When it comes to attracting shoppers, brands should contemplate how disparate lifestyles and preferences may attract or discourage consumers.

According to The Psychology of Store Selection report from advertising solution company Emodo, working in-office can have benefits for brands as consumers are willing to travel 10.5 miles when leaving work versus only 7.4 miles when leaving from home. Brands must also appeal to consumers with varying sentiments towards shopping and adjust their strategies accordingly.

"The opportunity for physical retail has to claw back share versus digital retail as consumers re-emerge into their normal lifestyles and behaviors [was the most surprising point in our research]," said Jake Moskowitz, head of the Emodo Institute, San Francisco.

"With Omicron waning and COVID-19 protocols being lifted widely, it’s a great chance for physical retailers to steal share as consumers experience significant behavior changes that will alter their retail habits."

Emodo polled 550 shoppers across the United States for this report. Emodo defined “work-shoppers” as those leaving from the office to shop, while “home-shoppers” are leaving from their homes.

Shopping psychology

Luxury marketers should remember that consumers are multi-faceted individuals who have disparate personal backgrounds, hold different needs and can be optimists or pessimists when it comes to the current state of shopping and the economy.

Home shoppers are more likely to consider pricing when shopping. Image credit: Emodo

Home shoppers are more likely to consider pricing when shopping. Image credit: Emodo

Home-shoppers are significantly more likely to value brand reputation, promotions and lower prices, and marketers are urged to target consumers at their home locations with fitting messaging.

Consumers who shop at the stores closest to them tend to have kids at home, prioritize in-store product selection and quality, brand reputation and in-store safety related to COVID-19.

Those who are willing to shop at a store not closest to them are making their decision based on different priorities such as loyalty programs, easier parking and the ability to go in and out of stores faster. They are also likely to shop more at stores that enforce vaccine mandates.

Consumer who shop from work are notably less price-conscious than those who shop online or who leave to shop from home. This makes them immensely attractive to luxury brands.

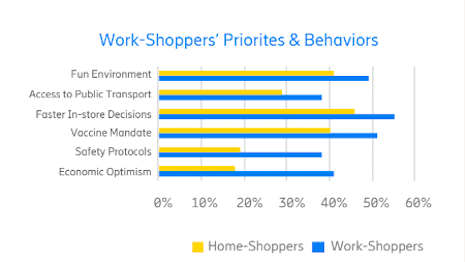

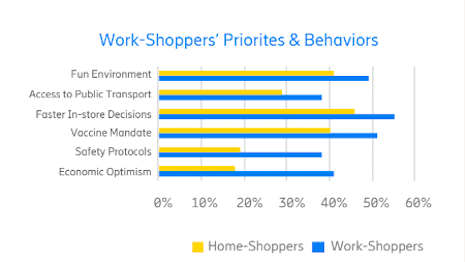

Work-shoppers are looking for faster in-store decisions and implemented vaccine policies. Image credit: Emodo

Work-shoppers are looking for faster in-store decisions and implemented vaccine policies. Image credit: Emodo

Work-shoppers value COVID-19 safety and are twice as likely to research a store’s COVID-19 protocols ahead of time and noted that vaccine mandates make them 28 percent more likely to shop at a location.

They also are nearly 60 percent more likely to report they have decreased their online shopping in favor of brick-and-mortar locations since stores have reopened.

Consumers who are optimists are two times more likely to cut down on online spending since stores have reopened, 50 percent more likely to be concerned about feeling safe inside a store and 200 percent as likely to visit different stores now than before the pandemic.

Pessimists are one-third as likely to report an increase in holiday spending later this year, 200 percent as likely to be visiting the same stores now than before the pandemic and twice more likely to report that the latest retail conditions have not affected their online shopping.

Shoppers are willing to travel longer distances when leaving from the office. Image credit: Neiman Marcus

Shoppers are willing to travel longer distances when leaving from the office. Image credit: Neiman Marcus

Skeptics are more motivated by convenient locations and better selections, while optimists are more motivated by brand reputation and safety protocols.

