Real estate marketing firm Luxury Portfolio International (LPI) is re-upping key insights regarding the next generation of affluent consumers.

Those seeking to further understand the evolving preferences of this cohort — the study backing May's State of Luxury Real Estate (SOLRE): Demands of a New Affluent Generation release found that worldwide, 46 percent of luxury homeowners are under the age of 35 — should consider revisiting the latest installment of the leading network’s report. Following up on the research, Luxury Portfolio's principal researcher recently joined company representatives and a members-only audience for a webinar slot, building on previous learnings by further contextualizing the wants and wishes of wealthy homebuyers, to the benefit of today's agents.

The July 18 digital event was led by Chandler Mount, CEO of Affluent Consumer Research Company, the firm which orchestrated the study and subsequent data backing LPI's SOLRE report.

Buoyant market

Titled “Marketing Luxury to the Global Elite,” Luxury Portfolio’s first webinar of the company’s Q3/Q4 2023 season begins with a primer, going back to basics before touching on demographic shifts and sector trends.

The session’s title outlines the objective — Mr. Mount aims to explore how best to help real estate agents maximize messaging to draw consumers in amid a luxury estate landscape — before delving into specifics on sentiment, category purchasing, leisure activities and other areas of measurement relied upon for the SOLRE study.

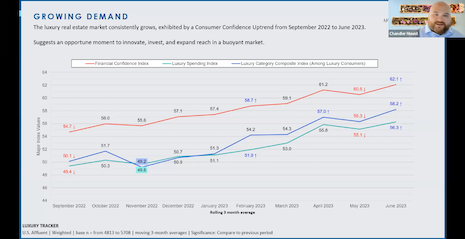

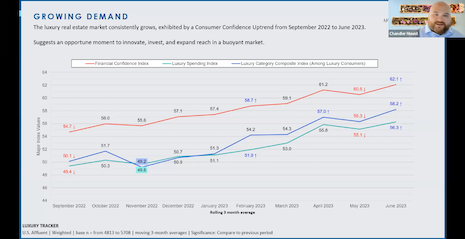

The presentation moves on to paint an overall positive picture of a “buoyant” market.

The presentation paints an overall positive picture of a “buoyant” market. Image credit: LPI

The presentation paints an overall positive picture of a “buoyant” market. Image credit: LPI

Despite marginal month-to-month dips from September 2022 to May 2023, Mr. Mount’s research suggests an uptrend in recovery has taken place over the course of nine months, as far as — the tool tracks demand across 28 high-end categories, from auto to home to travel, and more — market performance and consumer confidence are concerned.

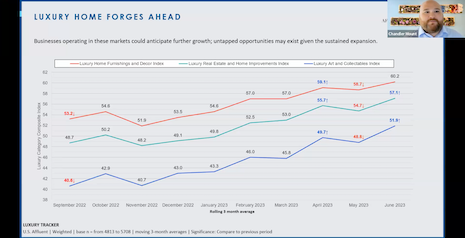

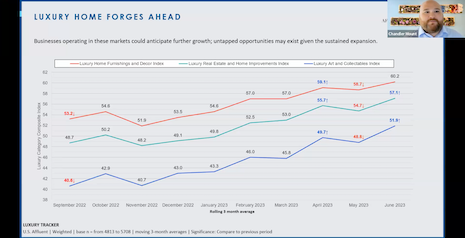

Upward patterns continue into the high-priced real estate segment.

“There’s no indication that we’re seeing a pullback,” Mr. Mount said.

“Certainly from month to month… there is some variability, but the overall trend is really positive, especially in categories like art and collectibles.”

“These are areas that tend to predict future luxury spending.”

Buyer expectations on the up-and-up

Affluent Consumer Research's leader also uses Tuesday’s launches into the implications of said market conditions, as they relate to luxury real estate.

Upward patterns continue into the high-priced real estate segment. Image credit: LPI

Upward patterns continue into the high-priced real estate segment. Image credit: LPI

Buyer expectations are rising as a result of demand, with “attention to detail,” “knowledge of the local market” and “negotiation skills” ranking highest among buyers’ top three must-have agent traits.

The same goes for those seeking added value.

“A luxury buyer is twice as likely to want access to exclusive services than just a regular affluent buyer, so someone with money maybe not buying that top-end home,” Mr. Mount said.

“That’s a real distinct metric.”

Luxury Portfolio International’s original SOLRE report launched in May 2023 (see story).

