Pent-up excitement for holiday shopping, a lower number of COVID-19 cases and limited international travel could lead to a surge in department store visits for the end of 2021.

According to analytics platform Placer.ai, department store visits may continue to climb well into the end of the year, despite the challenges retailers have faced due to the COVID-19 pandemic. Luxury retailers – including Nordstrom, Bloomingdale’s and Neiman Marcus – have seen significant improvements in visit levels throughout the year as consumers return to the experiential and selection experiences inherent in in-person shopping.

“The ability of malls to provide a more comprehensive experience including food and entertainment should enable a ‘day out’ that brings in shoppers for extended visits,” said Ethan Chernofsky, vice president of marketing at Placer.ai, Los Altos, CA.

“The luxury space is among the best-positioned with this audience among the most likely to spend big this holiday season,” he said. “The pent-up demand for the holidays combined with potential jumps in disposable income should help drive luxury success.”

The Placer.ai Index analyzes data from more than 100 top-tier indoor malls and 100 outdoor shopping centers across the United States, in both urban and suburban areas.

Placer.ai uses anonymized location information from a panel of 30 million devices and processes the data using industry-leading AI and machine learning capabilities to make estimations about overall visits to specific locations

All about timing

Luxury brands and retailers have been facing an uphill battle amid COVID-19 cases and related restrictions since the beginning of 2021.

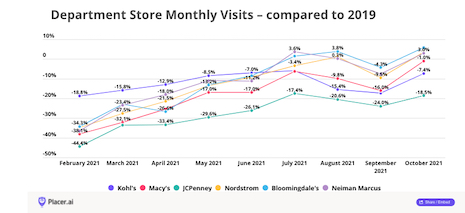

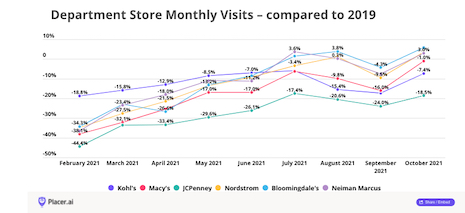

In March 2021, a year from the start of lockdowns in the U.S., visits to luxury department stores were down significantly from March 2019. Nordstrom visits were down by 27.5 percent, Bloomingdale’s visits had fallen by 22.9 percent and Neiman Marcus saw visits decline by 23.4 percent.

In-person shopping visits gains began climbing in the warmer months. Image credit: Placer.ai

In-person shopping visits gains began climbing in the warmer months. Image credit: Placer.ai

As the summer months approached, the situation began to improve for these retailers.

In August 2021, compared to August 2019, Nordstrom visits increased by 1.2 percent, Bloomingdale’s traffic climbed by 3.8 percent and Neiman Marcus visits increased by 0.3 percent.

Gains were indicative of a small but steady shift, with consumers building off of the excitement of back-to-school and returns to office shopping, new fashion seasons and more.

From August to September, Nordstrom, Bloomingdale’s and Neiman Marcus each saw visits decrease month-to-month after the back-to-school rush. The dip was temporary, however, as each department store saw visits increase again from September through October.

In October 2021, Nordstrom saw visits increase by 3.5 percent year-over-two years, Bloomingdale’s saw visits climb by 5.8 percent and Neiman Marcus saw a 3.0 percent visit increase.

Nordstrom also publically announced that in the third quarter of 2021, the retailer saw improving store traffic trends.

To keep the momentum going into holiday shopping season, it is crucial for department stores to address and assuage consumers’ supply chain apprehensions.

The 2021 Nordstrom holiday campaign. Image credit: Nordstrom

The 2021 Nordstrom holiday campaign. Image credit: Nordstrom

The COVID-19 pandemic has exposed and exacerbated longtime problems in supply chains and logistics. As retail sales climb and bottlenecks build, however, challenges continue to persist for businesses and consumers alike (see story).

“In a season that has become increasingly defined by supply chain concerns, department stores possess a unique advantage in the wide range of offerings they provide under one roof,” Mr. Chernofsky said. “This should help allay concerns of not finding the ideal item and even incentivize a visit as a place to accomplish more with a single visit.”

