A new startup that envisions “jewelry as a service” has just raised $5 million in capital investment, suggesting the sharing economy is alive and well in luxury.

Flont, as the company is called, was founded last year and has just completed its first successful funding round. The startup allows customers to rent fine jewelry on a rolling basis, returning them when they are done or buying the piece if they like it.

"I’ve seen firsthand how the jewelry industry has changed, and how it has been impacted by ecommerce," said Cormac Kinney, CEO and founder of Flont, New York. "People want to shop online and on their phones, but fine jewelry is a high-touch sale.

"You want to hold it, feel the weight and show it to your significant other before making a purchase," he said. "I also saw the growth of the sharing economy, like AirBnB, ZipCar and Rent the Runway. Sharing, combined with 'Try and Buy' seemed ideal for fine jewelry — it’s expensive, you don’t wear it all the time and having more variety is better.

"This inspired me to create a solution that consumers would love, and that would benefit designers like my wife. Flont enables the discovery of talented artisans and lets consumers enjoy an unlimited selection of beautiful jewelry, while keeping the pieces they love forever."

Sharing economy

The sharing economy has disrupted industries far and wide, from taxi services to fashion.

Flont is seeking to bring some of that same level of innovation and disruption to the fine jewelry industry with its "jewelry as a service" business model.

Instead of purchasing pieces individually, Flont allows customers to sign up for a rolling collection of high-end jewelry pieces that they can rent for a time before returning.

Since its launch in October of 2016, the company has experienced 100 percent monthly growth rates, signaling a compelling desire for this type of service among jewelry connoisseurs.

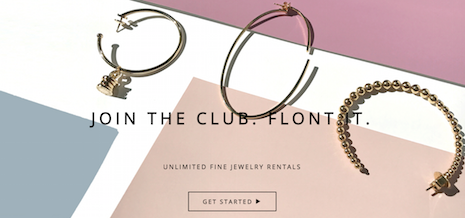

A piece available from Flont. Image credit: Flont

Customers with Flont can get a new jewelry piece shipped to them at regular intervals, which they return in exchange for another new piece. For pieces that a customer really loves, they have the option to pay extra to keep it forever, a process that Flont calls “Try and Buy” and that the startup claims makes it unique among similar fashion subscription services.

Flont’s successful funding round drew investors from around the world, including Hong Kong. The startup will use this capital to grow its staff as well as its inventory of fine jewels.

The confidence from investors as well as the strong growth of users each month show that Flont’s business model may just have some legs.

Jewelry service

The sharing economy is becoming a major part of the business world, and brands are working to figure out how best negotiate this new trend.

A recent Robb Report survey found that 37 percent of affluents, and 60 percent of the wealthy, have shared their homes, vehicles, yachts, jets, apparel, jewelry and/or watches. Affluents are becoming more comfortable with the development of a sharing economy, but feel most at ease renting out their home or lending a piece of jewelry or watch, at a rate of 80 percent and 40 percent, respectively.

This trend is reflected in the rise of services, many of which are offered via mobile connectivity, that streamline the sharing economy (see story).

Flont's home page. Image credit: Flont

Flont’s successful fundraising round comes on the heels of a similar service that also saw significant support from investors.

Membership-based horology club Eleven James recently raised an additional $30 million in capital to keep pace with increasing demand.

Eleven James has found great success in the sharing economy through a platform of “discover, experience and share” within the luxury environment. Through its membership programs for men and women, watch lovers can borrow timepieces from the industry’s top brands such as Cartier and Jaeger-LeCoultre (see story).

Taken together, these startups show that even in the luxury world, the appeal of the sharing economy is strong. Customers enjoy being able to try things out before they buy them, as well as experiencing a rotating collection of new products without having to commit to one for too long.

"By leveraging the Internet, many more products can now work as a service, all providing an experience, or product use, at a fraction of the cost," Flont's Mr. Kinney said. "This revolutionized jet ownership, and more recently, software and data centers.

"Luxury brands are sensitive, because they must protect their image and exclusivity," he said. "So as more consumers prefer services and experiences over ownership, the luxury industry needed a new model.

"How can you sell a $5,000 bracelet on a smartphone? Either you advertise massively, or you find another way to put it on a client's wrist."