In responding to two different groups, luxury marketers must implement dual messaging. Since it can be difficult for brands to identify who exactly is a pessimist or optimist individually, they must address the groups with two messages — one message that resonates most with skeptics within a segment and one that will resonate more with optimists.

In-store loyalty

Since consumers who shop from work are ostensibly less price-conscious and more willing to shop in-store, this could be a key group for luxury marketers to appeal to, particularly as more consumers are returning to in-person shopping.

Despite the tumultuous effects of the COVID-19 pandemic on retail, shopping malls have persevered and are transforming to match new consumer behavior.

According to Placer.ai, consumer behavior indicates that shopping behavior is stabilizing and, likely due to pent-up demand over the last two years, people are returning to malls. To set themselves apart, mall operators have had to creatively fill open spaces left by store closures, such as pop-up shops and art installations, as well as meet demand for digital touchpoints (see story).

Luxury brands and marketers are cognizant that for some consumers, in-store shopping never goes out of style. With this, comes expansion.

Last February, LVMH-owned beauty retailer Sephora announced its plans to open 260 new stores in 2021, making it the retailer’s largest store expansion in its 21-year history in the United States. With store openings, Sephora asserted its confidence in the future of brick-and-mortar shopping (see story).

"Luxury marketers can take advantage of geographic targeting techniques to target consumers based on their work location versus their home location," Mr. Moskowitz said. "[With] targeting them during different mindsets, and with the right bifurcation of messaging, you can come closer to achieving the ultimate goal of marketing, to reach the right consumer at the right time in the right place."

