When it comes to hotspots of growing interest for high-end brands, all eyes are on the Middle East, according to a soon-to-launch trend report.

Experts at U.K. think tank The Future Laboratory and its partner, London-based luxury and lifestyle consultancy Together Group, are delving into the rising appeal of one of the region's many nations. Flaunting an increasing base of ultra-high-net-worth individuals (UHNWI) carrying $30 million or more, New Codes of Luxury in Saudi Arabia outlines the forces driving an emerging luxury capital's ascent — readers can dig into an array of insights upon the research volume's release later this month.

"Today’s Saudi consumers are dispelling luxury stereotypes," said Alex Hawkins, strategic foresight editor at The Future Laboratory, London.

"Moving away from high-status, high-shine luxury, the next generation of Saudi consumers are re-inventing luxury from the inside out," Mr. Hawkins said. "For many brands entering the kingdom, opulence, ostentation, and high visibility branded products was the order of the day, but now 20 and 30-something Saudi Luxurians, according to FuturePoll define luxury in terms of innovation and cutting-edge design, along with customization and personalization, and the seamless integration of technology.

"Boasting one of the world’s youngest populations, 95 percent of Saudi Arabia’s 18–34-year-olds think it is important to support and engage with Saudi-first enterprises, and celebrate local craft and design, according to FuturePoll – meaning luxury brands must strive to strike a balance between global and local appeal in the future."

For the report, The Future Laboratory surveyed 500 adults in Saudi Arabia who bring in an annual household income of at least 500,000 Saudi Riyal, or roughly $133,000. Polling was conducted between Sept. 1 and Sept. 18, 2023, via FuturePoll, the firm's quantitative data division.

New-age appeal

Dubbed a “nexus of locally relevant yet internationally networked luxury,” Saudi Arabia is becoming a front-line destination for top-notch products and experiences.

With one of the youngest populations worldwide — census data reveals that 63 percent of its citizens are under 30 years old — the country's future leaders are fueling a shift toward a thriving creative economy, propelling rapid market growth right now.

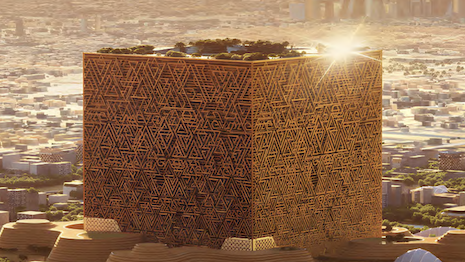

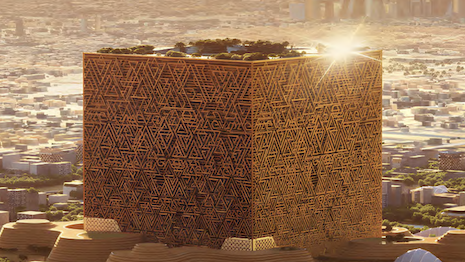

Saudi Arabia is becoming a front-line destination for top-notch products and experiences. Image credit: The Future Laboratory

Saudi Arabia is becoming a front-line destination for top-notch products and experiences. Image credit: The Future Laboratory

Primarily responsible for the overhaul are local “zillennials,” who range in age from 18 to 34. The report identifies a few values guiding the demographic's most affluent members.

Interacting with Saudi-first enterprises is of importance to a near-unanimous 95 percent of the group. The nation's fashion industry appears to be flourishing. Within the next five years, the trade is predicted to contribute $12.5 billion in value to its GDP, roughly 1.4 percent of the overall total.

The cohort still largely associates luxury with Europe: almost half of those surveyed expressed a preference for goods designed in the West, at 44 percent.

However, nearly four in every five respondents believe that luxury brands should offer collections or other forms of merchandise based around occurrences such as Ramadan and Riyadh Season (see story).

Both personalization and innovation are evolving as core tenants of the buying experience in Saudi Arabia.

For 51 percent of those with a household income of between $240,000 to $266,666, customization options for luxury products play a major part in the purchasing decision and, of those who make more, the figure is 60 percent.

