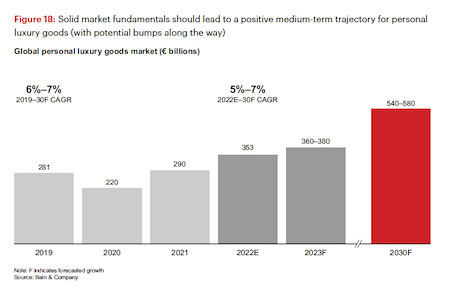

As a fuller picture of fiscal realities is now available via Bain & Company’s Luxury Study, figures from last year’s luxury goods sales present a positive outlook on the current state and future success of the sector, experts say.

In 2022, luxury landed at $381 billion dollars in retail sales value at current exchange rates, advancing 22 percent as compared to 2021. Expert analysts at the consulting firm are now reporting that last year’s standing signals potential market strength against future recession threats for the months ahead.

For the report, as part of its ongoing initiative, the firm has once again tapped Italian luxury goods manufacturers trade association Fondazione Altagamma to enhance insights featured throughout.

Trending upward

Bain’s “Renaissance in Uncertainty: Luxury Builds on its Covid Rebound” report spells continued momentum for luxury industry players in 2023, based on last year’s performance.

In the aftermath of the global health pandemic severely impacting markets in 2020, luxury lept back to 1.15 trillion euros, or $1.24 trillion at current exchange, in value within a year.

Now, despite socioeconomic disruptions, the luxury market is in sound standing, expanding by 19-21 percent last year. The team walks through this and more in the most recent edition of the consulting firm’s latest Luxury Study, which presents forecasts from the luxury goods and experiential spending trends that took shape in 2022.

Defining the overall industry are nine segments total, with luxury cars, luxury hospitality and personal luxury goods among them. Together, these categories account for more than 80 percent of the total market, providing a precise read on the overall industry’s health.

Of all, consumers clearly preferred personal luxury goods in 2022, according to Bain’s insights. The category outshone all others in growth thus carrying the title of the collective market’s “core of the core.”

The segment excelled in 2022, even as global challenges and ever-changing rules out of China prevailed, reaching 353 billion euros, or $381 billion dollars in retail sales value, an advance of 22 percent at current exchange rates – 15 percent at constant exchange rates – compared to 2021, per the firm.

Bain’s experts also estimate that 95 percent of brands experienced positive growth last year, but even so, a majority of luxury players focused on future investments. The report theorizes that the use of resources from 2021 fiscal gains resulted in lower profit margins across the board.

Luxury outlooks

A few of these insights were hinted at in an early release of analysis (see story), though the premise of Bain’s newest version report seems to rest in the thought that luxury is particularly enabled to ride out a recession this time around.

Bain posits that, between an unprecedently large consumer base with a higher concentration of top customers who are less sensitive to downturns and a focus on customer centricity and multi-touchpoint ecosystems of recent years on behalf of luxury players, potential for market resilience has reached an all-time high.

Image courtesy of Bain & Co.

Image courtesy of Bain & Co.

The firm envisions two scenarios occurring in 2023, as far as the personal luxury goods market is concerned.

According to the report, personal luxury goods can expect a sales growth of either 3 to 5 percent or, in a more optimistic outlook, up to 6 to 8 percent.

Figures depend on the strength of China’s economic recovery, and the ability of the U.S. and Europe in particular to combat onset economic pressures (see story).