{"ct":"HcyW3R5NLekyLQmWRWsGW\/3A+HlGgxdHei2VubnAhhoaL3bV08ztDgEU8CQNeLDjzCnhttEBzegY84\/GI1t4wcoJUqp0XEOZZCQni0LJxKpp42va+UBp891sELenKjz5\/mEi49LO5zdk4JrhigFSG942OMO7tS0jivHUMZyNdkl8v4rZ22EFf2RdmPibKyuPpqbQJSxN1h45BOTjaQKK2DVj6M6SdvZPGQ8Tfmrh0+q3B7VWAInEoTQCmY4WX+OSpbn1lIC3SjjgByIfipZ7HhVPoMuQP6TMHDnqdht6qEZmVvoeMGndtWNit5yzzYn+whZZ9a8GIcB6bGWyeoNo66vZf6UFxn47HoLIGlZWr5\/V3GWgm2+HFosRIAcNAJh4wlQ27wX9UHneA9ee\/YEJxzq8qQ8\/mI+ii7zK6Sv7EDVBzaGv9VLb1ZqKkgnYtVzF7jI23QfH\/vmKis7VyrUL5QK3c4u1Z1aBuZpxtljapXnB58p3h0kUvE5gtldzZrcISpcqeIS4uQ\/ivriq07YyjeTwiuvG4\/Tro44xNdryqqx+H+RU9FLwcoQ2+jNoY8ZGq7PxZE1NlkfICZMDwNv1NgCdI5z2EQxFl1drM7W1F9jKRm1Zm2e72IY9q\/7yjzG5+ogD2PLaWFJj8aLUf8vbLeGme0bHhgRIPc1Gv0gHip7msHv2LigY0ANOxTxXZ1HftAOK6W2F86jGg4OG5pUaM0HaKAMQ2RFtPOdzSIEmEWVqrkt\/G6Y4Cnf0ms\/udbjBcLy1ORC\/Qgb5wuvvFx+hORxC90VZetQIDvnVyUelRKPJ+ua7QQdiouwbt3HFSodGIvIlohzuJ0vXJ25wd1JLB04FaBgizNzC3DWAdCMF4dGKUp+upM2MKgVm3MgBXRNuOrhUe+MPOb+cZLvBAQwBwlgfA55UC2cBkg3ChxkSd2GOtEKFi7U91QDnlM3+HQ1gdMmpBhImUozAf81Wz5Iek36cH0MN5V+Jogkw6VY\/stufYOnNk8+ng6ZN6IvG8PjOm8QM9rCB2ELqhsjfehe\/N5UP+XxexA8Bn2QfyNEtn89x7y7vH6ZUTQpMzuKzaVdL9NsokTu8qECeyPAyxwPHuvXRdAN0w2pCblOZ\/q8An4RYHv4QN9entrsNVEAa2zetskEz+RLBFZoH9kILs4892gye5RKErW4oYLfLxW2MTZQrSlrnCzNy5g4Z1\/CLlLQ2y0PJuIaGcSJ\/iCC0YXFyRn4vLFyttSb5y6uuzuv+SP524QVWEJrN+3JU\/QaPRi\/J+HzZw5Wxl55paYKlQM\/PsmqXaGOVu1d5rA+tSav1WlESGR7Y6qacvQ9\/yWildQ5AeZROeP+EiuXHfZLjlA56qOPqNupTmj+T0T1slN2NUkG7kO1MchHJcY+5WmgnESlHe5YOY+MWtCS9M8Ov1Zbpcusy89tggNcV6YvPMao4UcKEosP2ioQkF1RSq7KIDqJEKWQX7VSwhJrOk2\/UZuEOVKW1YeqoSNBhu0Q53P46PwS0hVl780ajmRCem03bLHqYYlrGkrIQN82xQZgQDfISuvl\/EDkFACvIUExQyeaff1SdLBsx8cjiLqfO+ikM9ZMolQ6wrK33rUfdN5QX7NONqGpdU1MD9JREKlHKAVHroIYg9YBqqfHxop\/z24ZruUl0GwWUgV44FAWOjNCJEYg3+6K1ws5oSxv\/Y\/unnSY83XK7EBPEFUaxB\/NBcCacwWaa5F27lTLIFbY6E8fAjBCc51cKt79OfRMk2+r\/gFPhY2sfi9JkFnE3k5j4wwL\/KbIOp1zudrzJNvQNwIfbsLUVgyoTVdT4MViBfPhw8kswxw7YD\/67TSjH+o67S16iEvOASZZewfmgS8PEeGcmJaqRUL+QU86tgrqnZ7FUAjWF6AuSkCjEotVfVXL5ItjnaJKecaBaDFhcWhPIRcM7yS0+\/HUjfMZA0UmjSMbfqvtSwDv9gMDm4lNgh321aoqSkW6FawJP0nx6Vc6lRCQWDBnt3uOyEw8EIVLHBVUkLPKEvBSRHVceVcD51RVKu8Ly7zK1dcLknIlJJLZ3ywdw7GFop+6FTl+hNPcwoxMz6QRZ0lBD61BpyZ8QISwpFmYuvcuDkO4EggJuOVw6MHmSWfItQnoYmwMlp9LEob\/yskGFuu9hxIiKdFYecBK8H3Ulg1HNeXwPjyvrWhaUEtI7SD60ASKldA6wHwdfNHm9qwo3w3eFiwQvP5lzWV4AIRp65AcyWBSLynwgfOpEBQ1n7y2g5YbC41zKRA5ObSNSfCIsEawxS3plzB\/yvHxCGpC6ryLsp18uIQzYNVFZHGVqw77DKbWF8gZDnmKxYsDCyWAkxI72Y12imLLaTm1IJqOOk9LacRAcLFu6nbhaoLA+wURPHQL4JACa+I8C1+obEKj6R69z\/m8YbNYyL49uRr\/O3hUtuoZCxGldjAbdrpwpkT1SOORxA673E\/eIpjo3G+8MhbcHE5BdEh+8xdZgTkoykib0noRKZk\/nrPSNrLMob7VOOT+OBhOvIgzIzlnNjKDWEBkfmZ05RKDPmVYgSKtAuzhP7N4DqyC\/v8Da+FA8yYGFPlSv2VCQbrDKHNuCc8bTQeq12aTfJLWWswNwLikISoky8pe\/lrfigtsZSTtMj01jsBjRfTup91dBL5Gx1aoG1hqMRsTarkklIGC1\/MjOSPJxYPpDp0KnDsttBCfpz3LZx+bGJvrw9iWDNWDOeuD27dd18iVnk9wG88taanjb6JLjmHSsy0V7GfQERd74x9Fy9owxaEt3gt\/gbo52f9z9UNoSxPY3i\/iKT6AeSu5WxUqP+y3\/TBBdm1dkadTYjK0YUYAqBmDndSQBJOfsBX7p7dE73Aw22+3PoCefKfXQSQRc66alAUV0WQUBh99Uh3\/K65IwVn7CfHMs0fOZrzSlJvoj\/jfMlYIM6pRZpyAXJoSpAkVpXtTpwkchsl5OfsiOI4TqzVuOCiyRnvLiKcV+Oine05wbGFeJPuLOqlL\/WRRGRUjqnhDX4+vgjGylIavbRNT4ROcWCNkFDaXq30kE\/HthLrVqixWv\/cEM9ON+5pUJXGt5PIgmYJQwBOYq6UT205sEB2amPnHVH6mzulk0sfVq600am7qX1SXtOkD8E6ZJ+qSwVAyT36Xj+OqliXTtQVW6rlA3vB5Bej12cPkcnHojZERO3ekNVobrycXVwWDuEo\/WnMAc2Bcn9FGzGTuHPS5zeZ6WwdXhNMEFFve68W8NtcNBtkRhYI4Na02drDHWVVxaK\/YEF4r\/MNF38LcocE\/STgyFO73R7CGcuSNn1Gsqpl24zQHjPDtKzuB542XFnDhqyOi9WXWU6BeAONowwh0juOrP3Ekn\/p0LGZ6cMT9Bzg9k\/HLIo\/FS2wf18sl+9xUhqweLwvMODn3Nq18fSVh7HtIpYEY0XIKCqeLxewex6ghO2\/unBXOsw9Y\/RdowfSH0LK4lp7DL6ZRcghod8eYBG0gEF\/bnTF+b6JV8RQPef1PuACFQR6ssXtR492vYuZ5IQ5crdhwqaEiviK\/h5xFMM7xwaWZijLGnrG52xrdopzD15YPNKDCtCczCJkc5+p68EFcveyVb7zGgbjJ3Q3n13f\/5xFlsWeXNnxoghBEW5rM2TtfJGwXh6