The market is normalizing despite global financial challenges. Image credit: Chrono24

The market is normalizing despite global financial challenges. Image credit: Chrono24 Secondhand luxury watch retailer Chrono24 is revealing how the industry fared to close 2025.

As revealed in the 2025 Market Recap, the pre-owned timepiece sector is proving resilient despite adverse macroeconomic factors. Across the United States and Europe, average transaction values and price development increased between January and December of last year, with unpredictable asset shifts being swapped for relative stability.

“The numbers tell a clear story: The 'Tourist Investor' has left, and the 'True Collector' is back in charge,” said Balazs Ferenczi, head of brand engagement at Chrono24, in a statement.

“We see this in the data – a 13% jump for Vacheron or a 9% rise in rectangular watches happens because enthusiasts are refining their tastes, not chasing quick flips; looking ahead to 2026, we expect this to deepen,” Mr. Ferenczi said. “The trend is moving back to wearable sizes and vintage influences, but with a twist – collectors are showing more confidence in bold colors and alternative materials.”

In the rear view

According to the report, secondhand luxury watches have transformed from a “volatility-driven asset class” to a functioning, strong economy upheld by a global community of collectors.

In the U.S., which is the industry’s largest region by sales, average transaction prices surged by 8.43 percent year-over-year in the final quarter of 2025. Meanwhile, in Europe, prices rose by nearly 0.3 percent, which the organization calls “conservative stability.”

Watches with a moon phase feature were of particular interest last year, with purchases rising by more than 15 percent. Image credit: Chrono24

Watches with a moon phase feature were of particular interest last year, with purchases rising by more than 15 percent. Image credit: Chrono24

Over the past 12 months, Rolex led the platform in order volume, though the Swiss watchmaker’s secondhand market share dropped by 3.3 percent, attributed to a decrease in asset flipping activity. Collectors are said to be driving the future of the community, with the prevalence of outside sellers receding.

While Rolex reigns supreme, fellow luxury watchmakers Vacheron Constantin and IWC Schaffahusen saw massive sales booms. Last year, sales of the two horology houses’ pre-owned timepieces rose by 13.4 percent and 14.4 percent, respectively.

Cartier’s shipment volume also improved, rising by 8.3 percent, similar to its strong performance on resale platform Rebag (see story). The jeweler’s success was driven by demand for more “elegant” chronographs, with its vintage Santos and Tank lines proving popular.

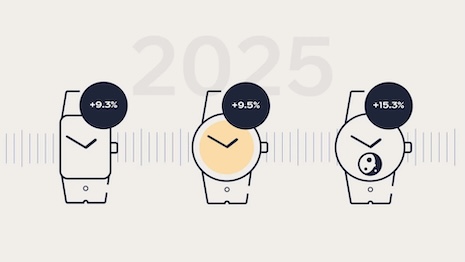

Upscale dress and formalwear trends dictated the market in 2025, with demand for rectangular shapes rising by 9.3 percent, with alternative dial colorways, such as green, champagne and gold, seeing similar improvements – purchases of traditional black and blue styles stagnated.

Moving forward

Throughout 2026, Chrono24 predicts further market stability, with collector demand driven by greater fashion, cultural trends and the increased purchasing power of Gen Z (see story).

Across luxury sectors (see story), vintage is in style, a factor not expected to change during the current calendar. Another growing factor is the environment (see story), as the resale sector provides a more ecologically friendly – and affordable – alternative to high-end shopping.

As speculative investors fade from view, dedicated collectors are paving the secondhand watch category’s future. Image credit: Chrono24

As speculative investors fade from view, dedicated collectors are paving the secondhand watch category’s future. Image credit: Chrono24

“Sustainability is no longer just a 'nice to have,’” said Mr. Ferenczi, in a statement.

“Whether it’s recycled materials or supply chain transparency, ethical standards are becoming a baseline expectation, especially for the younger generation entering the market.”