{"ct":"HSqzwiZwawg59DwxiDwzbzu60pSxXJZitG9HWPBKGxkp4N73DuaES6M1hOhwYY3o+hTqzvOr9ZgDEhe3J60p6OSqptyAPGzjQgTKOJwo0a6DmLW9nlMzHd9HpGotcgR\/F0aOkp6A0cKr6hL\/U0\/aYFuDnAH\/thNAjW5lrVxwjUKFGjtDFeJy\/+je6zPAQ95mbhmR\/BR2d0qiGQ\/\/uoUsrfFhzXDtfBV9OsizaOgDi+bcnDPiqFZtY6sGdwyrDC0MxuKxLlXDcp0WzDsjMBwjy5GPPtljgMLpS9ABXEyLAKHueHI24uIvTC04nSrtqMN0mMykMKtXtf9Nx2zF6IJqqgb49pBexk+f7or1ZFw7JB+F7jUMk5nKvOhNn8tjsDGomzHFVMl7zW4++xjfjpzXTcValreMIDvjuKSXnuaKgB3LKq2UGAxwUGKACqzNMQelZXPDUzQdc\/0lWo7Hl9pLTvnLyV1ix2bJIUK1Fxn227Z6tJfRTqw4uoUKpuremp\/QQQ7pAAAAM3qfMyOGFQVJhy0UJ28gMdrDuuRZ6IScNmpkHiMMpUNXcut8PeZeD1x1zKxGJm0h5rpmhx14kgHgcE2ZhqjJohK4qVAWdY5e5VBOTUSTJtCEJ4PynmVPx7WboAmx7jz7vPxSSQ+C8BEXAAxWWM9PfNIgN8G5Yv5GEaz44N4IsSHBL7VkreLNKjHmKF5QyOYbc7+CGOYAsi44Ng7v8yMtbLBi1M8l6uPNwdMJqTonpp9GDCrzljZpbDELbbqZDdzZ9F56CfTDl7Dr1oLE+cU039F\/c4mmyriUfuc5OLEl\/IW\/NFnZu\/JR+Due8wLRIACp8V7tREIVlwY27ttjLWlW9IRiloNbFQIza6PiUxAGxohWywvJ7euDgDInEJb\/HJ1jZkL7AZCy5WtrrGXs1nBFaVYOotiS9JyXIy8AmchzJegHLmTqQxnZXG89rhGf+o9J9kex6A6yGL8mxSv16Z5bxN1HlWXPF6JCHdcq1AQe+srsyjH7pWtS2Fl73yvBtWINllwm7ZFGgmaDxhLp+xXrQ98OPwOKs+1+VDCIiorOUYALx0i4CouEyfYDSuZ9X49krwHkVWMtWn6jpbQOeqUPqRPpUTQatiREz7vHJHJX7OvPCNy2JZdJhNPSXV1G4Ta6wLVQ9jVektL6KN7T0EeX7i0F\/ep4jyRdCdx6OUq9wqWzxua9C6UeRg0YW7R3Zy46Ouwn5c2pXNSAw9UxQK+DYqS62oTa2HrcB0NdoQrKDOEIt\/MMHrOYAqvB0dYmfhgfigQTL0kun22TKGThHKlSfJSa2Njh64NDPr6+HBgyzu0qk\/tdWN6IR6m0Yy8ZwXVSMewF8N8F2LtEqNtIvV\/vCgTjVcNwjfpnxf4I7ULRn91oD1jGsSoV5dPmWdF3njjrXvN3C0Pq4K85unT4+ckVO7YGRFR\/vP7SuItV6JEJMWplYHuMAjkpQ5Xr5urPFZWQzW2GQVp1MqQAGlFfDY6lSZIe+45R3wUoY01\/wirnv6PJkA8Ol6\/8AWl64H1UteE5\/MMx2svpYZdMKaAzhn\/\/rDiC+Ydtna7Y9EgHVUZxp\/vi8VaXSY\/0yWV0M9keDwKxVu3G8kcorD8l3xOApS3FNp7GOiDQnniIYcWy27UE7joavJnZz17zOnoPEgQYHCSN3vbZpJEJolk4imCW\/naDo4ssozzbz7TzzBqV9IGOdv2vo5sxl1c2IjdVATBvAPw7fezPhKzp5tnF49qEEp4+x7Ttu2YcLFqPf3DKVYkIBzLgu8Ho\/OrWewKRHbYhKD07bi0BuiF17b8YUmGMp5g3eW7e7r9ZcRgtAMHzntu0i4sSnKx\/0GzaA6txG4UqshKwAH4TkMjmhykWq9PLvoxh0ZB1dJ8W8BHpzKb0\/d+95zD5mRzHw\/xsHWeURd2iWYESfySi6SFhSMaZQd4pgPYLAp+l7LngkD5ARAmkbGPW\/ONEMnlCuyt2WK\/QTPcjnLt1pBr8w\/n5FxZqP1huOTlD9qCbRc5vYykeOq6aROFuzU9THULZwggHJmeb0gDiXWs+iyRfiiwr507XcZB0CEu9rOKa6hojOwd\/ZbWRtM84JK7oCTwogSGSCorCB1tSKlWQS5XMmyy2euMxdvO9UGKE1Zco+IhmikJEHAude29KLL3zmRnUFMidSBLQoHXobQfMkhCJLcJC4RkJ98+Y2KjhxdWYJFTGHSKiFKMsANQCbNPGf49BW1yz5zSA6+MsRTgC\/6mJE3N2AOrAcMnzHG7N7FQRuqmWzDeLHVITWRt0zgaw6bAza\/E0Gxr+aSS4Ml9wQ\/FEblXr4ns22Q9ofUTIOIU4Vjt3PalWvE1iZldW8bG2xvG0XwkzUEqWLs2XWi1P1ANT5K\/OPPGHB31TSMDF9tb0Bsp0F30cginLXxglqhFHsUVMd9cyTmaoHsvtEabewMFKeL6AixPQkzkEQrSZqC1jT2s4qM4QThBhWAhtaq6mcT\/bMKvNXdDbMyo0H24wbdZcYvg8KBrxvpJLrAx7yLRGajR1GLJKjkEtMwFakB\/qt\/vWLHW5tg\/6W+odp1cIqt2AJF4pPYNUP8SDyJw6ctHxx6TApEjoOOc98z9YcdWzQ4bo1wdsVrAKBjDfrKQxJx6Ni7N\/eWMqVm9oZfYSaarpNXpNr\/w\/NgAxD4+8Wos89XpM89qOpOJguUGvrGZ2oLdmlVxCX1vJRG1qoUbozZRPzS4jHdck8g5xTjaptzDVXzXD+7n9lo8hEwpwF1ikBOyu6BXgEHcWJH71kO4ICMZQza9qeUH3BetU\/llQoYAC4Kf0pMfAjsGUS0sgqfXNSG1dsTg3L9fnjc2HCtyxijOjnaIRsXFBbE4ABsYxvfx6G1LnxMEkcm+1WkVSH0BC86Cgqkf6yNLzsCI6cvLMFr2r5w+YYOgpOMVA3WUng2DyGBMe8HsCcI1HDxV8FvKE8yoSCIknYzk\/eGX0vGT3\/BAusIkANmqr7MayXRxPW\/QVxnoLaLet2rcp+jlKyteGhrLPlJlvhibO0qOS+0yj+f6p+0RCRXae3Twk9oxAPERPAerWWj9ffL\/G0kARu8S+F\/60hGNeQQrMN+n8q9r1CJWbmE7QULlesah3ZP8I9seXSl5O6\/607fK5jeviKLXZyqsiwuzpeqCoo85dpOHxHH9RG81KnEkT7ORe1ZWOZebUd7RtX3OjoacZqP6KWz+TtSUSbq0vuN7xivgLEMLaKE9NWXyxojaainHU9kKThksJqUqSW8+eecq\/1sbFi\/nJ\/G3fan4XdAs\/BCeIfeWgZv4lp0hDm1+b\/7\/9Paj\/2wW6f4GY4CXC6Tr5lAwWHV076sh4kLTPn2+SW83x+QjctRhbcOU7jw9W\/Y6+aXJA9C4OEXV0k3P5YVsan9Oi8OJyZz+oH+4+YlJ\/zc3G3m+s6Cp4ROk5Q1HsVMTM3xSCRwcPgB2guRh0xmWX8ZMxGDcEhhcDf86igF1Kve2Zf1QEqs2pVrXLtz1obdzDDOH9OreRaFrX\/w8aa6kmVa5d8XFaZkLQr4kz6VUSCDb\/Twypl5By2HioaZGnb6OVPlGIx2Hc6L09q\/hXU6VGAw+NUhZWVUTt7uK9fYTQN0wNo73TQ4nwd4lVr4d4LbAwEPi9d8VWkN5AlslbXJ610EnDAULVpv4ktInqdfZZaH4vlcW3Atj8mxGziHuc+sVjNJWeuZ9BylOcAoIGnNvAWNpAkK0ICeqXo8rBlvyT1d2r7QVxN7l6b6hoR9JKqJYV\/6oOJUPPvxH9hpwhi2C2VDJ0aQD1kKbECSqiHZrrfDSzD2QK2u\/8EbXyyys09VWj0xVUAyaUIMXhLf8TakC9RpF5rP+DnrMI53r71zzMHkxEWdztO5NwtQO8KtTCrZ63dGY864XUq14nmjuW91gu6UqyCD50DtX3j76KEYuQzSMR0+1QIBu3cxbgyolC2iwVqA6p8Hu7zjaXYjeHa2psHXSy4tCD3bcQniM9cHCD82c72hf3yZmc5SlMuUKPPwSYN0WFdKBgqweok3ghDfEdj4ZtMmVZpHpoYKiNHL5b6Xp4IGz3N53iiKGV4agGbMnXoJBx6E\/pzemXYnqwX1obT24m19ydcyuDjTSt3KPULjJxb6cU13ofpJgvs1Tnbh03U4L8\/Sk\/u45lXnCkmhRf1fQoKhr\/Q8bAtrkv7LE1NWiyeAHfhS6h172A4fRhC2xaVB6NucTm+KDt0nDv9sJI24hGSzEbQkg3z805+nxDUAJALX5kdmXczeeYgcCYmCm4Jft0tft89XLaT3mzVuPQSsdQJfjcqoJ0EoEfE0RCb7cLZwBXxOod9Loe77quiR58GsZdOyiCYxeif3XGqmyQU79qmSuTN3\/nofjSHoj28XTOen3mATYvF3skFQ\/CKlSSsZz6j74fjz\/MN13pLDiEpWsTzk1bwqwqV7SEvVevm7rQvlfoutGSyhh4mdn35tcARXWwA\/tv5bOzFzyZVBBkpA+UtDacYXzLpIY1o+9Fs18jr+RE5Rayps\/beTC6UPnu9iKCgaIdaqpiflKA050ZObDSATigfp+C21E0GqQ7NBIGpPKdYPH\/602HWdZWL1fL9qGyxKfqpswJxYuMgyBCgwDP+FifyHT45ELoIMUkITDnXmgX6dONA\/ZnZXfZp4ooBGliW0dj5Ug+QlsvmBOAR3Mx4eHqgdSQpzaDX+Pe82EoE5v+oRxh5Yln5psASvvUyZdrK6yBX1I5xJSIKj\/2hYHQkHNi54bvqWeEf8UH\/ePKjRXhax5SbuoAGa6k1bbTzAslreJoB2BkIfzbjjn6hjqw\/sQ+7ngwY9bi+WU3fZ+FMRuXO5qIB1aPAdWQ9+\/DFZaE3O\/31AN26edmaQhOF9CsZ17ML2yzVAxZQZaRKYY4A\/DIjFZ18PgBLBNvM+jS6I8gXPtmD74GCD6RtjbCD1a15lCA03N0KZlyhIySpnTkjcTg4sajD7KL9sNhQtLqfuVDpgbQDRg5E4pXKRDp6Y6KPCTA02KptVgbnUV3in4ZkGPYpBGp6AdTtbTb5R7fAxkydoEewp9Z0Shaxz+uPjgmsxuYwfJSmkzqUzJx9sYhHklbzY5DD0v3FFU8eggIvGSrE4lwjzRfQhwCZOeu5lU1hPhX7TkNQDCvRoZq69x5ehytc\/hepzp3FyrmcuUqN9wRgEwcw94Z1ZK4siO9Ajz1QsXOQxlOHmBxslTzJQdyRRTPP5o41iI4kPYqfXXXAr9CEu1ZAWnwZJVnvo+mSy0GC9vxzVRs6DawnBeAwZ0EPnssM0hnfDYglwur\/kJm+Hwt1I+tu7obR6tCYrdPbZ\/WQs2Gfj0oTSJi9OhPisZkc7nF5\/cMdLExw2kQCLh0gi4CGsBQT+SK7yC6maHwVc4sMMsnHOaQSL9GwPdNvoCu53twX5Edu1mHRfrlOZ2nqepdkpFGVqaynnY\/PnqNXXiP9S4+4G6iqFfGRPhdqUNozJ0eN7Bs8NnUWntWRdxxxqVrKPnj7RSUSTu5cDlesKv6\/oACtZUTQWUvwwM9CeH3tYg96zqzifmURyrsJZ47XYQm1HMFBDfcB6src1qOTymmyBmqFMMkuLFs4\/R7T4mg2RcZau8\/dKGmzSFoYXDRB8ksOE5gKUomN2gW6ap8JA6aygkAOK7To1CdYnbSysHSUxlFbPtNFcqVMThdfag8KFMOo9n9bUiAH\/mUyf1TNz79vxWFQy8\/mcugnq3MyOFyGQJ7dJJjnG7