As luxury brands ramp up their appeals to millennial and Generation Z consumers, installment payment providers such as Afterpay and Klarna have proved essential.

Square, Inc.’s recently-announced acquisition of Afterpay, valued at $29 billion (see story), underscores the importance of the “buy now, pay later” ecosystem. BNPL offerings are of unique importance to luxury labels since these installment options make high-end goods more accessible to aspirational consumers.

“For younger consumers who don’t have traditional credit cards, BNPL can support conversion, full price selling and larger tickets – all metrics retailers want to see expand,” said Marie Driscoll, managing director of luxury and fashion at Coresight Research, New York.

“Splitting a high-priced purchase into a few payments allows consumers to buy the products they aspire to own without pressuring retailers to promotionally price,” she said. “BNPL supports brand equity, whereas promotional pricing erodes brand equity.”

Buying in

The most prominent BNPL providers include Klarna, Afterpay and Affirm. Generally, these providers allow consumers to pay for purchases through equal, bimonthly installments, without charging interest.

While these fintech companies are not newcomers to the ecommerce space, the industry has seen strong growth in the United States in the last two years – particularly since the beginning of the COVID-19 pandemic.

McKinsey & Company forecasts point-of-sale (POS) financing will account for 13 to 15 percent of unsecured lending balances in the U.S. by 2023, outpacing growth for personal loans and consumer credit cards.

Additionally, McKinsey predicts “pay in four” providers, including Afterpay and Klarna, will see generate $4 to $6 billion in revenues by 2023. Much of this growth is fueled by younger, credit-averse consumers.

“Afterpay helps to remove the financial barrier that prevents a new generation of shoppers from purchasing designer goods,” said Zahir Khoja, general manager of North America at Afterpay. “As a financially-savvy, budget conscious generation, Afterpay’s predominantly Gen Z and Millennial customers want the confidence of knowing where their money is going, instead of worrying where it went.

“Afterpay does very well in specialty markets, like luxury and premium, because we understand merchant needs and help them grow their business,” he said. “Our luxury and premium partners are looking to maintain prices, but ensure that customers can buy the product they need without having to cover the full cost up front.”

Brands and retailers currently partnering with Afterpay include The RealReal, Gilt, Jimmy Choo and Marc Jacobs.

“By offering Afterpay to their customers at checkout, these [luxury and premium] merchants see a higher AOVs, increased conversions, new customers and incremental revenue,” Mr. Khoja said. “In a recent case study, one of our luxury brands saw a 5 percent increase in AOV, as well as 50 percent new-to-file customers that had discovered the brand through Afterpay.

“It truly is a win-win for the merchant and the shopper.”

Meanwhile, competitor Klarna recently announced a new partnership with online retail group Yoox Net-A-Porter to bring BNPL options to YNAP’s 4.5 million customers. Klarna is currently available across the Mr Porter brand in the United States, United Kingdom, Germany, Austria, The Netherlands, Italy, Spain and Belgium (see story).

Klarna launched a new campaign encouraging shoppers to update their post-lockdown wardrobes

More than 4,000 merchants including 900 fashion brands such as Oscar de La Renta, David Yurman, Khaite, LuisaViaRoma, La Garconne, Moda Operandi and Tamara Mellon currently use Affirm (see story).

“The brands extend their customer base by attracting those who previously were not able to buy luxury goods,” said Yana Bushmeleva, chief operating officer at Fashionbi, Milan.

As younger shoppers build their income, these services allow them to splurge on high-end goods without compromising their budgets.

“The vast majority of Afterpay users are millennials and Gen Z consumers who are looking for a more flexible way to purchase their favorite fashion, beauty and lifestyle brands,” Mr. Khoja said. “We know that these cohorts have a strong preference for financial wellness and budgeting, and are looking for services that cater to those needs now and as they mature.”

Installment payments can offer also brands and retailers an alternative to private-label credit card offerings since these younger shoppers favor debit cards to avoid high-interest debt – a generational shift in spending preferences that dates to the 2007-2009 financial crisis.

“I believe that BNPL service will be especially important for the young customers of the luxury brands,” Ms. Bushmeleva said. “[In the future,] maybe BNPL services will be provided directly by the banks so the luxury brands can maintain the high status in the customers’ minds.”