izcJTXqLNfQP5KydpbocXiOg2bWLzGZ2FSQ0uFlDmNgxMrFYQEs\/99KVTw7E4VHx7FJDZZ4bjpLBSa9KQMjLs4RZSQ6IYpKGaLXrJaDUnPYuKI0vav8NDzwFNyAe+XZai\/YEn04Zw7UdvB0bpmKkKoqoySH+TO53S6LYY3Dn7yC\/QhI2j+R0nQAKAKGGOoGvGt4nXtiDDgFVL022N24k4rzBUxucy6YF6\/d1dij4UuEJ1ALJnyBJMtlOIHn+39nj1GHyE3MPHBFOSSejfuhdK\/iTV09PLChYUp6EbaSAwyKlYmD4fj9frdrbYBDsNgB33B4tRcF+kFiB\/QtFnHbAS4IWu33zJWXBFHisBxp7B7pBGM3w8QQWa7z\/bkXLbB30zCX\/P+TlvI261aHbIppBxhNQ\/rbMrOQuKXmNwYXZFdutiYAIQ2Sve+FyMm6zuMfo5J6Ud9vBGf\/4kdJ\/9rsGYnU0PcpRBDLyfad1hqdqS5\/B7+CNzwPJLT8pJ+Nb7LhLE9VGe+L7jRgMMwXAbZbLcfrlFbV0zeQp1nPf4ILsFvODNSgIHJWFP\/7ri7xJprErtiizarbDl0Ov4DwDhm6M3dXZqqckFuX5eMdIZMGEFGp88l6vl9CJgx8ze+\/9b6eY6QgftF6MIqRXQPaRFxuehMVghnhUcAEE0fgp+L7GApnptcmeRM6qMPa2PEXktwCKBGIPKjyUgOr\/QbPyPXfENTHEmtyQ5j+D6S5hWunEVixwkBN4LEP6PvD3VHrojT4IyXtu6esg2YSBSuWC4Op4n8LBbMcNlm5D2EInZjTdg0wTHbkODXv2+kIUY2f4v1s3eZz\/Y5BvRd3IutA1FApFfUMGuG7N5E5+tlsnOcdbQR0Q8dLRWPAEshZTAzMToqIuyC24Uq5+GALizDBa9e5ylx5LLOsadppTIU5odwGgwgwrWqluh+FeLtuRIXLryfu+t8xgRTBFJfSpWqbRTWPcKW7qkAwMsb73af03zg9MlG\/4R9+xHTGfhhzwYrDbOVWEMDZV1gqufv5mHI9PG4VsUWAK47njAD1n\/BwCrFWYWG07BXaGrRFRPcfN1oxeumSFE0W+p0mU0Zpqsc4l4ygo10vfC456ZwoZron0nT+vnOwkHrkAynldquZweE+XcUE8TyIaU\/vFbeAN5xk6ptlg6uYR0x+JUsLEYyfsP++p7iNUmrokWBg3YSIHFrIaVml263+HC4NAaBqzK88TPOADz0ztgfZal+ZwK+3GPiyNZefhhpBRD\/HsBbee3cT1BSLxib8X4BIuAG7w1yQMG3E8fwTFNY5fbd+C47R9gyzsPNTtDtzMagHPki7b2hHzYKTvVg7+jJxxaSgQKMkYnhBlgSAF50iP2ygqJRMbRi35saGYNK0Gi9e71XNm\/3i5Sz+t4LKCMt+xthhrUZlC5l1KldHch\/5Wn3YSXVMKNnEET3BdT15\/JNOGhxCyZ6CVLrM1OFIgfw5c9O2zPOjM5Lk3hXACExXIz6On7x6UCIuPtJxYHhWPp59jnfE9ntzf9IMymNr\/QUyFq9c7CEvyc8sV5ssAa+1W+54B2pmBF5r3OVYJC5BhMAqcGdyyLKx0xMh2kUZ9suRHaRbs2izccLwSUo\/1VNKcgAb7SZ1bssp\/NoB0S4EGb9YcikXfDaDDKElhcmbH70lkAeBQHdx+3RCiEzmPBbm09MAolKIWS2A4pHlMf61yEsXRonL6Ccc2\/aI+yRIYpYbR89sZwewkHMSwFZx4BqYTyW48zM9f\/bL3o5vTjCZ6tMzSve1RZ4rJpWcjGT0e2\/oE2Ui2yUktB6FZ9ZVguovMt5LvnlZWA\/AKxEOnpoOslyYnnA2MrgX7DmXJsruOpiniULnOfiNJJw5ysPWwv09rZixQFBrvIWAcyMblL2DSXRv5x5C02mgqXn4ytp9jOIXbdLffe\/XTYbbJnGmjobJLaNn5dPNTho\/oSrRn17LU2yfQE9\/U4YRLF60m1OXNHTWwZGtM2dfSOWqrswTlSh1q2IoQTagUxy3c0vzMMatXf0Ieetikx93PPSPkSEEuyV\/YuBBGqwtxIAe6qYSh4r5oOm1R1oaG4hdVIIWHKT7NhvWTmLWm0WA8u8u2LYoM5vU39JxasEnY9Op75w0cUK8n1ZFXf\/cDMarAcZ6h0SeCOqUF4bbQsyctl2Gu+HtGD5\/wq5gxGhPiaCAwjYtJLSvRP3k9i4iRHzg\/ZnG9YilkF0RcWwoInRm\/7+1Kun2HF74q2NAEahy6wxvS4s1SkWX1UfJ3qPolO5hAinaS5WtBipBXlWzTf9TP+g7cGsOZFpkmOcoH0a5VGt1g86RptelO2ehGpaRErFLCrc0MLiNK2oGy9mrCWmv9LHDIF8xnBzhrtQl+bUgrKFXct\/WIQbS9uaLu88rtjTkoFzAqbPVLVFGCK6a4s01agaiCJCaqjd9vO90LkX7YjzDnKgT5fdzdEBOB7ry8bIVpb4Mh71fkLaoncIC+KUTTDOb0T\/7lCqnNxJYZ9khstedgLvnE2VWjEYXHvdgCqPl1+VBNHQFhUlNLYoFmREarwjZtDAR\/wtIJPKu+LJQW\/WIHi8puhA9ltD1mdBsb5eX17SgjwhUR6vHKhl+DnF9P5FEQXmwl7uD1TclmHS0ML3pUHloEgOo3drhu8qTZJZ1jz+xfzMIQK9I\/mG6rSDyvlY6eOxpKAWln6gr9hbnTO2EvtWhSov\/WX8bkx0rV\/8Eulp5vaNBoPJsT0z57v06EvC9WgO\/IhgKuyXm3txKpN6rkDAH5uI6PCFqydm38vkmotAbo6uYjCPlyWCszMDGQqEjLIakA28oVlgiC92mmZ4a\/ndl8ADmAvFcIGoSIfAgjidzWWCUiKA5TMc3vBLcw7pheh0ge9CNWKZfzssWQqMJ2\/SG31tgjkfwhoAzqMVfQxcRksmrF8fRfW2PHeZHOkHqjHvQigWsxP2eo1nUSFidITB1cmHHMmZz07XUsJD88oGX8beUSUi0krDhMbzva2Zeb\/5x3QGt9Vf5g+m11jx\/DggkeeubjYKzLRWAmsFVgdrNS5zPyRxD2m6jRjPxNNF+LOL2BlArMCfhQE8lY06JXAj9QthhRndMaqdBHFFvlmyoSW0s6xoCjrMRNCi\/u9yTbBieK\/1TS8+dMfhtXGUO7pihy7UV1prYgpGWGGW92eN+XrR7zmMfRiOhEGODy9uXP76iULjIQVYCQHteqAU4wFxxK37Z8B6tvJaJClQWbrqK45YXAPVf4zMevJuSQTIv7Te3O243xehQ7KRtgDR+eGMVJN8ePTLbN4hhFEt\/rp5Y9bivioQOiCevgzgx8YptwsGVi9g73W5eE5iE+2HYY7bMcTScerjHT5ln8pCnWE0xOnRMM6vaG8tkd\/9+1KmiIXKLno5RJ6aEuWnqBqey6DgMl0KrQQoJ6T0v9+UgY63KHScR64jqJKaHIJyYvOoAAKw7TYp2t\/iAZ8JN7pmDxC4Rhj3ooAGQdUa1uYp5XhXg1f1WNw61Xgnz1tCfAIFms+V8Gwx29+xF2MxoJlRazTKeUBTrncQ2qV3NqA3z2ZOeYl7N8sbEzF3KNg8PXXAGa8M6UdGIzV5M6wtS7Z\/olhOzvIfV3ccRELzf54ju4r5CmH8ak523nLgxARi+926Ck9HXjc