The high-end hair and scalp care segment has proven itself to be especially resilient to economic pressures, per a new report from global trend forecasting authority WGSN.

The firm's release points to luxury haircare's growth potential -- as one of the few to experience growth amid the COVID-19 pandemic, the market is expected to reach $31.5 billion in revenue by 2027. "Intelligence: Future of Haircare 2025" details the trends enabling this trajectory as experts look to the future of the market.

"We at MSLK have long seen an opportunity in the professional and luxury haircare market to treat hair and scalp with the same principles as skincare," said Sheri Koetting, founder, brand strategist and creative director at MSLK, New York.

"The brands we have been working on and with have been imbuing their brands with ingredients and positioning to capture the space here for a few years now," Ms. Koetting said. "[COVID-19] has simply brought haircare into consumers’ homes like never before.

"This has democratized the content and the process."

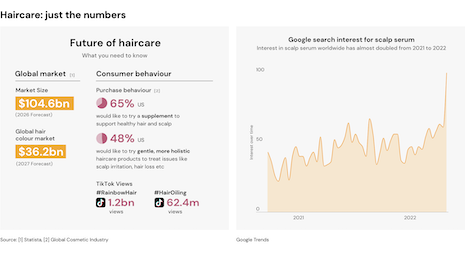

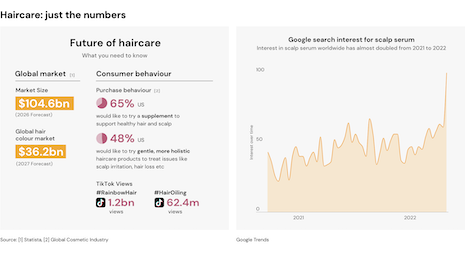

Report findings are based on proprietary WGSN data, as well as Google Trends metrics and Statista figures culled from web searches and purchasing behavior.

Skin and tone

WGSN's latest outlines the ways in which the global health crisis led not only to lessened salon outings but to the closing of many small hair care businesses altogether. In light of the shift, consumers have transitioned to largely at-home routines, impacting the sector's sales.

Besides chemical treatments and other intensive options typically performed by a trained professional, many consumers are learning how to trim, cut, style and color their own hair.

This turn towards self-sufficiency has sparked a prioritization of amateur-friendly products to go alongside a homegrown approach.

The homefront is turning into the primary location for which consumers are getting their hair done. Image credit: Beauty Made in Italy

The homefront is turning into the primary location for which consumers are getting their hair done. Image credit: Beauty Made in Italy

Experts explain that consumers are no longer passively purchasing curl creams and hair sprays, or relying solely on salons for the rest of their haircare needs. Instead, populations are transitioning towards more active participation in tress care, and are demanding that brands reflect their values back to them in exchange for patronage.

It is for this reason that inclusivity, clean formulas, vegan ingredients and sustainably packaged products are experiencing more success than ever before, according to WGSN's report.

“Inclusivity continues to gain momentum and will become a non-negotiable for consumers,” the report reads.

“Sephora and Ulta Beauty took the Fifteen Percent Pledge, dedicating at least 15 percent of their shelf space to Black-owned brands and products for natural hair,” it states. “The inclusivity net will widen with the growing normalization of bald haircare and products that facilitate creative liberation and self-expression.”

These green and socially conscious efforts used to be considered niche or seasonal. Now, messaging of this nature is becoming the norm, viewed as bare minimum behavior on the part of haircare brands, with most consumers requesting more than simple imagery (see story).

Consumers are working to attain their own haircare knowledge in an effort to be savvier without a salon's help. Image credit: WGSN

Consumers are working to attain their own haircare knowledge in an effort to be savvier without a salon's help. Image credit: WGSN

Part of this equation is marked by a move toward natural options.

Between the cost-of-living crisis, salon closings and increased awareness concerning toxins and chemical ingredients, consumers are moving towards more nature-based haircare routines and scalp care solutions.

In fact, according to the report, almost half of U.S. consumers would like to try gentle, more holistic haircare products to treat issues like scalp irritation, hair loss, at 48 percent.

Those owning their haircare process are also increasingly turning to supplements to achieve this gentle nurturing of their locks – a method many Gen Z and millennial consumers have been turning to for ultimate skincare health – with 65 percent of U.S. consumers responding favorably to trying out the oral method.

In fact, as consumers take on the job of becoming the primary caretakers of their hair, skincare trends of yesteryear are acting as the current blueprint.

Informed skincare routines have grown in popularity as effective products have become more accessible over time (see story). Consumers are now applying their knowledge to the act of “skinification,” or using skincare practices and information to assist in nourishing their hair.

With this trend comes the use of scalp serums, hair masks and hair oiling, the latter trending on TikTok. Videos filed under the hashtag are accompanied by 62.4 million collective views.

Throwing shade

As brands respond to the demand for skincare-inspired hair products and lines, luxury fans are taking yet another salon-based routine to the home.

Image credit: Estée Lauder

Image credit: Estée Lauder

Semi-permanent and easy-to-use color dye kits are apparently more popular than ever. With the global hair color market forecasted to reach $36.2 billion by 2027 according to WGSN's estimates, this trend holds serious capital.

