Since the art world is often associated with exclusivity and refined taste, events such as Art Basel and Frieze are enticing to many companies who seek out clients with money to burn (see story).