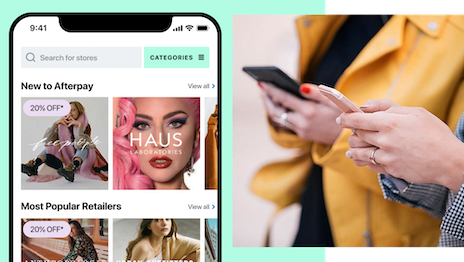

Buy-now-pay-later makes large purchases more accessible for younger consumers. Image credit: Afterpay

Buy-now-pay-later makes large purchases more accessible for younger consumers. Image credit: Afterpay

Although millennial and Gen Z consumers garner widespread brand attention as their spending power increases, BNPL also has wider appeal with others who may have unpredictable incomes.

“According to an Ascent survey in March 2021, 60 percent of 18-44-year-olds have used the buy-now-pay-later option,” said Coresight Research’s Ms. Driscoll. “However, the greatest growth in usage of BNPL was the over 55 age group – up 98 percent from July 2020 with 41 percent of that age demographic having used BNPL.”

BNPL comes to stores

While BNPL is most often associated with ecommerce, a growing number of brands and retailers are accepting – and encouraging – installment payments at physical stores.

McKinsey expects 25 to 30 percent of point-of-sale financing originations to be in-store during 2021.

Brands and retailers that accept BNPL in-store include Belstaff, Bloomingdale’s, Calvin Klein, Jo Malone London, Macy’s, Michael Kors and Sephora.

“Launching Afterpay in stores is a light lift for retailers, and provides them with a safe, contactless payment solution to offer to their customers,” said Afterpay’s Mr. Khoja. “Since customers access the Afterpay Card via Apple or Google Pay, there is no additional integration time or cost required of the retailer.

“By partnering with Afterpay in-store, merchants are more easily able to meet this new consumer demand for a seamless omnichannel experience, while paying for their items in interest-free installments and leaving the store with their item right away,” he said. “This brings strong business benefits to retailers – namely helping them generate new customers and driving sales.”

BNPL’s flexibility has additional appeal as shoppers return to bricks-and-mortar stores as the pandemic continues evolving.

“Luxury brands are reaching the next generation of luxury shoppers with BNPL and will benefit with a headstart on developing a relationship with these consumers,” Ms. Driscoll said.