Hair-dying routines are especially visible on social media, with the hashtag for “rainbow hair” maintaining 1.2 billion views on TikTok, showing the increased comfort younger consumers exhibit when it comes to achieving their own styles (see story).

Due to these changing mindsets, simple color kits, vegan brands, zero-waste products, vibrant dye lines and haircare created by skincare experts or inspired by this cohort are positioned especially well in today’s market.

"Olaplex is a great example here, as they have been leaders in making science and performance statistics, most often seen in the skincare space, accessible to their consumers," Ms. Koetting said.

"I mention ‘accessible’ because so often professional products talk science at a level that is over consumers' heads," she said. "Olaplex does a great job of making the statistics clear and consumer friendly.

"For example, statistics like '6x more smoothness' or '94 percent saw more body' are a clear nod to the skincare space and very compelling to the 'Hairtellectual' or the 'prosumer' as we like to call these educated consumers."

{"ct":"HmTrNQhyRcXnsTYj\/Oy8oMSter8qKDx8OTQvWlIwoAXDRYiDiQCNsCtPKvS9g90RZXzf+i2s+YDrDllN55vgBxY7EIWCk0Y9GoJDfyLyFmD3e1NujdtnAQsIwO\/v\/ds02m02Pw7\/en4dqkJHvwmniIyMh5Nr73hZIRv41lzn2sYCcOCDhpqaRCsLCgSRsudCcePb5\/QUkuk\/2hkF\/xdHTarKN3vNb1Cv5XqrSzPR6CW\/lWSATgHKESDAoGLirWHFmRJYov+95H9M0grbBrPCVoGUakfVSokugJwfPH1bImjVjiFd+FVzl4s6tiBnoVRlTnOAipYyJEm2NNLlQDOuAcHFKz608dYv6XPn\/BmiSO3eiKCO5bFWwV2EMlb+Jc0uA3BxIJ+g9AcHCxLY7fC\/QhVw0OCyXOUmO9DzbGKUrE80xopQN9SwtoUgQtVoEb+5j99qMoT9pSAwSZMvpzUlo7R4ggtDO+ivYxseAGIHmIqiM15TtLmOR3PixJ\/P31C7wpyzdoSGqfeXyPj8jza0TfslyctAr2h2N\/7puGTlB9AHw\/ZC4wjPo0BDlwIrK7Ppn8Bng9Xazynk3pUAF\/IR4kXjYUTU6U+6YYBNCUChii48JLLynzKi6rYmMKcxrdbT0S\/Gd98P+D+UmEWREttxCjY\/wCsvvRd+0bSJueR0vTNmMBy1KsDPY\/ijQM2J6KQgO+a4HKMxvSeR047d8qssa0oOSHLHfShcZycOvNCiTu3kginJRcVqLUoIpJ7nxCm1W4CAvBvMIZvDjRvTX5AASH8dPCmaHNFt\/pBfhMLO3Q4G0t8kD2mBSu1i1XRpmmbQhgvTr2Fdeey0Nq5Lz1heIzGCMLon9WiSjNWcJeeWfCEoSBTsCmwZMMv15DJz2FtOti2tXuh4+UIJUGbWSh3p99hZe\/0SkQv4UdTYn5xC0zxdEhKmpza2V+26VFcyFpMG1nVIiMX56Lzd+\/TLf+dkSIqqG+3\/CkPklGXFuyARO7mP9PjcPzWyzCq9QQXQbkf3jxuG9TWhep1vDLlosCj9qiQpy16Vn6NJrg2LTV8NBqMwbAlWElyOKsAZlcGY3mQfzMCvHxHdWYEIYhpRUZwkn5iJjs1QNN\/wP0jeABnptp3af9dueDIKhG4PRZXMVVJteg5Z5UQoGFpVEwYhT\/k6QhUEitstBODcXe6OzCgrJCL4yvO8pYCvgutVi2