Boston Consulting Group (BCG) is digging into the data surrounding green resources.

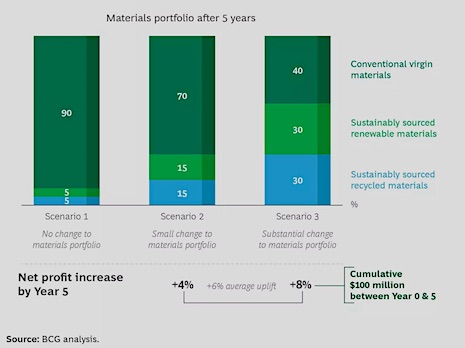

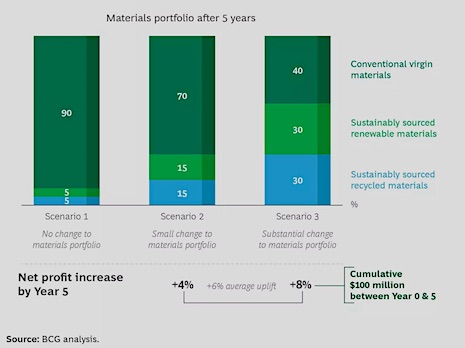

According to its findings, fashion brands that use sustainable raw materials can boost their net profits by 6 percent, on average. Despite their earnings-boosting potential, demand is set to exceed supply by 133 million tons by 2030, revealing a major challenge and an even bigger opportunity for the industry.

“Utilizing sustainable raw materials can drive incremental value when they (are not only sustainable but also) deliver against customers’ fundamental needs (e.g., quality, durability),” said Lauren Taylor, managing director and partner, and global lead of customer-centric sustainability and innovation at BCG, Dallas.

“To reap outsized benefits, companies and brands must overcome key barriers to drive customer choice – and further innovate to create disruptive new products/services and business models.”

For the report, “Sustainable Raw Materials Will Drive Profitability for Fashion and Apparel Brands,” BCG worked with U.S. nonprofit Textile Exchange and environmental sustainability consultancy Quantis. Insights were sourced from professionals at all three companies and expert interviews.

Green gains

More than 85 percent of top-selling apparel labels have publicly announced targets to decarbonize their supply chains.

Since raw materials make up two-thirds of fashion’s climate impact according to the report, addressing this area of the business is critical for these goals to be met. Based on the models included, brands that are able to do so have the potential to increase net profits over a five-year period.

The opportunities are huge for brands that successfully adopt green models. Image courtesy of BCG

The opportunities are huge for brands that successfully adopt green models. Image courtesy of BCG

Luxury names or those bringing in $1 billion in annual revenues could tap into a cumulative opportunity of $100 million within that time frame.

However, low-impact materials are still in the early stages of being embraced by manufacturers.

Suppliers that meet the Environmental Protection Agency’s Tier 4 standards are not seeing enough enthusiasm from the fashion industry to develop further. Investment and commitment are lacking, thus, many producers of such raw materials, called “preferred” in the report, are holding back on adopting the framework that would increase scale.

In 2030, only 19 percent of materials will be preferred, falling far short of customers’ demand by that point in time.

Apparel maisons must act immediately to bulk up the eco-friendly raw materials in their portfolios — these systems take time to establish effectively. If they do not, investment will not be up to par with the market’s potential demands by the end of the decade.

“Fashion and apparel brands need to take immediate action to invest in the supply of preferred raw materials, thereby securing resources and transforming their business models for a sustainable future,” said Philipp Meister, global lead of fashion and sporting goods at Quantis and coauthor of the report, in a statement.

“This will require brands to rethink product portfolios, strengthen supplier relationships, and build company-wide engagement — all of which could take years.”

BCG’s report provides six ways that brands can begin building out their materials strategy.

Investing in, and embedding, complete traceability to “de-risk” supply chains and fully grasp impact is key. This is already a hot topic in luxury (see story), with many maisons rolling out tracking features (see story) and opting for drops that center provenance (see story).

Using a science-backed method to support decision-making is another BCG recommendation, which could satisfy stakeholders and help companies avoid green-washing accusations (see story).

It is important for businesses to diversify their materials portfolio. As the climate crisis marches on, this will help them avoid the negative fallouts that come with the shortages related to droughts, floods and other natural disasters (see story).

The report encourages companies to build a case that has a “triple win” for supplies, brands and nature.

Finally, the last two suggestions are to strengthen relationships with supply chain players and to make sure that knowledge is consistent throughout touchpoints.

“There are many innovative ‘deeptech’ technologies that can companies should explore,” said Ms. Taylor.

“For example, companies can consider replacing traditional bio-based ingredients (e.g., plant-based vs. chemical) to 'bio-better' formulation (e.g., bio-actives using syn bio) and from bio-degradable (e.g., compostable packaging), to 'Segment of 1' – at scale (e.g., localized/distributed production) leveraging deep tech innovation,” she said. “The ultimate goal is to shift the mindset from substitutions to today's materials in the current value chain, to a new end-to-end business model that yields a better customer experience and profitable sustainability.”