\/N6VvpGE6yfx8MLrZxr\/oq8yvk3USE0LhbBNgUnOP0Ed8dr62pkqN1FlGjHDq9wEyox+JmNceN32UP4gbAk4oWJBUMgH+Xlqirs33LgO7rvc7j+RZv6rE24kHYWfuTshZUfzdeKFN1SS5UQ2QyC3+3cj7o02HLfYCga74P+DcY75MamarA1vhgPFrKV4IMBpTDB4zAf5Kn\/Seq2PPD0+l4J2HNMMAb4a8hKb1SGycYeL3PZRyWnRatwDbDnbgPAx8TtneeOx1uIQ6MNf8kgLirCtIY90dGmLoxIsMGvW2jqJ+yW\/TmiQzLgbSgzPkrujrlqr7XR3gZd33bS\/cNz8sbi0RqTBd6yIdv\/pEEmMXRcbWUrhTr\/s97hn05llHSlIreTC952fcuQ3ZjHF3mJ+8ef4JZXjwMg+zVu8m1gddcmxjzXxL0WfK4\/AE7E6IyfFS1CxuKYqcm+6KxHiaflYXWXVEG\/jtOvFz+Pw9B2tp9VuypJGU\/ytfOz6oXovQPzs4LxGZ9gGOIxFskvx5GFErADba13Nu1ivcQER8qStDVHb6zbZyIbg1ZJqgesjq3kssOAd\/3D7dw8Zv63PSmI2r+\/jPjSHVUrOB9pRUw\/rd4CzxXxHK94hnaNN2BAhPnXmp72Ba\/GD5JSV8faaJvejXzb4O9TK83jRytM7cjw1I88m3c838cWVJljEb4LG1AGNGJ1btq2iGNFvW6rcFlIouwkn2ZfZrzcnOUBYyIsQZHuggiFqPjU2WCHzqr5GKT526kHPzNAY3j\/NrV+BZzbg8E6dKBY+6E6732h2BpZpxkHzfKLn67ZdNnBEY4+koUQoh6Agq3KjwAPtcxZWIh96Zj3jpLyvqO\/GXkXECTyWdrBR\/uaZqT4Kc78JczPwiKaZxSpV7EbijqOLymfPut9DltxtHQLN590VFaQ+iLDOD0cTkQ7qd3zM14Ifp33BqSmai\/EF\/P7QSVu9ZLPBUa5PCwUp4mdiw+63TzPJ5hVV4AxGeMddd1yK8bqjSG6jr7Z6Zi2hT73q0EceLpx+HK6VuehlI+E8rrb9zpWGOK6Wh3Dlf2qZFqgLWAaVC1Cfux15O+1NsZ7lVgyujUxYESDtqeh24\/UPYn09QaPcAUquk2V+newEVGpynyv9R4LtenVUI+zT3HwE7PFmH6KdXhL\/vUwGuSzMIKhIF4lDwRseBcDTgvCx6Ikwtl1LIzqwPDgTaixgGN\/rkBZdq4jeQL\/pieK91EZjQRR3pNj5S4Bo0dK99JIHJYmHfC5GlLbZMq\/ucSXZ3wagGL51j9PtxTkmPxJEaEz01UqeuYOvc8OLBa2SoIBvl\/L\/tv0l4gtA5Z7kqN3+wFLYH702UL9glC0SEVJoeOh\/oXnz8RYv\/UvRT7g\/AJ+xyNILEsVtVi7zj0\/2CDuJ9R9\/E7GFeVZMf0eU8MXmC17NGkVXgJvwbHdwmTeCOiliwoaRpdIadCqhky\/uNxQ7thoFQDJE4wS5Aza2M6gufZxso1YcRsZ1NNsGb8\/U0JToGkmDpaH+++6KPTzt\/YgcEC+Lgm\/frbOH2NyfkWUQ==","iv":"f01c0ccd2ac8a0180f6f3f1d696c398a","s":"745be4cb5f63cdf2"}

Flont's business model lets customers rent and return or buy fine jewelry. Image credit: Flont

Flont's business model lets customers rent and return or buy fine jewelry. Image credit: Flont