PyBDBGVItVHE8zay1wOh9qzaYu+dhlqqzkYFenSFG2XSgOc1IQGez00njfVDFCPtOG+QCRQ\/6SFEG1\/BfVhb6ary4SYrTMLmOZ2Rr23DYaus\/fXg4sn\/CAN9I6hCjVOFRLH1k6VK0pZ4lX2tC\/Usf+n4r0A2NSSd605mmCOkqnwc8V9WsAcebUUArn9VrXo01zParZfp53lYQBAnskOP9RhDvIusLrXkdP+d1Al3RA+En3zmySom1PidN0Igz8Pt0oxP5adaic66+4Qq7O6IwuD2s3JrNVppixAMtG4elIBMcbiLEh9J5pc3gvkzH8UlH00JPF\/wJN2Qoo0n+qI0hZY6iTnou4rO5Q3waIZWf2Cz1v5xCXR4wo2Dt3MwJl4UQ1HrjTjLulCVCrTU8gRTyrX7WpmaEPZ+7jHUg488gwHFcVvAbvOKONaYcjRiI\/87ualCxTFR3MPmU0Y5Zj06EgUQo2aROFNUVA6H5iQ7Lt2UUihUlZXSo\/RTHrCmPaY1ysT0\/GzxP3+C6bal4KdhTxNDTPB7cUi+h2hB8\/czX6KfGGKYqfS2JNMFeR5lXjIR8mrjo8I6fz\/Ftt9g2m8NvCje7QILDX0k8GPDbU6HyBjdvS+pIZdM3D+Jf\/ET6i0iHpp\/Rplg6BW7p6fBI+uvxVOqOPlH361Pmz1bB4DIQhRiI73pWjNkS39vgbHOe3PUxAXPMYUALL7pYYDDKybkI62mQF4fwPydSAuwTvddLluLc\/oBlZA1qnHLIqgEzOpBtYP6wyEmASADaaauMGAaHIXqjaac0IwI\/VGw0IPfrlHR6KYS0Qa+VTSIGA+P7rNKl1hSucxvGr+t0EM\/Z7YNPYKNweKvk8x+4HXLn7a+GUdsLvo32lHq3MCHwO2sw0SvoFVPESsD74gHWofdL9JIVTVAWuI9zTPdrTdgMZHyUIeMHQBxArQELQphsVUNl2SCS9AtWeMru4hNmM07ZgRsv0wv9ght3CK0wcHSAg5ZPMW7gEYnITvzcnI30Jundj\/I2cFRIuo58AQNZcauuLI0s3ERXoSiBV8j4YPeyjZ35H+0E3SGM8vHbhGdV3AZA5pPApBL1JbbBkbz5aRgtnaa2z8jaIq3bfib2e4I9qchhfaXC4L8dstzP6SwDvpQFadkOQvp\/\/MGUaF0MXF82ynsj0veYV1sb9veR9qpebZoAMR1JZ04U96NcX8e6kkE8fcVs4caKUYf5lL0TTQaNAC5MZ05\/Cmhnk5okv\/+RN9XxdtRt9ivk9vzRIlN+vfH7T8lB+Lap0kI4ExAWFVof8fHKzSnG4iD00rl6SyG09s8biq39RqvUZ1UEF\/jhBKtbnb9NH6HU658UJ7pXWo8eRaMNwnY3adEVtHvb0\/279x0bWPgnu\/vQYR45ZtlRJKiKPpEq\/YqLzyVmOAsNp23eIves0GJetBE3fGCVSlrtkv8iZW\/WEGS4STf0OyeK0Ji2JggJfZT3a0U86kyBoNBr92mB6\/Pkb1DfchFVCky0p7NVssS9nRJl28JCOrTcSHUYfPNVtYoWhNgYf0AbyQqNlkMPmAxkpUfUfcSdiYtNerw28HSt8FBZo1kc1R7CdFfLb3vqOVJWuPHOsw7kBYFwZW605xg2I9AuvR3XPqBl+176ZCU0lVkbOrd1AYJW+AafKnW4Wx3jf7fWZutsTDiuudErG5VXbBe2ZH\/gT7DJfl5vAOTdmIN+CFO1fuiFsdaoIcOeigZwMjARcN4X1+89glLnM+RUEeCyAg9OL5Dpzgnd1f984\/WCynNBI6XU6uozG147La30RlWAXsWU+RjzOK+tpTbaaJCJO0nDlh0gBEyPjSuqPeVmq38nDhKmrie9vb7kFLhVXY+VFyWOqDUQSz\/JcO\/p\/7Slkon0qOOycz2kMOyn0KNzHhMR47C1sMIi6zf+NLl2BJ7R8FWa++R0rKk4JDHEDDiwr4SztkjegZOTM5EmrR6ee3t5aTvgGeaI3z2Ot6Y6xEL5sTVZsERSMiyQ2vL11+\/gyM\/tm515BklnmRs63IatNrqFrrzz49yn22cA4V9HG8jD7YFh6q8wiDNV6bDAtEAQIiPyfUChVBjU43VayMu6Fdq1RG+\/17QclraGkxVCUbvbC3hFXxcMEkGszHUFufwCfYObeIjgSyu3AnvP+cRZtDm1RjPpFPq8BzH8Xpd4smA9hnxihsdpO08hlSkbMB4CbEdXFyJgVW+MXprIHO3SsTWKJG9cRqf\/0qLsApbCysgyH6odDz2SWz0GLE4JjzK+QqiHJs1JCrAgr+p9BeUZXOhJFtBt34KBOIeGAmRxU\/