Tools in finishing strong

To further encourage foot traffic to physical stores, department stores and brands have been leveraging partnerships and pop-ups to reach shoppers.

In August, LVMH-owned beauty retailer Sephora began opening its stores at Kohl’s locations across the U.S. This thoughtful move is slated to be beneficial for both retailers, gifting Kohl’s access to leading prestige brands and assisting Sephora in expanding its footprint outside of malls (see story).

Pop-up shops are also reaching new heights as retailers welcome back shoppers after nearly two years of limited foot traffic amid the COVID-19 pandemic.

Gone are the days of only small and simple offerings as innovative and thoughtful pop-up shops have also emerged. With sustainability and innovation in mind, brands and retailers including Burberry, Bloomingdale’s and Nordstrom are producing pop-ups that represent their ethos and values and promote nature and activity, while also providing unique shopping experiences (see story).

“Retailers need to communicate that they can provide a positive and successful shopping experience,” Mr. Chernofsky said. “Much of the long-term impact will center around the ability to effectively meet the demand and ensure a positive shopping experience.”

{"ct":"0m9pQkB1g+5j2qzKHXmByMv43melJ+JRpCNVQp2kDNM\/4yrLYX0OzkuZQWXw5zx27H9mL46679JupTnl35cj648lSfSyPeT6AIBx4lCAduM6TWU26j7YJgL+omqdSUL+Xrq+18TEUeOYJyVXsfEEwfDPWxsipi49coTDfWHTz0cOPAzS8Hd1vRocf6LA3H8U7i3R3qwqjKKiaJcGBh6Y9HaaM5KwgnpjKCMHiVJ\/fPdaQ45\/NAMhVEK4ymuGk8iW2VGQz5x75+wHwlfESoMh4tKJHNB2sQxT4QY0fj8bO5HS7\/U3fgHYemyLMtsQKMmK+G6sNW+tIEoGCu7c9VbV5guArAC8YW8bpsGHx1HdsmKLSy7O8b8Q8bdVL5tzHC349tgiPfFNiaU\/4zgR5NShE6Su83RN68Ha2gZ1Cc4mV6Yv+HUujkDSdWRJekjYUJRjhVk25D6RS1gaKMuqkS4r4oqYtCoR1pjYm5AUPMeaalSzhrl1SH7RgZEaHFIAWK5O4Bogdx9H9rJ3NfqlV24+G6c4NJsaW2X+cArVSpQVf9I\/6OdPBtEdDuSuVBEwsIOBSI3L355