{"ct":"c7+vy6KI44UPbq2QnjF\/z8ju603nKR7wKYxihhjodDdfVbuG7y+9Wzx\/qsnbtEDKYYyGG07d8hfwsK4xJM6Wpy\/z12zJC8J2P2Jp\/CaHtDRpGiO\/ZZZQNwbXNM8ceoiPrb+M0UunTq8z9jSPMlFox8ljr3Gob0AQLDgwE0Wk1m29vNIC6ae3cpnk\/Pk7\/RUd2RkJk46wF+FO4LSxjOT8zZxUBCMxR2\/3sDIXGVknNIXAXnNxTt9TpZQGo18LsWN6JwlLeClJXNUSecUjymMaR0zKSKTMpTfttWtecGj0uVfnQXbe8nqLvF+QZv6vjIeCOQneiKC9zvuYcgg43jvfErC\/6PcA+emkVD0r1U1nwz2cYSeAsTJ5NDfCpBWdgu9oRqOvLQeeWpl6X5q1yKSRgORkblviFs9gsjtghZmst14YNmTAAgYvr8I8nGphCB6IhdxR5pCRz9qeYqfb9Q8k26Lap1MaZyd+1Vsh+JOp7lfpEJyTAAEKqTNnZmN1VrvOr6SKr0tyT2ICntyeQlHe2DyCMihgXq3gVPCXPZvX6CYt6vhkXuz1weMFj3la8fyCAitWzl2dujqG6ptMYB1gy3JYKoxDYETsZK3grUyNDMc3ahhitgUYooKm+9XyYelGkO4sr6lNMjb7ALLwavQKyecbMCjd9amHTWXPZpn8\/LNLVILBuTtci1DZOMNOlYRwcRJNf+1hNQgF4Rf3r7wJRuK2svYaURV46akkRrJUWuVklaQMPxOQSCTKoX\/TjD4tic56sH44dbuTu4VfGTDio6oHbgbFsmA6HRtYmM+51KQqxYQ2fAHPhJRvOv7CX7BPNges3a0Qh7M+Xs+zFTokuRtG\/MNZ4BEZ1xxlLmb0VjZ3nGS9r0jDs3uvbvsibinIlfvD2RPuk+KqBtiX2rtXfUGB\/JbnrhYfcT\/NlF5eEIOToKS3zx1KDZ2lBYoVKpk7v5Sg+xKh1BIPb3iLysQGxZzYu\/t3Iu6TfaLaQNkPvlcyO56\/pbfRrTtQfFL6ZQYAjmSD7AvmihyMtpWb9jv5OtcszZlcFPc4q9I\/dRlNc+SrT3aWcnDLHxh8pOdjsSoOwz7CKRXYiOlEmdrPGhPMeAO01NwY\/zvJ9U5xqppcHLlp8+LcGHItFt2XVuBNBejJe9JyLFnGKfrdelU1hfrd1vicc1tzzlhEFI\/8CfotSs\/xahqkwFFOO6RZzJYD5vd7RRKiyhANPOf0eWqRIQErGONpG0UGVcRrT6mTH9n4rWbbDO9KG5f2Lp+mI1fAFdrKSYLOthuwUC2dHuoEiPgmDMS2jpfcEbZxIQfYLmEhnhysTIjew\/WILoi4zvHi6CWHMlVKq\/6PKpv\/CLI\/7w4SIfMgFxizD\/BLh9N6m8qtdVYE6E0C0Vp8jvdtu4V+simnCLpxuXDMyPxjeKFv8y+blkBXOdAPuzFNu1mjU1Tr+thTqDxjSvzQmPJRY5TL2AB2gvv6A7v2hgsoC+EcKf2XSmEIEeMwlalGcYO3fFUiGyfO6DboOaIJmUWMrDAMtIsI2ztTiwJgrStk+HqtLeVrNnxRtSq7vtYkurHvzb\/71zymHRu40nDmbaHmMGraUerYTXaMtIyg7Cbtu5Yn8W18F9nYtxyXAkyWb12lfNAleLDcjChW2iAabVrifdB\/EchETm5RhyB\/pJLGwNqeI5LT1+Fhq4ytUdfR4YZ+kuAd4IFJgq6UYIDUVQzAMVcJhj2tGaqAEERdf7U3ug65lfcgzdG1Bm\/tK8A0B7k+rystRwJdjKv2PAATA6jzMkPqqoB5kNDh+KJPVdzBUJIfif1a7P5wtkthvNX65KEKz8MiX8i9