Real estate firm Sotheby’s International Realty is projecting a series of changes across global markets.

According to the company's fourth annual 2024 Luxury Outlook report, several countries are rising up as the next frontier of luxury homebuying, including locations such as Saudi Arabia as well as more low-profile locales like Turkey. While property owners and seekers are still navigating an anomalous landscape, the company predicts equilibrium is around the corner.

“Our goal for the fourth edition of the Luxury Outlook report was to couple the expert insight of our agents with the perspectives of leading global institutions on the trends affluent buyers can expect in the months ahead to help them make opportunistic transactions in 2024,” said Bradley Nelson, chief marketing officer at Sotheby’s International Realty, in a statement.

“Despite higher interest rates, demand remains strong in many corners of the market, as people move both because they're going through major life events — such as new children or new jobs — or simply because they want to upgrade their home and, with it, their lifestyle.”

The report is based on the results of Sotheby’s International Realty Luxury Outlook 2024 Agent Survey, which questioned agents around the world who transact in the $10 million or more price category.

HNWIs and hot spots

Countries such as Australia, Saudi Arabia, Mexico and Turkey are among those identified as emerging hotspots within the luxury segment.

High-net-worth individuals (HNWI) from around the globe are said to flocking to the area, with new developments on the Australian coasts expanding inventory levels. Foreigners have made up 10 to 20 percent of homebuyers in the country in recent years.

“Australia fared well during the pandemic and is considered a safe haven for buyers because of the stability of our economy and the Australian dollar,” said Paul Arthur, CEO of Sotheby’s International Realty Queensland, in the report.

“Queensland still offers an amazing value for luxury properties compared to many global markets,” Mr. Arthur said. “The change in workplace practices makes this location even more appealing because people can enjoy their lifestyle properties for longer periods of time.”

A vibrant culture and business opportunities ripe for investment are behind the rise of Mexico and Turkey.

The Turkish lira, the country's currency, has depreciated 300 percent compared to the U.S. dollar since 2020, leading to increased demand and the opening of branded housing from luxury mainstays such as Mandarin Oriental, Four Seasons and Ritz-Carlton, as construction attempts to keep up with the market.

Unsurprisingly, Saudi Arabia is among the list of emerging destinations for HNWI, as it and Australia were ranked in the top spots for affluent relocation in 2023 (see story); Mexico and Turkey were not major players on the list.

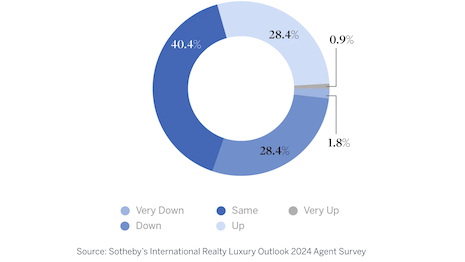

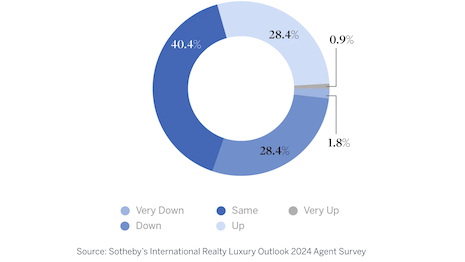

Nearly 30 percent of survey respondents foresee the market “going up” in 2024. Image credit: Sotheby’s International Realty

Nearly 30 percent of survey respondents foresee the market “going up” in 2024. Image credit: Sotheby’s International Realty

Tides are shifting for the Middle Eastern country, as laws are expected to change in the coming months, allowing foreign companies and individuals to invest in its real estate, multiplying demand overnight.

Companies, including Sotheby’s International Realty, have moved into Saudi Arabia in anticipation of the legislation.

Investment incentives

While larger waves of migration and housing traffic hit the aforementioned countries, other smaller jurisdictions are placing their hat in the ring with strong tax incentives.

Hong Kong offers a “family office” fiscal benefit as of May 2023, pushing individuals to make a second or third home in the region, as remote work has become more prevalent.

In the U.S., North San Diego County is a harbor for those fleeing “mansion taxes” in Los Angeles, with Texas, Florida, Tennessee and Wyoming emerging as alternate luxury living hubs.