In 2022, Four Seasons Hotels and Resorts announced plans to open a new property just outside of Saudi Arabia's capital city. Image credit: Four Seasons

In 2022, Four Seasons Hotels and Resorts announced plans to open a new property just outside of Saudi Arabia's capital city. Image credit: Four Seasons

Technological advancements are at the heart of Saudi Vision 2030, the country's economic plan aiming to equalize opportunities for success and make the region an unrivaled fashion, wellness and retail hotspot.

“Saudi is a huge market so, naturally, different groups will have different perceptions of what luxury is and how they prefer to consume it,” said Rae Joseph, creative consultant and founder of 1954 by Rae Joseph & Ghaïa, for the report.

“Until recently, the Saudi luxury consumer was often seen through the eyes of an outdated stereotype, which was inconsistent with the reality of who these consumers are and what they look for,” Ms. Joseph said. “Saudi luxury consumers are educating themselves about what they consume; they want to understand the narrative of the brand, its history, what makes it special or luxurious and how that can relate to their world view.”

Landscape transformation

Recent reports have indicated that Saudi Arabia is one of the fastest-growing luxury markets on the globe (see story).

Its leaders are maintaining momentum through digital means. The country has already invested more than $6.4 billion in related research.

Saudi Arabia is also getting serious attention for its retail infrastructure, as luxury labels including Louis Vuitton, Dior, Gucci, Chanel and Tiffany & Co. continue opening flagships and boutiques within its borders.

These offerings support the activities of Saudi consumers, 60 percent of whom use a mixture of physical and digital avenues to purchase luxury goods.

Spending power is also driving overall growth. The country has been said to operate closer to a Silicon Valley startup than a typical economy, pumping billions of dollars into industries such as beauty, wellness, fashion, travel and video games (see story).

Saudi Arabia's investment in hotels and other assorted vacation spots has led many international businesses to take to the nation (see story). In this regard, analysts are expecting the location's profile to rise alongside markets such as India and Turkey (see story).

The Future Laboratory will host a webinar to discuss key report insights on Feb. 20, 2024.

"The Kingdom of Saudi Arabia (KSA) is emerging as an influential hub for luxury – one that is opening its doors to the world and embracing transformation at a remarkable pace and scale," said Mr. Hawkins.

"Under the framework of its Vision 2030 program, Saudi Arabia is entering a new era of innovation and enterprise," he said. "As the kingdom continues to broaden its horizons, invest in its youth, and construct a legacy aligned with its Vision 2030 aspirations, a host of trends are flourishing – facilitated by Saudi Arabia’s commitment to technological innovation and ambitious hospitality and tourism projects.

"KSA’s new codes of luxury will fundamentally redefine what is considered premium, as well as why; understanding new notions of authenticity, uniqueness and cultural relevance – underpinned by the evolving preferences of sophisticated consumers – will be essential."