MLPpIJRAdUBfsbEuwN2ANzuhZnfoRKcidA8B0VfZUkzZGIvFFAC57AdI80J2hrrDZzl2\/Q3nb+EfBjMJM7JewkGhbaEJhb2DP54\/R6nPRFla18W4bIFYeZN6fTpV168oIB+J9+e1askoulst6NE1+wSXXYL4YThTH2Z0\/x6xCcKlKKdf4SdDEh9Sb6zIRSEZdBXBvEAjiswJQItai\/mRXCnN69vTjv86GnsIbQbphzM0wutkxSVdaOoc+qZCzKHq9Q3LDSvgYwgQSEgEUgB4rN0XNnRPBPCbiyi9fcfxxvX893qBUZQCYhdt349cELieahq07DNyHenpMSwXrH0oW1INKBigx0CJa6S3dbVwRc9ZpFcCI6HezNJZk23F0XaBdBMRu50MwtrjCISnoz1n9QDGeGWL1\/cHx4ENnUATtRv3f\/8gvjQked4yA2KiJm02zVr3Z9XfGky1xLfJ\/noMzx4FTSwioP46Xj45oHkzJ\/olZGMnNICCqV0s\/I9BBP8URW1spPHllUDYJvM3j1vOX+OVXP8fg6I+jdtV6hqqPq4Q7mYU5EoxKJh85KfKKjx0ToG4xTWiL23by\/DLijzFWDix20pxRZKYX0iPTEZDoTQRliRVwmREZNa6jTxlnI2EswsozTOuxF3Nfpuj82YIqiq9ASze5bYcfpfPxJi+JjT\/yMzv0kO6LWTN2UmxmmeXSvlKJox+T7cgpWd33fAlbDWTwivbOZrrkhj9XC+yrvqNclzgLpQNz7X74rSS6D9o+Bf44fml7b3kcxLtD4ptyVDXo\/MtBuieGalnPhQBPHBNl31fGWjXciC7TGLVTTQmRNL\/UQpiTtofNzULoL3zPjIyoM05aaEEV8LM9L3W3Ghvb9L6iS6F6+JbXT09GKBpqV9h7t\/ACmCY\/ECV0Ih66JhBYOHZEKyplOxgnx4LgGCOCHeAPgJvzj0eNFJwxK7Xmr38pagxhvqH\/W4lE4\/rG0zIRJQMIXh81jWqvq\/T2A61CMSaSu8mAz7DRT40gmOHTeuqCEwa9R6RBWAlhOvXb93KdoUq9XMfWOZPKm4oKzX6QMLwL\/bRCuiUjbQMYzyQGh\/YEgFwh0u+Nqi8eGYqLAD0dBDWQlfrO1puNBabZrTG7X8dtO5nKTzjQS9hbSponmpQsyYnbyI1Xzj1gSGnwGKSnp4cJvzZ63wd08aJFIvQ+eLsyAA7yEBdMloj8eXB+zsoEMpjKBY469gpTyNUj55\/AjeeGiRuH6jq6ebgN2IQjFeGMiSYkC9PmZnwg86JqWXVP1gIvRLUo6dZgqpPTdU2\/\/OeXZmtesx3QuYrf3kNlizaz3m3UbZiz41rM5JaXoSc9dI7BYYl+b8\/ybyEqAqkwWRqj8beffyhyrusb+ZWylLoejoJzRElRsxg2dIQBQuNo6gNNcJdu6\/k7WWwSOy8o1WLUzS2Grk5D2UTt8O6rBASuJKWDoAO5Jf8QxRQr4c7M0nBlNi41E9Mbh3mfko524I02MnMnbz0cUORJVdbbaWGFF7a6Nqutc5hA\/4O0XsDZvPFkYE1yLOQqLElxaSyjzMriOCh0ADRHTgxly6Wb1ybqirnQsIZEPPhnb0NTZ4qbdYnDUAxXJDEiG5kSDLsa5ZlB4Ljf6jjRLN955aDXue5dZfhLZwvTHkehhsT5H0Ogl7TIpNS\/+vmZ6imisMcWEgHAamxo+qhV1fdUqX9BIyfTTrK6jFXzcZ9TTQco0l3R9cluX0nTCPU+zab8Ipq1lmpBDbxtF79AU4QA3zACdYax6f0h46ARiBLx8A+IaLS5o8D9yr1QmFyEUVhX3OwW1Ujm3h1HNnIbiwnp75D2goMYRCemXJMVtZjxHllV25Y6ksJNjy1sq+dTSxbYqaPBa29QacnhX7kUcw5CQrmrrAwmmiQOlD3rY\/NHCfFpyoxbgLQW54ID0x79zdl\/6e55qS02HoIJu4SvJf+2VCM80YWU1kDlHm0TZRdLrHDEgjTtRAIUE7Z3FT2OYzh6RMQtzubPvtJ6lyxlFaj6tweq2qKnmFKG8qBvYp17yjBhSdlNyUUyfCv4baYf8gBt\/iN6asDkazrP8BWWtQAcStL3vaoMZONvA1+JeLAmM70uncz7V00PwnMckgMElg1pw1vsHSaWh8kcK++qs3E2D3s2I6ll3o15UnfeqyIcfp1w\/3zJcoCpAxYThw5kpszCZ0NQim8TJrVMoFxCbaN77Fsw59x+6bo0Qj9xiVy2T8zSJ1oMZafjup+2jUulxWVyW2QBPpvOiXuS2OmrfxSfGlv2SenKhvbD1M3yR9g95Spa+sOIfP5GQMv+tbA26Pw\/JkWUGF16XeYU1JdCAYUp8bEZpiXupKCM2zGCYAjSNXs+rHt0Sz1COlXCb7NlPmENZwj7pUsuQB6JjdxPfzV4PHlzA2zi\/6Vt+mpFObHJOMKVoshR4wjG4pbm78I7EaulOtKsmh7sYac75DR5NIWx1sbiMXBUWMSStVLY1I4ErdOK3hyT2wM+zVKzP1Ru4IYEvGwsQTCJJ\/zBS3n5ObEMWEvxlTud7MJqFwqIFA4ped2Ecb1N6IOFxELVRA83Y3Qqz1EK31QKE+ib5ig+RNBQHlY4jP13u7WkeadO65uS\/Bdws3VGg\/G+G9tnYLGld6WksHOI8t1lWDwF9pekVFs6KBQwquzZGB5nl4BskBBLfJmGk+515XeNCxnQ8zzIsK13x1+m+15Xcnv02oUFc2g3r\/\/VgDZO6JRAVtYGxG0VrxGvuj7+aVm1ZQo1xX8OjYk+fXc4BaO3DiUX44GjPxfWxuuZWx5zopB2MQ3zhStxnsMg3ZJpaNcBES\/Sg0xAQ3olEGHGpnJcH1BTMqK6IKaaBkJQfyzADKYWGbjmGnroKbEJhaE4r+c\/pzEUUxQCY37mUkZMdnqZBGCDqhdpq9XuYZLAwGCdLY2n2LmpseJevMuUpjvu9u5uyo\/yPbcb1xzniUJKmTUvJhRU\/62rGkGsMMXg7qH1JM3eYBB3w7whZisGE9we3HfMmj764n8GdsDv5inX3pd3yULd9jxlEYGV7wGZcHnWPOHsZIpc4fhO6QZ8a4ePMR4kQihHZ5FJAX9X1kdHp4MFEa7fUj2ETU7bDVU3x3KiT1fzlWblG53nkLhq7UAcGTH1GWr17Vr6VDZ2tZEA8lLhFbQgoQc\/IvMjo5C\/Y85Mgxct2GiLQ5K3bGx2ljmVDyL3lXu+AB4IH6KNA40mBVzHMowIqiJZjkyc0tDNR\/NujokL6LNFkjb0RVni0epsNJrFAqBF0ZMqA4oLLcAl\/KDZAFIDh+K5nwDdlyxmdkrr2JUisDaLw\/x30bVug9858yyXvjglTpMKpSv0syrXSOgAgJEamHqBJrR\/r0lFS\/XYHzmitN\/El8UqRqzBkMK1z6IZRN+HrTHkxdhBvEDBXbs+HcEcfGoQw6a6uNiVKCTdKnKqVNSXIvKPxcOeDYsdFhR496BMS198Js99MMisWFJuwq8kEKJ2Du6wydXt1kAa8q2OVDbl+GWcv2U+0g442LPwnNrjaBK30wLzsVbXVr1tjrnc4EQbfUOl6N9msu82eTJCl0ehvi2hVkd3ZQ74lndTcUrPcSeQvCXVdp2B4ovSyE+92FdCplC9q8H5XnNF01fbNZNXMWZJNic1GwaaqN4jKp4zwSyZ6I9qSAT75PsrnbM45d6eTrR+MCNcUOelxaP1WbrreH8nMnhYvYqi\/hTsLVQlpq4aXB\/UiEznKgQHYQCg8pKn2Yr6IR+a0imc2S\/4QsYWWSiUv4y6842MsLboHXjDeFQ+02Fj+KmAFGiqvcvG5kfnah3yFPlrqqV5oFvYdS\/LBykUosu4rjm78jktGIdK60z0Dx9Kbz76B5KZNTyUvWzjPCqpl1T+WLzhkLr+7msr9XbdViz2bLz3wsvdHwPLmzljykgZjCelaks+x8nTogcPYtiIDhypg\/hJHKEs96vbyHrwHxWvMaGwiQTHrQXsKx2SKeZ2DpkTKyMWVcr5fIWBEwG65t3+1jNHeicwsuTUPuQdvNWSGMMmPh2c\/KbNy5+ITB658LIVSiyFFfqR5MoIR2WcyVj+0Zw025JytN0BubgKP4QaQZpRQBvK3794bkjT4zFMTiwxeGB2hAOZ7X7ZdTvI4mdRy19ZXRxWhHltXe2cdp8mC7JUtKfjLnST4Zpf+EftSCqOuFtdatgl5BvIsTadD5Gwu2sZN8ad7LkwY9QGKtovEEImZzmJp0rdK14dRCUaaIZc7RFAySZJiPWB8m1a9KnNRkHDKl27oMNn2gXoMyYpkOUkCv1HBNfVsq26GiWpgAaPHxtGYkFwagg6T2+PSMCkQC9fMF2p+vtWZLG7bDsRoZrlIA8NkZcR0DHFSW7k3TOWVGU4QEGGUr95vhhDRARZqfClHjmbUqtz2enlxKQhSX7SvKT+v3aPG9bkScDA5o926yel1ORxXyTLH3J0d2iBFtb2Cdm4qq82qT4OxH0gNuK9vB7S0uT4j1mpYsBRmiNiVhHTs9ReHg9A9wDg8MExTioellhVD8dxQ46P0+tJ9bA8wef6dB\/rhMqwtpYOYKoJKq6dfYV8M+EWHJk9VpbG\/UaDxZit\/9cQ2h3mqFOt7jxwtX3eZzdSk7HblroSMB\/H6iuIvM7w9xlVqMrxitn1pj3DT5nh8y27QaMoHO5LJ0MhsRuZwwVxpkt\/bkszJWukZYD3LiKY59grU\/uYUA9VptOS4IKr4dRrM6knIpYpWSrHqc7xZGAjA7fCOZbs2B9osOIh4coXozx5DbN78q0fb+lv\/Zb20g4NoefGh9uoIvNXLY0GhZU4vD\/\/2c0aqG0SBs4ISctwK\/MXDD43g0omYbKAKtR+tIQK6sbSCYsgFX6cUBtLmgOBanURZRH9fj8cJfg4L7qqclYmC2YLYfBO1C1nYPLEGHnkq0oO9B2XuWX\/PiZ0tJcl+iBeSf30cbGPGkj5IaK7pmH1OEt9YED99UM1W2CjsPNDj7Ediq+rs\/3cXb\/ASwwOspoYlgebMtX7ihLGkZ5YBZzHFAZ1Xgjh1RVXzFThP\/qy7WV7H21Dh3qiGl45S5kOxAHYumAkGXYJFpbSxgsVoTveJPBuMrIf3kmRmGpIbUCMwCHzTHc\/fOvB34sU\/CLS7j1ukXlbTbv4qdnpHUwTVFJBpA2Xb7FwW+S2H9fisxC9WGFcN+yhI34aM9EBtwsqWkNQAGIWNBad90dZb05P1warwfYEXx9SNl7c+Too9EfXwKseXatXs7\/LS1v1r42x\/2FEQqXUPA7Yy8kbcU9fgOZ3KkIdcXxzMhNwEBI\/yeNnHcfm4MC\/ca1GhwoWoq8zgUUP2pyweXLp\/tV3iRuyEYg8bMFVOE9TuriExI2GQLL5d8XH0BpEiYkfLVeUT3w6oEbcyKjqXwTO0GEqb+hs2iSU9GHlgn4GZWlf2RPJgzweOGIyXoi91q+5syepHJlCsSgOm3A+UWU1SPTOsfu0b19DxNbDD9JZhIy8oBdJGXKQDVOiJZKU8yHlRMMMo0qddfixkCg17dFzptmTzLKnz5iLTkPZAd\/2PtXLV7QXSscUbA\/xp\/hvZoPZq1kz8Tgs5pXQJ64mpbzpN1WrmWicLr13n\/Wl0zpi\/U4lwXtRj6SXB5wMLjUrxB5lSpdDsqM1\/NgqOsETC\/azKNBZogmaOMvUV762Znjw2rXBtjAbE1HLIOZoBXmJXkkNEvUxtahdg9e00XKcnMTx3K20GSlm8CvjeHmC3z+u4Ojr+SjEwjZnROtp\/tRPd2sGzS+68cTaRNGaPBV9bR5U0T\/U4IYwo7pvlZxEsdb6U1jfguSYVWwCD1A06V2km2Oc8G5yScCqkujJmspC92kkBBqJHLq2I0XEN3v5JAiaE66ZTpsJAvvtCyMDWq+xfNKR+IX3JhYnVKzsE4dI3YgZ5gTS3BVVlA06IqEyjKwZTS+A\/uojUit4im78XdAH4qMASq2VOQf8RS2MugZMLmaZal5VrP39c4s0p2k6\/+1T5R\/TeLEOmBvDDkfmoqnCMHVdMkb+Rb7cXfrpolRSfxKv3a7C9FxbEipPUMjlrrDpG1CGxtbtc+eYtCvc8d9xbFjdfDe655TmLPaNLRE+SZIVEYnBFHrNsnjxXO0IzmHmQhFG+IAbrQ\/0ltdc7B7FGFN1zGQsmfeeHB3mokkfx+2PWdKOnF\/gatKffHXc22Oz3XAQn6\/bVByeJbCFdbI1Q1cZRLZuiwxpOXd86ZoTZp435iSBWL4uGceX6ad3i+GH4bSUEagj6l2WzCEruvD1sOPuHxwgjPh7HASHBZP+KJ342d2BSHFyGSCG7HDliO7lIYazWqTceaW2lLxIWSX3Z6MGEwQWoZyYgkHU85J9pym8Xbcu6frHQQTgNpAVCIEncxFLM8stqInkPCspEiLqDE5J3Y1T9uLspQ0LwCGgWYxJM9njV7dDD9hwMq0FSS1poneWrBDHf+E5XSXChcNyw1PUxQGx21ZJ+pAMxxlZbmbH1\/fDqINY+GDJMzM34xeAiqqIdOpu2efiVpSAi+JYUz54CYUFtPuWsBCmwZ2iQD5sWXXriwhgJI8swfatEA0QbUaePpWgwBDiJSGRa\/amUVigrS6TQjTRq0clzK9bWBQJya2Leau+SM6Sy22Y2c7nX7e60zJ1R7jxAS1rOrjjSJpUOG5pAzQ7r26St517G+EqDAmUZIx7Xi7IRyd7eQTumtzgv9HPYPqe7CGfMRiXh1uzj9kEvmittzozH+GxsrfEeHs6yoVutg36ku01+R4\/lqBa7rT8CTkbHjddo5dbddL5LrNSxRr0ieC2UGdK8X2CbwCzGdOyyHnGvF8c4cTcFKw3ms24PEk\/mZmrDQewR7cjlC5vqgtsURv0NR18cieF61TrvvZekJ2gf8gMLmMhHgMI6tTf+KeJ\/w16kO0QN5Z3lTI1KRmlGseMoLE\/TBu4UPg9VQg7s8tziEC1jn\/1Qg\/6XWsBCn9cjKZwoHpKymp7bCvumSO3qGiTFnZ23ForES\/ghUOfRpFtx+h9plilJINLXT8AUn\/34wWg\/Bi9TJlKQPD6PL7TRyY\/YAVwr3hUlm97Gb5a\/nGNavrmwr+yYwMsC7qco6l7g9It4ltLhEDibF5Bz8syITqcy8lalcH4g8baU04jf\/Po6ujxgVaz9L\/rIYBLttz8EXFZxJija9x7HQWevlmHsgP3xPwdIItqtsORmjTA6EF7obRjy3fR1CZI0zgazEBYRwIIwJ6s1HMtZEBVIiDrGr1zgL2zQyZ3nEw7uU+ySRHYg4QWAvftQYdO02KRhZpNNodL8pGZ3BvsIgjICLF7I2L\/yd+euO\/CfVVyncYnan\/QjYXKUfWU5L7leJtvYqWz4CmiaTI6DhKbJpo3USJe1dyEwiP0QICfNpKsF\/bZnh0kCZTopRAVfWSMfa4G5dxNJjzPzjp7QRAvGFKqAW00qTE1zKZEMP0TaBCoqSD2WHYyJ7rB7F9b7odIXmgao5u+yxlhw0Q0xJ1kQj3YO04mw6UpsEdrg\/WwVnqvChW91x3yJO47whBJfXAlkqug1j4wYLCGRhkKDmN+JKUVBDGwlJ5JbZ2xQMRfVGsjXCpgin0J7\/u0hMJARMvsPG0J98F3svH7zsKgZ70GiYT3\/Vb8WWkXeEs6fKr8wrcOOsVKjQSucRG3mmGxYi7gWcM6LxyAyoiXxBGj\/lfYFJKHiNtfzmWG5aHDTEiH6pEySl0Zx+ZPukV6yKu\/mhswI25moED5jDlpruYDg2pqpulbx+qRsny0r0AFWEu3B+Szfa0qU8rs5XoxeV90UEupnEd4PcmZL0wVm6Z4GnQpMnLYAUn+RtLNivezyAoPlYTBxk9XTC8t4PZnNqveKzSUarpa5Xmk84evXAtSqQJRHqTVEAFjnIKf36QaqrZBd9v9M4da3Gbn38gPg8P2sc1cfQU1Y1FBb0WeshC+W84h5ZczXlt+QLCPvb7M6XKPKAR8q1wi\/yoXVxNRG7oRqgzfibVdD0hi347FKDCVEs2uS0upZTCW4We1VLBagAR0uNxGS35sIaFADCYq8eAZvmgNXBu+S3GGmKHhQg9qKQEmHKMCUbmJKNP1SzibDl57PMcAbmeQFuNN3H+efHAkxxAohNEoajUloZxXH\/QWvcSwMKrHM1v7t4OPkZhbGxxLASoDly4pvpHmT78za\/43amDUcYhTPHu6u5nwk12kxAB5ikvMPaKuNAencTfoIuOcGM3Q2VgY6ZhSt29BtGQOwgrYoNklRXWbKSe7P2E1hXlX9bXOWyVCSY3jTh+DsdgWeRTmyA5Ncmd9iMX9MCElLvfP1FQvHTFNUuFGoXDfyW5eOmLfOhVu9rhwcE1zDAUE0\/oqExF8nPNHXqpqTFPwcDPeGTHiSOVEWxkQZg4+39XfJ0oGT9K0VP3DTrcbjMsdcy\/N6xj522yLnoxOZrCSAi5dewD3tG8K7zvt0pS4Jotc3HOunZd3GeFLXjb9\/NyALbwjz0BndsXOBV6+sLkhYGwQuAAD\/efWVSl9\/UbVRB1pr88hX0+N3ep0SqWlxyUavFgj+NIyblaHGASdl1B33mz0M+EDwM1jo3d9JzvZmht1KmHlVrfu4ExXEXLDHgndZRu1xiYkL6V0yi5yRChzRiF+vSY1gfQkj6IafRr13gEy7weHENOSZLpoKTk6HG5BxdaL\/gr0jks=","iv":"442363b079e0764ee1d81c493bf88d8e","s":"0099fdef9822568c"}

Luxury department stores are seeing boosts in foot traffic. Image credit: Bloomingdale’s

Luxury department stores are seeing boosts in foot traffic. Image credit: Bloomingdale’s  In-person shopping visits gains began climbing in the warmer months. Image credit: Placer.ai

In-person shopping visits gains began climbing in the warmer months. Image credit: Placer.ai The 2021 Nordstrom holiday campaign. Image credit: Nordstrom

The 2021 Nordstrom holiday campaign. Image credit: Nordstrom