Green legislation hits luxury

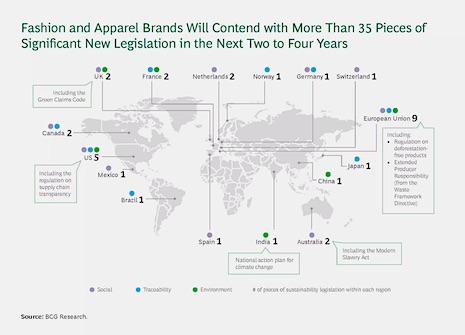

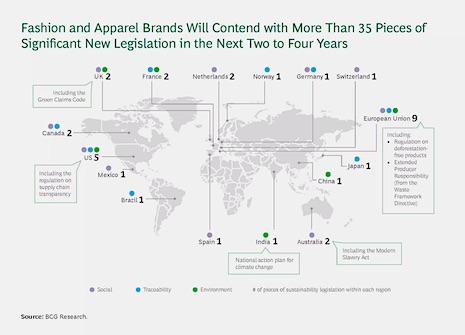

Sustainability-related regulations are multiplying around the world, with 35 new pieces of legislation slated to go into effect in the next two to four years.

These new laws and guidelines have a larger impact than ever before, and customers are more research-savvy than at any time in history. It is vital that companies comply, and up to 8 percent of their earnings are at risk if they do not (see story).

“Fashion and apparel brands face a two-part challenge: they must double down on driving carbon reduction while preparing for upcoming regulations,” said Jocelyn Wilkinson, BCG partner and coauthor of the report, in a statement.

“Success on both counts relies on a robust strategy for preferred raw materials — one that helps brands lock in a supply of sustainable materials for the future,” Ms. Wilkinson said. “Putting that strategy into immediate action promises to pay off.”

Regardless of the stricter framework being applied, the report estimates that only 15 percent of brands are currently aligned with flagship regulations.

Legislation will become a bigger decision-shaper in fashion with every passing year. Image courtesy of BCG

Legislation will become a bigger decision-shaper in fashion with every passing year. Image courtesy of BCG

To avoid this pitfall, many in luxury are focusing specifically on minimizing their carbon footprints (see story). This is popular across sectors thanks to the issue’s metrics-oriented, straightforward nature (see story).

Others, like British fashion house Stella McCartney, are working with inventors of alternative fabrics and producers of preferred raw materials (see story). This has become a centerpiece of the brand’s modern image.

“In the face of the climate crisis, the policy landscape, and investor and consumer scrutiny, fashion and apparel brands cannot afford to underinvest in their raw-materials strategies any longer,” said Beth Jensen, director of climate impact at Textile Exchange and coauthor of the report, in a statement.

“Brands must act boldly now to invest in the supply chain relationships that will enable achievement of their climate goals by 2030 — a key milestone year that is rapidly approaching.”