vUoQchg\/dXDN4QGi4E2XpExIAM5dj5rJDu38vcEHg2WwKt3EwghCLvmqHVIERhaAVaxuKk4ciidklSxOkbhrdLjZHilDLMIqf9YTZlSWIO4tbp42El6zCO4motx+5qEmx\/dY1uVrD3chJ5\/eyiN1kIb+pSpEFlKNxG75eFqUpTw+D54dkCECgDwRYv+iepSYSDvrNilRKlu4facQk5jsfxSMqYGJ25quaY63iCyBZbAugqdjXUiFcvz3shbd18hIWoxh52LzSMNOzAot90z8owBcSGjzRYe9\/16Z47v2sI24lmtMx9qYiQioQNullcmaczPU89Jg+h9ZYZhMK9xHrHWjs6SmR8zkyq0Abru4HhiEFuYm\/oX+Y9RMDeU3QTg0rQiurSXJlR8DbgYtSrvxe53pG3RJOImHSe7j0\/r3gbI+KgRsXQQMoNC19TO+cXSv5H9fZYoUO1u8C2MmRU7FRx7z5aI+OTIGv6++IvgCMx8RGZpVOwnyVGJ9QCp\/eRqFjJo2krCwQv1GdIZ0Ero\/m7bQCUxpUyk2no8hx4esoFN68iMUbf6o\/1h+tdCRiCVlKOZnArdioSzyBVIoztf9tzCo09wDXYozDFsMNDlfdnqy6pxFZneqyhzPROFMrP5Hb2eDRMezhas5wmmUWzBFlG5q\/jLqBUlVVRnNC5AcgJgMK3A2V5u\/2UhFyS3TLh1klnSniU8W0bDzFi\/oJl\/57RgteWWpnjDRxG45qWONWpWbSLMjuA6bs++28DsiYmi4a1hL3wEQy\/k\/9xjGtDw8ymWlnYWDBpA+nWymtTuMiPxOLriFedIiREQRElzOUlh76VqbWZxChZZSKU1s5q93CZ1E41HpEUwE1Z70eWtAh3xQiHH8nkBJ4KBg0+ei69nRKM2q7lm31TDb7wIlSUNG4s6esFiD+rf3S6xnHh\/Wf7pgse0cnsEHptzxsF0EBejL3qAVYxR\/4HhNs+FpeEOawkrNPsQW5utNc0uItkHvWcMnqarwNrfzBfqpaqMdp04SPun9NNSnb6\/nCVK6j5L6\/6+3l5q3mOs0auj1i3ggV4ejqrWN7hUIcnSOmYEgKyZpyGplovlIPn+7sKRZbURa+JOprItJpZ66XtZhRiJIfNfsfH3ej6o\/moDJPXbMORBMt35ixhFkN7jkNjDulxJYzXuYD3PTppnNb2Jr\/f87kOKpkCS5cpfKaSjWPeTqK3SOdTwL6hi883lDcpW7ASVqQVnltXVETbdonjUYDXpKbvGRvFVpNi0o+EFtluHHd+xRMkboOJ+RFEWj8llSaCpY7gYqqp\/6cu4OEIVAsFZDsIh9QiGjZyctJoQA0vwRBC9esfVWSia0qkDgTV9XI\/4nMOBOAAgEVpJOeLnNAQx5D4BDFKe3DxZ3Dl5fC9RGhOLR9cECHINmPEFtn8xDxmvNwSmsnGvjZ\/esnoBmyau7TRbWHMGMDuCyAizV59MvasOROuZFRZaSmmvMwV5g7EDaynLOCeK0n4lNh5k\/dJsa6mHMNYm\/SoB3ZwUoM03cJ79GknQ8RgJ7P34g2zijLFJgXqnbJny9qddfH7YBs6Pw5L7vlpoZ+SDeupW04pWgBY1YIX1YgdShN4h3dNdblYeFqRb\/Y0QYu3cKhgAyOmeupI512gUb1sV\/a6KehX7ySiq89W8lJS3ghIqjf5quezYSLPvFv4VlwyFWeRlD7tjPDV24roJLeD8kysMnkV6gVGU+6NsfrDyoTKC9dwoKWgTBQ3H1VSZlZrvIibubWegXMc9rTpfJCA\/UgzWXikLcNufk9ITVuWguYAtAIR7d9y\/0t9YI2U\/USzHVTITQjDFviS\/m1u82