By Meaghan Corzine

Did you know that the luxury watch and jewelry consumer is +8 percent more mobile when compared to digital shoppers from a cross-section of industries?

Combined research from DLG’s WorldWatchReport Benchmark and Contentsquare takes a closer look at user navigation and conversion.

Where does one begin when assessing the behavior of the watch and jewelry luxury shopper?

With the lines between digital and bricks-and-mortar becoming blurred, unifying data sets from all different viewpoints is crucial in painting a thorough picture of the modern day shopper.

Combined research from the WorldWatchReport Benchmark (WWRB), the leading market study of online performance in the watch and jewelry industry by DLG (Digital Luxury Group), a digital marketing agency based in Geneva and Shanghai and publisher of Luxury Society, and digital experience analytics platform, Contentsquare, shed light on the unique online behaviors of watch and jewelry luxury consumers, helping companies grasp a better understanding on converting insights into action.

In order to get a more holistic picture of this unique consumer segment, both sets of research were analyzed with a 360-approach in mind.

Device usage in navigation and conversion

Contentsquare’s data suggests that, on average, the luxury watch and jewelry consumer:

- Is 8 percent more mobile when navigating Web sites, when compared to a cross-section of digital shoppers (250 million sessions analyzed from retail apparel, cosmetics, health, travel, banking and automotive)

- Takes 3.7 visits on mobile, compared to 6 visits on desktop to make purchase online

- Views, on average, 10.5 pages per visit on mobile compared to 5.6 pages per visit on desktop

“Not accounting for cross-device behavior and other stimuli, we are witnessing that the overall pace of site shopping for the luxury consumer on mobile is quite rapid, almost implying spontaneity,” said Christopher Peterson, head of data and analytics at DLG, who oversaw the combined study.

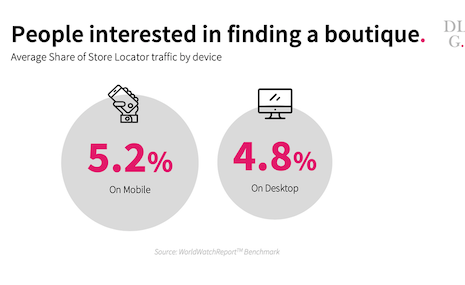

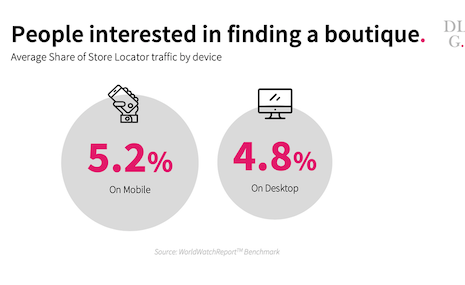

Regarding store locator conversions, DLG’s WWRB finds that:

- The average share of store locator traffic by device was 5.2 percent on mobile and 4.8 percent on desktop

This means that people are just as likely to do pre-research for a boutique from a desktop as on mobile, when it comes to finding a physical store.

People interested in finding a boutique: Average share of store locator traffic by device. Source: DLG

People interested in finding a boutique: Average share of store locator traffic by device. Source: DLG

How the watch and jewelry user navigation impacts conversion

Brands need to look at more than just mobile versus desktop data sets. They also need to assess the layout of their Web sites and which page types support ecommerce conversions most. How do these pages impact the overall site journey?

By evaluating customer intent and experience, pages can be tailored to help the consumer achieve their end goals.