{"ct":"eDlfrgE\/KBdgLV7WE45Zout2ebTkH9jaGvTFJmX6jzDDfFlBxOoY7Uxca+t+1T2cCA1drkGsHi0hOqhocUjVlJCLgBAlWFZNmL4IsaUGwQzFd38XHoiSURr9B4Se7do91g9oJCo2Jdldp83TqZj0v\/VRfimM7ixHIZCYb3TZ1Qsc8TMTGm2AovW8X2iqFfBHrfh+8gyFdxqFsbeqbKKKYVqKpZbZfhNDB+TxCXIiHuKmYVz9ImunRP+lmvK7kZicGEbQ1vapBLwJp93MDp2Z27VVJuG3Um0r4zxu5zmmgzxS0wjCQi9z2hK2+BC87PK44lTof8UiEwf23NCFdSwe5Chk3aYNOUwXBXDTpBn+ju4+7kgP30ma2oZ8Bf1c6dgr4y6\/bH1kmYXTulCDAk1eU77o5c6vcNUshGRylSdcSJVNoN9aUnqlMTLYvfQ5d3I2oikmQqTXRoNKlMn8cifr0\/jazT1IB7HjEBxEAzHme6\/RVrpvTBhxPhrPPTorp5FOCg2GI4\/S1EanX\/iwFf1TCs477fVHfwvL0O8dJtFspdMQz1N1L6ZlgyeKMqqpChMuU\/qXUZKzaOax+XG4t6OKRmyd3Vdf2KSWjSu+CwXXZxspcmGNIAl+HGFyLGjKj86om1bYkGiNKKTqKOjrNCriZQd75Q1tDSi2vZXugIIwLNHFRcTWo2G8pFvhw8Tq9E5EmeHbDlD6HMiI41xgrr0RXdDoHuzQOW+9qJ3\/TyS247bMlDkmZ84i8qaGyp+SMR\/3tWTqopFbZ9MllI7oQoWTYVfeaFaR2d0fd0keFzVM7Xg+Oa5DhokxefEU6vW\/RzjQn\/TK8Gam2q5YOrWGD3\/SfrKkP6CA7XvSG6\/dSfzkvJ27JRBvIZGFnkQqWPWv6EmQRtqZaPAJWOFhpwCW2T04qZzo4E4\/8FJ6Ssm2BPPPeeNk6JIzw1WmNGzU9p6iNlS3n33xf9Z8q1r6k3lWc1tiR0V0GduUudkInajZ5MV5jxkIUgq7UQmoyLyRWK27eDKXXPW2GuNr9QlV2\/i25ycTQZd5DfrXzKfe4uJJ9TgCaaKW+QEPx28gkdoD7IfrZBns47NVYYlGVlJ2MydPN8ar5kW2sAy5Ixdw\/ZmTJbQMczEbfv3j724UCGuwtJ+Lb0TX3LZp2VBrA7iy9KAnOAyYO6PlFo54QNdgaw7xc3INb+TVvPkEQQcvv1K\/MDC14Cp5W4O5PpXGP94FY30dhS2e+hG6XFRyWP9nHWoTbf5vD+UEJLLhlq1kk\/qkvbeqW3H9zlDusQQF0CweJJFeimp7psWTeOdbqrZdCG1BCRFdJxsrlPlVHEDka\/WQw1k5neiokH\/EMv6AaPxRpTkumlFuW0do5hyrpQV\/223TKDBpyxCbxw2\/lY5kvsTL63PTQd\/r+Kc\/ICh3qm8Tq8OFJJPQUieajUlmnH0ZzBSCpyiZ0Z83AX1XpJ2aXqQwieZphTuB45Afv9unkiC1\/Dt+rLvdu2Os7GSjdBmVj98YR0+ID4eqjXZ4UcW\/o4kTsxIYm25Te7r2td\/HECnHEwk9gPc82H57VPUFpJDOmDFC+C3tsPaRDg06paXsZlQgBuyVyMD2f\/Lv2qmmFj6F+lJSB6hWCIpNoSVymFB+lXUoGqe68xovc80Q2nsL5S+O\/fUYlPlyLQwP0Jcs58j2dstkU8vN1EM6hWDiFH797KF0tOoS8eACpCxYgGlKOKT2Ki3OfhajSQyN5JB2+WAs8Qe3rZ1ahmRrzlODMft492OOOT5OpByLQ9ikjLNtFhfd4tAcBcvHpzNFBBaW+S9j5X2O1togLxbXZYsnb7J4IQDxYjHiodicUODeO0UOBSacQXT8bES9CRh9TvBTXYFGLfHQVWjR+PV2o6RYPmeJN1u6bzyktAqEVZ8hv4B24q3QZgHriVH2APCnjP8gaNQ9O7taqPgwxPvwTS0CGotH464vYE5x7Nvfrrpw5OGxJNL25WlbfDxFIwq3sfxjqkRotQnwOk2INz5bEwxPEGxuuNOstpsiBzoN2obG8SGWQ\/gPGM0rPsDo83gOXZyjbd2qETVtRac4\/GPLRvEfeuD5oF4w+xicAKSeo63ZHcZnQwU6vfWZ3hxn7mdWDycpb6EcRgNMruTPXXgtJ18+w1jJyREgBezbLsRbwVPaI5hem6VWYhF0EtWfCn6zjtUW8dmHTTQy1XkE1iQHLDjG6a77i8WRH1oOd40qROpNoqahV4dV9rrDJG0qtmZUT1HuU22USn0r\/iIQjEgCStEWlLzCSawDS1lKs2fDFoLwyYio+7uI9wkw9YnbQeUgnxuVgGkSxJiGo9pNdlJ+9Xdzfo97RIJGgLEQJRXUbSIAlWTxq+\/eIi1O+ktve6nh18tyYXPMPhOp98ISonTSfBJ55\/frbL8oz341XXRLHvaUPwahPynhfy6tQ3gf3EUuf8WRxT0gT+2F2mQq1o6LuYVtwKl1ufwGzcVMA7fuYWclKeuVKu79qbaNl7PVRv8efoIGjk8W6vNvVA1AMRHubZIRPHEQ+VbPC2mmRrCeoBDL50BvAo7aLRMcXDphFF721U8aWu68ybZUSEJgn7wfleMa7nRpPD3ROCEnQfcBauN\