{"ct":"FWa00u7Ppv9RcaK9NXCInWN5WUSYOlqPivP\/sF6UPFCKFZZNYuT1gU5papSiHkGmFAxDU1vREErfgajMqgy9AVqImdprj31DvSGv8W9qSJ9Wf05Ye24xOHYeQsupbvAgwXtPlOxTW5P65Os4OToSyiaPhFy9jMKimRZVZYtg\/C3iwvhcR\/9y8bzuYzb6UR\/kw0ETzQ4WdUVm+lYdWKUVvMqPSc+1YKKoHkzSKo9En0+6ZDeJKbZS0+LbaKvgkf30tm5QTtEexm2+aAzBJFv\/oZ4tm\/zNasGcRBJTivJjU3HQGTXpiRvh9hqZ0RepyhdVuAz3Kxkg64cEg+6zsS1eXchRKy2+nGfIksTuB8Yy5aHDqYOWy7gOm46f2MfOG7r\/g5jEicCvjfwNATNNGHCQgHuBF+jUYmlEPSKrhiQ+Ofm3ooD7wjjP75zsuh5ecFAlYqWBXDmpkYi1ksYdcK6pKI1k\/D5b4t5SoMtQmm6fTmOCTTRWcmtI8iAOPKv3csB1uAzpqViDKVxIf8VcZIuaK4ppuU0qtSEKPFBATh+61ZjK1mTpVwkJFeEBzhr0MTr3GPlmoFcEH\/uV6ouJaCWD23UouCjVkOktcB0xHzAwJ\/B24VYYhANDUl2hFPgumog\/Wh+9sZSVnRzIZzVgywe3WpvGh542oODqhc4yV\/\/IJkaayBjZEr5zZZeGbVQGrki0lM34e\/Ck3KYUSYUDknBze5Awbdq6yf5K5Vvr\/AWpAbTNleVLaiOIJpt7MM+Xj0\/0RO+3pzhaz1KJffFY4jnUYyZGtooPI9E\/MT53x0p+eFZupimjIIvb8IU6SoQc8e0N9x\/YLxEgEJdWoyn79mHXQIZw0nBR5MNL7ypkrfqitbrFxeTZzr3TIbErEOpKXMXnEjngBGy63UQC9dHi8P4qrF2elMIflYjU+g76na91UZ2MIsiWRpJZPAtYsZxuRzHMsNCUeTqB88hRqT8GVHOGxRAnv\/1tNj2JpN0elkLU7QJYouk31jSFkBFbvxzzcvompxTZt8\/qhClxmdSDTj\/hSoX\/JOgOfGZd\/oMir+vJE\/c7XBGTg10uCvkhJEwaHt34a2xR38KwLf+bNqkfhKTdzbD54fu\/3aEZx8LVWxxGiT2USES+vWh4ZBYctwXk\/08O4IDTew5CcxlLBIBRNCWVZWPmj40kc7HPos07hnfd6RRjmxCK6VfyXTwO4Uga0XXSFsXgGGd6YR0KK5osDy+0mCsW5oPVCPi4K9luc9ssXKgD7ZkWY\/C6RlF1pf6SC4R5cG\/ea0uZAl1b\/fBZvO3dSHCLk1cm\/FP5M9lVIx0Hi\/SHts12WzWyaVnUWH7yv1USkXl5pwo9tWJc6\/3pKeszM\/LUJtjyoy0offnSdp5Pu1GmvOx7LokY22iLBRwRFaJNvN3bF4mi13Q7SlR7fWGpnDyBkDvV0zkjnDV5fTuXooVDNEbjhYCCl0f6316QzIve0\/92jS\/zLQcMCPntGi\/5kx6McnjhNBmxdJN1Y6e7o6VpTvwmz5qjuOrv3RMmFQI0DQPCP7c9DZETG4aC4aUVV8BU03DSt7cSbX54prI7ZpRPkaKYFo4g3gU8gzQ0+4wH809lWQ7cwREqTXzRn7Yod6dObqkj2vDiUa9dk04EMKvCrnWUMb+NjN6\/C3+vbW3bxy+SpunhDa1KZv6Rfi\/WtRHSP7sJ\/znW+H4oep8I2kAVIJN4cZxcxoJviQ7basJoOml\/kcqb2CG9cKPDzuL1K+5KsVwhus6Po866NHY+oQcACPywtrCH7Gomtgop0fHGCWJNYyGNzH9EF7GgvQRkef4hX43jUniZigGWvv4fGZ7LeTmPypLiv0C0L2uv9CCDobStl4zUTNmk0om+wnLiJcpDlMeNtvHY4ZMzzzvo\/ZhUfpIuG0KAs0b8zL3rh84dfmAVlB7oSKhrmStENZjq4z8tzp\/1rN\/g1IJF8T9kvaXN\/w4r9p+l+3\/PFOEVKTZx7zjmr\/aBpt8CCkPR0ACnBcYLd+i2QJPEvBBO9R2O+fp6VcgIXp7yW35++\/KpCCiPH32WgATpPUOfKOUqHXHSF2s7Sq++mJNwBiE96Rd6X\/+b9ffdqIasib1Puopo+viYx0CCLmL0F0i4HjWhbg1+SJL9u7GcY8l6qeK\/rkBBaFePTqP9Swjdrq+Rk5OKA5gdQMozvTp9jIWU88NUJf2jWLnvRi1Wpdl6s1LOgCwBJzO7qeSCeb+oq8tR8+yjnm3X4H0Dzsmy4Tx4iPMYWayFaZUzLIC9n2Nz5WlJoNv0WgwU9VyAwaCINiQIeNKZRVgGS\/V0u9UQF95RcSTvutaDbnS8GC2uwOkVZMSygBfAv7r8O5dsN5+FIat51uqgdDn62K34UNpfwm8tYuwNc4xXoKH0wHYvVh9YAKzJEieUWS6X4oyySYvIeO04eYSFafgXzaBIGJH34NY+PO\/\/p8Ve7I6FAfIEWmngrCQV2ABOHPjoeRJ0UwYzUN3QV3bcir8BNYTi0v+lSFpXHWKyFxlZ4jXq0Gh7btGCQxye21AmTrpSTNV1LZhNrKFiVmvij01K7XbbKwqqaeA\/ji6UMgnlWbKHsdyOVUOeChZqGz6JIJM9QBV0BL8Gl+3\/7mvRtNeKtH3O1UaMYnECRVit1\/lT598Gi1iOoFi51w7+aKK\/byJmIECH8lA3uWyUpJgqKBtXsugylhgFrduqeJ2V\/oo+mH9qCgQHnyRPGcrYP+5DIDz9AW2ABi8bhDAAJ+Q\/o1dXh73zRNOPS8wJV6TGiAeRfb5neZTkOsy44eJfYsySCnBfABCKl8T8tR1i+jHKHjCApK+i3yAaH9Ju9p7L+7Elj0va3WWAkNIrT7oabndQovj\/mlJQBpw6G4YMUvE8bGJqqvw1IAfbjUjY2j6wV5rCZyGIUbZX6rwy8Mt2Yg6xoyB7hct6XF1vfzzApgYK5IR1aRY4eEx+QQnC2fG9kUf94v5GHYsW53RDkzohKbXKNnGOcQjt63iORS0w7iRB7H1tVDEqBfVFC3J4QoKJUrVHDmh\/EKrqkZZFwxiTpS9k5qh86nEci6ew5xKA1j9dQsQ1CltHyfxuNHr6Fw8oV2JfBlUQQo1QllOjotu3Fc2TYFDE8xUGPsqIbiCOn1IuNizJ7m45toBlclrWALCXD9USZDx5J3VEotCwVm2YEtRZX\/pfnHzM\/L69i3WNxVwk5+d5Ua3lN6oXU64s+F0BqLwCFiYJlN2TxagvOqSK3LOUzxEj8kFEZzMHU4vpIqAhQlc+T\/rzEeetusZiB\/yLDMNAoYgdsuIzfVkKlDkalVEZSTjRr3oCBWJekT\/vQYxZ59qwqD8bCR8lJ1pTg8hCi6A+EcdZSBhxshsl1wUZ6VYP1NrtEdV4QvzdRI+GzufObqD4aMm2dtN+GM7VGQnCx4NpXFKfbTVvPgWT6aX9ie103y1mRAIFtBcc9o+CWn7HMpfPxTs4LAOOKrWvTy5si5A