{"ct":"9Uv19wpStiaflNdKGdCoIGPLa+VVbhvYmmUGTEh9NpcBOJcM2o7MiPL3m+79qszcI2nj6ptUJuO1+hk9lBYMT5Rysd7xxtSFDu7reKSXqtcs71uS4vjsFcZRndI\/NVdKSMrbdIWL6kNa8tBr9rRqkURRy9bzrBqc0l734hLk67vveHG1dbka\/KuvJJMaAatLdbwY3NwqsasLBRr92o5CshJi+jzWaNNG+SiqS7ljUJWVpreRZvRwOojd7\/fx9UON325u84NABvF7vtQmzi5Rv7\/22VTociy9Kz8QsWBl98CnywAIwxJUdAHBTVJ2TrOIaZ\/lrkUJQn5m19z33FfV0LTNwmrd0Ee4+H5ew9ueX8oABgAxc+LsU+BBugEzIpqDK98mRiSubw79rl\/H9CAiuR8OH8jxoH\/q0\/xCr2e4pxlPcvQmdhr\/cs8e3B8bBMqtggXZK0OI6hV\/T\/C+QekR1yvB33aStYL0eaylHaIY3oawQ7hcFhMEs373a6oeBN11EaK\/fEV8NYumKj1\/Eh\/o7GsdnD\/qgZWHF\/AUUtWW1Ju\/ue12TYLkqTQTeM527raHgsMXZ90Sh5FditoGAxVm5csfx48XXNyqUbDE29s2cx5rEXjpGBG2qkH3f6tyz20CSaVz5CSzhx7x\/PKyejiuDrFmzMJ0K4ZGtWKx8hYEUqZlt4BWG5BMxVbJR6e9Ch8nXaJjIB9GXg2vbmdNABSzotol1nN0nQLsvDbJ9pqvQrG7W41Cfq2pqBG9fs6K4zU5IEkgNBB1KbiCgyOJ\/uEh7Qcq46zhKYnJcM7\/+zVucRC+o5+qccBAhXUK09CanYWL9Yi+OmsYtFsgni34KhOGfyd\/ac92Xn\/wqOtPJjtt\/nsNUS7SVkG6tfdW5Ks\/+sKoFumJkblV3uN+7yzvw51uoygW4GCuPvGTi4QcUZPErzzv+XA0PkoKuveBjzSquwYBuBSKpcvoLDHuUVP8FipgejCrEdtmRp0259K5jMJrE2oyBE1XY4QPN3TMzFzp3ce9hooS7kgWGRfNCcYffe6q91EbML8rAGqxur3RMcBnMjUXz48f0++I2kEZ4yB7i2WkzQaxX3fTK9CJC1FC9no\/XHEJiwxyqEyatnPSlTZsq4\/gH2sYcYr40LX9HD0KB7nolQ4xXrLIRPxV\/klukRWCI\/Ho\/+HnPLIkYTsiv+qtl6UbwSRYqgRhkuEdo50f4Q\/8GoFYISv6C3HCuluoCsOG8tr1Nh\/IcnQLk1Fp\/TNZaIPiPm\/Kl6yoRanow1CLnbZqa1Q\/xqw2Bz255gktM5m3cUMcebyV0qc7q6ke1n\/pkmSPPiofWPkkPf0FbPdJv6zos73IA7j3oLDaevjQLFCF5apP\/Deb9JqXOZFJGCjrJA0ZO+Vi44+gzkZ3yu0\/NypAR7DgohHArwqhMRt2t4FWoWrXhXILgc1Ldntzk9MORYvhvKThECNNqAkJUnits89GgM86hb4bOgRbt5bZLdXVw7dj5uGs7UWhcF1fDPfZ\/68mLwOpjTMLxqk2jkl5Yc0GHt3AFNS58WAk7majM4TyeyXPjtTUuTbAJG6QuzVdxu39VdDhcZg3fUIsCCx8iq6RLycWty1I2WsAIcnqSUJ+XAWrJjmpVgLSBMbgOhHpdjmXwmbbpGYzEtCzGUYyEqFj0tTWwJ+5raOYQcNu0jyzOy2lWbXF1XEbWMi4KgRjIMPyh+ysv1477\/iU7upmhjFPpuUqjXV7f7WR6UdCXbm8oDZ8cNWLiRSp+ny04qbDJBJvmI8m+0AIizjl1jZMFcXGlWTzbvyjikh9rbI2QFqQxPyCySozYZyw+AysSXN4zByZ+rSuAPiayvRKJwlNfvJrfM1aP6oiROFC88BvBo0I0lfU\/J4hgTDjol5h82MF7pKiR026FhzQCMWzT+34iLbAbZgMfGFNboE+xtNAJ1QOjrMjJWL\/UjZ+HKXnCQYDgyi8TqKjL3LtH2LLW+2lWpqkS5jh\/Y3YYBA\/fKre8So5+BiDXhDW3f2xG4gAw53S52lqRm33\/ousugAyIw1+daJB5