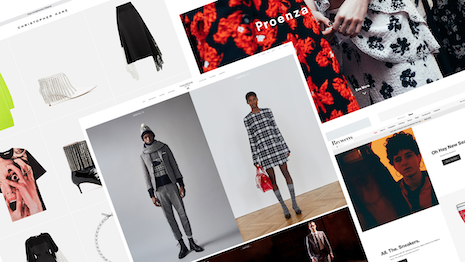

To keep consumers engaged with and attracted to a brand, businesses must strategize loyalty programs, personalization and data analytics. Image credit: Unsplash

To keep consumers engaged with and attracted to a brand, businesses must strategize loyalty programs, personalization and data analytics. Image credit: Unsplash

With persistent inflation rates, shifting values and emerging purchasing channels, consumers are more interested than ever in getting the best value for the price of products and services.

According to PricewaterhouseCoopers’ (PwC) 2022 Customer Loyalty Survey, more than a quarter, 26 percent, of consumers stopped buying from brands last year, with 37 percent of them citing bad experiences with products and services as the top reason. Further, young consumers, particularly those within the Gen Z cohort, are finding more reasons to ditch brands and try new ones, so businesses must strategize new ways to strengthen these relationships.

"Generally speaking, brands recognize the rise of emotional loyalty," said Jon Glick, customer transformation and loyalty partner at PricewaterhouseCoopers US, Chicago. "Experience is all about how an individual feels when interacting with your brand before, during and after a transaction.

"The better you understand that the more ways you can engage with customers — and the more likely they will continue engaging with your business," he said. "Additionally, invest in customer segmentation, as behaviors and preferences have changed, you should update analytic models that aim to help you better understand your customers."

To compile the information in this report, PwC collected insights from more than 4,000 consumers in the United States via an online survey conducted between May 5-19, 2022.

Brand loyalty: dos and don’ts

According to the survey, 55 percent of consumers would stop buying from a brand that they may have otherwise liked after several bad experiences, with 8 percent saying they would cut ties after just one bad experience.

PwC suggests this means service recovery is critical, and that begins with creating more human experiences.

Despite, or perhaps due to, the current digital age, consumers are interested in speaking with real people. According to the survey, they cited human interaction as important or very important for their loyalty to restaurants at 58 percent, financial services at 55 percent, pharmacies at 53 percent and hotels at 52 percent.

This does not mean forgoing innovative digital capabilities, however, as 51 percent of consumers are less likely to be loyal to a brand if its online shopping experience is not as seamless or enjoyable as shopping in person.

Finding a balance between human interaction and digital capabilities is critical. Image credit: Farfetch

Finding a balance between human interaction and digital capabilities is critical. Image credit: Farfetch

Expectedly, generations differ significantly when it comes to loyalty.

Gen Z, which includes ages 18-25, and millennials, 26-41, are generally more mobile than Gen X, 42-57, and Baby Boomers, 58 and older, but are also more open to personalization and perks that can build loyalty.

More so than their older counterparts, Gen Z and millennials value fast service, feeling like they are part of a community and having a personalized experience. Nearly half, 41 percent, of Gen Z consumers are willing to share their personal interests, preferences and habits with brands to get these personalized experiences.

Comfort levels were strongest with personal identifiers, with 48 percent willing to share their birthday and age, 45 percent their sex/gender identity and 37 percent their race/ethnicity. Many consumers also are on board with contact information such as an email address, mailing address and phone number.

Only 22 percent are willing to share product usage data, 15 percent their current location, 5 percent facial recognition and 3 percent a fingerprint.

More than half, 55 percent, of consumers belong to at least one type of subscription service that allows them to make regular payments for access to a product or service. Subscription benefits are also a major factor in driving loyalty, as discounts, lower prices, faster and/or easier service and automatic renewals were what survey respondents liked most about the services.

While they may not make up the majority of luxury consumers, Gen Z members are certainly strengthening their buying power in this sector, and brands must learn how to attract and hold on to these young and passionate individuals.

Subscription services could help maintain loyalty, and brands should begin testing this model. Image credit: Rent the Runway

Subscription services could help maintain loyalty, and brands should begin testing this model. Image credit: Rent the Runway

Ultimately, PwC suggests brands recognize and act on the rise of emotional loyalty, invest in customer segmentation and update analytics, assess loyalty programs and reconsider the benefits, activate data-driven personalization strategies and test the subscription business model.

Affluents want rewards

While discounts and deals seldom appear in the luxury space, brands are increasingly acknowledging and harnessing the power of rewards.

A report from payments platform FreedomPay and Cornell University found that consumers are more likely to share personal details if they received a reward in exchange.

Earlier this year, luxury resale platform Rebag launched its first loyalty program, looking to give back to its customers.

Rebag Rewards is a multitiered loyalty program offering different incentives based on the amount a customer trades, sells and buys over time, broken down into four levels: bronze, silver, gold and diamond. In addition, members may earn points that can be redeemed and used toward future purchases (see story).

Last year, U.S. retailer Bloomingdale’s introduced new features to its Loyallist program, making it easier for customers to navigate the rewards program and earn more perks.

After being the first luxury fashion retailer to introduce a tender-neutral loyalty program, Bloomingdale’s has opened all of its tiers to tender-neutral Loyallists, enabling any customer to earn rewards regardless of payment type. The retailer’s “Top of the List Unlocked” elevated tier includes the program’s most rewarding point earn rate and free premium shipping (see story).

"Assess how rigid your loyalty programs are and reconsider the selection of benefits, including expanding beyond points and discounts to experiential loyalty," Mr. Glick said. "Activate a data-driven personalization strategy to drive effective engagement and stronger individual connections with customers.

"Where feasible, test and learn with subscriptions, maintaining flexibility to quickly adjust in response to subscriber feedback," he said. "With existing models, acknowledge the potential for 'subscription fatigue' and determine how you can adapt those models to address shifting customer needs."