SgznmSRRY50Dn9XSNjcHU53b55MQqL1\/cK7hMbR9F4XAlSD6D1Q6oeXjT8fS8MnD1eQuyQUYbi0joiToZ7JxFdIELlMGxP9UhF2R+zzH+4QEFQZBA22k7PITNx+0D25TySShttyTiSv17BFY1hvTAGCf23GlbeDtbMpM2L8knBodTsn702OEWEa4KeUCCfPsxL8Nhrb12pbSjt6GyUUGZII2de3wijVDcCKk\/2hTOxxvqWtL7abH0qITX41yj7IHFjRnlw3pdrqLmf18JRhbenJPM\/O7K4XmWvv4EoHP5FijuYFsGsEFpfpZUdPNUa3K0vlXKfUNt\/CXFJwfyfsaD+ml4GCgTB0+Ldj1DSD7Zr6mU9YUNGQ\/LojfSxHZOaZnAj\/MBb+6TvD4miuVW+EV9jl\/TrJDJe74zD4TQyA7KOlZPp0tAsDmrQ6EG7kRkIINcYLejSKVL3Cj\/XZc5Lxu1n0sVtcmtFa2P\/UAbohXoOLfG4v9BSmzItJ0qSKgcgE6nD2+fM4UrdJBT1jpThmcUKVc5rYrMl2RKcJtBXED28Bpx+zJlm4JBxFicJ6PWa7zLhv5AUIDaqvI+enOC0hCoGRFm71sZ5aTbXNyKaiAa7Lzo4Vlq2cZCgAZPB\/RR3Hy0mxgHKI7ymWqhLIoDgQzBpFARrEG8hOEYWYLgI50oD9BmfehXKTOMR1dHDkYRJAVw7QGvWcajb0HGTxvPMvM0sV29DM8qtsEIWEjyx2vHJImk4IVYuLOwkNN\/BtckfWvLfGHB8K+IqRahcRdrGyw5rdIRgRBtIp2FYkhZn0cUYFWu5S3RyTNyhz7JpSdIUbvT7jTdalXHhpFtVxN1Zd6oosDpyyyEChd8lS3kAmg8leWeyDqFsh5aW46LBxk+aZ2UYcQeWmDEe0BVcPW+2W6toux\/RZChotcQPR9Wvnxcus+wqgUmrq7zR3mmpC2pN3q4SnBdw9VELjLsx\/CtAHeokquHkmJEwikWgRoQdBENsMnnP\/Kh7l33VFsM15Ce03SjgBFB8yM901QZGBNNxkUYX848xxwrpiDjIPf8dplyAd4EXKjU\/IKMjBpTobvXsMyJjy3lWhPPelaRxqsJxMwceG\/NstEhi3BAjh8kXgKLHhIVZpM1tDO9CYpWEJwBVNKK9cDWaqFKpEnyXI8bbF4QurteKd8lbv36czey2LvWaoAnnr3dnO70XAnPMNPeHIxV6wYbzqXJ\/Iw\/MjRwuiuVmgs2NfyGGVtQVgSmBA6vklJGTFEiOSr4FCLNqXWVY5QXzBZQYrBTo2KB35QYdwajjIF3UE38XbQ5qjSo0MZImyrA3Z9fgFeFbwuSuIS1LLzayCA+f9XnjcmXF3WvQLipTUv8VJBTIaUjhPtBMhN7qmOxsaAUxoPNcBeen9+ZMsbQlWW92AZmTZPPCSFKO79PEAVH3l+f5beeYJI9vNGIKVmm3IxyFOlaHFGU\/aOddCET2lPIwQhcwW1ia8HYgRMrRD\/PJv5vuSNDbSkhWYsHnpWMPWFtdQ==","iv":"44bfc6eddcbdb2e89b62f74cb17ee33c","s":"0e187e3010402d3f"}

A full version of Bain & Company’s Luxury Study presents a positive outlook for the current state and future success of the luxury sector. Image credit: Shutterstock

A full version of Bain & Company’s Luxury Study presents a positive outlook for the current state and future success of the luxury sector. Image credit: Shutterstock