ydMFvziHc9QXNakZNuLiC50Dq2M018Pv4GxtD5+t63mBF6SPblF4ULIBArsDDR2Ikk6HsZ+ah9I4lUqCinUkAV7gkbgJCsiCATKDaRmkGhS+IucjGDpuXOE+n5GCA4tLuG2eLVEI0Qdt0+QOQVyNZCYoaAckNPGmF6xM\/eXP17qzA8O7HVTsL6VB56p675LfMgdl4yGUrFviHlSVLjcVavLrIP16DXTWYC0ugH3GMkYakrjVG4Bv7gcC0owlkdwTCQLchrXezIeBmGPd51RZOF5lFb4i8UcC8MicTC5T7hhiFo1ECQEUdJEBhECGPHRcwqeDsYDKur7951z1e4K6iQeGidx0xuK5qkY9mHkjNZBOOvK99WYkE6Q4Dhaji\/ZL+3P9ebdSmtvBLcXdC5sWXbK2vEqT\/zroj+y5sF342CYusBM53kyMvUYk81aMzbv6W2SioOEh++RkFd21ACO\/6fzhD12CHj7RWMlIM+Xw9DG5DK1O0bmAGLAWsMGwrDthd\/1bosm4\/c1v3oTIhtLF7oQiBMguQNCb\/uDDPqGlQwqxz4a7nb4JaTMDaVRiUsBVS\/D5xIL5gjWbxnAqh9wyvj6PQWr5mH7dzFr5t7EtHWOCZ1i0755znCJH\/r+7JzkQ1Uk1wzxEPsrCt04T0ufgF4MUmG6zPS4rFnzM4wMI9uFAMteYdwacCObr4uKUG818\/MSrtW+y1sphNS2jL7vB3IVwAzywkOmUTuQvosO+B+6sdHxkZ1vmBumJSKkKOI8KUQuKdwNDTcOdg8KtnmkIuVYYRzWZFKEqUQPwpkDhoTBRdPgrMN7HBdXiHb8949N2RHLjG6OlkznvtjmAjQQAbkVRyvI\/u2PaF3Mj6nWNVk64cR4IFJ3lKgYeXVwFHi\/\/kyFWDC707l7nf5\/XQaWndnbXxhEFH22QiCGzIqJDu88Ub802LsscvtogbIIxpCYF0Y3G8Ij57zJv9tUngZ2b9+UUONxJgpnyao7mD1S4bKGDrNhZyOdOgzNws7Na3BG75OBydmNhVQmkdwRRaSMtvtUx9OnVGzWQWaIIh8RCuUYnJIwQaW5TvcpYWGxhYOopLPtYYqmK911zY7SrqchbmpXPuPcqK8PK6BWsIkXVtfq\/TZt+a1czlheD5TZU+qjWAPztJoiIFxOjbxa+3pBORaR9Aki2X+dKBpS5eLOI4KEcXIkxvB9G9CFKpLAJNafcLpuHdJCFJOhG0doAXk4Og3TRHSUJ+JFj3Nm3jkOawaGnxvv1e7H+vqfHNAZPsadxifRHjoC\/yA8B4ERltfyDLoZl2P2Gx2Qrr+XKMRgtMdHnx\/VhZVeU+y5zExgMMzyGPjdU2zX0NQENlpGdNqo8mS5RDajWZGis20ZsaedllcXtngDMtubEqDrTogE\/wRUllzRQIns36imWUEF\/U+P6AhHCSem7i1l0JLs+LqOYMdA1BfnRhDTVngt+J9Apthj+IEl3AGtvPCI11p2vdxPlhmpK3mepM6LBQUf6TisSW\/WMz7HfFMM0f2lp0PFLdm53c6SFspWW6b+UDN9ncwchqh3AkCRdFUvJrUc3hltWljYP4jShYbEBr+nAc\/wprtuN2iW1Rz2Mrzs3FTi23V+PrlVCmblJF4P+jOkur9scbU7pnUqJ4qtBObORHFbzEQUOzqAQBaYWdk4ngswrBir3l5p5W504E1BqlS7lls2muiYsMrTD9+nXb3KtE2pWPgxUgDHzX3w\/GEoeU\/VzAPVR6ULyvVAxGOYC0ESI8ov4AtE8\/K9UJV20JNRTiZiQmFhnxFT37WEKsSUQM7exx7LVjkHBusYVKg5cegBMlah5+9V7tkDb1XtVTwIUTBYFDdk01JOt64E1adGIltGx3rzttpKsOChpEb6bhR+0kzVTHWAvcxZwbDkHgh9sJGT6j7cDzEe89j5rW5pzaIWhSqZU8MUCzLc24FMd11LCBUCwe7T6vySQJpakfZXhU1SUTzFQhj4VVry6wygpfQaiGbZ7aUIq9dldSTzCJA5cmYtNxw5zAPvpkHgTt9oVLnfV9jSs7PfsCsnDcC9MP1UmMCBaQ3x2bXBQkHMJc2O2QpDGKWg2decS07ub3Nj2X3PfvYu97LtQBel1EGqJ26zpPXwkRB0sWmz5vzWbKxLyzBUmI2NCP9LBMGkKP2Li7bQ+0nC5LXRh0Ole7S0Ejh7fd1ZqWTQUlvPuip8+qNVTv8rPBVyRziLPY1NwpcmH0jz41gcidBQZxm\/SmKqAgQ+byR7pj3pVC6EhlMOpSlgtaf8UQyRZgp7gAQDVv4SJlrEGNXef0t2k0uGLoIkvcZ0Sq6r8BppVr1a56ByOOl1dFlFrpZpsatJXJlrFdoTyTe7F1eEzDbbtFju7UAiuSQLZvobWGrTVPwRoSVck05IFkb8wVPSpdRVax8j4w5PDVxjbI0LJJJg+XpKAgtInCTqfJEH701C+x\/7pc+MPqPby2J1CU9W0RN\/S04xvNudP6iiDeZfr7JRipzqV3yzdOQxfkra7k+lvyHSSZ6Wt4BW07FGE1G8Cr0s1VA8HvUuRP3yvWnjgIkIA9iw9fGYZu7NXGmDJdQ1siTFo7TjP1cXzUXbDpJLcgq\/uUhP06xp2gcXu0X\/D5DsVTjFyGdsSlxGv80R75fIF+SOiJVcQ9ET9wLWbvZK7oAS1o0ZC9ycCUmBqOgOOXkwT5cllrhNN\/QGf5kZ0Rt615WXYVmiNjwWCP8\/tHBEXgZT+o+VpjWq7FYKj9C8lMAsXU9PoTeLXjYW+WGtEx48VN0pURURwNxGHBcg4Y+u3ot2mfhi9GA+sGTAAJCjTp5edanbLp5uIqi2QsFIYQMQ6mIPLVCpISsqvXmvLoFwTD0lfuiQop7uDPHSR4n3qfqVyxndoL6Tpyrn8cIMnvN\/fkIF4qY\/ASdszQx8O2TKx9Q76fIV6G97gOeiurwahBgldaqvuCRxcvX74lTRoGVv9775ymdSnyzQU6\/T7pTdLj8YcXeddLkEGVu4\/PAlh4jGiEXOBRvl+G0sYnV+MYGg+duL4mrIKjsDEoOLbd4Wbd6uqx2RPCCPH1h5PbPSgpdtyDsgjv1EHTC3PDxAt82t9oFHf8iMd34nhQDNmkHeLifp\/GU2rPA+32Jr9h\/8Jp7qA5AMnIs2\/R6HfBrdHzbOiOhLfRdxWg3CNs70dfnAiZu2RC+ewYGTAM0rJ9nnY+jK4i12p+EL\/kROsBaPjp\/YFfGyG+co9R\/JtXHQlrAzQFnAWhNUGPXEzoAL9drs5iAxQHuOxyWtI+S8emNXSlZckumXZAzBXrvvqValWBoLRxHo72wdO38ENTYuC1RvhURpYO6RjHE\/XvlWMN\/CK6Q\/Fco0P6gknoDfTKNUdWujLLVBO+vosMEHQJR9Le5H8\/\/2nfImPER5AQl6gRgv623ENVMpsb0dq2aihKLvGtCGUXYJVYd5rLLqm6om40eYO0u1YwbaOJt3xvzSbONDSTbdl0OtHxm33k4tgvlSuMIB+i580xqrccE+mexicbcsgD3GSm5KFidAFHjmmhd6DZJxdUqDZwnB2lrp5wkwujy02oB5dxCQ2iYJr7ky7iaH7YMus39wbheqv8L9w2d8E4f43Bw4z5DV\/HM9KF2bmtlFq8Qy0Rg6Fm3jweItaqE8+3rJnITxfnA\/7SGR74C6U+H7xQ15CeTRsM7ksPzqG1s4e5ZW0PxCInDVfuCPeFd3lk6JvYO7bQ\/we4UxBr7nTHv1TA\/rc3IfKTQmeVftUhZwE6WibY2ZqqQJObl1YZKTpPSKIB2Q8xRPl4ny5NvTB+pYNHLL5dERkfU6PVLYi4nVSWcA2wAyQEawKjyrP9+hXaA3GDfCSmFPkOjZboqb6Q7p6EPO1wRqMsFfaRwQT6n2\/gq7AsdsCDuV23jez0YuvZo+mI6mRFiYKzmYoDkv3FPk2zWHVX+6jwvanCU1193ioFxUsMwRaWtEYmNu27UEQiwmYZ14UrUp13UPMMQjz9vlmHQ2Uxtq\/n5VXVYzYqTBB+oWmzMugxFVzAeIeRJDc8Jwpl2JZdZUI5FfOjsa0Emvg0AjS9svJYFlHo9WpIPFbCAdU\/VjicD5iTz\/B3QBkZ2CD\/\/xnTaal9XcQitohu1j777rOTJ4\/dFMWI0B5+H8\/s65