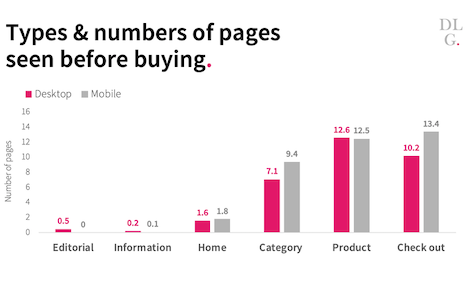

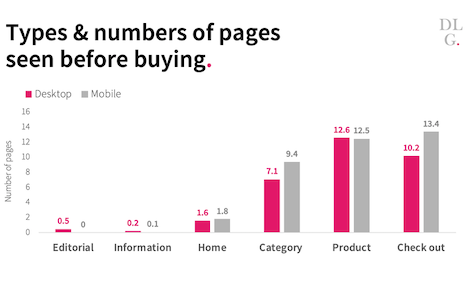

Types and numbers of pages seen before buying. Source: Contentsquare

Types and numbers of pages seen before buying. Source: Contentsquare

While many luxury brands tend to focus on the homepage as a key touch point for the ecommerce shopping experience, Contentsquare’s data indicates that this page is only viewed less than two times by luxury watch and jewelry consumers who make purchases, if at all.

With direct Google searches and product placements through social media, taking a multichannel approach to reach the right clientele is something all brands should prioritize and requires thinking differently about site areas.

Category, product, and check-out pages benefit from significantly more views by both mobile and desktop users, compared to the homepage, editorial and information sections of Web sites.

“Although not the sexiest, it makes rational sense to invest more in ensuring that the check-out experience—and all relevant payment, delivery, and returns information therein—is as smooth as possible as the consumer intent here is very singular (i.e., to buy) versus other areas of the site,” Mr. Peterson said.

Additionally, the data shows that a buyer session on the homepage of the Web site will click more on the search bar by 53 percent and the menu by 13 percent but less on the homepage carousel by 15 percent than a non-buyer session. The interaction with the search bar seems to be a positive signal of the buyer’s intent.

While it may seem easy enough to treat all consumers equally, the proof is in the data which demands a stronger need for teams to go through specific trends regarding specific user segments.

By assessing these combined insights from ContentSquare and WWRB, luxury watch and jewelry brands are able to identify the most important online behaviors of their consumer and optimize their journey towards conversion.

Reproduced with permission from Luxury Society, a division of Digital Luxury Group