Insights shared during the hourlong webinar are based on findings from Luxury Portfolio International’s State of Luxury Real Estate (SOLRE) report, as well as Affluent Consumer Research Co.’s U.S. Luxury Tracker.

{"ct":"JcC54fLvLwoEp3hRR\/WYcLkGiscY5LHR0iPdEfhpLur7G8fSAphoB6\/utkCAyhe5pPsf3Ca5dW5IyDlEU9sCyJopwwfQKSQnDix9PaXt993MIp4kUprMrdG8CSlPU9Yz6XzlBuZ\/i1JqSM\/G34loNn2JZqsY28Skb+ugm8MDjDbD95\/4TDy5lydYh\/7ovRNHx9QmW0m55ZR2QVe+7G64bnl6eGYnA7wuixQ1fRPSEUcYTnvJ9y3Y47idyUkrDECeoYgc3jNsOb7x4dh77bWm6kz492BD++6oaEHacXHCEftAUl+ZUnE4akyxiRQmuETuXoDa9wQgkFSL6BjJLWR7VxxF0hP63+8VszN0U4HjqdJZhoyfed7nOuHYBeM7OC6VTVxOiflSDlRnX5jV0vBgQqFFPyDmAQ2Sc94RQTYciK62wr3eBd8C+gWu6hW0nfy3zBCd80Jwp15guffeyEPD3Pn1kfLJ5e69oXuk87BxcYCEgA9EBHkBiqMMKGm1iN05VlKrpiIiFHYNjnXNEBH6P9J7hx\/kZx0drHmFjlOnD8M6C\/tRDQ1AkK7DIkxbAueGjPxf5W6yCHaHISX8EPQgRbpZtKxFJCyJN0ROZqONRO3xapgQfACkR+Eq373mXSaCEHHuPR1SmcryOwGaWyaKqfVnjEnTud7mnz2M6o8Kp7f4rW2ohReiJn\/bn17DZ8UxzWViijnU4CyHn9QCwckeNjFW4TsCbEfLsnMbrBQbyRN33JmbSvtanYUR6etwtJpC+f2E4Che8mhfnX08cLSBfWwv\/oNngZswzfcQSbqP09KzVz+tsl7bB7iZw385JnLOcK7LmxT9G\/wWpU0X7RZoyhzGUuTcsZu7DDw+iqrvnE3IUJddf5t4iLL8w9PPKmkjLwB13j+nx6OVvoTGU0WBqgX\/aZMledFHtRMaVMVFIbB4ABO3ez0i7\/cuRBSksStSNNTkrdXdJUbQfgnD5v8NWI8TBylLDAItxKOJ0vTna9U6GiyGiUzhMjkw69dFK+4bXzJv1HvgHXc+216IYAxr0eNUAXIAxkBgV+uWXUfvMghXavNFMD9h\/O3iHl1K+yOt7ANoCfYuJWtUCgWKZOYxsLB69ZAH8n52Ie4z+NyS75HHpfpQVeLMHI3bYEni4Z0wvhbwWPo4L3L6buuEsANpoMLNwAZEG3tb44iO\/LPO0Gk0wdT32EvvQu1qZRMcNOYlUfzeRwhcLI0Y3ZoOmUCHcGtxhcKIf6SZVgDjoifEXNdmeM7Uk02FJ808d\/47Q\/N6kCNfQ5xQm1\/ykU3ogBRcmlSy9pAPOhKUsu5TYjE8UloZ2SfKw9aRcXgBO87ZVXbnodV3MZkK5D0Hd5a17PaBeD1uH\/Ly1b9omOI8c2G53gle8Vr126iuzWGrCay5YItv4u2MCyazZdw+VOFdggIPhOWEg+bF4cvWEysnjemxQuKM1zsOq4en+M8HGMlLTgzI+i\/TcTPKGC7UcBfDY7FJi5fa4VMblbdXetHRnTaJ+HGxAKCXnOR8TkobPXWKTWdZrU12BZMUWEw4lEm\/f\/pkVHbToHkS2hbu3OahISwSVQMwdXqSDwTF9hPA2nM011iyp7C1XTj9cKJAScfyR7Qd2z8skzYdJJpXTSefhEXlOhUtQgu4Xv6JXoOHjDM61G7Ovb1cu4JCVSDJtkqNQSzb2T6IrMzXRTWZpkWwaxzEqCEUOM3ydFoH5Xx4vmjetnuvpI3By+gtso6OXMR293lfKI5zHMMC3WWdALU+T9Q35yH3LMZHRqELJa59Rnu6MTgkJxpJRRz\/nHK0qe\/wH\/ap0tbY