gCsK+Xa6oyYoo\/FUosciU6TmXs2JA5YMkGJ5sRTYWHPNNxKc3hFMD\/8DRX7BU+5+dGunpm\/oxw7naJQ7vpaf6Adf+YWJAr5jBYVxS773\/NfIJTqQfVNn4\/bcWmcHkv6Vq6k1hYJ+iaw4rgMzuql32ZwiLdKBCd6Jizq12sDw9tLdhB2ZnReO4Rr\/eHLg1hUFS4AI+d5jY4n7noXhWjtdqM+ilmwETfvZHT9mwMO370wx9pLbaKhdtkQcu\/gWeDbXFdIdBvHFFZ8tCmxLnvsPEFc78UsRfG0IH+H1Mu9Zq\/6bbUx3lHSNMFkJ3TyPJ+igrmjVNzvmZiYWvgwpYK2Opw8sIW5Isi17tYAIvzVvtKBoxOVyUE9zNg+n7CjJ9hSLHpdTF8Ex4zckM7+otB4dJ1YmTmbOaGYk1mj8s4JYHNmyMlIFLw9o2Q5S45IaM9tw6S\/TWu2L2a1HnovzISi8YD\/tpQOj4W4LpJrS0X2ZvShEGJ+E\/1qx6oOp0gymAa6cTXEvNMrUYwk7HSFtWj1wBM0MtLkH44qHGLITxMKFmsvUQqmKeRPIzIvN6EuXMiDd0hDnqbPfFSQ6e98cBME0j8Ap8vUCKt4Jnw6y0lVlQmf2j+fDkKL\/fNPt\/bVSwJsQoxPAthsUNibPy4RIFdEC9DJz71onm7FyRIZ4KOhyWBnpL3GTOn0FI1DhoWkvP16HdttyPKb2DIMVmiv+C2p2OU3IbYt8d9OpzXpmp2Yza3Hq6HjQp3H4M\/a9i4GNFqYYNFrGxmt9KVy0SriHMsNDC5rj\/ApSDhUd7\/QjEdNrv1ZV3ieGirgTBRIN0sSaCc+q1FRKMEKCwgfowa4Zcy7JpEy28dQzgi+Lt5loFKu4FlNcNtz+0wL3qk8nTBIc58\/tWhKaVK9C3AYFiUuhSTmSG9\/5d+zRODDMwSOdBSEklF7JyZPfi9kdd8Qn6rNAa41tfepUzTgNTlZirpBci9n+62G9HXD3xHve1x1SQZ8p2J6+d099fCCzmy1w6z0EHVM8AAVwR5uoQ+eNUs1vzjCF03aTvwKAs2lK+GP1xpHwYjiYFyVl0d6MG6CY7taUZNdQsy5+oKlvePMT7gw4xoDhV2kKAJDqmgaN57QGdarjSHnaZKOtVjVpwRD2grB9xV1Gj+QEfiOEhISOq6A+JiO1BXHeSkDFZSS39TwP7CE36NQvV1gfExdnZ01Wg8liama+45RiaA5g3kEFjbC9B5ecWosyvT17o9WlG6GvwXZLG5G3W\/Vsh9hRhznhSVj3oH02AnWKYvKpn2oW9BXsvaaSgqHp5bU5MHvbwEf+enhWhmnbGe3OegBKqnT5tkoyiHwK\/a3ZdEsf\/KCfCeAqEOx8zc0LP9eOJJbp6DmwaXMmXSDOdGCRjpy1EGO2XXSZDH4Y+oV0GsC8in5FfxjXRHLa\/2bvnQrn9W92jZix8iTa\/HprcH5iPpS3MzG1fSt9dl31Aku6EwYvNPtYnl82P9z+zBudQDayaFSh7NFsS3pIUC205BCVS\/taQ4Ob1tpSuAXppLoasb43zx5rE5eY47MLZgcwAovT3\/bAOor00cJ556VhGhsLCycKZwwBhe5J76l1z7zmBErXsnjx2C9QH6qMubb4TxiRrV\/3MSQ4ZlSB45\/9LpF4RCJ0VBunCs0JsPgkjw9YtYVFTXuQv36\/rStPnL18t0OW41k3q9g7RM8LmfAy5x1Cu7mtkiW23WAknvwNb8mwf9ikYEqmNQG4B5XCAvK6KtCsbpwbHAhPubXMtUPcAd4JTUgjurbfULEzATyQZsg8S6nwKL\/MNnn9sW6rm2iimLoVJr3DVNBjRboxLVjiMPkwn7UEXcELdgz1G2aB\/1gtulEe5cPdJhUJvakY31OWV9T0aBXq9H5evWZtop3imnMZQ5O55aGhphBpH9\/eGlYvCHLazn3N5XmwudQAdl1HRPhE2fSIN1WNjh0sGTJjOPK0JHgCZjtKUGVkmzN0p4cBh0n2Q+64XRzpT\/e06zidYkDMdqMhQmHrXX8lO+qqY+uNbYtwysjgbaBLCtHouGDZA\/\/LfMoxld3LhC