{"ct":"+msZV2MJeGFSgzO7UJ3ycy4g95B76F6Ni37uIfsyDaQ31L2NJLG+3\/J83MjLwDRY1efZlcpcARvaKiuQlMiFY4BRHfzItI1JDGhroBKlU0YKjS7qMP72ewzG07bx6NJcltrN1mQ0+wRbPT8teni59pyKt63w6bTZCBYjiTKU0385OPfHsxQzJX94i3kECRwj4UfDlpONOH8fXw5UlzT1mz6dr5p1CSaIMuoS7Fj1xpwdm6nbiQfO9HCaTOKzHq1kIq6eusWKhOzjcscvY+XKsRBowIzIjn7ZYG6tCqiQ2jzXbJ2StTiph6D3frLzrebydQ4EXH5p7AaQ3rrAIP9BjOvV9OqA47eNUiGnje5CCl89ue5vNzmDvMuNnaDe7l7p8p5Fn0GhPMt6fJ4Y24Pq+2D2\/JHe\/pbTs8IzScqpT+CRke3NOpOkwtxI6vMmbnAULrExmJweiXqr9Hue24KKkjL2OjHdpfDg80tJDt0MCdOPBnUse7qmFL6+VbdTkZ92KzfC3VBS0JcY82IMgkK3Og0QYXxrv6hV9+JcAc7NCUISWqgnaP7bfNpCjeZMwZFqfpuhiWIucjn+3sjTrTr23gnlmlXYOR6cXRB1Q6wVV9dgMCNBO7X1t3R3+VYbjgsu2NvUvc\/yghwkCbEmwxJgW9B9XBjGVv\/+dhFXgrMpbd5V180xRQmGmxGARyaC7FTgdSLGxKxR9LmsSayYZlDKaIzT0rKAhWtnJHc1XdIFChDCCaBeJkBLbUVRmlIabawUH8IDr67qFIHc6RY3LD1rXWRplT612VTJt0N9jPQK\/iUaY3OXMKqU+X4Vo7zUxlTVy1sDcejLte6ke9Ml+wI4xf9A3PGbZBRR1Wsz7T0Z41MjYsruucT9Yja06NhuTR3a8pAg4dcynUm4kmf5iE5\/L56llub+j5RMyFvkcJj2RfXcdBZybubg9aRcOjFDzfRVlOJDUaIi1yoNHLQm9RKVfcEAdbptnis8W7vt0AoRE\/ELUmyReVDHs0nidC4awrpiLlDPAISEx4ZPeSm0OBk6g5cm9fjWTnqzCor5jc4GCOh1E6il0te8M43Zw16NsAKBPi82hApEMS9JlVcXPfMH3fnuJkotTNUaFs93hj9O58pKcJ0Ny6qoGyOQbSNJI07zKAxKltO2KzmrthjIiWJmrAINlfaOY4FUj+MSSzgcBxwKBj1s4BbzTq5VwNTasOQ7pYOCyMgoNpZyKaTdECKD0NquvXuwQEu7FsJ9shVv4m\/x8aSD\/xOdRe8qmCSVLm7vzTMyyLBoo02rzgsS7mUfXrMdSw+RoHi1tMdEmJrlHKInvjw5vBYgo0UfCB3Q7QORHSDnOjibAGhePgTjHl6ToyxVMilNUtm4OGGy51t1ltmur471RZprGTDYi\/R1npvpJ2XVdTZ\/BfAj1Pk8WJjNWd06aah0G3BSUVOxpoSzKsI3mgwfez\/ZIXMVv8kg++hJPpiLEPZIUg5lqgpH0Ug623\/SgqZREFFPIUDy839HI9xUn\/kFkkcsynkJl0\/F7ycI5DaTRX\/G2iRJcFIt79HCqkysPTt3G\/QC9QPnUUa5phFr5rZvpliLPOcGfl8IgXnzlUcn+4E1TTaE5mckSv8AaOG+eNKqvxreSzTEXYbpUluJSrCzlwBwaNXEmjN+nLloeIuYY6UmZhWUYDR6KH\/o11JXCSOHI7ZJBLhE1JCXT3VhZTgZYDol96NLbPjSHFGlmdcgfZcdVaptL2Sw53ZLa3kjCQoXbRgivvVAlSOohU+ur5KTurwATa81ut03RQAYVuuzZbxTihK3a4A0YNAVjTw\/B3+NTOtsxm+X0UwKOn+4ZCS0HkGCk0wr5NC\/FSYgKhgat2nZ\/EwknU\/ApxNeTGBOMOe\/tHG3pytVi5sJou5AFAENiiHX4mtvueVxms3Z1F2+DjqElo7QffAF\/s2YgUxeasRj3vUo\/qVtuwLN18xelhTbxhlSb4+C2YDOHRfC0OHS+BrhjUL\/EJQ2QJ2u9dketwWaJjLIfdm\/x5zoPrRtDLVP7upqUC4EmUU9ffJ1CVqfKUWua13676JMoqsU0NbcC6wPEnAMJQJBybPwiT26TDMXMpH+ooM4d2hwRLHNRwygIbAtICjvYxwh0Zd8bxRxg9P5TbKVYf9YUDdZNUQBmzVZemHdl31rG1Ew4KfoHAAN7Fb3aYV9ayXdv5p1\/sMMjKGJ\/bmoXqM0PiMAkfZMqvilUPRtQMxYHCDiCcMwwU53QnpHaGk4ij6UL5KwTScamS1pc08Rk2IPAr8+YpUQ73HTcdj2qefYLxL2Sh+mhLtjZcM7ijEt+DpIjkbZBGdMhzPxwHxe9A31Ir7QlT8n9mxYm3PKMFlyUFsFeoquNDkZgXLydE2gKoIG5Lac2qUPjgkVIJodPREdCFBbK2iYJ9t3iNiqmOxz4+k99AmHNDublyWsjWtuhqCBpiJG4gbO\/qcBrh9Ajol1li6ZhDmMs44cJII6BLWQGASsYllmkH5d\/xPf3m2bRQZ2PQX576axy5robE8OZBAwZ5VG9uzloz3OvrTIsnEVd6GvJekmj6jLbJwrOTA2U9dTfBwb\/OL5rrSbm8E5+2CEfF9zo\/ZBNqrHG8MNMSiTk6YQsDJ5hEUSWltCDUP4xidm8Y3VsJxr6dxHDABMXm8vzEnaQhSWy8+Ir+XghszYzibMbaznAAdBL2uISdsCpPYsaYxLwQn8Pd5WYfBHKNsJaQMTurgsi\/5NgBAJ8qo0sqqwZNxEg4WHr6Gju8H7LauS5QIDA0rX+oqO6DE8f0nLits6RgnmcqI5IPFNGlzupFmxH26Lsi39fJwl1g8smHIgZrfZDLX7FEw4UnoBRCjsekAZyAv65OcBqBcxUXhbDzRRDeQX0l9xiNIs2MFnnLg1ShHwkpSvp7SAHJmpe20M0mKX7PJ+W0pK1uRPZqEGyz\/Ijsq7VddmcdnHczRru4FjHeLrUknDuyvIcGDRQnqRejezUdT\/uLRwT00crSe4p7PF7zap+4mG1lg8Mt33lcegbVGU4djQNz5XBbwp4hTbUIUud8g3mmsX1w8PuI4h9ioSkFLgOqjtaDH8+gtFVo94FGpD1r\/vBY\/aRyHIyk1dJ+yHeX7+9+EBNoBzwUiFlcUP2\/skkWtKvAjSVHxsSJTZs1IqfF162Wr2OGrtscVJi7Bglf8WzmAtQWdNOZT3AaURv4sZ78ZN1DEzD1faENXBp4jXravkTWxMW\/6ZPYrJWFO8refEnTQ1BKC+z\/u4IM66Wub5eE08RAfYAgeP47Cs5uqZ57XBCjrhwFCA6WbjLeT85PhTt4goWnNun3QeC1MOdXvTUxEbSenwtWzkpOOgVgnuU5V5mdtnWyaaKrExvgIwM6SqAjMY1dcV+0c3YqOc26OW4pQoTJUF3Mjzv3C98itdSjjvPDSdBK8LXAwBaaftt7IRHHiFVbEGU9gZNqMh0mmgef76DCtan0wF1K2HQgFAk+OLn5T08zbFNz2zWrxXGcceYoFrjhmPU47MI6+GFKAF\/MHV4yMajwLARppuDaVHhnj7hXY58Jtlwgyeq3Qxz70zySRDRygD+MjwqzilI1stx83JRgF7v5Z\/omnC2LHndMvnT8aalk6\/Q3vmkZKeYYyvhhLsIwc5SoYMtduzSVndPz0pANYlYGS16c8w3W4p2mp7tL8E8oW8z+\/8dL4qIWueUC7BmprzRoWW6y9qFQHfxdI4X6ugCpMgvGZbXNs+eyGjZ1QNxblsuPAqNZR7eLxr1ibCM0u0knJruOnmkz\/18zXUueRqFOFb3l5GCK34Fbq1N6rHvaQhExX6o6jnDyO+tefMDTwzTsI6DKEKUj89q1IrhKcBRMWZZMb9HcKKzeXtSy3jomUcvt0KM9z59QeeNZ70L7pEQU0weD22+SUmVuEOcbI49Bzks+5P+ji5DmZnbcWeq6jWvWn2zk0u3FNGhf0AbMMmCShPgg4APfJB4qXWuq7kgUQDMsqsQkz3LqoORh8Lg7pmyulMsw9Vy\/rD9ItjoPHkA9ZPFRivkr3i3rhFBYsKKnBSx3XYaMNILRP7sa56yBTSUcDToDbyuDhwsFV8bGsSVMsMTPXyJyBcCW5DMuIi5vv0v2RjhN+\/Hm7iYUkZO+jVtv+iORHh9WsG+0v3JELHzYPHodCs8fSdEbowSQTmYis1Io5otWL+H3+eIIaqVIyYgI4tlKrN+4Avq46649zwTXkxNpvcSGnGHHF\/q0ZKwr33M2B\/EHTP8DDoTCTiQR\/dnmKJJtr6xVXJLEkiLcdsSLrEWL\/nFnjpw1JaUsOIErRrHLTwkK+rrvH7lmvW4NNUhwTJz46DFmxHUN5n1nnWokLPobtwj9mdQgnXsYtiTiIIEEX2jTdUd5C4MiDmDpRSv9Vomr9+c9ZYeF5QxDnewzqugAygax5rbYm43c7uAPanLX0GM0iYwkOFF+xdOr+KWPxzhWom188I4\/EfK2fMcgnisOZK4XHSnrVXa5X7Abb\/7pt82nAJX1w1ovDh5MvQlMAHcx6Yf75uEVEMupW9uMUGZgHzVxiWCN72+0Lt0mt8MPqvepzUbE1lYBZ6umuhdIU\/a09s7osNWwt6x+vrCrY1aFnZt9QHeoSa\/T\/KViP0UXdn75NeiCGK1YgU2a4hnLnurm2bgOiYCsDxD8jIbcDmQwiWrHrv6y5YsS2dWgHJDDghJaLNv4JAekBTDzF\/GWw+P6T\/uBj8ydfPd76LmkRY91qQDTV3r4ceSjgNvEQ+LTxoIgHkAC6COePl8nB3AeENeCXpAU+bGNQ6+Vwx\/wGlMvI6SucJvoWl3\/yjaAXxmpKroTfTVNYwqdB4V5b8jmlUl5dSkfAzIrDHKvEGwXKRTDLjqmE4i\/gdUDmtMOjgrnUOMNtBVF9lTu2s\/0F2NLy7PO\/H3f8ko3hWJqF93SU1mX78D4sTirAJqL+1p6XUcG4eHeEn2fjgCwv8BchYdLrnv5k7de4Paz8sG8ki7hvhaJ96bArMhkf8piXYIHZewQVnrMCMpoNSxFrGAQTr5MEv6qm5FYKOx\/MmH0DGuCXM873R8gjElX+xMqJBep7NDEi2KDPk6nLGSeSEyxcnzujPDJx7GsGyy9Fe6RmF5TUMwSffDGjpDxsiHRrBdZ+WH6j9WvZzUj3ce\/EemWCWJFuGr0rhlKlt5eYFb17WHjVXQCHLY5k1w0W896LhOq4r2\/2bfP3MimkwVigJkd5OMQtBz35rF5e5GToHcslfc1DY\/qbHqumlxVpXjYF44JMk0u+nz2HEg5nPLNQgInOVNsUPr7RU37j1y3KGR4k+4vmYeVP3RR+fCGpmhLLaIf9ffvYqBIInyA5bZUZJb3+n50KyuXw\/rqX7mEtn3N\/ioh\/gR6SpQHqUNRj+m+eCZzRcz3Vp2pM6IBJ17BpKJv6BGUU63R1kkRL7Sz8fzcbDVjjouvS0F5HrKORPPPqksr6\/SSkTXnsrq4ATO4RBDGO9wGtubFnjaF4FTD3DX9wxYiFknlx57Y2fK0z71tHzsfJIvFW673USCfR0nKdgi8ehYICNHYilDH+WqTCEflC+w7kALedHCrNa6mFjyQM7Tq56YGrnOlqgxvqWt9NOxhAwIVUw3oq9N7kXqeVJ+3bTwCbvB+Ba8NDTgVm4RdXkoisVywWV0qsNfMhqduqVRD63q6XrODPx2eXZseKHoKH7S5LaenYPtyjHt\/pRw48K01sWAKpgyeiNm2\/CHIpycCJEPz6QpcYlLvf\/orGYXwvnJtfY24F92y6\/YNdaw8UnzdmrqHLzcc2+NtjW4ignUatnefgBj\/rHVX\/2jfkaGs3T37n6C3FHBagObLkJpjz6DmTUp1xyukq13NDdanTBWYVwW1g+MulVL4x9BF7Ru8+HIPTg0ZOyDG5FLWS4X9DQUZklYNCVxEHTm4X9LYpw78DwJwDn8TgfWMOR7NM9DUz2BZgVve0ux3UXnLpDcQZyPDBhB2hK\/f9tsers97Ar+Hhy1RF6vhKcsghxA7jZNfl5eQr3ZLGoT4wCpJDB0c09eF1M1d4aES6NB+5EQldkkz57hX3oAUCl2hlztPjUBB5+mG+Qa3jHgNepvc8EI7JrpeUrlIg7DlUjn+AaSsLPcNQ1D+TIyxBEOsZXaJpjK0HxaU7AYvlxW8ytRP6oFEJUkBAIJ1FCIV4GcG1uU5xibWUY00Nn+v5CMQxcViZcstnfHrPPz3AdjXEsDBcTOjrveg+62zi0UehKNELu92UUj06Ak\/M\/9wjeqxwTO4IgURGQACVn28CdqoVKdf01cGCtFtofos432JMu6RiY+5BU5uzqtfuCJJT\/VmWHSEIPzxPeJv+ubBAbagtKDKn4Df5HTCXN5gtKiQoVTYRdMxS1aeRinIJ9cQ\/oR11Mosd7XDxNlIPl01bPhALRjmbssBnp1wg2p2kx6GFDf3qJwtqwpWZWh4fdi5I49oM2BxqowiOO6CUw1dTiAuL3NfSilT13Om6I2Koo3qHfPhE8ED0WvF6FiA\/lmvSukdZGVmvUL5Ab5lJyChBZeT1\/BM8CFl4+mVNq0QAjek6XNoke3IC0RN0NrXU5G+\/aVR22zq2OuNOrdBdIMxjLEcCh\/dqu8J5mRI9lLtaKk56OOE9ZfpOxa9LZSnTETU1gU7GiSuqVS+AhuRU4vc97uCYt88wtr8ioAf3MwrQSOpN9QO62wNpTxGxWwwfy764dD+BUsKS6vqQIqhNotGU04fApsBtrPu6c+Oy+yrr0I8yf\/hTUsyX1izJXKtWoB9hrJauHWYxeUGoke4MksJrRiaMIrO1Hq9ETYVnMPc3VuNQWLpdmkUaR98pwmMadHfow18eGfi9UyYkCz5tXEEEafl9dYMESFnl8lZ5+MdeNF2PdIM\/O26Nk8ZnWFcFeUcjdr1albLMlXnAgzSBE0c6UN6NTyWPd2YMz+4RAMX+hkX8\/8V7cG8eMfsfQ3fhy6Rggy2v\/yCun6W8ZufqZrEzUz7qwZNRQCHuNo6lW5S1jnRJjzfprDTTHgFCt9d+9kjZssCmzPJkbYLm2h8\/tS1pUAGwz10e1nIAR7CgwccFLA5YSHkUyIPQ8sTXan50cCIvfqZNleD2+U74rO6tlzEuAx\/bqLXaJICDek4u0Jhr9\/344G225XR9Lg7eQEy+HwCxvYu4VMwrAjo3xuInpsBZfN0Vs5MtWPJYLl1n6lgl8EnwIWr+sm\/0j2quFwyOBNxqf1CVK1j2T4X1JDKte\/9Vv8jGlwmbgqw+xD0J6TfWLt\/7BJXEPU8nn6OsuYNPS\/kbxbDmcMl9k68tAEM\/FZ+Iv8aeuJBz2U+QVxZ5FLgdO+CfQ8oQwELpPIJcIG\/364SBTNMrBWrTur3aOjQmMhy9cGKuiJlgUoviLYTo7QRkmTRNe0Vgdjeht0\/YYbpuksSwWhEQZ25uI5IuSa9pgZoGx5\/IGC+eSC0X8fd+dSEkMKaQybeytzI8GHgR\/W5PjSV1tGmcdXfP5Vd+2tlYSEqbohUguK6sFPzLoOT9vg\/SEdXoAbb1OAkHwT1q9WK5smvplfcwk4D4vtSfM27li8NqSNO9wI8tZ4Fxp\/v9voaCR+TmNvjRGUbBE5j5ArwNdBalxHTjwKZ1MTjFuJFUBEh2gJVBajhoQdmvutzvp7