CLGXXFPXljfslF\/Y0t54XlEjQyveoczpXguptxVds0\/GsoyZC+YdYVpNbdaXdP2Jkh7j7vBmmbB56HYgmNvhvBaA4penqBaBfNNdxxPvCTb+2p8VotOacLtUK+Kr+XOuuCiKZfSor6u88v2UKfRDt8BijQk1ffAMmjtob\/AA43HO0ptCJGrIhBVAMtT96yzjgj2l633xEQFUEbR4WPedH0\/1VO5fl5Zkl04u2ARN4Wbq76YwgnVCCe0\/6MB6ijYqOo\/ozYSRouMp6Fsaju514rZRFHiKrd9RHDt+M+tEibHXN3dWyl9HD2DNtUhpZDp6H0KnGgOXQ\/o2xfkPplZ\/LU2g70JoGBp1Heqo1EwJCBzbWlBFQ8kTHPt6LyhLICnnnKx6gaFdnFtb9IUsbFGEdIZzJ\/GoE\/9htgVvy7cRmmFLbWj4VhfVwNxNsbnh7jeQY0VR1INIDCtcmzfLhkXfXOZwh9pEXzv79PfQEK1kpXg8FfyWaflMJJrF3J6fURC1cLJRUTc9myvswtjnR+NbPbESobPYlwFOp\/\/VXnqLvXkGbmM36UtJ7n5q2t\/A+7ru5O8Y1HQdK81JOEsuqN6ESz4zts+0lf\/kNwvcbItRb7aNzX8cJtEKFf78+9OqTYOINceo2v3kN0Q9Bx\/aEQ+m8sgam3A4q+DfWOwtZkDzvuW3ugcBz36kMKHN6wsVVfnogahPr0f05X4PlBXCdWr3Vl4\/xFboe6EutzX\/CvXpADHlPo3Kj0hzzmvdmRbrjwIGw3kfSlteDf222CK1BvmWzt\/n6fCcT0VuLnYxu2DA272zNAyLVabfbIS7dtJv4p6c7f0ncCpygNlFCCrAhSDVXjSZqGBwQ1hJ3xaw0E3k1oYh+mwjdiMaZeNmkV0Cyloj4gxU7VYRJ8Nd5Yz\/\/kOL6QDwonyoezg+UcnACM+tPtv\/ryFrbVGeoI0ENocTEo9\/CXghjBNk3lqppkDhu50NKCAFIJkgSaoK3afC\/UOMDGIOFyBVSmwK2Iptve0xPqD0Y+LzKTsSO7KNdVx1DKse\/wEOIquUQ00CmJFeX263xooJTtWmXgPhl0UIJm5UG0CD8jZLjzmuLariRyIC20z3qbEmzyP4Tivz7WIcZIOlVyj6J5j1Mlj+WBZZtXMssC67V2Dw3in4SIr\/6eD2CqgeppdOJc4y\/EAWjUyoOPFox2nSGzihVeNYmXHGrLc46LCEVl\/eINOIN\/Y6t9CPep12oBCuNpmsKFYIl2IOUbXePbjNApSA8HFICJTzTYnOk3aZFOiG3ghLvm7vlL2\/gC3ZNsnNuSeHNiGOur4bkSSCa5SQgzBwV2hG10IuVb3QQBYDi3u7sP9Bjxl22tPXGTo1+dxGrIe+ishnI7gS8p67j7E2m0qyfZ\/7l6MXEVyy9KArwNAdY9l9bukRbSt5TliBTr3aG2L6ZUkFHfet1IQC7BhiAIenPn9cIoIh6t64qA5ZgLsLtpZ8B6jT8FMRzZg94w18Kb+N9DOnp6Io2vPBKPjAcVFILUrLmQFr6OFx7DL\/Tr983q+TfN2RwOPyPpnaDVYplXxBmlGExfm\/MEhthctVrCsJwhi\/Mu7vrRAm2gmRY\/EBTe4YXBlNI7z\/IkQMQagYtSsx+KIMbHQpKFBXRyaXCxR\/5yfM+pJbgmS\/NqUpFb3iCVUac46dc7E2nuI\/WnujrQvPgMcJ5ODulyoNg90bA3dDNL4em6Mbam8aSl9h6c+Z48TMu3lseVnLYuhgFwz2hrwJ07QnVmbEiawCdZ1K4kCa8plvvpeD0OuDSFLi5eaUYOPY12qPJtVfNwsUCXruIxu5Rx19jHty2hEsz24TQ1lx2y+uo2ueBclTrtQawnmWf\/cgBgJ1jqv95Bq4JhUkasdoRySHMv7oqIsCwaRRg5+1lVqZYmshFuAb8OH7dlXhOw3TMSPW8XsOUAMFwFJtUYI2Ed1ZYIUEcFv4M2oMHv5XffxXrdri1AEymu7F8NQPKv1Li5KMsMY+VjYuQ3PJKE+1ngsdsmEWx4k6dbWfpFc7JMhqoL\/WwFjl99Po55Q0K7YDuQeuSUwYEzBZdJXmgxnL4dYVSYsAAVHD1eT7KmMa2PzEZHg\/E8rJ6yD3gtQchg3vy79aaN1j9RVA5JjT0Nwhec076A1HoE6CsL+pZDyUeaH9ETgad4jyr2ywcEFobD\/8X8FLCrzlx47CTcFwF646XSTymNTz7J0AZDkm0USC+lbjY4oug+qCLlqnSi13OMBMZcmqjwm4v7a2pU3EK9sw4Nq3pBAkbc+Dts8aBTPpKcPgfesr5gN8Dq9Qjlt