A 2023 report on the North American real estate scene from the Institute for Luxury Home Marketing found that the segment of HNWI owning three or more properties rose 10 percent year-over-year (see story). With more tax incentives and havens popping up around the globe, it is possible this trend could continue in 2024.

Nearly 60 percent of the firm’s clients own multiple properties. Image credit: Sotheby’s International Realty

Nearly 60 percent of the firm’s clients own multiple properties. Image credit: Sotheby’s International Realty

With the estate tax exemption set to be halved in 2026, Sotheby’s International Realty is urging its clients to prepare a strategy to maximize their respective wealth transfers, as housing market appreciation garnered over the last few years especially could translate to massive gains for younger generations.

Another trend set to continue in 2024 is that of the all-cash purchase, which accounted for nearly half of all luxury home buys in Q3 2023, per real estate brokerage Redfin (see story).

In popular markets, such as New York City and Dubai, this option dominates. In Cape Town, 70 percent of luxury property acquisitions are said to be all-cash deals, rendering these sale prices 8 percent lower than the average asking price for a luxury home paid for by other means.

With the mansion tax's impending amendment, HNWIs are in a position for further gains. Image credit: Compass

With the mansion tax's impending amendment, HNWIs are in a position for further gains. Image credit: Compass

“There’s a lot of excitement at the high end of the market,” said Philip A. White Jr., president and CEO of Sotheby’s International Realty, in the report.

“Demand remains high despite those higher mortgage rates, which also don’t tend to affect the high-end market as much as the rest of the market,” Mr. White said. “We’re hopeful that everything we’ve done to expand the business and cement our strength around the world will lead to a strong 2024 and beyond.”