/NA1u5LcIfK1h3MhSBBqjuJiDGxuIF4R8XCEYNx50Eg5VJU4VLNDXEobudyZDPemsc68FW6+t\/86lXOUn5zW1JpH8oWp+tF3p9mtXUXqvOlPzCKJ6Vwij0UF+2ZY\/LVzfMWKfCTZcXSsHt+IrkzedTwRdQzgNJ5\/l2kWH+dxm7KX\/3HcWs\/Ee0rwuT2xbLDAXZfFuJO5b3ltFCBTyuvqdi7ZKsApjdD+qEtht7+wobYz8rBmYh1Tm6HuvfdV2C5SXgcXGDXpACZbM4AG0alRbiVfOYrUMKjinfplRivOM+dpc1bsDgNQ9bkiLfj6MK7BeFCgVPOYQECIYU44dP6DeaJ2iXSbi8P0QaGTmhIW8XdvhmtA89dcUR5I5OWBFSTbLRXc1Bjp+l3MvTtE0s0QuuS7Ow2p7ZZ1N2EyQt5\/L8Nxt7gb+M7wF\/0KQ1b4A7E+CHVu0nBFbA1JVZBo1lKfL2Z5+vEKjdFnbeAoZ0jABMSPmx\/t4DVYX2p8\/1Ii06LNt6s1eL0Krvh1XzxqYXSt+UTbA+yVQ1B9W3u+zxfbIB5EC+a94imUftad6MICBg3dbK+lm3WcsP2OHEmjS\/ZziiybIfzcGyW9aqB7ZZHlMc4XY0at5Y2sZLNXsJKh0MZfQAWvOsCxYtWa6BNgh\/uXpz6YzqGLeNUmnjKV+Bt8hG23Qi5wxN5rZu5K9xqC6AapqpOZ3OU\/WGv3FV1BALzqVT7JsSN05t5wkUdvJaetnnti\/yptDGDBRw1gVxxHy9LvkHq0u8flBoxS7ITbAk4IulX8W3hq+LLNvOB1cTGXaulGX9K\/4Qfk6C5bmCSncuOgHN2O3rCX6nRIJiaS0o9Ou8KT\/8r2Xu4\/\/MkL0HwLPJYVYQRxx8f2X5RJZBmNfA73XwshluY58KJdZjpAKnhBz9aDMpMD3n7T9dzMTGbAFQDTxy2zv5qdKLm6i\/rKxLP0wTwiHalF0neQklItTfOXlnJ6+0VppHysDwaOGb6ixbgTzTXQwEF8lUA5Ogcr87vy6gziwmZTr8x6Uflhtn9DoaxHFAGX0z\/M3bEdUG9kBjXRRfzuyuBRTr0+QnULmdYIVFfjBKiZIllJOaoBwYUfKPJZ8+lelYPEZGz+x++fm5DdpJe0w+KEXqf0udyuq\/HeAhA8rZtwzIEXKQenqC5T4wcdUPZuaNgg3lFuRKtmeAmIMBtCRi0pcQUsATpSQvg32aKgnipNq\/7raqCpAqj5q4D2LZ9QorFZxSpjHbgfAAE53Nh7L7XZ9ClABMK8ejMiSyPjteNQsSat0lCZzCQsdm730qSDPDmKdxQ6m2GT6q91ONlWUEBnl1K0WCq1hJNxRHnDMUL3E5CYsF19ekAK9qs52DylpYGx8udYl9nh2tUlm7w67KXbWdEMse1GQMbSAvKx6e43oayKmfg3vfEWMPm2OJlqkBuvWHPyBVWE1gA02Qjx0hspQHVQCxrXpSiGvJHYxJxSRR2D\/ZQbJZS7j6YBR5qtDnt69DQsL+McONC3XhCZ557RRMptOpn+SAg16Y9V7gS28qc9x3CEqX\/p+cBP0y6e8pSEWXNMmYpQ8OhJwcZSbabtmetcx+AxQRIjQLQtMxhkUqiFZ6J80ZPbzg2gVotp+ah0JnqH+MJgBSlQjYU8fKfRVPgZEdPRQIgOZ+ao4\/kDfTEZ4En4MJNRe15e67v4z\/QEzo7Ijtja3+4eS4C5f7gZzR6hZyESiWZrssRelxU8hTBeZaRKDVdgi4p\/1ijlgdf1TN9tYQ1qWlXgcLkNpGZn3iHEHTT\/1WzCMWM6v8YPPkyJI6tls9rT4OEH2pY9\/wnxlKVh4AjpBQNW\/pWDfkaIRymRqyu\/UB71gz\/C3+IcfyvzFzMsIac+sxnOpuNDPcFuAUw2kIqAa3sy9k9Gklmf3T4Bi51OtEm4EYO+6Y02lSyCCzpY2H0LRUcEHhjqqsvjlRlTtxTYsDpCFBY1FizoBE9mCGTlaa1Ym05pQUT262\/9FQMH8h\/c0HLOByHDODDmg8VuFn104YSRTLG\/E5yT5VhELNKODXVFC4BsLEy09TrsJoRnwZ\/ARrukoWvf+KFw0dHctyrVkbW5p4lnzl8WztVfz2PTuVrKK0UTC5Fcs6Eab8TkrFuYKij9jhUqxULdQ8QuFC+j+Lh8iEiA8GZzT4PkGTJCexqkzSw5Ge74oJZ9ejtuvCmRUJxL7PkJDi7xtEDa+F26W5ojkpMLdKnFFzQB0m\/gEVg2DiFASgiokIq4xyzJv136oM\/CVEOVX5bU76rxjUttTechDWmSIN5KviiWnGCmlP7kK99hIPwvUqEcjRUuZ2CiRBtZm5oKG+zrgGeyyHgmBZtuB8xMCBGi7UQBw85XmqioFctA+0WuXhi+Flb6yzJj\/dN\/nJ5sLFgef11wRKkuFc0F0gjT03O4XYCl1\/dfx0J48L0TP3EZvtK6KjdnWULED1T2G39IRhyUt16Ma49EikqOm8meeyUKeLLPkURfFdmfLkyvxbupvNQTjT0rjEgRdxS6m5SstC7hxRvcdIfXEHFcau05ERRamCdw9DuEIja0AKXeRqxc\/l5+1M0jfT668GgKBwk4WdruOAWZuZ0fMUrX4Tp9Q3