3+idyVDmPPxl9D+oi\/2d3O2GWnucHffdEWetznToA7YeoVT302wtG6bVMEUBkp0Equ92GHo5UMihXGaiAOHA3JPBsGKTLG4fRtioVY2\/238eac56FZqBF\/RPfjcjQFw2CBnW6wI4jZ5IS52rtwJ+6vujFrRRmd0dfKRslXuwWwKaRTZSBybmrt6NJkKvkQdEvL2y3SlPVZrL6Ui0L7h+iBPM\/HdrZak8IjVJNFpwAK0luie2iXuuSAmvvy2EeInaqEmSvKNfDzLvHKKInFt\/yyvCnWCtC9UUlGe7LEztEw36hvJT7oTIL9mibKXTE0xm37YSFjzSgudIYmkE3cloqgBqGOzZg2HTg3DtWXH7N64wE56hM6kEAwjFQXC0JKA7mf6Jh+ky3NsVrbHHS4J7Q4+wJlUHSpj+CyMc9UngGevPE3RhpYG9Beb00shSYlmvs4SU7fFlUjUUxlTVB+d5ur44DOApvN8dWBH9HsfzBwBstmLywU4LPnLijl4YVi4mGAf7RysVSJd2EziCke4vF4k4\/dJy8gDG+bsjiENpU8BIrbs81+ixn84zLvBfcFwGCYzHhiXavu1I9WF2Sg\/wj7usvXoNOrRErOvrRmPBo1WVF9rHnnQmvmPtVy7FZm\/AeT8p1EZ7KX0bWfc0gq2QWuQ+iLApu9IzEKSB+yIE5NWGCxStBG8eRbzGBZH\/H9sveymPjlBpFFRO99uMxdk6EHXYUYqk9I6GFoXSqbl7t34DMxJZzCccV7sze7EVtSTQCTcTiMFORHEl5lanx\/NAr9R8uqNQBurLKo0HqoGadeswASkQfiE0lgexxuEE1U5v5rHsBVXRgKAbyTUlEwXkjek4NEPIuB\/F8E8WFM9\/56\/Pq39vItGmEtmjKq3ZAH3azdWwkb1nicZ1hNGg4NGmPpx1sRBp6p70\/Ucfd5zGXFICUIDBta3aOXd96EtqjnwMTuNN8JzoZ8e3Qpe4fnasKZBCPcN6\/MJD91ap9+rTb6sPjO1S3vGPiLzkQwX1sqP8QqCuLHNjI4a+y5FC+VNyY95OriqD3w\/cLxAGoekOsAnAbgh0uh\/9LMdqXsEoHKq2dB5CzFlPzG0aPAphCmRocDckkseSody8mBlzXzOl9jepuxilzApUqyfbGmJJvCF+er83clIL9uRU9hMVg+9Nb0k2vb6+3tQGYQdD1KV8lb3aaMGuW7xRdbpd5h9\/RduERKxgr6zW+V+DUz9CqhdBlNp9GgOSjX3bQZMqjaghzp0Nc1AVU7qm2HL3JhollclTr49amNH5p6ZAkXah\/fU0ZLc8xT7oHRk7okikAfSTt1wzG+ZFFZoUOaHSWlfbNWJmmYudd7PRfTjeuiKmfwU8TsEJcWE5Dlil6Qtc1E1EH\/\/UdYrcXX9HtH+RyqNJbVlkg6mj+tHb5UYzmmmtUxWvOKtJYnYJdgV0\/\/xSVbgH+tNjbCItwnPqxJ3plqMjQRjS6XZ0nYGD9jf8+dOkVAnD054+HXIMrrIgrq9i4OlHl0F5BqoJGxJBhYFWm7bN4bPxCcdMYPQyULT7UwXZykMDsIjPiSX\/G+e9YPOSp2n1lSSbR8XOnsFIw9gXpnrQdcBU8TK\/JItzA93LjChmjFt3TnMd2HKAeToMCmTTgWWayM1kk30L2bvrmZ72X6KyZfs+kO3IiBeY6IGdCM8Yo59QVivcw9c4qpYD\/NlD3CagxXYrUCwhz+3XWn\/8j9AQeY5747810HisPzePEcYgrSsmyRSCNYPeVNQbcQpDIk3V\/cOySM1JIyOtZENjt46XFdFqkzRz4l0XCTCn3XWwNnQfVazzQNe8fF\/nLM1fAjOqunuBjkvkOcanYC\/foKXsd9AhJCv47\/HrJzrdgKtlxrpdIKL\/U7OOqxjQh\/2sZ7BXcmjhXh4WlW3Oy4RkOPwgkKZhrymTlizfLEw+qonvO4EH+j1sXruxTc70PmD1gvRtm2NdVlEbRbJSqu7YUb+WQlv0ivLYJynB9UKP4qQDXfbx+FEXnTD2saQ\/v12O\/iargx2byM3NpzrQskm6nEj1J1fewpzYPcziZO3ebh+EIVriWy732PzPxdMaGYyqwDJq8kspKcgiJ3AaSE9zba3fUqIZ9yVSR6y8std\/aantL3W28YY7pLXP+cHGfa9BZSsHavNNGTzNMyqwlfsp\/1yco8+306RDgVeIKWr051yBq6LzQf4uBaJzuTnDPAuGNOtcWraVLOIMEIonBoaeG\/xd4BgOqHhIVSADQxHJHSCN6QvnQs456GXVH\/OBIwclVuZIj\/4fTESqTIzGDBgL9H8O0JAcXKcD