mqAOdqbh2Ifd3azWL0fr3NSD1X3fxXrMz7pA+aMlEshaFl8sOsFfPyHfNHFExWee4IUEji8dKKTuQirkxPZinr8wWT0rSsjkgFgGPwjyHiiU4jN7SXEsg8ffQt4FkvLiq9Cq+D4GgsMLeK3g4PcJoZR\/of1UAIH\/JOEs3Tw2ilQDuUJOn32KLDIBlYF5FcJ941+KWv62LLgw7+d7S+j+C7XL4Qc5dErMd7SCmO1KczaZHuNbSepAHKEa\/RHy0HYUrgV8l\/nq2rQZGxZe3T2GkcW1fklyC9UO6CByrneH90af3HzjHudl8bJz7s0fg5WhnBI6vZAUgaaeimBYPJXD1yEtfu3Gb+FuA\/uq5n8TzAsxjwr6AwAK+Yk3pWLq1fYSpnjKVhhdv46xHdyRqbKjwr5H+a5J9vuklGXvcWpsa37g599vbI7Rr36WaK8l1B3aUtNOUpPEdFxfKT1K8DV05hjQ7QdcKVJDpuAgwAQkJ64fmhgwA\/6d61xPnqftgOpdJ1pY7FITdJySbmLRpMhFlGlM+IMLSZbM9FBuRFGTlMANQBRSJFjgWuC0B94IB9IX5hkKJ4ubca5aXorFzo4B7jTxcRfxklXm2RIQJVbh\/+xNul58RI0C3iGiSW3wyXB3L\/10jb09eBoyPvnC5KdwlKhkuP3C9\/RC3LZpxY28oiAlnck5c3evDrauW71g1PiHd9CdXpu2WLDxVZPRD2+5q5wLP8zZWiCBg252mf8oPZeZJIuiPutBQQmBttI3BBt3894DtDLEiHUWXP3qULSaZhEmoKxt6iHUHt+giTXZR2OAwnn+V1drBaHjYIaCE\/lx+nouetUDJjjk6vKuBR0lcXcAQep8jdwJ3cXx6D3ZiXUk6jfVU7SepHTHogmO+xS5SMdI9i4VrSE2qQ1\/nBdUDxn+9goRQueNs5HbH1Zpr9H5D27NyLNrp1gMFXTagO1qTlQxV8BQrFBqz02lnfUv4t92epp2Epx2x9BNaxFm3fpvhzKA6pdqlI81Yq1Yt9GNZdWgfYabcXwtECKJaUMWhvMueguoCuVkcs7b1zmPlg0jF1Hd5NKeSsiJAoDkEGnByIoL3Vwu2YGR8q1SJFa32w3fgqIflkaN\/9ovGmc1ge1lHeCvE57GNuL5ier7+J8Z2vnhJVUeTpUeQvwlxYN5+Xjnjv5iIH7IWBsRk9VxwqvbaK6p6jd\/v0Xw4\/sC22zXy6Ze6TamQ==","iv":"5c78a899a3c1d72f4ca358c5928eba40","s":"659695cffd14f5ab"}

The luxury watch and jewelry consumer is 8 percent more mobile when navigating Web sites. Image credit: Contentsquare, Digital Luxury Group

The luxury watch and jewelry consumer is 8 percent more mobile when navigating Web sites. Image credit: Contentsquare, Digital Luxury Group  People interested in finding a boutique: Average share of store locator traffic by device. Source: DLG

People interested in finding a boutique: Average share of store locator traffic by device. Source: DLG Types and numbers of pages seen before buying. Source: Contentsquare

Types and numbers of pages seen before buying. Source: Contentsquare