gq604r76zcebYp8HFjfd7NvBJLTH7bP68QK0WfDVlOCfDBaT5hhIpXRciO3LpMBAIpDM4sUSERgKJlevAmWSuwvuKH0Ul55ZJgt5YE1cXFwHjFRxCITeT00CzRjuBHhwU+KExpkZ5\/QEd3ss2wkJyj\/2m4YGHmIROF\/Y7xbsHWr\/DWnrWI\/IFkw5IvyxdLJ8Cb2ja14n26w7m\/JBHRbRbtTcx2V3Ha0UkbHAnFC+nW6ndtzyiC9d7lr9PufVWzLWa3vfrq5Tuj\/XIQhZHoey6eDh6+CImCeGeaLj451tzugmokcBel0rg3U\/P2m+nQ2GuICr5TqJUXA4flz+h\/yBfx6N5skzC\/WcA6TK8Gwjp2tGSuGwuSBHrysJYiCu0Ka2DLhQGGYgQW5yqi3Ad3jP4pY483ciEn6A5Cq0mBbf+AQVgkUZanrLQthOV4p4yHD5pXl+2pt2TjOuPbdtAfzeQbOBQGBSfKpcF3kIXcY7bpS64GuxN8EcBgqtdtebOzIbeXVEEjANyqL57BhQKU53s+OsLUrjkloEQxmV6+jXmym8+1r6tN4LOaR4QZBLuJfuXXVHZk88gdljetlcoJh80rK5kBudo0ryTxL4NS72YKbgcDAC1v4CvjPvk3zseMXaGw5N09vlprWljapGhRxH7UE7izvRh+f8W5Hdvv\/SOI0PpCSQXu0WUril5Gjqq4ZE1fj52YNFfQ03ZtK7efhBhNI7Kh7vRqYL0lKdfeFq6vcbFxtGlx6+ANSO\/JA8N+NenwZUlucY+9rq13JiggBf8XPsW9GQLHTwjAuZj0ld9hWpvHA5QT2r2u86R2lzrHlyo2zIkzEDPhd6Zg7E+hR0yBxEvTttvwHeptYRGzx6sxeZKnGxpFuHXm87i4Ww8Rkjtk20Oa4Ykylzm9nJEBvqvCLhqDoAbg\/oi9sUW2s8DDF\/HCvAmuJRzdh9lchxQztDQoomo3S9nF3\/5vw4ng1Y7O\/AIMfIaqHxqgt2VlXyyYWdakCVPkOL+YL6eI3VtYWekTMQ9aUNTkrhgigSpBhzQKKLnFrjeSFx8SMhL7yg6bjYX3YKh3LedpFcC7LPjUznVB\/jobzb3Z9+UPsxhy2YtGAlEz5S+AiYO7ZNLYz6DTYML34v21sY9hy8YkgNIitoNVW7AKLrQtlWdVCLOH2vJjvNvNqOrrJ8Tfw5TU35q0cPLKbC9n+Sj9oU4jU0DiRN9ivI1XjFAG4qECVzihM2AaraS9mnat8x0WjNKd5KYs2oZ4AMVj3lppAI+HoYhVD3V9ufXtYT9+b8\/p90NULj396TQShvsOinE2gTPRlQV2LhQ3xdM3ndeugk1R5vdqoZfhL\/1YFqJ655G\/Ur44ippwAoZXhyRopvxYzVdR6rgdTEgwiohMhBU1aFr8QKhKT3eBUCJ2vjXTvTs42D5W0tb1VOUoLegIUOTOiuzze9rcLmpRqRstVbD65lYbXXy5espL4N7QfiVkgr5pM+6T3885iAE4sg9phb0Uyyk2M+sSKq\/Ovj2HYWkMRP1FOYNsbtECnu0gm7jbz5bi40Dguyd7AbNppaMpQvHrE6Jt+nCg\/iiSGOs3CB9bglDIabzIFDYDosowOUNp\/cfwYlz1r3xTF3Ve\/g8wbLwparuTwOZaI\/kw7yIYo3tQ283v\/UiuOymR9aAMbTo9vJV9R3TSMA9+Ry0EZgPW7J1gBaFZaRCELkIl29K2KRA4QqoElodYLDVEP50AtJXr2gCcRf9D\/+oLh+bRa8DcD9tVyNVqz9ctRN5X19wl0cq5WzQrtY8a7MjxQ9WTmWX3Z0lQ6E0E9yVcLlmB97VN5llsLslbHQ50mOeDSomJ9t4EtNt4UZIICIPv3oQ2OiZUrzk4Or6FjXZTX4DBo0kVEll73Gs7boCJ+52c9Yot\/8Ji5uJIYn8QXtiSX8Sc2bK2jdZTRArdunIYJtnyfDOAe07mPW7m\/eNDPCT0mvp1\/BRQ8Vt3\/tyhTTdOYyqEYZlz5PL52ihG6CQzQX\/1xI7VoJ\/0jVtv4gtvQk+ZCeAcUxi3n1vndonGI0uE83LOnsjTb3Jh2H1EhSNhnl\/5QKqtPhEHpNkNOKrnPZjCm7FQZpRSW\/lChgS5FKtdZjnKuo+Y3Sdj4omLaC+GOB7bZlW12ZwiF25v5mKVqCxKiS545rrCb9swqkDMWCcx265G0juUtuD2Sp\/8wLMAhUAhXyJ25QhVif1r7\/a7qoWlNxlwvtr0+rBaXwvFtxDKpezst\/mv0VVFuD6YfG6UcPzjiIXSRtuKszweO+sPS7sG+mhrwbMjjXFJQ3c\/UMWWwkm+1XQ0DDMM1VYv\/WoOmXHRlBPYAjiA\/ZM0sdpB5O0lN\/ZndXa52CUEkvqY9rX55n2mJ3ttTitmB\/ScjxXroHqthQyOosPPSgnjW8NpugJKkjDpfiQ3FeeYlPWx5ozpRTBa0BupnmfYboz\/9ff+oJiWlCjpTXklymVvTDslEwSHG9GmegvaefjUcG599z9a7L\/QwzBuHpm5LwE1deYzAY9\/F9FH7RPEhH0fyH5sMt01jIIQ0HZ6if\/szyjvD58ZIGsKBDjF0ritdQuUcm\/k\/uwixxPAV1RR63HbkQ+