Marriott Bonvoy stresses the exclusive benefits of being a loyalty member. Image credit: Marriott

Marriott Bonvoy stresses the exclusive benefits of being a loyalty member. Image credit: Marriott

Word of mouth can have a considerable impact on travelers’ loyalty to hospitality brands, since even repeat customers can be swayed away after reading a negative review.

According to a report from Yes Marketing, consumers are seeking value for their money first and foremost as they make booking decisions. Marketing amenities and perks and providing exclusive membership benefits can help customers feel rewarded and retain their loyalty.

"Loyalty is based on experiences, and consumers want to feel they are obtaining value with every experience they have with a brand across the entire customer journey," said Bryan Finke, vice president of communications and customer experience strategies at Yes Marketing. "With today’s value-conscious travelers always looking for the next best deal, travel brands are still missing the mark on delivering experiences that exceed customer expectations.

"It is challenging to earn loyalty in the travel space, but it's even more difficult to maintain it," he said. "Consumers may feel they aren’t adequately rewarded because brands are not delivering value across the customer journey – it may take a customer too long to earn a reward or value recognition across the journey."

Yes Marketing's report is based on a survey of more than 1,000 consumers.

Decision makers

Friend and family mentions are consumers’ top source for hearing about new travel brands.

Forty-two percent of consumers say they heard about the last new brand they booked with from family and friends. This far exceeded sources including travel review sites, Google and third-party booking sites.

While a consumers’ close network can back up a travel brand, three-quarters say that they have chosen not to stay with a particular company because of negative feedback from their social circle.

Despite the rise in OTAs, brand-operated booking is still a popular option. When asked where they last booked with a new travel brand, 55 percent of consumers said they booked directly with the company, compared to just 45 percent for third-party platforms.

Preferred Hotels encourages guests to book directly. Image credit: Preferred Hotels

Price is the most influential factor for consumers as they are considering a booking, with 58 percent noting that cost comes into play for their decisions to reserve with a new brand. Among repeat clients, 65 percent look at price.

Quality comes next, but only 19 percent of new customers and 17 percent of repeat guests named it as a key attribute. Following price and quality is perks.

Overall, consumers are seeking value that brings the elements of price, perks and quality together. For hotels and travel companies that have a higher cost, highlighting added benefits can help convince consumers that they are still a better value because of what guests get for their money.

Another way to drive loyalty is through exclusive pricing for rewards members, leading with monetary value.

Value also comes into play when consumers are choosing whether to book with a company for the first time. Eighteen percent say that they are looking for a company that proves value over its competitors.

Even more important for winning new travelers is having messaging that is relevant to the potential guest’s needs and interests, which 40 percent of respondents indicated they look for.

As companies look to target consumers who have never booked with them before, they can create a sense of relevance by going after an audience that resembles their existing client base.

The most important element in building trust with a new client is being informative, noted by 42 percent of those surveyed. This includes transparency about pricing, such as being up front about fees and the total cost of a booking.

For consumers who have stayed with a brand before, their expectations are that the company will market offers based on their past actions. Guests were most inclined to say that this targeted approach would improve how relevant travel companies’ marketing is to them, ahead of leveraging demographic data and feedback form information.

Consumers are also seeking more useful content from travel brands. At the top of their list is information about their booking or past travel, followed by partner deals such as airline or hotel offers.

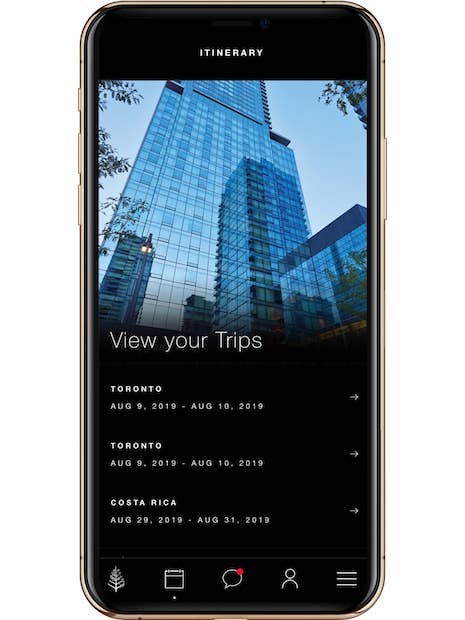

Four Seasons' application lets consumers monitor their itineraries. Image credit: Four Seasons

Reiterating the desire for word of mouth, four in 10 would like to see more customer testimonials or reviews.

While consumers’ network can influence their behavior, reviews from strangers can also impact their decision to book. Sixty-one percent have chosen not to reserve a stay with a brand again after reading negative feedback from other guests, and this habit is even more pronounced among younger generations.

Yes Marketing suggests collecting feedback from guests to so that any customer experience problems can be fixed.

"Travel brands can harness the influence of word of mouth by encouraging customers to share their own experiences, for example, by incentivizing Instagram photo ops, enabling travelers to participate in events and creating ‘surprise and delight’ moments during their travel," Mr. Finke said.

"Travel brands can also encourage positive word of mouth through their loyalty programs," he said. "For example, they can offer exclusive referral codes for customers to share with family and friends in exchange for rewards or additional discounts.

"Consumers are more likely to pass along a discount with a positive referral if they’re in turn rewarded for their brand advocacy."

Leading loyalty

While three-quarters of consumers feel that they are being adequately rewarded, that leaves 25 percent who are underwhelmed with hospitality loyalty offers.

About half of consumers want to receive exclusive perks that are unavailable to non-members, such as late checkout or room upgrades. About a third say they would appreciate it if a brand waived fees in exchange for their loyalty.

"Providing exclusive incentives like late checkout or airline seat upgrades is a great way to elevate the travel experience and build stronger relationships," Mr. Finke said. "In fact, almost half of consumers reported these offers make them feel most rewarded.

"By enabling travelers to earn rewards or recognition faster, brands can remind customers of the value of their loyalty and encourage them to come back for more," he said.

One way that travel brands have sought to provide added value to loyalty members is through partnerships.

For instance, InterContinental Hotels Group is extending the number of luxury properties available to members of its loyalty program through a partnership with travel club Mr & Mrs Smith.

Starting in 2020, IHG Rewards members will be able to earn and redeem points at 500 hotels in the handpicked Mr & Mrs Smith collection (see story).

Hospitality loyalty can often come down to how well companies deliver on the basics.

Hotels can earn guests’ return business if they deliver an elevated sleeping experience, but a new report finds that only 42 percent of luxury hotel guests have had their expectations exceeded.

J.D. Power’s North America Hotel Guest Satisfaction Index Study found that 71 percent of guests who get a better than expected night’s sleep would stay again with the same brand. While luxury hotel brands often emphasize factors such as on-property amenities and service, setting guests up for a restful night can have one of the greatest impacts on their attitudes (see story).

Leveraging data effectively is also impactful for building stronger relationships.

"There’s a window of opportunity for travel companies to further engage with customers who have a history with their brand, yet many are missing it," Yes Marketing's Mr. Finke said. "Forty-four percent of customers say they’d prefer that brands send them communications informed by their past behavior, however, nearly a third of customers (32 percent) say they rarely or never receive relevant communications from travel brands they’ve used before.

"In order for travel brands to better understand their customers, they must first get to know them – combining zero-, first-, second- and third-party data to ensure the data they collect is actionable across your communication channels," he said. "Travel marketers should adopt tools like content libraries, dynamic templates, models and segmentation to better scale delivery of personalized and relevant messaging."