8XQct5tUOBlo+Bug9i0GjYtJv9dpPDoyUvZCLKC98tSl+uS74++VlGUSJtqU8hEOBzjd+hD9tv4i6LosJ3q2q8X1vRunXFLsqTuzXLJlYT7Jnwu9h65WitVotj3zkEKIZRqHUgmuOEN5XDJWljHkmLSDNVRV6eFlYIsCz7wErti4diCFrakehe2d0eFgvLxNr1qbN+ud2dkg3eEhXBmhKkLjkD1vyqrHHoWK9Budaf9sjL\/XKrPA91bioyhU8B3IIMg6C5Wrcz3VGSFUnM\/T8lYDKw398IkphzH32gKdQTyaYxkJVOmVOsJnZMhL\/WZFr9vu\/oBoBhiSdo6OKQAvQuiqHbi4F5GZ3ntoRrZlUBv51ti12hDNtablEVbZiaHAVJn976vY7jeCTRr8JxUrA1i4hMoYFJcy5+yTEFTYo8NdGMA0xH2ojn0Zk6LuHyDK5fjdUFdmjNsNIkNxH\/nTjPov8pz\/E68pWz89NHf3RPgU\/k5xEMiqUJpm86UpYj1f2d1Agw\/hg6Ddt3B3g3uCc5981uMWX\/j4dw7si5UompGqMH8mjOWMH2muwyC01s9LISyZoT0lhPI3Ah3khotcdjKAd67iMxOKR8jF0x4OL94gLley9DoPrYMugDh7QdtG3z+rboRVJzc5xEQeOfW2v40a8wJe5qAgFy2G2tcllItfDbC\/0fAf37XQwRTT+ESd41wVr81z5jl7yo2fVwvCrZKvT3xzpLV\/3Zne13A1iaf8Yz2Ha4BvhTyrDU9M1af43cTrnBVH7TqVPkfTJ\/VXpx+hdSnXZO0HbNGjBpwhITqR8E7hRT\/oofgn\/le2gUMqyu7ZlZ19XhKbxRnT9OSkScEneiJTghjSXx9DHEfcphpBJQHE53cv9QoKHlK7NoIdYGTsVELHWHg20mld7GaDaQbfjKjt3pM9If\/5UXwuxHXhXFmeqgFVk6cDJLnbntpqzHugyTwXBEpny+5gOV6G+fKTX3FP9jpVIowYYhOGBNjQOSBzJzej072+vCDe\/gsRNyuwgfhYGkK\/zk1fwwtBGE5Kd4aCToDevhz\/08izJVVxCVAHzL0KTL+pwX9DP\/Us6V\/Xis\/w7LKdPZSXZw1h5sjWlrdX4oy8Pk3B2MW1qacELSDcx4NTtRyoTlbA1JS+7A4WIvjSPe56W6gaAaTP81gAAbiL9iQzDdnzErMvLf47+zKjZbs9w5mswoKg68trd9BY3ybMwCn0CEpLvg2pcihb3dbNRWl7Pft2VFa8xDf3xmzVq8D85WeJvL8DyDXcYsSgD1YHKb0cIsWkyMbZQ0cIA1OG5ICvWigrmqQYMiw5FT4nqxL3JUDmoRPH8z+rpooiAHtpRD40zi88uVkqLmovJuvwC8zMbh0okXlV\/eulBshDpWczb5wLVJYkLXPjHe8LRQEIM+QOfRrqcHx5bM0DrbrzM+iv8OrLYzxZUCAQ0IAAIsyGa5XshdropH3pPL9Od3Z3JO\/0aJ6SneVqWHXDzV0Q4rD2CpMYqfFQQcOSZhi4guej+EXflW4gjWfPTDNLI5uv6LLKpBx6eZhap1gh2gDulu00GvycQP3dZgylEjtsTJXOFODCJ\/r0BpLIlWM0hnYvKGEbmKNYi53TKZXcfSSRx5\/TKO5MdEH08NpwQaVwpoiRPtng+ievvD\/uHZ5AogqJyRXmyMUy5T\/yQbvSlSW5Vw1JpDyG0Tv7I+MNjyvizY5xtO9npIl6g4ip+CyptT81m\/GN\/68J1MsJFE1lDd9iwygGq3z1YjwD8bU\/wNdmeVMTGS8do3+Ygo+gyGwMa7LW4uPhUw2Cjc3W9sZlNz03mfe0tp8Mor+ExslhNW5sPa\/F+l+J5ZGjvQ12LoOtT+D5Dv8R9r9G5Oe0oyHYb+bc+6xEZCfwvbLmeCEFU89nbgE9jmIU4N+qzdkJ89NCZVF5mkjcxlwB1352TboCwmnh8Ajwn7LYxK4tJ58gAUPvZXpjJAyegNt6MnYnoHHvzS8LuA07XMEUyJPhcJ9TY9qf+B0tnpdwHKDHg770RYBXe+ptpTlHXjTLBjJDFYcjobxsu\/qVNgsHCTPt3