Ut8NgIQKQ8Y2E2yewOAvbvbiGrN7hOxvI+SBaoS\/fjEalFtGeen3oa0LAMfBH0aOsStarrbotnHrn98Jk9DYaa\/yuMTeN6qJCv9nu9jxPFPEBx0d1OS61+gtYdFfr4hSxui62d2xt2\/ncL9fs\/1y4Eds14lGbGar14ECqWKVkvUCIn+7CtidEllXWW4s7iMM2Q\/NTGlc9zT+Wcpx\/BljZoC81c0yVryJMU5wJA9sZbWyE9DgxQHzuqnZ9k+bXLKbQazaTw1I3ZrhiCIk6MdrwlPZvK7azRUUJIqW4n4jAIA3Bfn+n3R4dK5ZvVrdFeAyHzUZQgDPSMP8goOoPJD418tj9YVCZSIGMUX0rtYfb9WX5MkPIRYmR0laEGh0UUAww+5VZm\/9F+dmRBAIP1HIHeA\/NiXqpF6FDWrMRjLDd7JhUJjWA9QzPFY4i36irnXYDBSJpRQJXRxt7hxNNLQtn5N4dclLMfpphlTFAyF\/AkAwbCeqxY19+v+JvwoOkVShV5PODZ74\/IwfqkMoLMUGV972fKdE4Y\/v24myKM9LTefSiNrb\/q9D2dwGTXA3vBMMMBvGCZRMl31GbOuDuBjFzdt2lzRsFxi6ysD0hVg6eV5fs5ePfiQ6nthEXE39D47vZJVhR1gLqGPuWWN0++I6MbPzn3cEbLQId5KE8KDMIxf1ooFBjnUxHDJgyISfZjqngHt\/q5B6Z7MkcHpb6F3Esicz90dKrwgB7DLQ\/a4Utn1NaEHG0KY3orndk5+s8t9zGUotwwZtD3\/QWVxwDhnzl8pInmFS+k3CSo+bxdx5wqcJoMezyouVZInWke61sudakj83muZqHqLHQ8egSlJ3mlLOEVLwB+r0MGD0\/RqNp\/KnfVsmJ1RS0oal9U8yJjgy8pTyAahrPAIFSrtWZl6VkZNgV8PRYxtf6uc2eveTeucai2Yz3yzCtW2G+I2OyXzg4yjg2pmk7uBWzJ+RIdTFgRGaxYmfwzsUKF8UwkuQJ1mx7I5gKRK93RRLJKieHlZ4Y4LwBY+WrTN5UUHVmxkU3KHurDnQZ4CoepgQAS8h8fAdSqKSgRaDwUcgKWHR+7rr04JXy0g+uTcnJzA826bTQpkptgAGbmAhd\/xn8f5jnUi8pF+4bc6jvLe14IDZmkOUPgE1iC23l2pm2XhFnYBTOs6nETNVKVkoKm4x1jpmg173C5lWKCHzawHCotpYMU6Rm91QHzphVqARDO8drP305KwLLQSKX7dDAh4wbSCjOZnwaXrvsdXgzHNJG1rgJrbcT8jotMvY4\/rF4K\/viY8pJKjT+bRJWKOSHJdNk8nMqUzm2nUTsI0njHjFnHPzWdC+0Oy4vCjGOdl5bgFHgTsAXeUtHLjPK1ZMoblTUr9aeNmfeazdfHQDWOvPFKdj3D3egyANnRxcPuycUtcAnbv35H\/4baY9giTSNy\/YsZW6tj2Yg08KIh6vY+mHo3EbeuigQ3Tu0yx6t4sh6Ado99R1a+BqxF5QsY5Ke1qWWC75Md0AGBUwHUbnHBb3L06cU\/tOdNNXVsUYpGqWM+7wxiYn+DoHBGSC4hMeeukPrSNzjHD0u+XgkEbkeAqJUsFYZr6x8v4b9aJAMHHLxvL2+herjjp8V4Yw8HfuqUmRlstuCLssEi49l6riHzgy8Z9UYCwYpDT2vV+uFlyi90vfx+oBA3fw78beNMOhKLyE\/Rkf5wF20dr3rPnuSYEdWwrQdQqyYQb843FsbciUk7WrT4xEPmC02eXEzHq82LHdf698CWRgbO7dfjW03B+HD8y6x\/IFiHjuf0l5q39+6s16w3ZMMagKc5QtAIh0ZJ+AD3WF3S9rkIJrRNAliGD65n5EDbFAtl42jdGxQwB6PCZWBIqMCfVIq+nUpfiNFobAxnyyihq+fXG1iO3lqe3xczqsfgEEVYLE\/psegYrAoYv3G4f5LTNvAblSrHrmEd366WRUmMuN2qKV3w\/Eu61Er7snKAFQv5zzOCR7A5dPqaPHFI2XyUT2AmxjCUCowWUNNSRxtdsyJD4\/BuAHEygB+gBzo6wkRrVPxv5\/1OZFa\/\/V\/4wBxL+BehvX7Rp0xFJrzcJmFAB0Iz+2Hsw+wlgYDXXedptildvd2ljKWkihWovM\/A1fVxFDLSPQqGzEkr8BJTj2C2lL9THUpuJjQlNlexsS+4IcPbIyoge8k2N+K1rsWhr8WK0ql3g7BG1T8qF+yRBxEX4ue1bHySWHwNO1nDrKAIiWBAieKLNTWWIE9U4OES6Ov8AJke\/mw+cMGqMbCeCehk\/qlBZKoIjwpdixgRlo0Fo\/zcwfUd+gS\/qyRtMCtzatTzs\/+\/t2+3SRDar\/XOz6NvN0NGn79zxO1Gn+JrOPw5KrOKZ6F4fxA70tyW9EzqewRvxAA5R36YAwj71lK4xRzt5A39yHs1gMYtej\/i41BWYs0S+bSC9EzfnTTaEeF42VdRSAhuW5wUYnKSDn8DG0FYoFBhY5QIPqryndT90z34\/\/YxugdhTWy62iBaR4Df0eNmERW6elM7NPdkfBHMqEWn6akr3Vw3nPQfCkQUD2Js6eYX8pYeq1VpY3dznD387pCrcC3T7hKYbttFiDzSJ1UcblKIiaEK1fgJxOJw6fluFwpZv80S+15WofQh8+7dEYSesF6wXFQdidywj28V0oUAqeS45WX3PhLSii5XXK5S22Vu3yw3poU9jbRJeZsSAacueKKrbbs7Tp6LRGRSw5gtGCvnHqwm6EItKKJRcbqRYCK8XyWuH2300z9x0LemaJYkLTDRLq5MuR+OaI4myds5g+rqa0lT\/SlSOWmyp2aMe4u\/QEwFXeg22Ugw2JXZlHaWw3rezXBx6KejQAaTZ4kCSQW5YLB7OA48hMSMT0ny3UAfdUJR3raxZGUh8k3hpm4ivZzvMSFx8lgJJxqZ8UvMepa9FAlxZxsiIq+eiegJomh04vbKtzdlPzbEtdkXFbWUaMSeg24emHQ0t6G7HAZNTWD4MBXrQdYJFn7tiNGWJe1T2gmRCesXaZ3HJcjrMf\/5hUr39KrozOTSaeWzVx59gk0F8bCW3xJDpzgC+8etO2H8cofpMSahvgW+IuZFcDc5dz2OxMO+gELU2zqBqp2HKb6p6aHiqRTds8NNysOfEMsbeWdHb92tEAsBmi3OLhvABHugkoINwlJfNA8YDfifYXke6f0cFy5sLtccO2Z8uHDv5Ag+e\/4Ig8JIS7hQ+Ms8CMIV7zshSXO5Jq+LhrQEj036R9WFLzaNNvA2IEM1tLwmOsd0r41MAHEyYP20c1q3HC1CwoRAs8Yy5gBikIGbKGideXRU0+86ZCk+n4nQt1836ZiXBye7Nz9I+dY+OgUO7hDSPlz9+tCnk2bSpp4NLo1oVpTnjORxt0\/0KPd5Dxw5OZK2R4ThKtFSez+SmtvoaDRxu1LlkvaiZY7vePRO9+ZTWIjtnUR6XAGAjdj8J\/MFVlJIWe7VXaTqPSA7YPQOx+7XlsxJn2lTC5tyfbTHFf0mYtMRQUcqOKkMTb9K9bnirvOLX04k3OWe3XrF4JSk1AIMPKjJvtPhUYZTed9RHSmi3Yc\/Jx3wroaFahnXgZPppYcQY19\/7n\/amIUC04+BXMvKrpmVTc3UQWcKwvYeAonPylJNrq\/+qSvDYyXsvN0pZmqA1\/oU2eG\/tdGRlVN3z1T3DyGihdKeWY79WPVnXXAo3d2sEMITCq0Hc3rf8p\/cCsk\/uFqjyPQAGE74FcNobZ\/kjgVjb6rGouIBoCN31FzCMEikUJ+pzFVZrfS3PNMmSsY6PtrFofX+JMm1GTpGPYNC1L1\/9tQcraboiVRXOil22UXZocmWt5pvupqhctuhIjoEa6AeRgxr0LCdTVVSmTubFXz0yNXaJT\/bXn2DBi1PLqhj9aMnx\/5hTKgRaiMJLpHz8uHu5KWVkAxra0SuO\/0Df\/B9u\/rv7ak\/nge0mrQsvESJckkpO0JWSKL0IHTKWMaMPPCPyFSJEKFzaJ\/U+quVc0S+xc1nvgHyeg+kPOA56WNkHGHJA7cpd9E1aJUGfcCW7EnbxyGBQ6yeGlz25MrpEmv4ntM7OcpGysqLQz36jl19mVzpgngYGIOg7CnegwGRbbyaEk4UhsVRva\/S5vCP19XFzsNUo3jJHbQWxk8AFZ0iYukXQ7+yc+tlcou79doP4GDFXwKwBbWm29sUMBpCq49LHSjBJ1y\/WxxMeki9z0U23zKJKmWOjouhjQYKkXhOd+n8XAz7oLoAPSXzKEWDtDDbhu2sNfJHOw3WkugsKOTgZwQxZtWxb7u9NJ\/DArb6k\/8W0hqbBt24MehueMDBUOP8NTR71LVAyHmL1qnQsnva2paXkC8dgPv8PWBCGx+8mrUbyDHA3e2wOSmMGt3IdK8wx1s92W5aAH++GK4QAbB6X+VvLqsBZ4Bh8oZAr5MyDjNHFWCicJ5Yt7vL6rz3Iuo\/oSpNpZ6lM7F4MZ9Dvp\/dJswOpSy1sTC9d8D7pDRc4uhtAuIKD8+6l0TxXEhoV1HFf+2ZThcZf3iq8Q\/IYaIBMMA9sQa09UOOiTdkWOqrFTaky93h87tUfaBod8vYay3F3+zIRZQUYToP4VRRYj5GBqIomsJaGHOOhCYvRIi0JinJcb9mASW0H+oubo8jWLBTkZLoZYvWayhLM9cSWHp2letiHEEV3Xx+yFe1Ah\/3wTZI5MTf3VOBH1LmgHDsziLcFKLdYNyiu0oCw+tOf4jP9xameRU2YaRtfst\/gPrM+Te4dNxqGpn\/svCduYsnyRYlehjNK3PZZxK362St4aEy+J0d6h1+ItYIcqv0nVf3x7UwCv3aN0Hn0Oz\/ixqkn3jzUfCJg2zNMKHdzNNaDAwPIqk9cZTMEke9PRuVzAoFVhJ3vJzOLhgvFgfnwIEHrEadLQaRvcwh9gb\/o+Z6C6DBY9y5OUFL7rDGq5fcwvVqiFRinI09+fZqLBOQJFt1a\/ZFRp\/X7E3nsgwxy1lPKjjQoZP35y047JlTLSEuLQ2sbC8csp7M3Ky4aUI6OJ6+vjEYJLOgMNgtAvXHe4Q04qRUkKyM51h5uwIK\/cGOethV7z10Qo2mgoqau6DKfyFGdGIWZAkV49ATCaJtqyASIS\/W+rrPRHaxPIo6keOGC8ZR86Ge0zWNGrohasLrRZX9JMjMsNRqPCrAieIlDfhRNqKDDl55RaN9ZOG8zYu+Qp7GwfOyjowRRlCRYFn1fPB3CQ2TzFAQJE0CzkhblQY2m6Dgtt1iNFlwG6NX50CGHvMg1jkEVaA2EcCdLnRVpeGhJQhg1Eh2sHfrRz5URgGxMdHKudgxET1THfnJAlEaKMO9OQPhOnqUYb3GeC6AQkzm4FDKmC8IfA\/8cdtX4pwnhtbPl3vbj+g8UVGGFSi9ZlKyl\/wjwexgC+\/TlG0p10ePOQ8RiONX2ygAErFcaIl26p527WxKaMbAvyWgHH48T8GTllNpW8i2te2SLiYwwXNoBz9i3r8eQFfi+8XC7+h8YKhp1qwiA2vW38N12VTUu++xf9QbQ3WiZ6GB7HyxvP4