Global real estate agency Knight Frank presents an adjustment to its prime residential predictions expectations for 2023 from 2.7 percent to 2 percent, down from the global research network’s June 2022 estimates.

Though seemingly small, the tiny changes represent billions in global real estate values. A reported switch from a seller’s to a buyer’s market is exemplified in fifteen of Knight Frank’s previously predicted 25 cities — or 60 percent — expect prime prices to increase in 2023, down from the 18 — or 72 percent — the firm published six months ago.

“Homeowners are having to grapple with the unpredictability of soaring inflation, the rising cost of debt and higher taxes,” said Kate Everett-Allen, head of international residential research at Knight Frank, in a statement.

“Although prime markets are more insulated to the fallout from higher mortgage costs, they’re not immune.”

Knight Frank’s forecast

The company’s latest report foreshadows prime residential futures globally for 2023. To start, of Knight Frank’s 25-city analysis, Dubai is the clear front-runner for next year.

Knight Frank reports that the city leads the prime price forecast for 2023, touting 13.5 percent in annual prime market growth.

The market is cashing in on the capital outflow of other countries, as stricter global monetary policies and taxes are met with the proliferation of preventive measures from HNWIs (high-net-worth individuals).

A real estate tax law up for vote in the U.S. provides evidence of said spread.

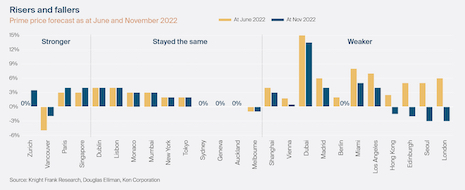

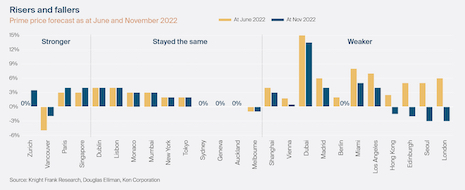

Knight Frank's infographic identifies key prime residential market trends for 2023. Image credit: Knight Frank

Knight Frank's infographic identifies key prime residential market trends for 2023. Image credit: Knight Frank

Tying for second place in annual prime market growth are Miami and Los Angeles — all eyes are on the latter jurisdiction, as city legislators consider a “Mansion Tax” for homes in the area priced above $5 million.

Elsewhere, Zurich, Vancouver, Paris and Singapore count policy shifts and weak currencies among current forces driving foreign demand.

In actuality, Singapore is the sole Asian city of the list’s top 10, one of just four whose forecast has climbed since Knight Frank’s June 2022 reporting round.

New visa measures and government efforts to attract additional family offices have aided in positioning the city-state as Asia’s regional wealth hub, according to the firm’s experts.

Separately, New York City’s 2023 forecast is down 2 percent from 2022. London and Seoul come in last in rankings — Knight Frank predicts prices will dip 3 percent next year.

Besides laying out regional markets, Knight Frank’s report also identifies the top five risks to residential prime markets in 2023.

These include rising mortgage rates, geopolitical tensions, higher taxes on income, wealth and property, currency shifts and an undersupply of luxury homes.

Conversely, the firm presents the following — safe haven capital flight, investments in infrastructure, alternative asset volatility, currency play and target markets offering relative value — as the upcoming year’s five areas of opportunity.

Knight Frank’s realistic look at 2022 expectations, both wins and woes, quell any doubts regarding the accuracy of expert analysis, stemming from the company’s prediction misses.

The firm provides prime price forecasts across key markets, showcasing comparisons between June 2022 and now. Image credit: Knight Frank

The firm provides prime price forecasts across key markets, showcasing comparisons between June 2022 and now. Image credit: Knight Frank

Extenuating circumstances for the United Arab Emirates market are repeatedly cited amid the firm’s disclosure of what it got right and wrong in 2022.

Its leaders cite Dubai’s rapid rise in comparative real estate value during and since the pandemic, forecast by very few.

Had the United Arab Emirates capital been removed from its estimated annual price growth equation, the firm says it only would have been off by two percent for over half the 25 2022’s city listings.

Qualitative queries

Learnings from a survey polling across four primary markets commissioned by Knight Frank and conducted between Sep. 21 and Sep. 30, 2022.

U.S., U.K., Singapore and the Chinese mainland accounts reveal that globally, the historical stability of HNWIs' collective net worth during global economic downturns is most poignantly reflected amid data on attitudes and behaviors.