{"ct":"\/Qj8MP3GZE5eXzC6iaogJF+BKpktEITgP11wJzdobxluPfC7K5xeDQslZW7uI5ToJnszLiBSMhrMekAv6NXUPFwX1TXTE7nJqKZZNvHT6a3GOh7YINaYWU\/XxBYKBWCkiPrBlUI1gC2gwIIcpFpenO7k32UcVjTDxdYSvLEIRtPKWtYIGIwz+aVi2Y2WR+cFSJ4a1miwyVppcAqS1i0DFW0IiVGrEgkgO8Qh4DErGpBt3U+Q0lzng\/t1vxicmevstCRHkaFeh\/RYgBlTAHFZBibI\/Xb\/c\/p9\/PlC8aIEJeXgO+XkgIm+0xXRKhCDItoRlmNKb7PdxGHWYoInC51Zk7C7aqqndgKobF79gmEqtBRE8taDnxcX9dCTSI8G+ep84Kju3Nt8XCJAjqPzucBkN\/ZvIn+tmUUu8\/7NAsBJNaRVfGGfeugcQunFEhaI8taskzQrkZa0fm7+c2TOpjdXSR3zHWDlHnjZQor3H2qbnEB2r9hBMQ728qlfY1U1Yy2Jk5xYo2xFClNIZBAwYq3QJYH\/d1y1Dy7wNj3pWlJ999w4pdHUf9oE5P\/5960Fv9AHDFU1IptTgivD0+Xae0vkanAq+wmKfPLWzIsv1JjntSacGeIRU0z6F9ZMEayvw5vbo8ck70K4GL3kOxe+0DvEslHPE1XvTiwyvNXkV3GYh38Uy9zV1EQWaXGq8OV9b0HqTT17xW3Ok2pqaLhZI6apMqqH33MrW50A9TJ6nIODIOTT2emlIT0Y\/ZryU36aVfkZ0y+72Q9nsORfpopGXA1SxizCRK0vjXWiadlKIbNG80CATTWl45RBmm3cwmxN3Szp4Ov9uNc++Ve\/PO6ZfMKd1bNbdv0FjAacZ3EmqkmkjmXRjKgwljMDomivud5f1PsrEzWHGO55g0uF90U+lmD0nfZe9Js3zzMYpO9io33GoZdvVOLOz0sQKT9gFh1QVcET5E2h\/2RTGqAMEt5dCPR5rBS9kss3lr7GkGIadn0MP9LM6a2El3WqspRL4iW79sPKx9urFJ9Dx14DmxADiDWdx1PHOVvoL8JmJGYDOp00Pl\/1\/uekzlLGtUwsPbrU7yLqgIr0s7Olj1Yq1sJYNZYZS8ScXl6lmieCAyL33JWt\/A+tyB8c6N1oceJB0xhTFDDh+h9x3JRIZcWojQcnKYx3Yau7qSbwfSJHg7fj9eOZtrlkmZJ+AGMuzE\/+mN27I3ulpnbLOS7\/ACN1hunOy9+BmUj4Mu5YoyAb9p7NkJ6Z2aXmsBrN78ebGymMY68mHb4s6PclRGkr+tqliBA6J9vIg8+gzglk8OFrXqMngJncTsyNPBMe9+cWKk+pUVV47j2UGmzoPB\/+TdJHWrQFIOCm61zAuOd9VSCuaQL8vzRNwhsGecNFYThMIygkbbNT\/3qltaNBJGXOAwPxphOjEqWk\/iA8fwNRkENNYrhxNSy5WEXrQz+X1H9caJZ3Of8BhSSyZ\/+5iHq+RYeHAil3iidJ0Dqv+IcLeY8c1hXp+FWcKAPI72erHto8j1UGaSBN1+vSd\/hiQDf9Y0tdQRxp1EtESxsCCCHkiwi\/ggOEuZHDS94xzcOuCS4gSAmzF4lrjFOUTHKwZrbq2F1F9XI6X7Z\/ZpYvgxFl8ax4TTjJykB3uP80234YTYHBYMWj8YD\/xjQO6HeuP75LME65iNtTf1UTbgP5cxbxEpk+9LSJl2rkXyBq4dSiE3qq0Qi6\/Kc9VhKBiCjKIANeercunwCr4li13IYcGY1q9q6dtFiHyV2Id+dYd14qEZqrR4rFRLZ58zeB5tVRMN+BSf7BHpy7LVbfrQ7GQfHs\/xO7TlDW1oNdpVt6IPz7p5vCpkQ3coS4a5w9pR\/cdVXJUlRhiySE0B9v6iy3cYwL5f4f4gxwClTfhzKQBt3gS2d67PeEvUatDkKinEyH0Ki3bwlJ60c3kGeam2GyIOCeBBctmp8aSb+8uKQCzmehkijGfL3JrW9x3ybHpIlxiZOMr14wBsPqd7qLKQWFwtlyVob0dczFjXCRk9NaAKAYIJSr4w52N318buGsFNtwnzpkgTuQjAV1s1tFTqv+rMdxZR1zqYtMccOTLF8k1NHGS84Kv7H3Z1J0SIHIJEWGFMDQqiDtvQiLFoTi8wXP8d4aUcRDuO6GezEVAujcLHu6PvaSIYWHv4eGB+JZuO6p\/qchBvoWlcgGnTwtDJOdiZGIir7xk1QAH874FA8F7MEqG4nTbqM18e6smlylF1NEMBsiO4VTkd0U8tirbVBECCAx\/VeO\/lh9sGSHyYEp24q6qgUVO+raHB9bAE7YLRLgaYZZPaMsB3Wr70wUUaeVTyuVpiPdMBGJov4IU0QtPZeH\/Bq5OVsuuhkMp581YaJGLT6U7R3X63Ci+AS3qIFedUIfCQs28dG2JySphAeSwanto2ea3cljX2WIs9hn1X0ghgWdDRn98d6+QMlJaKzXPOCVsXpAdIraktMk+X1E7Ue8+jTOijp9RywGgQ+c2yiM2XrPcEKpGu0RrX+zInud82ZRpHBjp9oQs4luU6+DoKWtuvNiahepm\/j+E+rUGmlhWxm\/9tAWP2GpAeycAGKL+mpqhlwv\/hGgdXRdMKpWkpRX5dtwF7+TH\/H0WYsk0\/+5bw1CX1jZ429bpBpCW4t9u4t+9kuKEIfC+o9OMNt6kvziy7tQ3u1R6Px8aqN99ch\/738CarlUB1wcknQNcQDjRxFL56tjLUWco5YhucdbErhD\/4ySwugGUxs71KY8kDthdsGz7l2vp7CdKN0OaZfXyLjeNgqu2tdafQui2pbvh8t2QszAAXJyzwfBnrJ+dyoWnxL2rlIntkL6PFRB7DBAAXzZ8pIH4P2b3VKVaflZ93e5gEGiihq+RKGREoQ2m0gy31HxCVvjtyvoPsU9YJTvetW9fumQiPkGMwuMpqnf\/C7e0DpjW1WzWIrYqS9hvwbGAWfzPz8f\/J0RCUHrqif94J48areZjOFH5SBGYRZTs9EVcajS6F3u4cyjTHs17wYH5BpHs43FvTIQNG2v31JUhGzouGIOk6Uona99blr7bgOAWNje3FpeDSup4W4KbcczxqMrKkRsUfy5Jw0ENY4TSlm6qofuxBTEtp3QS9cvtPklOwogsrHlblxSzZxrCZGK0iu\/IhORlNCMJTMbS2+YQYw3AWpa3g1Kp5LOT+6O9dd3HFxoCwFWGRLd2g5jgrpZExh7DDPylYaQBlGsZx9XImvjczXp6TSiBxq2sGal2pwYpjxiIzL12S9CZM7eSCHslsvrWh7EQnzqr17TSQPU\/M5pJ4pUigapakoCm3WQvnUiORTxhXZVz+Rmtf7XUkF\/HrTbogjYxcEDfljcHhc8q6oN+iGqkKVCjEH3v0JWj34Sktu0qejZqNx6nl8FdPUUzP44UR7l32sMZX5ag4bZEeitzhagXGu7M\/k5hlOEsBg0Au6ALAUTWWjOKeIN3am7yQtDDChMZzFDBJAkpcGGvGyDLBpn0mbqtmqdfvS\/F8o1gxOf1hUElSCO61bWK+VFDa0nlHNH4B9CaVkv7zTWfPj7KAHPX4eGEG9v1Uhk9ZLP1ONOlkLkRCu6V8nxQFCx1f4TtMgv\/a1WHULmlii+KfJNnXn4u+viQXbyZmphN4cr31pum1fwE3lg9VfwqpKNaK5DDVEc+53+mwucy41CbsSYONHR\/IEocspbYLSxlDhUSswYRJZ9lOLSBJ4brH1ofPI52zYnZNBLzVb5VhMYyI8D3uiryxhKxTkrYSHO+j2y1wgvZK64qVz2eQfnYm1dfHbgMhr+XyFQDMk3AWLD4sCxGKG0pN6r9YfMkRQtmwmXKbv70Cvu4beQg\/3rRg+0OaJUm+X8sw3vXBZmjZ+DU\/xIUGSBymkrawjPjqU1M0Hl1ZzM9AAkAoEvYdrtziRXfGZOf6Aev6CwVkfwL7RB+HndbYd9REIl4NYGK8Xj8\/Mrc8TDvu26GVml4J4g2aqJ6uXVX5qDqfNAZQZ1N6fN3y+rD8YlAnl8co0437ggDSzuCyzlOZBezskLr1hsLypxPL5hxsTwK1\/t7uZ3odfYvbje0p+3qp5ZZ27KhvsYKQUdDOoLHrw5\/I5CjfS1tx4Bd3PybePtDR+T\/c80vUHzbaUkSqSQ+CUA6YYpDcxVKaDKRWsTugdbSqpsFcvA\/ZES1P3Mibp7t6ccTMLj1DFzCasquR69ILtjmcXMLDPLa3XeHZCD\/oidetS5pJgFQhHgCQDJNzSZd6eANVKFLwn6AaVR7EEGCr4tS9VAt6OYrTHI5kHvGD8sClQu2xuKXJvHjz1aY82\/wZAn7WJwpmduQ6cQuMuXzi1lbEdNhn6\/n4HcAJiWMV3DgQvuaAVlRj7nGUjW1IyCQX1Kf+aUK4UrFPtxfeu4XhixfRH4IXC4ypa8Ucr2QWnFZpU7TL8MqICU+hm0CEAkLjXEKhMXhnnmIQVLzF7f4RZgvPq4nw8wqWZfn8blTnBvmf\/4SKtmgRWag9Ira7jXkt6JmUf1CspkALIlk135qK5Cn35fXY0yKYoCqfZso6n7T+\/DbdbBxswpL59+E4UV\/Vkn+KyR2qpNYyLWo7+3wGhuuT+SMOSB8XoLjlp0NNX6xWm2LZy7YKFk33NfNNgfkfRy+E9mkE07zNVdcFmK5MeGF0JBu7sD9rItGpW\/FsMNFIUGJ3IVOZuOA6OWjp2zCJbxb1IGxdCeHrlxSKPuBpqLN4ff9XbaXhSNRNX1WVk3ipcaWw81p6t8Rx87hJ3mqlgB2+3hSIY3PRowHzUMChuKTmA6b0AoXO6rEoMuVOh7ahoHc1onF4+mw3sRysIqy5w08jBlh90snAofA76hdX+d4ASp3EFOXfXPjkV60jeJu\/dQUhjHfuLQg096RRt64YF5RsUAdjVrAcDRHY6wTJwCFOpeBHkSRkU085vKV8qSdjCu5I4QsL\/qkKlP7vegkwKxC40j0yjDFuBMjp+hF0JmOgEC4CW8gcsayx12r94GPr0Dp7b16hGyNGGXJJ\/0pklsdFghdNbA5sG5EaB7hHzWfv4slzSjhZb\/Rgz0TZqywlTYm6NeV2WjT0orCeIrzSDGNvHizuPPSE3Lh4C\/CapZLVxl8Py7AB5Pag8ebd7VNXtd7O9uSPpKadtSmWOne9jQdvkDCMzWgHl9ROeBCIbc0Fd8yxnSEo6UTNNql61tfW3922JgLtps2YW9HNPZS8My6d0sAK+GJVSH077ate+5kHMsJ4d+iIxs7lMP3qhK1oxvDBe3pQ92dF6ozUC1EAw28SzSWXKtp3co8dvtXjC1YoPI9XCzLLAGwC8erkoUqlHs8ssZ8cHNoJWLSjGY+c4BpyG+3yaNqf3XXSiiumn6RpCpFgB8POZuio45ogOceqr4VQY7wP3dCzcqFsI4dV\/64e8HLoeyfmeHX0nP4o27xKTI27kQ1QTVU\/6Ecd5hYpyTpXnFmDwoRPovO27mGscbUrw+QHvLJfaPom2LJ8+9uC6dCDFaA82UFv0qnCeyWLW9961WxD080YcnFFyv3aKWA6rAYA\/\/XWvLGQROMDWDQE5nsWVJ2xqpj9jzPfqF29pJC02cnh04XlEnJQQgLDmID0HnzCdjyE0hvrkwZlKfakcMByypptjJycBR3eGgRwlkY3Wh1JG7Hdt4rMnSkXbykMv8u9mnBDOwL+lhJtmkUSxTCw+TGi0dbi6kEtIwenvElZkLtj0bBImrXgFE3O55x8aGDf2+4AubEXf85TLV2zgqY3jZA4R+xZa8aPgSyyIYnlhGmIKpjQbLQ\/IExvu4YuXNzHcb5FTEVM6Mi4W9f0nkOI8z9KYiXqa8XL+Q\/hwmqP32yJJUhA4p5XFpfZiudV33eE707OKPoh3DdCEYtOeGpMwjRq3rfgt8OU5yCxmxoYg9UYjkeBFvnz0kaiiBO6UAdBk9C43\/5HebluOtmVEMrcvV55EFP0jJwcHhu3SUMenT6VIISSF2j4zqp23uIHmg73CFaGUvPd16YFvYOwCK26cAiKMgPOeYG2yO1xTnkhkA1+m1e+ZKYuOev\/cmthX\/k3YgaCmfg35xLFLGZugd3sNZV\/Wih1Z5c\/YrMCZaA6oVBzitAaSN5CJzBR8zU2yXI5IIxCKdOEj4w4vUqP+AxBVW3VXDDhah3P24IMtA2yPOM3yyyxsq\/Ei9GyLE2ZNbJ5ZyjuSxQm0koWAeM51D0ab\/BQBrKNCxIuGRePcheoqPe9HH\/66xm\/tm9xuAA+Ra6Qfl3XI6yeVg0HnRYakVX9\/wUx4RdjpomGe8dq+3HLbj+tVkeS0E6M+DjMzC39UbDW\/MFeZjveQf1gptOrwfTE6TGT4qW9KXowevHvmxOlN8Ic9990mrgBYX\/6W9a3Atj4NDZgaPAzFvtHWPmK2uiDt2i0xdR+MJQtSwrTYLGcB3snJjdL7fi6llTVyIXrVe6y2gLXXJMdkI2xQGUhgJ+KsbiLnLdjmNsDRtTRZ5SS15ECW4xifpS9ZUgrFjGzXQQOtEcEG0jXxV9uyIfxyG6\/VbxinIKlugJivFi4ZXgocNV71Nq1KighdqR6smKtAi4EVA2CbyF5z+\/xf9l9gbtHVaAY2SKrBrWISR3UsEHWw8n2bwDNOQ6jhYsdMO0\/rGo7ZG5h70u2DNPqJoLzQwhKnbZ7dg1bll4jpUbScPWX8BCJO3flzygOu1b34vgZ+g8gbxoj7wnBl6mz2+kvzDipLvoJ8dSiWv2AhdAaxlAMtL7Jos2Ye+OKiN2vz3VLHyu0ReqXs7qKbpmrR1YG0WoQYsIszd4sWjYViJXVKnjGr2aUfXfWpH+jnD67\/tqEGMB6RJ6kJAIqk8xACe17spNg7fvbrMC\/5GT4GKLzhWvz54SuJc5e2b6SR4hCnVNEfqyTgJ49rRXNwOXmwt9SdyAF1H9ctZ10HlBbNNwGAPDMsxZ2V2+jCz19m0QIjkcn9OGtDTYf03h6RE8jzUzVXnvbzw5i8BsiOFrq1Ma18Todu2wig7tcqAcUGQWpYKHZqUFs+ZnLABaxLr4fvMg0FRH9HXdRRMftlNJ1GU+kDFjeWiXnWqAQgAOaEKHRgrsKWKpq8KqUQlaMra6rLsDQDFekoDXQyVAScreiBXUEMnZ6dUSV\/EJ8BNzyuvRYr33Vb66m3oYWvfAaasbdiJO6i5EJ9ynYS1C1he\/0eUQHOaBfDgBX6eVVjUHRK7Iv\/GN6icTjsa\/sRpRNdFCSMUCPSq9kggKKlyUwcTEiGxIi0D0jQ+nN1PPwsky5E61URdnnhCMd5E22AUtuWc7j6aNuj\/7bbEkG6Je5yAq0txUaBEmc9LitcWWJAMs1hUZ9Llgn0ZAfrLXTbVor5qxrlcyRnQfHUxdog\/AJyrWJTO+mJwpchSOo3ExgVT9HscsWz49WcsEBWyoXmooaswiHhlTMRwyWUlWl8cgXB6UfCr4WIUZLCBieyx2hAkyyByEEU5v91B\/tOG3CZ\/VBiFJuS4A5R81cbje1R1Xj6nn5UQ3I9g\/\/T+hJV7V83sZP+xRxvz0dPGF0siHcon0TXnIkkNyMHLrJF6GwjmGPTfSVme2RQ7os2SZdllcrdCL1WCjoF\/aXh\/6\/IiPlCwZWlMZ\/DiDHwPWHO9VzXO9BrcI5KWqYd5hpkoQtNiLYWwTBdd6t4FDupsBRX9rhuXA4cuA\/nekkoI2MoG0lL83H+3U99MW1tMy4piJ7Saxtc5k8nnfZSCZVdUZWSyKKBv8idUyTTb9ZKxuhLoMkDwGk5wmVNMiFiPc3HrnuXlqJPY5FYE2d2OHS5pBEFTNk5pgsgJcL7Wyg1W8wgc3aGXP2qvEsG8q5sDJCW1ZdA+5gKop5dNdSs0ODtbX1FIqoLcfB7s6K\/PdkH\/sM7m6E3TMOoPT2y34rGPDNuR+Lqb+R\/TDH\/EzXYspBUHnmXwxkCM\/Z431fV5rLDS8Iu3Kh+XeyYaNswOG7oimAgP3amF4JzuANnNo+z9yOqzCrWyTF9