8RrO57AaqoPDMcDxUEGiiFvJdHfggHr8jCVI8vAJMguDRCrRgBbAX4czDskmWAuzlsL8CCyy5BERBHUHvQ7sju+t+i7ZlEZlD55DwJGejiSeZW7pj6NmydSWSZtxWzJTHhiQXEJaym6ol6G0zMniwxwzdVM8JsxgheEIXZxTcl1JEamcE13DgnXnOG+gIu7XTy5dE4DG51FfnexrroG+hts0tBEQGiKBx0BgLJcfbjh3dYoXkORFG\/D+IsW7GMaOZ25NSfEJXTQaAYNJTUIEDwnpXwVlvbZidHD5syoAkrbrCcKb8TitvUILrFde5DJqhCTpEP5g26FR9s4OgJurfhMHw1qJGsS2Is8qG6GfJLTl7YdvHFBnMAUYHvsoLUn0i6WVgNUJ0S4fGRth9IDBtmZmVG56mBlMGcTxAZcMBSmW0XVLTGcddCt9P5OZtaq5S3wS64TkkKcmBMzOgq1Cpvct6ZJHKsGCCZF2u1QQFrWADwP7o5\/Hh6cga+w\/zH5dEPFgJHeWumJlY8g3XkheZf19t5qhcOzLAMom1\/11jkA7dcG8eoGFM\/tXa6Zk9b6pLQGYpkdEu0GjWrckVoRTmlz6eZBg0P2GjZ3xlqFsVInHk5TFkr14EQhU7Dl1eH4L1Ei+vafvJs\/YYv7deRogaiBAD4speRdHItp0ZLXs37zGTCPujNOlXwnxnPDDN5KrOT8Acs9f11BAfy0Xwi1284QVMvCJtX8oP7kNhl5vYO2LYZ026pYAwvDBY3u4ezppoU+3XRlzs82jPYSqyAvNHHyPkTyaOO33aRGzNR4hE8GBa0afsERo\/Qmpxe+djarZoEbw5n0\/4+U0oqTMqV1Uk+VV6FJTjvulS8939jPyvpTPuI7CghedGqKC8YcpuBcM9AfwZmNswrdfTkKLvqF3q94slkysviZYyafI9h9Y\/zvc+2FB8wz+vCF\/GBrW03T\/IMrfy+YNnqbm9BV7+LC+qUIY0aMxldskB1qrlBZ3jlUdZTjUv6vIeL\/2pQQzIHU2V1sO2op\/olYyJRmh7n5NGlMxTBFhMRS10sLSo+bSEYEoQeCgeYEJ6Y892mRJHGhFBNh1IObLwu6Dxepv3iI9383YUvA62fWqvl9ZvuEmk8kQeWYF5S1\/O\/0YO+VPz3Epz9oTCTTAweCfoTjWzjgi6wVlTqHiC7d4GApoIDFCq1mVOcRhj1FKRQDVsW6QS\/M2hr1h1YTSGTgQ80nAPUKll5NZjSOfSaGW0FdIb53nEy9+ByjOGg1JkNZDMCdLQYQGgyeCQlTRMK8p\/OMDiaqKb5kQSeNRf4sPx1C4ccA5ND0K4PT1OKUOYfCyHmn4am\/Te8u5TjX+7uNNKv\/OC8Qemo+2l6QYIlFQg5PO8omJ83a7w2WVjLmto7yM1vhCP9M64zbjYsVU3VYVqkgVIT9XHHkrlpn20RcYpqmvZESXvdMlYSFrI0tzaW4XPqC1SAKgKfVEpnfM4G4pzVmO3b3MGg4gxZjAl6z2X30xuQSndaLFK9yi012+XV+Us5uNPIu5T7SaNXX6jxi623kgzG0grIpPMveqb74XWonyAnfKS\/gTpEf6obShaCuFUCf1\/yYfaIAdzY3d0PqoXE+5u2pnsoSeymU2g01xzYO+uquBj3s+iLpfp1YaG8k4oky1SYUXwRKzyzhRSc9x\/6HCfPp3CD+49+ke4YBUwi+wCoNdVhv75FhLGaTwJyHQlHy0pwZD2Y9lg+dFgLcsIOB59gHzmvbXzJ2PTZjPcFxq94IW1Z6TJTNEpTFe2p1r0RRCQM8m8LhyIsWgizAcUtkHg4gE4nExrMiSmRzbl6va2xPunNi8bihFpid7E5tENNuEzvbpGwwjNhOb2c+cPl4I9RdQ4e\/cN9toxQRz8t0NoJ+VxihYh7W9\/JnNWwkPRsYWzWpFCXUefVgB9R+97YUz8Zitkg4GIbDBq9yuQqDkBWvQtQKFjegMFAfV5QYMfWE\/AlsB1NdO6zYOp+ANpTyOpm\/MOrs5ZNzFbrLlq5ic+0gdlhqpQKR+3pBnVBNNjfgTmUgs1pfmBBNd5OltWOoIIbtPfL+lt306PrBDG7Llj84F1gyD0+WgiDzDKhuf8uUJxrd2Bz4951hRnBso95+BCuOe3y1JjH01KkD+6ViXataIw7fgPwsbvY60FUZ6g\/aSxgyBhe16\/Dp6RteML1bhwix59ZGhavW1eGRMCF+lXoZKMP2HTYf0Ge\/NxZAtYf7toASu2UQ1LhAbWpTmhtmu2T878zeXdhHcJWG5fgD0NH99XF+Qd1y93h4epNEfWEC85FqiiTLUGKrpwMJLJckhtHz6HfjcPTXo1BvGMN0z9YY7mgs6yjp+q+Q9Cozs3kbUZW00rbGztd+t33\/DvZ1TVmCl4hXdEmnTqOkFBgJ\/pbes+DZ0qLs3PHs7RYg5qgAREnDlKcw+hdysaONRZs6E9Bn81iNxNha\/RUp6O8Zm8pr5j6Xl583X6TYeoMEYjqbC3821g0PohC8vyjCMxA0EuEXCMjc04OcZa15Wk1vkAUia2QRgt9MLoqVl5six4wXnowm9bgNUA39s4OBDhAkVDIVN1yclXQXelCVoGnI7yxInvrEidyXNQxk8BK5SCwzm82gdBEOzuG2\/cKRdwQbCuCnFNPpzZJm7XZVAqy6+k1hswUyU6rmlXDOcK1U\/aiQc2jtsDr7Z7RdzVoBOOmHI6s1f\/zMHL4HDzDokjqTc0fnjAxmPBgE8SoXm5KeUpFl8NS5n2x7aImZLcM+SEHpUhKoO3MBgua3xnaC0lMwDFf+\/ufbHB+sAPOW\/\/x7AwefP+DIa3+2uqRdhYqANetfPd28r7fdXd9+PRwWDa+u477BOqbAqLb\/aT0qPGo+EoAVZszlSivi2tT6ei+LYGS6BKCXJ6RDojfOuE7s5onpHC06QLL70kcGKhMf1nOvqW9t6tr\/yLwiDeJwYoH0jHwiMreXSrMWllTDgi8bmS9MEJ8i6wt6hPCeoVClPEI6TPyzYrCfCE\/VwI1ILAvmtRtLe+JV0AN5h89Ayvo8DRpDV3\/OMBjwbM6pBRJOkHuxJ5oomwUezhJvgsiV0gdaV8M22840BSKGpbrh6L5kTdoYBpl6YPPRT3k6apD0Dgie70umPtKhzwHnFvEypX3QmDQKyQ2WQvx7Lr6MS86gLdG2lDY\/aZ8oJgyr42g2SepWdg9fV2XCtNv6Su6v30UMzLe\/55qEuH228yTPklQ1hvx1nrAwwQfUR4wOizcMFGTATAPx+f\/5z9oz34\/oXzDG\/FlS4B+GEAiLUJteyE6C2KpvQD9YPEpovu3qkJGp\/WdBjf+mxgKLFIGbUlIGmDRTAhTBW4nnCEkKj0oAfUisHn7FkZHPMbQh\/N7DRJFOD1YXJ6WhDmz46lvEI0gdsHecfqQERjP5r8H2ShQmfgp\/DeIhIEdud9ryt1QDUxL7QdsV24MT2dQ5pmF\/8dGwm+2OfuWZD3XOETn3JxX10Hb2RVhvUH70G+iZarK3gld7aSGN8OZRZpSQIGv7RcjaC79vydZl5mWMxXdBdmNjHs1jmWIEhiCSILtABr7vWyEZ7tkDG08KYQGmBNjX3SNmmONSBZ+uk7S4jBUivgCHhOht\/2gC17Z9PhCuCGHYtd4BbiF9XaenuwdHpKGmdbfXy0sqTAEW82YhuefNWrRKaDy9qyUd27gDAKaT\/uuRjmli5YTXy3NMjizgLf+HLl3icF06l7I0tUUwIUd2GFOgVUJPNzNNlyCcnaKUPtaXOW7un874x2Tgh3gLHXeSlZmYq2kHo25XbyGwzQF6UamAL+uW8RGjhDDd57q0thvlSB+iiZk9RwTujDCsbP5hViBVKYze2YQkE\/qt85bqUi0USz8RoVAY8mcl2tRQzGZDN23MDhKOOAXqISQIUOUWPNfUUY2KAETRW2a95UC3iZwc3Kd+wI8Ow\/0ySsDyL1DNkSK3GqKYPFwFCN2KCQ9GUPwa3fQikQwUJy32E+hAGO0d2A84GW41bJfbyc28H+wvRabHjA1UYNOqKAVotu2JfsdwIy\/LLgH7mj9x9VcrvvfXnrwdqgZvwL1nXKtk7S6zISF5p54+TeorAGNL2LEfH\/nzLhpIquvnZIChl65Mh7Ry3GIGltL8JtHxMWMjup1msPdBCrRvOMkaoaZTl\/m+TzgtM5t7UkvtfWi4\/3I\/2baURLe7BOf3XjqeUNfkLsj2MGhdJRjq7NPrjSeuvYPBxVsWj3AQ5RmaVOBgxzTdyL9QEnwdHqxkeDL5X\/L8vhyTiaH\/cx\/mnDv8HuHYgQ0f22MJCQ7tyyQ8yHyzruWmltvUN68l07jNlJS2nlpJVbUQWNwYoUqHEShiddKrY3I8h\/CmmML3pQtdsnof6D9Ywcw3tCgfLT4LuCwYmLre3AqoUs5Jwef2Lb3TLqVuAqfXgREpsiTyIGrHlO7hD\/16y+a4rYhGA4ViJvHKLoPNGaa1QdL0OHrU4E2s664kOEZWEDAKExK2m0f+QqPHZfu\/xvGQl3Dz4eR3jw7Rgn27wEdTCFWLDVGTiHkq4RhGBjxfrN9tt04ThDOM62KU6o7ecyeJ2UbOfbie6r3Ai\/Ni7gqas3Sc2fAold0wB\/XklRg8x23RyDLRYaV4xVc8DnxN8eECq1QGSvfF7oNMGd5OodQKXSZMJGTEYB+Q\/edPKuPDbo8wpfu6KLo1D84JTktvE9FlYfH9fbERtP5TXyAXvgrkcex1r3nendZU3fTHqBWezhJYokIuPK5hX8eehCpZk9hcbpq503wygT1S2Wv7Q0YQqF0KhZSyx9PL5ei09vHxLQUjfK4Owuxs4S0CWs45XXL\/LAxasG+ixyi3dld+X73f4b2kjm3vtj2ezocDIB5hSLxkKKhaKJPEzzE\/6HrREVtiZPY4htkbydxBGKdd5DJzWXnaAzjs864IO1YxEQXb\/SCmoJy1eiFSCYCuVDkSp12ozrR4AIE+xol0EjdHQAQAyBH+JKfxIRzkBmqDxLtGgGWlpJ\/EjWA3QMBgkFWMZnpcyHTCM8sEl27QpDGcS9M+A0u8HbSeWQvU2bgSTgZNnL9B4QK0aMxsEJVnVldfLUXZjJJYA9igmXVwYo2y\/yPNDlS+471TkIip45NevMJuLsKDHyeCf+AAdGIs7TdI5BxQVivTFxLd+c+CM2KYbzRR5uCdtFXb0Gt42+otNJUkdvB0GPzo+owGJYW+fCro2OywcpMdWZhjFh5QwwcleR40wAJicd2CXjR1iasjCALhMhpIqcBQaoM5C4\/xAjc6QNO8AlCIiOFeW0jYh6dUaBD5EF+434K4zjYmhplDUZsDDLM3SsJJ5TwpN4TEpaYuWa3JesBLhxCo1QioKBGAokCOtj2zvRMhq+g2\/EUWuYvyucMpXZMyJQZcRR5H2koZWlimjJBjw+uLKnOw8K+wx035slbtjAdEr4uafk7eygY1Tz8horoE6QLI8\/nleJ4RTauAnwPQEmYCCb1rXUcrtNxSPJCA2ZtSFhKKnQ3Rm3QVC\/+tvrTbskvMznPoIU4pfhne9qle7u3HTKmvIEwYRDBwPoINZ1zPPJGN8CIYAki+WsyjopfrQhveRof\/UydQJoXBV+Bu0GqueshijxH8lI1zxMhD7NHcrdThsizZysKQyNf1f93V5ylH3eT3XmyVDUoSOLuIscW63TQ\/VavPW\/cUG+9wJhCE745ZVjuJ6rgOkB8hxm\/+YJwQcwSKh1+m6JBxN5wjwR5iAOD8\/UNH\/hSf15zsnbdufKsqXri2COXhMn9z7zQ8AkIoBnDX7TjY3AqoP5GdsDxrCJ7kxAduBt+6A+66nszp5a6wUpiLNXtakFtlU6hfkZ4jA3crEMbfSpAHbM3pzE2M8fQ2qyOFJstL0mdJ7URjQObq8WIcUaSV1h5MUn2eXhqSeKDTNfb1W4Bz42P2v5Yi6No\/zCM2pm5Glps6\/sgnWcSYpwVGH+cJUWhTNO0GMK60zY1QT7fcrFgxjoNwdogywlCu2vLIQ16joL6HXKirwHyi8SsU78l4mda\/fMZPdag==","iv":"d61212506072a440267e463be14f7daf","s":"82a0ef86d60dfe77"}

Per a new report, trend forecasters predict hair and scalp health will top the list of consumer priorities by 2025. Image credit: WGSN

Per a new report, trend forecasters predict hair and scalp health will top the list of consumer priorities by 2025. Image credit: WGSN  The homefront is turning into the primary location for which consumers are getting their hair done. Image credit: Beauty Made in Italy

The homefront is turning into the primary location for which consumers are getting their hair done. Image credit: Beauty Made in Italy Consumers are working to attain their own haircare knowledge in an effort to be savvier without a salon's help. Image credit: WGSN

Consumers are working to attain their own haircare knowledge in an effort to be savvier without a salon's help. Image credit: WGSN Image credit: Estée Lauder

Image credit: Estée Lauder