cSeWFnH9g0gS\/HRUN+tbeaxta0+nkYYnUXdEGMOg3JMwtxAQRKTwvjpJYriYTzm4+KGZk2JDO8hYbBi28wuBeBym83MPO1AJEhjLDlWBxO3S3pFngVCgn3nA8Ry0MM\/DBtBed0oS8WO+N4OZAdC8PPQoZK6XqepEmV+ZrVcBOn7ocjAn353RaWGMJF3aQSXP5c7kmpp4frcMEWOCOoqU3senGPkcVBrAk2Qg2eQNqs57rNRPQTvu5q2chRfqi+tX76kBADSjc9aoVoqTkBKYG8EFBy5YPYMyX7F0tm5rEp3JQh54mjhojbHvfgHTGvf8HBYkTd4noOS6v2Xt7nFIfIA7Jy6xZGFcR1nK4++NBXTk+OCIqG6Yd4a0AukzJu+\/alY297jRkb38UlAK786SgZH6fWcX5xMYqUBT2Ot06OKjS+\/yB+sT1jsyPKgXH9df028qi96M8G8cVkBy4Bk5U6wTv2rmn2ROWPiNFrxmNVzvfvD5LQa34FQeXSKReBNYxXysXEXAEPZqcFaN0ZdUWMbRiCjmB16aSQ\/74bsW\/ra7kYAY3dkcfIWLUTuPJp+EsRjmUf7aIKfk\/8XaOa3smxhA0axKF858EZYmlqJiLqlf\/eI5hZ\/7tHLZxvrXeQe1veI8xSBzIMZQ\/TtFt\/MgK25Ch2IxL1CZmzXB6p46ljS7ffVw9qs0ewsjsDyzFUDa9AnLA9qQrWUWsiNSUW\/FOCd0ghjmwH98I1LdnMHdcJi6c6QVpHFoU4NZjT2y6Xkgg2+k3nQFL8V4JFpPggM47MrziFS77\/TcxJB5IYXKDIFmCxtnA+4SFX88jkjGXS8vBa+p8iVRQ8ryDtg+jLwmFWYEoo9tyQVylUvn2sPF6pQXaRQbuO31romsbfLkqwnQi0SvWg7\/WaPM\/dJIr66FmPT1890P3X6GQgYawCD66UZeXKw1wBQv5c=","iv":"c0c2b491a09e2a20a749385fb710b26d","s":"3f31f8d6291c14fe"}

Those who leave to shop from work are less price-conscious and more likely to shop in-store. Image credit: Unsplash

Those who leave to shop from work are less price-conscious and more likely to shop in-store. Image credit: Unsplash  Home shoppers are more likely to consider pricing when shopping. Image credit: Emodo

Home shoppers are more likely to consider pricing when shopping. Image credit: Emodo Work-shoppers are looking for faster in-store decisions and implemented vaccine policies. Image credit: Emodo

Work-shoppers are looking for faster in-store decisions and implemented vaccine policies. Image credit: Emodo Shoppers are willing to travel longer distances when leaving from the office. Image credit: Neiman Marcus

Shoppers are willing to travel longer distances when leaving from the office. Image credit: Neiman Marcus