Estée Lauder's Pure Color Love lipstick

Estée Lauder's Pure Color Love lipstick

When it comes to online shopping for beauty products, consumers seem to place their loyalty more easily in specific brands rather than in the platforms that sell them.

A.T. Kearney's "Beauty and the Ecommerce Beast" report looks at how customers shop for cosmetics online and finds that while overall sales are healthy, loyalty is the latest challenge for retailers. What they found is that luxury beauty products perform almost twice as better at online retailers than mass-market cosmetics, suggesting that luxury consumers are more willing to embrace ecommerce.

“The study, which is based on a survey of 800 American online beauty shoppers, finds that 67 percent of consumers use four or more websites to fulfill their shopping needs,” said Hana Ben-Shabat, A.T. Kearney partner and author of the study, New York.

Beauty and loyalty

Among beauty consumers, online shopping has apparently been a surprisingly enticing option.

This may come as a shock for a product that usually requires extensive testing and up-close viewing to ensure the correct shades and colors can be found. But A.T. Kearney’s report suggests that consumer appetite for online beauty product shopping is large and growing at a steady rate.

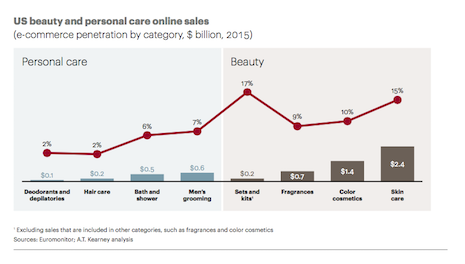

What may be even more surprising is that luxury beauty products are even more popular online than mass-market products. Mass-market online beauty shopping penetration is at 7 percent while luxury is twice that with 14 percent.

Shares of online beauty sales

The most telling piece of information however is that while desire for online beauty shopping is high, consumers do not tend to have much loyalty to the online retailers that sell their desired products.

A majority of respondents, 67 percent, said that they use four or more different online retailers to purchase their beauty products.

While consumers often buy the same brands again and again, where they get those brands from is constantly changing, suggesting that online retailers need to do more to retain their customers.

Additionally, with a higher penetration of online shopping for prestige cosmetics, luxury beauty brands should pay close attention to the data collected by A.T. Kearney.

Online appetites

Ecommerce is an important tool for luxury brands in all sectors and not just beauty products. It can be especially helpful considering the growing desire for international luxury purchases.

Cross-border ecommerce opens up brands to shoppers in countries that are growing more rapidly than established, saturated markets such as the United States and Europe, but retailers should do their due diligence before making a move. To make headway with global consumers, localization efforts should deliver both market-specific content and commerce features (see story).

But even with an emphasis on ecommerce, beauty brands have to remember that in-store experiences can still be vital tools for getting new, loyal customers, such as a recent addition of in-store salons at Neiman Marcus.

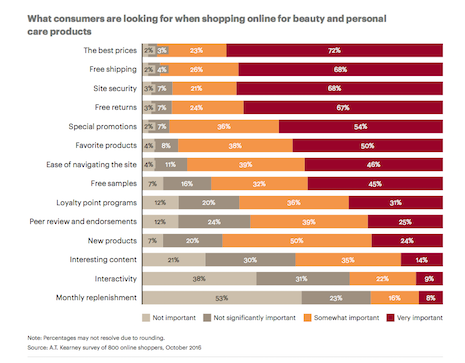

Competitive prices are the biggest driving factors for online sales

The experiential addition comes by partnership with Hudson Blvd. Group (HBG), a holding company formed in 2015 that specializes in high-end beauty services. HBG’s beauty portfolio includes DreamDry, a salon concept that offers on-the-go women convenient and personalized hair services as well as Spruce & Bond, a brow and hair removal studio, and Pucker, a cosmetic and eyelash extension provider (see story).

Loyalty should be at the center of any beauty brand’s, and especially beauty retailers’, strategies over the next year in order to deal with consumer trends.

“The growing challenge of loyalty, the daily demand on retailers and brands to deliver a seamless experience between online and offline, and the need to ‘give up some power’ to new sources of influence are indicators of the current state of the beauty industry," A.T. Kearney's Ms. Ben-Shabat said.

“Succeeding in this new environment will require an artful integration of all channels, and adoption of new technologies to enhance personalization and authentic communication," she said.