Singaporean HNWIs are the most optimistic about the direction of local house prices, as 86 percent of respondents expect an increase in the next 12 months.

London is where most global HNW respondents are likely to purchase over the next one to two years of the 10 cities listed, while the Chinese mainland’s top earners are the ones purchasing — 94 percent are planning to buy a property in 2023, and will likely be doing so abroad at that, as its own property markets face a fair amount of turmoil (see story).

Similarly, the U.S. is seeing a decline in U.S. real estate purchases overall, with high-end investor homes making up the smallest number in the third-quarter portfolio (see story).

Looking ahead and of high concern for HNWIs as far as future house price performance is rising mortgage rates, which rank number one amid a listing of the most pertinent perceived obstacles for this group.

While rising mortgage rates trouble the U.K., U.S. and Singapore residents most, mainland China’s wealthiest cohort skew toward a greater concern for heightened taxes.

Knight Frank’s full release — The Wealth Report: Prime Residential Forecast — 2023 — can be accessed at https://www.knightfrank.com/research/.

{"ct":"A\/WgU3sPcizgrJAmuzl1n\/sLiZyIpGdHASjC5NoZnSeJY+cxZrveEoVzbyZy+hOhTMM5Q\/3ssgNGMjcxuC\/AE8NcY5PLPyZygU3FuhzLeBneFNTz5zEi2cAPc8Jj6iebOZ8Y\/EHjkE+BZFUH\/1Ys\/4Ar\/2BvC3N64QEG1uEF2De9zA\/41VG6E\/am8oqUrCrtvvUNIojZ0ZzJFP0KKadrYlQ1Z1z3FTUwADn5O7CBQAPoM3Xos\/\/EOMbnAg+CCfk7PsCDCC5mc4UypTVvelJGBztmDdcXxiQWHXoGKe3cRU7XS15gUojANIhV4bmb41\/PVrVdOgw4wym4zNObfkHVqTorZtP121RWQXZ5babmcRYZ87EaP9yEdiehIQdndMbYkmptdruBSTBgIEmYjXohNjWIcOaqreu+cug7nEFHNRoWk+YuenebeDCCNCjMPCOW08fT4WZCXG\/FAO6QTfmtkX+NJqmLTfZZUowuF2LhQSU+ApgP1uvzsGZL+E3EgFSnZkegHwByyGB4wpzg3Y9v6I98NGlEzFP20hdE9Xxn1Vd5FVdSinWnY85Zhko4PTnUfEAvBi8WW3yT29eHv3e4Z4U8lA1cB+scvdJO9pRjF1BgsBOYVAZ+yEfqtbzxzEBwZMo4ZrEmuUOFuVwQrbk1kKACzFFSPhS3JzQ4yOeZpI5y4ga+7duiJj8l7nXj9fSbRO8po\/gXRDXtwL0C5HRrSqdZlUhGpcjeng6xclF2xJLye0cKowq9M1IHWAhJxacrNOSAzXqlNSphJkX8+v6qL\/YyDE1W5OqAjZiRRxDvDwFqzmTDRlYHl90aIx8EzIPmSwXtRVcSsz\/IS1mUTNpmwp4zFheV3lCwfMZ4IXIQKsFfhVTIHZsmxz6lZK+UIE\/AepWeKgsZKILwdTIZ2WWZg7gWlkfDyCU1lCfADZ8fcMKRuAOMFYoUVBV0SrUJH8vdjfnEmjYG8uyg6zdsU9mqa9DQlMUVRxf3KwdUfgCNSRMYKjSw8uwLH0i82fY\/iQEmv8fU2PzkH1wAMyblbDud+hL\/vRZ02ZVMqIhTOp4Z9sLsD4T1t4epwFyyB7XWO\/HTbc3O8VXodgsQUZ7E\/nmf7XxrTWOkN50jCO1rm5kxemsfPUttHrHnpVt7qlYnz0LWWNhy4HGiVh0lZ873pdW7lcBrO1aw2vbVUGgBAnQfiNW9tcQ5GXboxw+M3St3Kmowg8UE\/QVFo0YRIB23YzsiQqEXuvScgTk8mLBUQbW4dmxM0eCm9vlIjaxTiJteScW6y9UpjSE9EWzUvinopHRj\/+i8DQuE3bcMjRaLfVSF+++lYH45A7R3uR00GrHJ9vIkSC8y3Ombhxkq5WZMJFjorWenNT6aQe0yDOOCTyUgi2YijiFGVkZ\/VU4TV8zdRX+6Q4MqMdWVdDNIxhDedgzhThKnFZQejCAh39s9lTOJ2wfbOUMigSVGtWGJxbgaC\/7FHlHZzdf+cMie2B6ZswLZNQ9wgfM5jRFy2BomSbbi+4ruKq74WqF+olZNfA3sl8QoUV3EpK04EGWk4cDK7fDJH\/JOnS6SLwa4TtZRon2Kx160Scb6TQpd+Z0cQZx4NUbVo\/jB3RcdI1Zw1orFnSKtv0LSkfzMR00d79CSCPchLGfibOlSdCwjyEEh0MmTsYvtp0PNnBAV7wlAPHcIzDnZ2TCAfSlFPDWOuqdvtEHgLrQEIgmGA0iMG5LjG+PjUtuLzkGCPuIlpDbx\/EPzosT1kDwMDD7vKi\/T5lZX8VOMt1+bSVdqPyCtmbdAg8HSxEzUOEHOd5fBlprKdc2Fr8xhw6pesXEhB53i0BHOJul7IgXXFHwWZGh+41BwdhzZXzAca4aLtkaFlS5D58YLIgeMhr\/q0Pi6BHvfTW8ACqvDnG7nTC9E+32RvsnrnMkanL6ML+2qoZT\/hQ2BcTDQEuuchHyJduxj0LAQgJuwTT2y+Mm34IY+zTizER7+92wBli1d1jZz98KPk6W8FI07E7Gi12nyJVLO2y5Zo06d+M1dcLJ4AA58uRLMEFsca9\/7P0En5NuHibU9EbG27t0yHLgfmzS4KUaMaiDUirhnmyI7yyRCclPRPki+QXI9gExb+CVGF\/u\/KrvasFw+3lO\/68Q\/5XFxyJQMiRFGGN+dFP8QrSUzcuYMb4Vs0QRUKRDhad1D8V89gSWCAkE3G2mFKGnR3QgkKNKs6+MQfuGgn4iDHIcuUgGv7+bC\/LnknwGSrHmh2Zh\/WQXHjEG892YZs9ndl4oT9g9FHCqqkux983FC+kedzEb1Thvd5jUwtBCT6aUzZnBkY+Ow4W2rSq7hALE2oZBxTTq0pO+RstlG40gxSdK\/5\/5jZjX+GyPZN8zq4zd2x3D2e4Vy8q0r72iZtrqxfPsuAeeNZclNgggoUusOwo9ckRLNtdSpc\/iHmZBYLS8vMmXGHW2oQqNIvmmk+oujN0qH5RBiiCOIOoarvMxeZzclElVbaNRYOyD8rFIatYbTuQ\/Bl99ZOBGjSVD5ZdPMxztYKsgqENJUyZfhfrNakZvqXmh+LlIcN25aEf5HsxZE+QSKIva6klsJQYFluhDnk5jQM58MFrlvJyxhoB0vCx22cMVCzNeEBnIQw8s6BKT3ucNVvLn2AZgSdXIL\/iji6v+6kCasfga+u0XdUeHj6fy0AYu7IV0MqHTHtJd3J9UFmXzxRK1hTHcqaKdsq8PwREaNbo\/Emrr2O8tiNzBX4PTaa6HuSrWcrXog0UKqBfZzK1X7QmrnfHzh+GrOeD4fM28S31ZRzUup2GGaUOgVSr6aYO6cAsLVvz8LPQleRBreGCHwjgMBdygbdxGnjVqOhC4xEjHzdMEcyojDEPeZFDWo9RJRuLYpWxQzcGl8oNwC6CwwgIHxpFCTAydpteE\/pVhZSr73NEKfet+sTTvMLmF1SN7xmiBW8VGYz4QgxViFrf7V3bHH\/rm0YIObmP6FTLZjZHPH35pzYlWnhO792OSgEWBVgnxhYRWeXj3y0TNRtuMKNix\/Car7qZ6q6aJAHlV\/4tbK4+am+EY0AcG8InhawY+WsNmIVKHCjKi9uGDvHfFfcDPtPFFpttWHtK4iOlEIMlAFyOJSzce9mt5UqV7UgeelK9zMYGKa+pz5ewcH4Vf9S2wY6FcK7VZHE+YL+yhUH5JxRg1bwvFn196QenKVAPF8BR3QMEQdZm9y6oWhGWgPG6ZCqBZiXYP\/JofpLFUYVoK0bsJ1EpLvcj9y+zAacQBRtD8aiibjd3bRyZqeS2yprX1h2WEzbY6Kew3pIAusUQhkHfDhJkqPSxB\/8SSi\/9wZhYnafpD39TL9KVb4CecqBusD6DayqQoETAb8U11\/J8yf5+CNfbevqhwQ9iOlVvpre4VObX7HvKPw8\/IL3Dsp3AmtowL0Ln6nu1kOfhgw6bOEPDIpqqtaZ+Kl1EpUMlLsulbUOiOsW9LzNbhTlP1vUVQ7ITZvUFpu\/AV0cAFm6Jf4OeZuoIaPYefsg+SEH7+yfaYN8xH5NjXIb6IlGeyNDTvYtbLzQRv5nHzAS8+pltCfyBQEGWJePbeJn2AVfbQl6Z9gtDr1rNupm0pMu0laGdnkD46ryW6joaV1h8ByWQphOtS\/EUSYwVo05+gYCtndgcUlM1PwK7BfXdDaC74XUHrR48Bv+MKgJlCJF\/xUzq\/i0b\/NPZaNl\/O9rMg1J3rHW6puw5pmyUWORa9ttJZhvedflizxzczjgQcrVaK9\/RXCEdRR\/1sFTs0bNEdT1y7HCKM55OBNAuGPXCfjxgyeVSHlqbTyoPQheccpOjTnThzeUOM6XqYk8Hf7lj7s24+58XW\/mX2Vs1Ecspin\/5gyO4CIAtIsdm8UpnQYkZbobjt3Hnd5OyM+Kal3EhhZk0RYMyho42Cy5Z+DygvwUgnCUUT08wTHDMg8lDWT6\/3EJtsodbMID8xF1rNItMIUma89a9k0F7HwuPvTsvU8Dd\/9t9Goq4d94Wj8gtb89ldIJFkNWEHHQaQHnoOMFzFeRP0k3IuPBQxQCUe+qCe2u6zkSBqxep88ljimQIwyzyhZyTbDYrIYA0PbAYYR0GG+LyjFEfYXdfSQGpI7yherPP6BUDqklBmRkRiWAWBGMbxrvzlAk9fF\/BRJIRyb1ElEv8HdUmVjBZAkpdUKq73+f9wjrlOeI6SLEKyr\/z\/vNxqozXtsJnq\/0lDyppj5NG4uBWDeI8RJ45qlM4anx1\/gUe807syU9hol3IepjqY8xDGM6OC+G1uGe82pYTFFZUo8cCT9eqdBiH9mGYAqU7DSMgVQHvKvROjMEHeSsDog0SiNFogfDkStdgS+\/6Jq9LfRbackEyMnV4q52tiDLQzHkbHCuIQmXRllWfIkd0VMTWS+EXKCWYlwN1un6fXlZb5Ww0cN8eSK0ss7uA5Ctl2ngQBpGuefERhEzHkY9eycGBMvHjSmSTyxkBmsPtVAU4LF9GD0XpoxSveNjIJ+FrSdu4Fcr1cnKSTtHeSOUo0UN079OcdifLCMKke7WgqcbU5mpSKLQLex39pYPGHcBzk4fbli+bmm0zjTakiAjioalXLVVAeMSp\/mXjiXQcuMonV6y5Z7AAKnLOZr5oZymEKou53SwYqxStxAbPyKbqwbuk5d++1htZ4E\/B98oyHPn+6bic1U0MrRCENC4DWezNb7grC7S5jSrjChALaT2\/EAv8mUi8+01ofXC8BYuKc+U2Ajrl\/gF87XEyGDPqVXRxM2YdbDJtpjTfW9\/kHW04zKi7ToywZlPlld5N3G9Ts5rfpBgqk5DVQMIk5XmNMBvm0XLRM9chwzkBbBjQaK0mHV6C8bdr3ypsFkhq\/jrMKg5YSC4BLL99itcNd5xVkSzT+qLaY89ajIWYscYSDepjq7kapStU8b5XPxV919gFE3Lezb\/CYETdKWVR8FOGVIajIbVUryyK30vYi61LNcJeLtTO3yZABRV1pLRWAcQu3PHjLMI2i1W1G0o1+VlbtMoM9E6xVodaS+\/GVUbaIVUiIyDNtWIOWOH2Ld3hvPZIdiGzyRGttVR3+deeIdcEs2TY4m\/IKtxVW2kxyK\/JWFSVOv9kVBrR4CB5KqOXZ974XKCjsccjjsXbeAtOri1aMB+lRwrz1S7o4QBZChz1tnfXheQv1k4nDkC\/ryY2EAH8QnMLbtGnk8\/LtWITqxayEdHYGSIk2mE5753SkZRw1bMO56z3fa+\/grupBC9ellbKqKXfTtVl35LvXKuTTKc2ujX\/1zLNiveS1w0Ly6Ra7SbmN2ssYlIsAr6c7lWsbfUiGd9ld3zMFcDEXhHhJwwhPLjFAcQh\/IM2DYGybWmRWDBibsPyt\/9pFysSJviRV1lOjYRqRWx2hyGqrSiInFZuoTbxl8cQiyqfQUDxtbnbj+KYomVNWCNh3KeendPzeTP3vd20JeZZHsj4saqzkUDp\/iGBN70E9C0iul\/azjKb2aX+2PJM\/YB+cTfhdqDZTcWX6lN+a+eMSrWagCqSVM4UdmD\/vR7pvvTXRFbWAltVPwPyTe24Cy\/CElQuugdedgoOrUJG8gizXQgKUrvHrEiSHxOMH8uBFONXYqq4SUkNjNAl8JjhCjeFIL97hlulRNILJWXtUD2uDR4eovbqy0J0PX2ZUwS0aPisc8wfsc1OvS9f3yNS2hZ1hfvcOCriWK3lCJs8gAW1r14ab97X1bI8byno\/tP9Avj5BX8QW0sCIZFhlF2b3ysOY6U\/pDlxoI+fin4yMy5watkOYBWvGFTWaSYRjqgEUnP9rymTgp0bpd1LQMqDnSEYopt9\/kHrG0FzEfvqz8I44bV7lmprYiRKhRbiCNV9fAPWY24ma1s6DSuSMbsL3MODbsq8Z1vheMlvif\/6XOJLMKVcH+IVpdDGBf1fF9L5N4YWZIK31rxOOhKHKHvqtDCL8sMam0R32oxOaD1wYTn5EO0NSnbNqt6mQR0GhlMCiZdfkfY2DkGFmTSUTKrhN5lciK5Zm8dsnCogzXS0l43wq11oge70DXnonndFJyaGC0U72UpArx7wiQ0Xk136chJwQDqv0ufOqk0hNq8JUHDSlNh\/jaanSfMKapYiLO4n5xwM8vhzu14hQZGL9sXfIRvjYjWEv+YW1eWTY5dg5XtXdSD8lG67Svmq0YsB9JfuyTW2SNJKpeoRhaOwHGY\/rjYmL\/HHVS9la46Zjemfxs4NxlJrsmDYj72fZjBO2eN6tBQsmtePKNrSNGS76LIxChqJo1H8m+TXgITCcl68q6HWX8wuYrls2\/bH0Gosl+4uyaJzs4LCY+s6V9HFzatlL4rz2whXNoPDi5mWCyrAedZ2qfoJY0+rejln+VyaPJ59ci7MckJmmK62h4nCh7tBDj\/OfvqGG6YMnaQoZ5SOSPgoCibKheMMAqeVFWUR1tvlc6jVo4a9PS9ROs813EMQ4M\/\/qOvZMjxCw1pCvX5Fsd+0xEmalDjy45uZr2+lwU6r9iwlmtRodgRJ6vOLapCEKH6ZPWr9607CFqNfusLVMutM91FoG+\/APJ1E5FL7ldtf\/+8sqknd6BpSgHvhi6vTypkqpKTFYzh90l+R50UVlvuq7GoC\/k4Mn4VRNj3mZBR9MpJGeEqlCEyFcxSwKqh8iB0QiTL1oV2tRbDwSE\/5LrdEoQb2Xf6fjSNxZC2o+zG6np7eUTnSm944eFKsHywxg6\/sp3FydTCcwD2uHTid+5nsxHE5T2SPk2xyITI5GheTyHRET2hvfIASgjlY3Qbm3debBJOV0\/6d4Vj5c9TjtoLV9QvZJqwlU5lBDeVAPzyIvI9Dcr\/jbVpJJekw3FZbZbaYaItuWVP+