XOX9Vfq\/UtaVAcZjgOZ2wyrTYUbNBz6O5HvmqmNVrEIEbS07jFs\/g7aJR5lEQbLxyc79avAruioShtd0fWaGgjXbv51HHMTswMIYHagz1X6eTfq6QMmdA8\/BP\/VUQbWk\/F+X93\/\/eT8I6wth5Z2zWKREA3byWk7Vm3A\/Z8FtsmMFlHP5Pv22DDnbvlVe422mLq6pDFLf49EFn2XHgHq4GlX9jrw1gTxViawnpWFU3Llse9pVi\/Bw0fW8Y3WdzF099NrqD224Glf2vnMr5oLLG4cXEzPZRT0LdLE3iyVUVclV0knx+BuVwFuYiaquYhNZryDVpL0Zq1AlSivGwY1WWYphiOKaIjywmJWQ5qfcnV0AlzJR1vs9rIJ3PuWi5nLSWYfnQrPo9nyHCo0r7J2oHLd0sYsY11R5YK8kJrjA3s3xOKpsFVee3j0nYjTAhj0TswOYklhGz8UTlm8GdNX\/a1GDEhgzeEa6iGU8cQcGHhqfEnsIwuNeQXuXEQoo796KhQCA1x7z6DYWLRtnogk+m0+KKRtH681iuEk375wBTR5BIRih\/pDVIkYCdg9+k4aPAwK2o7YCAesraZ5C2znfzBrdvlh02oJpEkS9IidcbvOHJCgdRmfWVGiMRTfkBOSDXQsSC64xgrOVxf53ACTqlC3\/3vpBJ+TFGsUPJI6QG7tBoFTLUWQq19R4z2V69otD12g0pxwyBPVMtQDCLAG1NCFtW+P5HWeIHmim3e1N89FWVVwIPMR\/krsgqoyhi6pCw6EoiqHqv90HVwJ9cnvurRQLvKnlwsXbPm10WhPDUyecQi505PVitO0THZOmdJSSFGxrfO7uSq+\/xMxzSVvdzmnav0xctIvKcR3risIjbApmfnV1gVckK1vEqiDT9NGdN03e1XEoZyn2RQYapQNNfIcYfl\/YwaYwM3ZYA+4vKREsN8rFvtGhXNcPo\/Nfors0YA8Qd6+R87C1e+O0c4MDDQchAkCAoNf0xd4tTENyyGWs0KbklLFPJEVOvw4Xm4WQO1Z0EOhxueN6yOmvS04XDUdBYzCcxMvHKVGRvmCSNO16k7m2VBIo\/fFaY6mDaiBolAonG6MnJkci3Uwf8JQLyh7mUojiAWbWNz4ZzH0PRHrU7IjT\/GkfWPBRsp5NPaM9NQQminfUFXO+nMPWdUTA\/FBfpnWMQqlNJWjCfGbOQeoIp+7cEswwu3FBKW+Gtg2SklUACvSMqNzNmbEwKTi1ZXGvcwaqyVV4YbLN0di5M\/1G6FFa4mzl9zq1PilkFt7ECvM4AU\/xw4Iouk\/VFTvl\/5+X09UWp0zHVme0mhYZaf1YBVuBF0tJG\/e3vGY2L9Zx5eELHWKST56JgNEhAc2wWe1DZsCdWdmHF66b+Colht55A4M2Tz0fjYjknIGlTQY45XyvJuIB9w3YKJmGsvCmE2Go+mqs2MxN\/g27jichXmGLnmpRhKVUVmA0zSuW0VbUFqBeyJtbZerbmFy8X4etq+J6GTv\/Vr6msIMYK4u1DjOm7Z0+BL7fNJ4gA7t06SkwW\/Ec6bI3tb3vSkchuf1monW1qtOK1BKfdyqtmcAyP0kI2H7fQimU5HVr8GX\/UpwSFzVg0qhE\/cF2rkJjdxvyoxTUK5Iyd2hljnFQo\/upVtJbtazFVlmKdIM9jE\/+YXnjfICdzEyEBHA2\/PZBRtd\/0OmiI2Dsp6UEjEthtEEUVc3KZz+V8YL7zkZJQ\/tRIfJHPwDra0NWwH8\/9HXAu\/k2hJ8bGxlNQM6igi7SlvwPHY5qYIoB54Oq3HAqpo53KaQ==","iv":"3519c4b039584ad505eeef6d02c81ed2","s":"82c2b657caa642cb"}

Buy-now-pay-later makes large purchases more accessible for younger consumers. Image credit: Afterpay

Buy-now-pay-later makes large purchases more accessible for younger consumers. Image credit: Afterpay