c05T5+RcODIcxrf5768qNE5MaMMzX+ySi9lf9YIPzl\/03GQBEPk6+8jZ4h8mi9A\/awDllwnp8EG6A9mNivmDPp7VgaN9LcUqcODn9lbCMZuU7kMOpT7FddnwL5zSzOJWuzMh3A5DevzEPz+z8XPCwulsF1WcXUTZiT\/xZhDwnc5N4dnPznzbO7AlGbNYOmpSnPRK5pC7\/dUCc9ndOiC2Q+Zmo74eOhB8uXjVTrwGg5PM1udJzOD\/APGdgD\/9EmgEkmqxu\/WIIvwi+Q32OuiGVP5SOFks7uDYOTeig4mpjk8Mx9hh\/KFwSsdxLCkJLismSfAMA1R9nAyKpVrxrBf20hli+W8mu9Lkv5EO+gO65ilB73\/zgF39nnbMH4luyAj6\/FK\/LpND2o8JPklid6ik01Tf4SUy4u2BTq8BvemFNhywrygaYZ5Ma2UD6VMgrKuLFj0p1GKGo4sdnyT3BsrP3YYIzcuZe3NOvS1O3lRwZ\/bNYedtgLP9zfWxPrg9buPg5vgaYk4QBG39nQCA50z1n5j9TlAQZfzO5fACslPLuhGFvKzIDMqQxhJVvc1wa6X9rbZe0kas258+LJAsQi\/8bSFbcCtuGeCcASPDV2Opr60F619xvdM3R6uPC6zJmNflTVKuoeushxe65QW\/B3Pme0FRiOAyigGizlmgrQQ7X4x35vBoNt6Z7TiqYR2fj8FofKeww5pDkWQAxYb00yX6\/csHtkd3RU\/L3eZDlrKjGpbdeoVxmCU3evsLlwOXliGFIxTP6KL8nXV91823NHMoe9O7uF6bSYsCBN\/uhwjt+S+WROf2pEl0REGNgOnfJkQPp0AwguQ0eWBZ+wyt0vO5wykNlgmK2gVYb9EOzrVSes3MWKKMPa8669p7JdvIZM68v6EW\/3GwgmKAO6vyCoU935DrSw1dBAg\/yotQSphDJBu6eV3XZdxPV0daRFtPPqTiEVBFmGs6LZHyoT1CXrTBPiC\/VFG6vQDmLv0W+R3JMV3SsJpbQHldPl3ZYQ4vw2Bpu9gBWSbvXGtTrQRq3c9d\/My3OV9diZ5EnHmOYvNWjo9\/TgAhErBZuuMOUIowAEib1Fprs0+l0\/DfTvkN7HalowWQXmegjit7IwRLMEWl\/nJ1qBndaTwHmQ7VSJ\/L2bBdkZCzfIYxMRLSTMstvdNk6p5YyXdMkJffg4nG\/E1aBEzl2Q57tyHjJ4bJ2lJZ+s06+WxUkJpUZuJvbp26tELmr56Zm55jSc936v2E3tGmsxxjxEcIdC1BnC9YV6RqICZkhnYKnaQRrOzQm+akuAc5EcX6yrCuyFT24QzHms7ovT34gESyrakx7Fw+GVk4YllqhvjnBwJMyvBkTID3tE01f\/qsoA3zI5tuKiCrsuXpHJoenwY\/DSBVniFSZVXs1TsXtHJZuh6HucA\/PE9uVhUgY83GpqtJqFNbnlPD\/eHk2aLUBpyPqD3A7i2BENCrXKH8zIdjx4GYP2Ak\/1Qk71lC9ZMpHDzZE52xIKXKLvnT\/HhU7gJk0kVNDm4h8rua7wUEOLhht+uwuCuvqiYm4FWb2o0EdWno3x8hly2VE1PxkEAy219KaDkmK683rXqZEkXCFOuqp6XGF80Ya2RKNwqTFdMbwKtBip9HiSJoCLo0LmrEFdSt5H2qlYj4y8nKLk+JY5OmU9CvKPwXFT45OedNO5RFDTgKFJjTgSvmmak56UyDFcFdXyoGnu5W\/tsWu2UNLnkEXpWULpYGVDlKhw7eU5fJ8tnuM8kUuYDlT8zLl5f4j1KJ31+C0rqxheAKjbIGq5w7RfwYyEDblYHRVwOF5SpTPglSkk0S\/u\/xq3kUVlnq0VuMSuin9W8QePO0zbi4PZhsSpGtbOetdIjk85k5eKaploTmiBzKi8BT1FZOPC13EsVkSr4lePdvH8qwablU461UkWVBJon4sIgQ5oPms\/3t1WAe+IbTX8XlBHK1S2GIIHv6pAYi1hSwNyVfQWHkHYrctbFnIfO7KLH88oi4q+ZZpvY7aIFNmN2F3ni9Wrnu0ExWNBV4J7rCzgIBEF\/VHNam\/S3II20mbpPxVKi9ozzABDE7e+1UjoJnQcQ9MSrqODtUTSxJQtafrkGL49lE\/aekfiGSm+9iNkkY5TisGA9R1lE9DZCrHjzrNeWHsk0L0sV34dIo2e1eRdOKYPTMk7IM4F1ML0hzWtR7nXtbZXoOaa3U4R6DYHi8GEvJJnXefiR6anxPFQzA1canzYfVY1b61Ysxl\/F+olD65GesL792nLtEieWA9RaOakYpStsPCyq6qBigd50WkqYUJDzWROuY3OR2gLiRTH976be3wWbmjmblRE+ik3EQn07Gjw26tWjBBsOJtVSoGI5vbM4c1QJ8dCjtYRusxy5ryxTboi6Bjdf3bLW4ImJtbdht6kX4phFQEHwTR789qIeTs0lvGjUAFPpLN\/litdvrzrBtHV2J9XuSCoEw76DIXNFtMijg0Vz17bOglNSxDNnFc9FXZT+9zJoBZZ21uoh81gTeBkkXz\/ErD1DTEJg50d8Fv4bTJnhiJNAjpBOWxpYOxRAPBvWk\/oM\/MbFu1fwvxfvDcdy6PIF3BspWuEXxFRoqruOljCl+4XYX\/SiUUhtDtN0ouGgxomO7bnMSW0uzd3w7z8l41sluxXRBH5ac\/vg8FWDwq4Ots+lw9v2usMpwS\/gDGXUQ+Bng\/pV8j7OQR+ZaIs5qjc\/nWYBcI9kOZPWvpmk+ZnAYWDF60EoQE\/rorgp4Cc6J6CTf0YdSjNz5jZa3HnRdDXLqN+ssFPWdjAmpESjnntcwDYQgD0F0KE88Jtu+fUe3xKLbvgJS5Z1RTqEsxR4+Wf3Bdwn750AoT9jDD+WnAY\/+SdziiE1ryYY4oQ+tJu\/U9RRmPdNWi15rd3Lov0CXrAQUsL5Cyrey14kaYh70D2y2FPgWO4qnSeqTfI0idJ5XnSHwvzRJ\/U07LkFGbw64c3j2ZpfPyubQtxpbuST0K99TMHF0x\/z3BJ8v6GHgR5453UJ+Z03LWfbkLwuJuXo6BQvVS\/d4+QRwwYtMwT5kfVJj\/+Zk6vL2g7bFiBClULOb1D7jsgGn677gb1f7W6Ty4g3g9ARffp\/oXFlIWPj6U4VHPJ1K0FJx0s4N9K8hCzwnRsmlECPxUmoLff7C8msL+DXTEUF3Nx8ajtT8ckX2OdCkRHArC\/ZItvebmXSgB5sWUH\/voBG0skRYY50LGbD5qUQ9diMdEfbQWeDX9sM1PvfGz04pldB2xJTHlgKBTKOQKaUcns9mO8FWgBnX3OUsB+YxSOjppmt7I3ybcOns+\/GjU8cwXgPmpFTnIMHQxku5awRNCzxE2rjZ\/IzUbkDfg5vc6BmtrtyNPROMCtq+SLLIc\/+fUUfKY0jCu40f3VLJvp5CYNs1bp7UPrmbsXaDeuuTIxAysifwa9U8hoWEKgD3DsjkbN3BdX+TAwLQUrcOf8eplqjiYik8WB8ROzJfC4h06xSccr+0DliVoXbIXRaiNi2wNiQzmmsB7zIhUevBL1TLhwDdNtyUfQ0lOS+7cZdcqurgjCzLFr+Axbjr2kJdct5kMcclNk1iFzQsy9JMGTY+eMDEn\/PirnJphwK+DwtodcZWtzdWjmWOAnXy83IDHHalQyKPMIpOrIlFtyyFLz8404L35fKQynB\/RL6SKK4GlnOdYPlV7th4Uosyf0W323qPcG0hElTZkrAb3TdIzTb1S0tpPgPshelmXmjKs6uMRrmuihJ7BLBXtjTPX45lJFcLupJwvRcnL9icUW+uG+SmzIkqjeT44\/QwNKHDv1IWhQUiY7HC3JejmRY7ygUKMrnt709E+vqi4+AzoEeMpaNDDtfra\/LVgWM2Nw8wfcNJmWf5NxbKJ8y2JSODEnmAft+HTT9\/9kOCQBCiBTgjxhtA\/jB27ddFi6dnh80O8wHS0d+cm8kEt9Bucz5gKN7tMg2OtKQewivSWzjFSZD2Ba0jJWT911mRAauHknBzAWnnKffbm5e01nwLCtEmN6mK+U5rwRYSX9fU5iLWKPsbGzuwge4XDou7\/hm63NqpHIvjq1gsi+0G2YVrWaWMAGZS2856\/8mUiBQQqBNGY6K07Cp29EDYQJtI+\/w4G6ivn9v76fA14g5qgxqnEMwvXr8KXzLJGN1h2a\/zXrlGLce94\/Ncn22oxAp71Ewmj+Dw2vwJssNjFmWzFfuHGJlWu50SSat+AmGIuwk\/\/97pB0rt2crQM\/KYVwx85rDsBHVYEQ3qvVSxzmvDwP5jbu0xlZvR9LY1asB4h+DJUCab9aHQzxSlcNy2FbslT77crXAOHb7gbY\/dEQMp0rDfXn39bubtNqbrlLJbxoCRr9+KOSXUtz8V9DJgATLOslYBGUtwTQt\/PozF5DEzuQR6kVg0l3fPZOe+agKDXijPP8yBJXhCI2iwwaz01gYIK8\/ALOinxCZ669\/1CaQzbO4Berj+LMGsPvpbNIOLysXj80jtVOUV53Zly2NECVS2br2TiB9y4SbfcOJxFC0vz4GdfRGq35GSr3Wi6dgNwB3zrM18AkoWsfOylgAalTiS04z9mK+SBKatLx14G2YYuPCUQIdNLrlr62a22uVp7ZA9bYGQsvEBsTqdEVd0oZic6zdz87Ql7+Ru0pYyfa21Quk9kcDeNy0Sx6GkUaeOdtegl6z0rjh1D3nSLKpWUsQaFffKrdUsn5\/I09WjbSXjla\/\/jLLY5g0s\/ZVmvuwjEbiCKwaWBbXNdFDo34++xddGLdq1aRUY5Q9mW2+ohvf7wBiIZcTA366P4OAZbA3UTBqfx+T7p27YMpb2q7kboVROlLMQM\/JN0eLldXCumQw7jvzhL35IC49YSD9+sL0MHUXcsxL3uVbpg8i6DEkKMOVN3m56kQ7+rRwsyX2sYg5vk7Aa1eQmS37cY572aSF+NCEjAK4QhdLSCi7j10HezkJmVSidhAHencnIflfXKyYyKMxLOrsRLtb9PvL7jU0Zb5V9EJwfXJMfsr82YCk1DJ5joKP0EmFZ4+1VbLLIajiGLZ5I3OnIeuLTkqqobyxLvwmjpLQjJ7xcTF2slqOWWkLKfXAQWwupOe\/gSX8F81W8iEqJUf38+Jn7YDsH5u5+BOK\/K3zM7b\/PEhODuc9uL\/MGSZWCy+rV5C9e+IW5Q85yRBXDYKxG96APjbOlT1FNfMyYxm9a3c+hni7HVbEdgNegq0SdG7DpfAYDMmYTosAvhVrwLR5LmK6qwurFADTxAkuCEGFrEajRqTzHXWsgK6+VMkWC+IGv71kCxZULDbR++gcEXtEnw8ho530TowF\/91jPC4RPay05E8MOG5kbe3YnhjHXuSUK7j2rFZCJlyhdYHWAzoYhUXt5YT5WpVr2egONuB\/vt7fo6ozLYv62l3vhD++npinF\/vc83Wk9yJOGtbwOyZLID5gyWoGoi6cMZofarZ4xm5MDr7QHGKyMGUZmUFR+Zcw5bAx99RHoEu51K4E8expuM0lpAgyuaqpQxugrDCzGco3abQOjAsEPRNq1s63VNpPN9F2V+ZAIdCj7RujMevKjc3dalU1DPt0cy4j5lW8m8u3gm9OMu09XmYkGKL8VyLOXPfcKg540bgRTZa\/27Pf7GgtQi7A+WeKZ1Vt9ND65G2ELRNPwc6dbqxYX5Fepo3XhEvHifLdJgJSwGtCzbaHnKSQnrCSR87eI7bNGsE2+1cf5AJCkailepO4h+7s5+Z1VP\/34pOfo5VfPuab4mdy1Gi4IYB9M7le2AJZW010kkQRd7BJb9ePCcINjd0nfXD\/1MOj10cJItjxqMxYBycu\/Exx6Nj3wCOTOEOeV4mm0eJS0u02s2CQZ5Su+76+aCg9+S3w2gHSLYX9Et22hyv6f82cDmDf0q+UDf8mVXE3q3\/umb18xBzqCPAUUxFZE+bghje4mei4m+ZOwvvLo4SVEBE81hmQ2hERUFH98Tsz+j7f6dcNJ1Ng9PR\/XFRWB4lxUfFiuTI6QeFT+P6EmjZXmZiUNPns2JvPe7V3dTXa\/5dHjvr4iY39+MKPkNJn0bjmzlghXCtyue\/M1jNLkTGK2wiA+bwJ5\/U4AJ1oT9DXNS293l4G9DgFMaq\/3g+Uq+jJnlw1n+gVTy05lJX1qCZLetu5MMYcmdRN9FwghGCEMS3LIuRYHWn3mcaUOGlhZXPm+3+ySt\/\/wlhpiOE\/Itu0AtaOEOjniRph3OD9nLP+a6RVgMZDX8CYMX1E9DinnN8EY8gJC6wx3aIrkxb4n+2LhZKdBkKrP5tbzptpc4dSyJOAfj0hwx\/gV7ShcdFq2SK\/Cd4\/sK+uRCa88FYgF+LJMgW\/MeDxxMJN2UOFOGX9AI6rmGVl+xiIMuUGE7TFl9CEONltQUVFcOCcQOY8+67R+WNKHHfBwZHtI2S\/JipmABwpACzARys139Eeo6ASTuOGdbibLIYKzoG89WftmZ\/O3hWfPAZ1bXuRAxG6bq5upBSDt1PzeEA1zY9rn3Cp7Ds2ZXrCQs\/Nl+clKTPH7kcblWQyIJ8T8ye693OeDDbhe6hscYYdRbX5tv3yTsPyu80TeTWqp1P+n2tNBJezItTQtA8pKozpxkSVHBpxLwiJbJM7fasKuDdEtGf0f9mdbxuxWA475MKWga+rLKJKBkpgJE4lOHWOQJneO3nh7AMSasBlWx5iWXVYOd+GwhDkVTqzqkuBSmQmaNIWCX0NdHC0AagsjWrhoBLVLiZe39chZcqKmUnR4S9yilNGBpXPzXm0+byuRjAS8\/fH+1m\/4j11zPerDE7A+GmIUCAWjEkADd0BbD62lAo3nSnAB83R+g5eunFjo+v3RMLLr3uK8Ib1qoliyvPhwi\/KXik6nC0ox+wDDxGOwB9pS4NeDA3LjErn6r5I0LoVmQB4mqmiUDG2eOHEuYGw4vYi3fLFCf9xZonVDAbZwKhDxJj\/5ZfTD9EwjL\/RnDznd+Z8QZm9ucnYq9v9lO2yzZYG2tzXrZ9tI1qzWiVP3klYFqfy73UBIyva588NSzhQQFmTaXrQqUGybqZmGbM3I9dyKvuUeZoNlyS5xH5wDoyC4P0OisXOlKzhEP5hXExq0M=","iv":"bc69902171c11931dc27f2d276ce164a","s":"445050abe685dee1"}

Since raw materials make up two-thirds of fashion’s climate impact, addressing this area of the business is critical. Image courtesy of BCG

Since raw materials make up two-thirds of fashion’s climate impact, addressing this area of the business is critical. Image courtesy of BCG  The opportunities are huge for brands that successfully adopt green models. Image courtesy of BCG

The opportunities are huge for brands that successfully adopt green models. Image courtesy of BCG Legislation will become a bigger decision-shaper in fashion with every passing year. Image courtesy of BCG

Legislation will become a bigger decision-shaper in fashion with every passing year. Image courtesy of BCG