mR3oeZcZNXDPkTmBXUh5bQ+xuOqJDFFvmnqs+NQEFrXogdHTdT6dBZDl0FP9cqJN3AhPiecoChgDiq79TjJ7JRyFdJjnXAKG9OaRxIpEryafeRsbPA8FN84T4j\/iNBfGQ17MoCmvY7JznEPb6q5xcjxysAHcW41BnzGf+uOXBI0gUOWKLJp+7dj8Vs9Z8ikbZUJeXYh6FM8Imn6q5gS7pMF+fk1bAbzhJc1EeQd4c+dd2r+JS4HW3pPEyCw0ZXPh7gaR2ype+IeA7+5n9XbIpFlXusJpJJRuTDrSzfcVcsaYwDPS6i1h6uXkSPAIkP1m1O\/jfohKb0AWAVVzWAfZvH13AoFigI7IYI5kFRuxktLYsp1AIjKANB3CJDpEZL9lMMgxFqI5Lp5dRQ\/vpFESPx+L34GWyjvFD5dKTez339RlHPZMEdoAHnjkPzz9tWQ\/VXeVcZOx\/tb7WmMdIkwp\/GI4uXnaBc4UplEBSTHJ6S0q9omOXhaoNkP8ww5q1ls+oF\/QNb\/j1RBgsswLZFi7JXPph3g39bBp3xLiWm8\/siQvKoDK2EEUJJABweTzgDES2fOe45ZCClRHF8MHbNe8z9v8snCO4UrJGhvSX8Rhlf7M+LzH8zv8T+8f0nOuxRugFHwE5igP55IDSUHostKeIKLWDbcdt968ltfC59yz8o4qyKSniF72drexueMukzUnTQx8mxZnvp20dYdhhI14KgIu3psfZGG7+V3Q6HRiEgcTmMSHxTVOBj5viQ1cZKjpCZVe3kif\/hYZdXvLPH6PiFfdd5oLfPIufogbxfFDfC0NSczyz2SHnpbf5QGpiPcw8DGqN1fKuGxUs7pchTnvWDkK6RsgdjWBGLUE\/fQnvx9bavJtYqxq7gOUeFirGQ1xjq6eH9Au\/bfsONEZh7uU75wZMWK7V561IRIFqSQVncyXdqxPPsUn8Ft5UqNWzm5YmKmxFxRbK0GGps8zzn3MWqqy70+4TNt3\/Dn3+OC5Ntq9Pil7\/fxKR1S1KFdOYhR6NgRcSMGpHDTk5b7994QV6sXUd5xtchsQNcjTt2t8O03wi2DxBRMBp80P7kcJ8VFZoYhp\/RBL1m330r0FqX4g2QQb7sCunPVsDunyT31w1AEsVYKexLCh35Kk7i1PjcuM2yml3E9LiFHiXDhdJSrkrbV\/di3NqcHqH3EBrWeO4+nD8IgTfhTXHNvpQbvQHL+ruwJVqb2WHXnhSX\/\/dKKJuHjgqVQs6oZJGmGpm8umC46UNul4ouQCAn17ZBz4rinS7glaxHQ0A+5MhsGVw8ToPkwO1RJJga7bEPT3yyM9E7gTdSY66T\/bSnApyLnueIwJbD8dnIXFXwGQH3urJznOx3jzRFCFZOmmnWYGHjQH3htc6pkSQlAOZ5hRudw1DEJ73C8tyy1p\/5ob93uvb0+FI4WJKwdxzuivVlySt5buDiM6VZqnafXofIzZ9xdwHuOKoQ7VmFLVg1LgYg1uijDRiSzkCgJv1fuUZxY5AGnUJZm+q5vXDs2m3aLwLbTQ2DJityL576C9QxQgTsTu+LBS5uinIvD0aLdoQJOuWRwcB\/\/2BOa9Ho8lif1fpXU\/W2J4+TzHE0BI24Z10uDzl+s9ZTL34Z32o6YgsAoRXy9eERdir+Bgl1xi6+iXYMtJafdNpP8sbnmtZ5alylRlJD\/N\/rSLhBG8dcePCD0zei\/ZSPlT1ptTWC6rU3a5LG1G0VfM7DfEBrgolrE+Kn9IN3HVsdV5NVmyE8G69cWJ7zxsTNpAwQq+\/J0ljzq9BzeV73Kg16UzwtcxjGQPHNvEcwX\/cuioCx3PtLcsiqrkVDZeY+qbSO5QvgULYi8F9clhMFuS9x8w3NtWiSHcUInq\/b4q9OJ74gNTYoxT8auohgZZ7CtWr9ea2V9cvsKQy8MxP\/dwhL5wGc996RhTqXp86s4T7nF4Q8RCYXeGIjPHiNXFvGFNaXmGdXObBYa5wiCS2z3JVSxNugFRBl4yVNV4TQfE\/abfCdZqgIcAMTdZROmIKAXAuiyO2EgswqqKsNIChczTLPCXxG1AEUem0Kndl57nOgRG0BVGrfbRE542GW0HmVQEOgCxBh0Ru4jUYp9f7AhMHbYL+ENqIctA6oo5rTGa94hp\/Hsgw\/TqJTcs9sSknxhg7LSDqD4cQXrVjijivr5eI3Of9GKGZF+UfZK\/L8AP7doU1NKa3FdlynxQRL4u2\/kbwjVFls3\/S2WeCu9mPJAqHVbwmfI+kB\/TWJqRlNYYbEff3Dw3BaUf1miUig7NiXRaZJ\/k6bubWdJ8PAaRaCBOI+U\/7VTqTkiKVKQILb4i9MS517ShgZtWe1b365cthUYu1\/P7k\/KphvjTnHDmQ\/x46FuJ4gax7Nxk3XnwIvEQ5aDvdUyb2IoaRRBXq+S0FTRnJHHzSLWmMX9mQTGrkg\/\/9\/0VlHprPe3KS6boKKq5+2iCikTFrtStFeKUdOmZR+WmQzEPIgQFOz2tg6El12vovkIfcpIQyh\/Lnhl+TpO+Dc\/PygWeUjIiF+SvYjsR1ivkf3f7PL5UQz8uLnrBybZ9inheTsZ8DdpRX4jmoR2H8Kz+Aje0VchMXupQMeo9Lu7c7rfLr02y7WfkHxftdgA4kKDB9z0T8jVDJXw3o5N+4qvHN1n4w4CsT4KW8nciHGyrA\/A3jPjr4qHzS2D9AIJ6X7PSeY\/19jNuspxrVx7qX74vgIrvZR+fU0N4onDXr30BW95ICSSiK9mW72PyBAoG50ife5VClOelK6YZT5M+objz1rVWBByEUnsSHIgW6doFLJwkUs2SQfVd4Vt60bfwjCt\/ke7z3ip4338ED\/LRcIOu\/YpsiJNCRFLOg7P+kZNi5D2o1CwLnTz1nEffZFbDQKZoLwCrh+CgB\/l52dDd9iFVmUBRsBVDR8u3kxcJdu1NK4iaNQph8WB9FJSYJZouXssk\/H39m3O8XKIZumynCDM9OE7UJZJ2pfoJC4+oGHzZhyEPWFG2vOhbh8oAj2quZLZ21Habq4o+Q0alC9s1HNbUJMnDYz","iv":"924f284f560d7bc869e2be0b5faa6f14","s":"3dd11f92b80c0443"}

Knight Frank says the switch from a seller’s to a buyer’s market is already underway across most prime residential markets, per 2023 forecasts. Image credit: Dubai Polo & Equestrian Club via Wikimedia Commons

Knight Frank says the switch from a seller’s to a buyer’s market is already underway across most prime residential markets, per 2023 forecasts. Image credit: Dubai Polo & Equestrian Club via Wikimedia Commons  Knight Frank's infographic identifies key prime residential market trends for 2023. Image credit: Knight Frank

Knight Frank's infographic identifies key prime residential market trends for 2023. Image credit: Knight Frank The firm provides prime price forecasts across key markets, showcasing comparisons between June 2022 and now. Image credit: Knight Frank

The firm provides prime price forecasts across key markets, showcasing comparisons between June 2022 and now. Image credit: Knight Frank