NVRej\/MDLw05uIiIgruQCTPe8XUvnVnWG7x1nQ86B6YU532iVjdcFgjYZXSbxZKEp2YbUysIlBedrZblCsgwX1\/af6m0nlyrpZW8axUyZ6zkcnFoCAnmUdR8Pkzk97TtFeLxkf8RwWU0jtT8Rn6dMcVfFVOyh\/2uBZzqz1QEJ+KSRCDDU6IxF2SkoLEAZftAbojl0rPQm4m9DvN3byIHbE3WCDRMxYZVdyEWiTLl8rufGuVQotfFM7SsxZztRkI291zUfiwRWZNcc1I90D8hTPohoi5BtnWf5rt1KKyrAZaPYRXtUF7SwiaGnOrba1r1hs3+gQ5fTKjH8ANxTYk1ibveoflrW8IxWPkUhjzo7BAPUQ37F3n\/yCf31ud2qljLX0YyfNxjm9XYUFW8WPeamMo3rpXZUlUJS+LVyFEKSTjBeeWOUR5wNNsC0V2S+zQbnvc5\/N6MYI3gYmvBDGMyS8HpTphhU\/PPr4fByKnil\/4ILl3ziU7pm2nM5T3sXJ6Vw9sRtVRET2OpGgtKSOgk6IFDSDTTitD5rw0VDDnRY5epn\/Rhj51N64fWtPQx55BMQSDHwm3kAeXuLalTMqnijA\/Tf7EnSU9AEjUz2ttd44\/uSVBWDP7biDWmpDvsx5aDSB\/+nlYxM8gVzD15X6asGPJ+w1HVmYg2PeBvDTy4Lwe9ryoT1IfmkhluL8wsH5Nh3tSiFZFhCIvYB1j8eA2z7ryeMAbS0Rq\/8VfxsheAfU8NoU5dJnND9DqdmGsc\/ddUuZgmgXWcD3AGVeCosELuNbontlCYTy7Z0hqP8woQsNP8uhrqCKWNYe\/blXoYydNi1NyUpBwmMoIgqFe4toBF8Wdqg3xkLqRQiVmst12Xg5jNxVSH4YEl1ZVdWYPmnWu54ofHaLSQad1XLVvHj\/J4vv8NQUgBc2GoS3YOEWDGu3d09d9Qg0OFX94NIM\/aaCuXGe5uLaeI0ni9JwvCFZJb5nHk+OJoEVviGiEGzVahjDXicSBP5EUxLsIhUShUeaOhoGqxFM2S\/56K\/m7C745R\/asapDX5UeGeKFyppbqGbJ\/GPPYSCsea72\/gmqX7aBT2gkZH\/+6HEJnAP5ZxEeBxP5P\/eBoXStthZC+L+TsDbEoYWD0XKEqxpIw77fK5Snb0V\/l9yawASLYnzjKHF+BUSuwShn\/YyLX2XrHa\/SNxPu+UAGve66LU3Uf5fOh7fWuaOBoRnnwnrI5h4rE3+p07LTyRHDDFEvh3JMXZ3Sm1hqQO8ipEUe0\/g3OqDxHHdZSF3VdR+F1GVQIjJ8ZHRJUfqUHePqgQKhchNel9WUVTcARt0Yx0q+QN4o+8kMnI9w0Ko6iws0aEi7UVNFklQcfQZ2GNR4X+Hicc+Wkxvmw1IHTAHKba+7z05wHwKMW8zuyyflia0l2KUye91eG1Xu4iZdcIya9GaLz0zfCGBacusrlSWRCs0rwGmf7WnR7oSenciH2spZ7apDFm9GHWpXtuFwP6uKRwBeoUywdQBz3zLCM3AtI4DLrVl6RKvoNVmanCUlk1zGL5yTkQ0t6CuYgWpbKlIwEcscWgpjgtN72DHQRz\/t+CyBxbdlE53V1b6ZAXGP\/kiWhig3VjLtjRhCedVK8D3csvFyj\/KBSLuTbuukMx2QvIZFwZGJapdwjsHjzIPDW\/ys8\/ARpLe5ao2J6bP+xfen01+8mciRaGMqRYhbQ7+JONf+gJP6TBTGfo83MJkBMiumRc\/+NF\/BU8gerjT50awyif0RBlZgu5vwEUjJqQg4vB2DNJGehrSY1nBXUZmHY4AXblL2GyWv4dZiPC7XXoNyNr1bmtMULoZrOjFVzI\/HSOboNqGQx357mRQAwKHISAC+i+4k6FZaP52m0LZX32vGMMp01aINgQvTNV06kAW3CKVi36tjhL9PlHB3IZYFzsPqsfhmCyJQ4zX+mefMVwwZMp7oyo7MqI10aO038stLhfFK4\/kiEDX+i4\/HnMdVhFG2dY8aGrMlZTnk18oH2gveghAw6n6Co2vSSLZhHp0G+qn8qW9ISQS90SBzf8t6wiUMTZ0uinLQIz5g0KvH6dnP186CP5IJhnn4kxZrxtnzyIPpICRxSIdEET+1VP+vi5cYre\/VqDJ624olVMg0bEF8sEdW46APGsWOt3bsM+sOOfj4y32yKBfk6zinVki\/Fq\/ln0arsKGP0ml+tjN7hZNmquL2LVn4W1VijLxgdK0Jxs9QxHaCPeAQhGIhS99eU7+3\/gmtkQK3WOZ6XCW3PnK9zY1MreUwAZqqJBjW0dYNiSL\/MH0H9Cz0dMaHPYiT9nCI9vfLKrlId2WWgAAbpivYuI1DVzo207em5YlTDnXgHrbOrsfN7qbEfAkS+2xKDUk7qm\/yGzkGGnijwi37EBIcrX0bNpBYHF31um7tSl4SKxpjg9K1NG\/1pLFRCKn89VE1Ttor1NAnIPB3JSo83Ly\/UUgXDTaZASFxuSEAnH1JpS3pA3HFVRiba5KFUubTZHCSHLl9y+Vl9xPRr3WNtiEWm8ujabO62dAdmyc3WFpzYUpRf5g5DWLgd8fDHcE5LGY68HtqK\/e+xY4FZNUHYUzJbDtWWGIYkSsNC6oz4wK6swQvppFT26xP5RXxoadNlewDQmc\/KdS0r4f3r3e40qceQpRoqbX8zwDpHXf0QyLMlWtKpF3RvonhZLMxUx\/pnNLi04aCzrVR6OIfwiI\/\/nBA9HOWNrwSR94Qv5Xuj35x8xYBxSMuBuaqhdlyozEzlA4yhP2co27Gr0nr8kobCqUsogHZ1KkOIQ494QCGqvdS6WDyVommDHc8yM3Bv0lN6chSl2a\/H6ruV4lgyqh+z4sEPHv9rvGRQpsgF0Ks5d5LR2rM4imPA08sIfK5l0mruFyhZZNrkEhQjypF15Chs+C5j\/4DxDlJgxeA3qUuMfomxCXK0bg6Q4NVA==","iv":"584ec479899f8924dc0b534a9e167967","s":"cef7e86b62320023"}

To maximize wealth transfers and avoid imminent tax exemption cuts, high-net-worth individuals are migrating accordingly. Image credit: Sotheby’s

To maximize wealth transfers and avoid imminent tax exemption cuts, high-net-worth individuals are migrating accordingly. Image credit: Sotheby’s  Nearly 30 percent of survey respondents foresee the market “going up” in 2024. Image credit: Sotheby’s International Realty

Nearly 30 percent of survey respondents foresee the market “going up” in 2024. Image credit: Sotheby’s International Realty Nearly 60 percent of the firm’s clients own multiple properties. Image credit: Sotheby’s International Realty

Nearly 60 percent of the firm’s clients own multiple properties. Image credit: Sotheby’s International Realty With the mansion tax's impending amendment, HNWIs are in a position for further gains. Image credit: Compass

With the mansion tax's impending amendment, HNWIs are in a position for further gains. Image credit: Compass