6HtFehULRcv8GalOUtFTbev6X6MkUajsOMR\/wXho4pdwvF8eCAavrKuIBMi4ictDEMW421t4KJj6Tw64OQMP3pINvdAzmBKJMWEscWMEoBpj\/eHQqhFI8MaZjDrxu\/sEMSFqiS3A4On+Vy2OZ3ZjhvixQBOysgiSKZeWibhFrIIEyYZjLTK36rvMrPJFjQHkBkmJ2\/BIf24ETbm56UPFAZod8PzcLhjKvgGRNWpVVcZjbfr\/Wsa9drntnS\/wHA34CkF11uV6c4xxKHLgk3m3NP3uLP+R4VYL6Jge6Y5pJkmQcGXHfVeA9bFVfSkqjIT0HCpRnKABYObrB4Q4XIqd\/Aq498Zx+VatuTjABck3+wfTsjDyFIAkN4LLCQiZeSsJZ1m8cVTT8F3DeB6kQVjNrEQ1GqLHFoqx2ueKjlNIHiYgC8UYJFq0LnC8cg06K8DO\/QF4fqfkhIjdwMmRQSN08wducelYMh6+4et9MJSsoVuFZkmDl\/AEwpEmVhMuBZJ+g4Rc\/C4X6QyZo4uO7lHlGNjDF0QKvHAD\/2k3Nzcy86yuo2PTfC5L8EA+fDYSqM8ResYVwmwSDoSV760PdeMbwyQxe2yzphPKtZYYknB6v5CTSIbMAs582NJH12Q8uZzF05dHfr+l+e1I7MPrwqgOclZptgHBfEJFTGiIKWspxrORoBiJ+0oZHBScESNzdU\/kaAcA6uACBEO97bnpbzol8q0HXsSxS1WMoPBMrvKwMfp+8Xa627g1QUKAgtOga340n9N25Vnvzu0J8dGFwrmx37rt6GF7Lx7gII5OAYVlaOE0E\/VDxormyLFDU8SI0wS3DEXl1rSMRCOwJhS9jI8eSqULv4jA\/EMXKU1HvQFAepeS+zeP7zzblxz7oo2eaSGGXzoI8oDsnpYAgfz0DmsVSinVKKQQ4vcW8cM2IPziyYan5ZMrW37v0NK60+yKZqY77+kt1cSfJ13AG8aK51LnfIS1Se+ePTDe+RoSuEPR2WB0BeRGCu43uL1PVqVzosekP7U26j420sl+QssV0XP6l7fEYylQF5HVM0OC7ARaFUTbFnNfkt+uT+xQUOyyhyKmDlgLoKtMbh0z+JRuuBIscLZ40pGipiUcWLPJdliS6SGcip2a73BXD78Yh\/lLdqAB\/k08RO5VvTSdbdIRBfQPj2BP9gaJ\/3DN1HPp84CaN\/7omZp+2P\/jFsdupLu73L6e7PXagomEvCVKy6thFXDkgXN8AujNL\/Gf0me2egJHLHywE+wsSJ\/qzYExfCZuYGm0vBq3necNqXDFkOe5OhdZt8j0BZv9RmoIIipJL6EWbwqbcn3R5R76qgqnz8y\/dOVo+EqT4q8RWi66DGa1bbipWnTClDexMvC6ReoSJhaHMCP7ryrXSkU\/iaSQyG8IQPTtQOmiZqsRpLq0AgIQrkzQQz8HIa55ZW63tjKROCnToHbnDxTTa\/dLwBw6r2zlDR5vxpr+AFibnsJbNdUbbYb3CmAURPZjPRkSbSEzvncy4RMdpJNaioW800\/GZ\/KbnetEAXSNHpf1OO\/P7Cwx1SIRO\/SG3hPNpR1tQKuQbk36WyfBhHf\/I8NUwu42qQFCnVeYS+aSOLjwnh+B7hxmf\/E7hbbaj9CGtFzJQ9SZMqCfC5kQ5KJLUJo8D6FhJLLtoR8OT\/96DGnWhYDHRpvsn6WBcC55Awkss9PY884uN3U7V2SXh\/3g\/8Y4PVeZc+3TcQfR8IlC5TxDBgINiJ9lNJzXSCf5KFjz+viH5EHwWbvnZBOiuXgopUvBOE5YyCIi5RZ7kV2KjtsvQ\/ngUftdqeO7qterZhbEnY2Ik0GnQbhV9EIBT+4WbcoLWXkUUYj5pQMnQWHw+KF2VlTTWR5xVsU55eyjw8tx+swocBoUNVobuImgmpaLW6fAdP8u\/2nyhF2mF4v0cIfwyHu2afuRznHN3KaUpLFP1jZ5HzvzDvr9JINLV2pwdTbmAl+77IzylFQ+M8wwSo6B+BGXSYccM5gytmv8teaHHgXkYpWKnTJb0yBOUdVxrnCrqjis3DIif9TYztMyO77QoQZ5N7Q0eFww5IEGwVx9\/GM4JVGYhFMJVZZGnRwhZNc082MwqRitCDWTbhBlmqp5A+BZPJSqTDF4oJeRZn7TqUaKLqGNkjdQXYgmGB7mSAAdncKOWSp6MTYFWrfvqG1x6\/ysP2CCfs6HpDHpGZcUFi6OibMV0Kq2QKZq3g4V9aJLzYde97SiTgFbxxNY2vghqNyYhobBZczB57WINwZCNw1Znl1yoA\/vye0iyeMWA60xlIXeB9ZU6uXeq3bloTtN1P3x5m4NMREUpDmSVR5V59Y5OIEaevo19yDacv9Q8\/Fahjmsz\/iu\/XM2wqZ8e41\/cKuZ+KJGN1hJ\/qiYOHIzF\/11sNFjOehjzeaJ9cV0F3jhUovoJquntsGh3PQxDU4td6UgLiIK9Rg9RMg8n+Fk\/mKtRo+DhRl8yBBH2W4rR3HqJ6+KCHAeYaXj\/Yk762OdSNvTQfBT6apR46JVqDqAGAMhtABmw5GmpT5ZrXbdu\/BiJWs1f6af5\/ih86kGCdnly4n45ogPHgpn7ERW5eY1PL7lOAUY+709oabHMmyS8jtUx\/e3\/iS0ngs0Dpp1pz0b6KUy3uF7jE3h2a6Mf9LoDgE2ZjXgE1o+AnmZKg9RENR2MnC8nbq6yunWSIDd+2QpUQ4rlPCoIsoa0l\/5GvdQ0MfLxQkPcz7QzkmiETOvEZ2g6J8C9nvQltqIbBNymd2Tsi6zeOL9fOvMcEI9\/xjvJk0EBvilQK0l9zI1xNPTOgmZmIx74h06iDM8Yo24kxYlkquaL7eFk6z24bh2XV4ui04\/81FgUa3OfIQCwcHkaf2lgxUMcHeEkOTGvkRghYDwgdsA8ko39HkeIFT5DzuP3rndwDXI9mDcf8PFEp5lfDkojkmF4nObET5APydugbs9f7OmBXZ\/tJjCY\/UxQO2so5gpp06TdjhTHRzE\/dMjTJu+v2a0wuwPDWNHvELpeHI9m2tMUzrJu2QNDl5EUMHvIoHSd43gGM\/6rGI8KQbGm8yDpqSDMqV8PBIUWQED1xFLCLK3VSsgVFwBL4mxs2hKSCNQvLb+Qfv1ecx4Gfe82my5F6Z0HTJ\/JbaMgA81KE3dyd9GKvr3VySXlqCpCblgN8w6q14s7oVZFTIqat5JfIGrqfxh2YQPxmEBMGAvKe+DlHHqk10\/jpWl7AduAM7eBudsSrw9Y9CfYW5l7aqWzd5vvbnFYpWs1o39bcLzG1CQ1xAoS0J8eJVGrk9DAF5mqikODTLwDgPYWYWRsLeoxqyllsQaKtwLH3qXrrEZ5YKqPek\/IyhZn0W0xtp77kiHzFjTyBMrLm4FfizBlQwWcJERl9ao3MfEztb5eK0smpNnmFfUM1r4REErSo4CpGQnUwa2l\/0qWviqDUs4H\/BBsxYj1aBv1Wlv4rTtDX9vfzEkeWP07RJWB+pzxa5Ii+rNwOpXIRZr1V7G4glXcW4p+BQlYG1Bsqwotk6kZPX271xNRXHJZUV3UOlMqIwonV3E6g5ecFTxqEb2hu2PphRhovAUtZRX9GZeILpvXWGfnPuR+5YcSiTdek0MhXaeNFuJC0dCUA1yYbqZIDR4izGnzd4ofmLbPKwtQa1W47zfH7G1GLpqPKfxKXVpUtXQssDE3mInk7ud2F1Jo4YPjN1T\/GHTs0BTviNyMoPSuvQj8w7fKodMJHjN+i6xVguMIzxoBk26YDrcdQW0+0\/fNkGBarEi8XsdO2QcAPag7zCJv5f7eDJo4dSU+bGA008pkCUjXHKhPiDnrZN2OiX9UTujl7TXFo2bLMLYeZ+4OxdVerKDb5fQj86mojY+XbC6iJa+jCctyf\/ioRz9OIQHifBfAFeUQMICxc+M9IFEDumFVuzlUxnfYpfiraO4ZOPAGBJcgFBdbOePGLZEYgvFeVqTgAwh2RObDPNe\/VKM88eBQq5bFNJoTXAE4qA5OgR\/0DFzwWjfdAS3A9ExDme6TsN2YtqGIby3\/mUugf2yb1L\/3bKt\/xRaHBPE7cFyzrcFjSlZmpcexecOnBowGNiPOaz+BvuUp8xDTz5OTtjmPJOhHsKLwWgN2DkoO0LP4ePdsYVtJ3wCQDp6oa4Hu45e0gpq8YX8foAoVziJUiQa8Enak9RO4X5irIoow3FgBDvM9PSuAia70Gjyd8XY9P\/g6vngx9EXk8yY9T3GxGl3+3XjrmZdH72KryDYusDBkLyUcLUJ72\/fzX0Acc2ILr2G6q\/2f8boJz2wulwsuCMPIfyrHHDNzzpfd05yetQvdH6brhrbQffTid1kmUh\/vAXZjxW80PqilnUy8a5q7EkrB47I1r1WWOAMzNHuoVCGdXgp9cgs7XtUxJNkKam9RsAouQxzJZUNpt41fPRkxBxG8eVczkKtxtIFZL0abtkZ7qdbmkta3mYCEHwTFdxQR\/KCd1\/bOc3sBTveLZgRV9EiqLstBt2AgfPkZM5ccVv5qcy2+zSBf\/ZSRA+oeqhjzlNpKvt8mpXkwE0HLOSL0V0rEwSdU102xVr4oYB1gb0CJeNVT8oX1clsHFqQJWLg37LJ\/4wNvsu18DzI08TCwkFls05Q6Q8v+zAuNbJtj7m8OU+T6qewhJCqzZyNlLOlVi1QmMRcDAnNYIZXxpTCMEahEet7\/GuE8BrP61kL8yIPAC3LeZDPFttO7QMyeib5RjCK6mAr0KaZnunqBUqIxJiTBM8Bt9jigON1U6iuRpS\/EUmkTPcoXAnGNYX5ildLGCm5HzszYBN\/MfsrfLWf\/7Ln55y3HPTM3AQpABUnVW5Txp6HLMHu2SBMl+RO+BcgiF5cFbDym2d+ccD15q3P3T5UORwTomvbjkTJ\/tq318qKKvwvIgdc8s1dMdGew\/Bl681NqTDr31t6KgV1aBila71eUzLXU4ypUoK+aJh7g0n+3VJlkGUUN6+cKqAuUFx1WCIl3fV4fSA4agQquHiDXqKhTyhZKHeOfyCUjRMlfVnQ53ANII8Ofn+Oz8eSwnMYlrH3eaxUGtLcMiSpvtwm\/kcPZEge9L1a5BRCoQfHUe9IzmQ4liQF9c+JZ1YUaBRn4dnODxGicEJivv++uKNmcUt1DV63A8vNvTuzzM5KORtl1iCBZuQcCiv\/ErKkgyfNVUVThNSaFAL5DcbXrnrqYEW4EJPcrdklpCOtqdQ2aIRWp7wjKDljuI1zYUcp4ZThS9HUyOBzSrhe3fyXTGVkHg==","iv":"cd1c9b132091e2fe449117adffe069c7","s":"41bb34688f6956d5"}

Insights from LPI's July members-only webinar pair well with the leading network's latest research report, titled “SOLRE: Demands of a New Affluent Generation.” Image credit: Luxury Portfolio International (LPI)

Insights from LPI's July members-only webinar pair well with the leading network's latest research report, titled “SOLRE: Demands of a New Affluent Generation.” Image credit: Luxury Portfolio International (LPI)  The presentation paints an overall positive picture of a “buoyant” market. Image credit: LPI

The presentation paints an overall positive picture of a “buoyant” market. Image credit: LPI Upward patterns continue into the high-priced real estate segment. Image credit: LPI

Upward patterns continue into the high-priced real estate segment. Image credit: LPI