+bLm2RlEkJnFQ4yg3yh4XbVlNn+MoBmagoYk4LSy8nxB0cHYVApCFsT8shIAum8xVRcIedHo8s0q9jZKukjRig3GAqXQy6tu5\/G8ryrc+fUTJQz1tzgMO354Mv\/bcUe\/D9EukjpmSdU0+EQCyMs4aSEkVv+H+M8KAKRmyjYYtYODFPRHWXFxgKTZp0DYdJ\/v1Yvl\/7OBipJBfsIlHRLuuL5nrVIkywvMU4TjLWtj7WsU3GkJ+P0lvwIc4Wr7snhO3UI68YZcqdRw\/07CnvcDPAe2c9B+iWYACDJ3fLLMoOyY1vlXyXlFmAmiqhNqnC6jQdfjfyay2RgBYjOgsLR36\/znUlY\/Y1eDJ3vozIngDT\/Q8ApSRqmHEIfJj+7\/lot+6iWzJ0W4fxDPz6i4+W0LExCZduqycaEAW6xaUZ\/DTHGvdUjOZo9jn1H0M7T6lOjjZMFRiUVaeYS5fh3o1cHURhloYgDj9JNjksP6Fp+NnahFTCjnMR+7eIhplCaQIAN034TgMUFWAJ+4iSIj9Snk7q+GYbZW68iiDK60ehGZWJyioGHxZ9w4QEQHuwZ3arH1z4Gx6A+Yow5M6Is6Ve7d+PwaKWpX36tu75+qqIC8nAwRqQpscK1MuY\/Ef6ef4n+teWBczchA06nlrEO5OSn+oiOeHFSwaaKE94OXoFWW4SqAXkd9t\/HmIWMKmHuWrnrOBrW4SiN4HE2HfSeVLkr0sgRJ6mu2MtLzSYC3rMszwCKPrNK8vCd+LtS5ZVSEfkBM6S8m2Nigv4mTLOkjKaZvfQYKT\/xO7lXMKIcxnD2LOAGIfj3DmYehsnhY9UYuITUin0IP9w2xeN9NrIbt2leYziOYtNHjckMCSeYsoM8HHO88htYbCv1xXHpkVZjUe\/ZXkP430RmPTZjtVaGFw7Uzvme7s+EF5SnYijUMEKpUPtZBGdg57adBibFagPBMAtcmBmhJKydKkyNHOhBPkmS5\/JBXKWFDWJWhr0CnAjd5lBgGq9lDoETFrEFQVrX+WMxrDVZd5yUri+eX\/CRy8Eq5MuELld\/Fu2WHYlYixd4dotfnl\/kU63Eode206AsQD\/fi0uesqRbEXlLGyKydjz+ki1c3earhxdo4yUIDBS355adzig\/OcBIPe3waVDTHGeKlhE8X0qO0rg76d+UAeMmOQ5wYD3FHI6257WsC0ZajliEkkhVAIgMHwCOpks4A+oWoOTpg9bFzFbBua8f1Ss6TiIestLx3s+X3qTeY0S4gy+9yXvPBpFO3ptW8jnvsBe1OEFBhwjE4n05kxgjZiC2KjO+I\/kjFoerCLPGbzqoFMHhtDymnn+BNUmo0rX7vrp8F\/nWScv\/g5tgd\/C7BVPizAxjWKQf8l2B86N\/7Pnwnbtbbilvl6N4Fnr0NWMW3EloAwPLf+FZlaeIGjl2v95igbLPOMkCXLUhGyuFMd7LKPEJlduy+mYn6GNqNIRMQVa1mKOsz78rKm4R0hb5OKgnUv\/meomBkFbnlZl2q\/jL9uNTtgXUqOeoEoT3Z01fVFOUzi64s2x7m4KEB2cDsIWPZoHUbcTvXdnvZOAhvF9GEGBEdhixEaL+3QQG3q2sxZUk8a54d7Z0KKuq0vZx25XgsNp3BvB45DC7QkR1QcMk6\/ySqFnX3SXA0GKHHIrYoXPcfgnR011MUjn1GTkSqdED7BpgBHcOgwEC+RJiD0q5waHbCsrrLLixraSCqvl2r3qGsNwIvbi\/UV0QngXzlbajOK6++Jncw5SMkpawjyJKxeCfNEJ\/7F7S9InjiyKybNpMj71SEM74QXOuo8UECjRyOFddP3BBWblPoJGPPybhwEG0P21V8FSZDV+QSeUzn+F89sjhvi8KaYyYr+fZaLqzORwq9FtC0aEUYF3VEx4H1s0TCRGEKJ7eIy+ODHC7dJr8xQMDG3tMcrt6Kua9TA5BSHnnc0wPxLZGEaHW7YVVEl\/y5eulgTRTvzCYP+RRsqxBIzk+1+hfU0GFBdFUwA0FFIKaPXxdS75d28LA6krPjP7yA+bLRmHlhoJQNAQnIotP5TmgTy16IVNtelqQZtbKxCkS0ag5TcJ4OehYPTKchH8xxPhMZkZyl\/6FXRa6WQrkZ2Wy99ZKOK1dqpn5olM7zGx7xW8Zs2fAFC9LJBKfxC9YipyfzACIl5QNEjwn9r54amSbfTQX4VUS0c6ZyXGmragM\/\/vfGUgpEyWHkEWcS5EU2l\/5ycTSzvW451myq++J6qmv2VgrfqBzULdDLbgR2aMyuP9qK0Rs+8rgFFQny2647LwCS2Nw\/0dLkDkbZZLUZUy2TpKApNqCsD9y3O38DerWzw\/Mfqze+4Di0+7vvMX0cD4PD8cA8aez5Osm+Cy00BWitrkk2lzNGGW0INJPf7U77KmCnpYlr1+iIIOVd0cof6Wq9Qd\/P+tZBDjkUTRMpROzD9b37Ddr+hqSdiLwvJOSpcSWJA9CeglawNZZWIyIO29f\/jHQkI2SSinVNUDJcu6kkas6xXhJon43tOSb\/icdNWv8LasKBhLfYFjF0gHPn0gDQokMOykbQx00z5bHCfo4z8TDmnLhkDz4+nJ0Z3nwOCeEsOKlw3bnFMiXg3wm8fbXcgwtve0YrVOx3dRgJi3JlBp5PVvYAI6OSpIL5ePKEUnK69obRqpN8ODmaziNReHQWTJmyj\/dRu9US\/hTlXXT5l\/JJwM2f0Bk2IHce9ZX7\/2Tgh71G9CfoLI5te2n6rVBonyDQt5Tz6Vth4b6aeWGcF3ylyEfIRQKPlx8D2rf3TKbEI3N2a8P49H2cK0KQq1WdTf1mZqtYPqJvKCFagdf06hb3cw9IdhQJMDv96Sd010CvvKaVrtksVxCVjgiH76XOzt3kX0c8GIWxk6ailShLew1m6TKazi7IoDFxlaN8JXWCmB1E53lL5NB2YNUiGwofI\/STz0\/Lh1E\/+oYBIaNSmXWPwHUDDjJ\/qquJb7rVvMUFV5nc4YIU4+WGsYzU2CWxRm\/3t4UK8mSlAEGcmW85mLRPsI0lU1LemoC3Cg8KsleHyetT\/TwYUzFrbcAGlLwKT\/\/WiLQQcun2j3CfReTzB78xw8TOYQZJCMO03R5nCDwc89b3pfrDx6u40h208viQskc2Qxady1VA+kvIkCwAhqVpz8NmC1ZstByZIkrdIdqSbHLXVEyTSz3TNIzYYWeKqFqNjJIjU3q2dSHky3e1bZJnDFIR3wvZ7bEvp608gMtbieTYB8SCPxRW7\/koDwtlBevy4PDGje4NLusKYg4CLZ6TT2Rly4ol9FnZP\/LZrP\/rDZbgrovTKOxRi3+RrqvQFun1PSYYEbL7weKxVnekTp7fyMFMf05V80PDNXCZmpE\/PbDhPW4FWsuGy2K1XfE8vJP73jix7X5OZbDEdoJn6flDrHEwZX+BaLYHb\/GxD10J98059NiqdeyOIWl2d8gob2sm1882gSiA3X6iKrA+eBCau+pajDvQqdkvlvV5ie2VYD+xzvlutNHej8A9KQQktgXzXJAwHlB1nh9xdhz8zNAiskDBMuwzJIKIiNFtBzWWDvvOGIbBAtLbgX\/DVwjld2FeEqTTf\/JuYgmGlSxfgwSPMt4NqICNgQNsB8dRiDM8\/pyvxwSLuvQmvx5KwpM4EpYW\/Eo5OUM3PubxWF4Ml1oPO8aDhOz\/s7ti4ULNe8+f2Ft9RBhKn56oPbzgE+DFwfn2il13\/vSyN4wvBTY22Kw5+Y5jy5wI+ucZW+Gifogr9q4DigGjniJe2E7+XiUsrF50Cb9abe3ah3jyiaPAhoYzg+\/TRh83iI6Kv0lxsdaEYsifoVq\/HiqZ4lAbYQ8AZAbX3\/TI7drJdDgBpdak8RvvhI70APIpi504jwe3yhjb9AIvyyS0a6afFNUHsO6NPLIBF4BFIaUYupYAeO1Tkt\/yp0VZcaWvj6lv2\/5mkou8a7WZaucV9OJJrajX\/\/YzFtmTfQrBjL68X9Vw+FUYTux3R5sTY+OzLdafadGImfcCGppsdXWrEUzm60GH26oDuFJCh4Sg2X9NJdTAYKW+3W1+AhH+36kp8DuABK+3LOJRgafEVdR2RIMYBocbfW+J1JRAHyPU1Mqh4JJ\/XTWUtKupROJHgQcB6wvFT\/P6xHyzc0cIfUC9U9qrpXAC8oCar4QmjQ8wBJkva4SbjmslO0H+gfuFXjqObGfC4rcEVloUU2Bsfux1S1Wf5OWinW5ZrL25+1baB\/YdI7MGaE2QV\/gvAxpH4roPcKUomEtQxhR6JDLtlliVhW7hvTnlEfWhhbc7eAC80kq1paSZ0P3zrgnYs7gKpfJkLBu\/N8Wlzm77ZLDF+yGVzNv80H8MYaeU3\/Sf9+\/rxEY7iZWN2DWVC56mGYG0gU3G6tCd6K82UUm3zxvSIPklrXh3HrYiDYJaOYzL2lETAAkpcF1ZYY4fwXxO75aSMpbqonxxQYdkoyy7h1VeKn\/bJlIWpINA+Q5BSDblY1arUktL8arHj4sdBF\/S8cKyeTOqAc2g46M15TCNW4M5eAK1elXhHk++G5CUakcsav+BAku\/eN9xn0X8137R60+0thK1zfhzRkoLHW9+NWcuVEOAAOoFwLBiCt5xYs2wBzEftIyhrdu0qdSol7ASgmFrZCjlx4H0UTDDYm8wonWrI49dQ1AnZ+RkIeq4HP1DzAgW1kDUnB+eaOAT+N6ecY9clIPnnrglJxyvjhORRwK4hfGOff1lc+M1\/HpTempvFhvgNYt2v9LsWoCpnCMKGxISl8JcmOHbpnbNaRJZjJGdA7lU3YbGfTZuDVKlmA+ZSv4fp0HDXpFAuMZ4v3Pb5IuJiBjahEtmqBPbIe+dTNaouO8LDItB2xb5LJSI3k3SfJkdjk3WPEGghaMQ+fo7DKRumxjX9CoX9i9IXQlmw2HDAQh07e4qIXV4wrFlcg32rqCqm6THD8UcCJD8Hj1jyuz15ohrR4idrM8ww+kmVu82g57emcTMwdNzgCg7sEHNq0vBcLGwwqa7dJUVyvnN3NjaN4VhZRoBDRbKZQttlWIcAZR1rln0r2spXsEEpeNM10MIbTgXSGu17lB+OMUik3p7W3inXntdlGw7FVF05H\/okZd1p16str88gFkelrK7zn383+Vv2a4Ary4czSKB+njz\/uRYtl\/MBNTO3dk6GhbnlzJnVinRauJ3qCV05C94Esrf3EiHrCnfGLy6T\/IBFXExJYLJwgusbTmdgVk+F5M6zC6iG5YDK+\/6tbsETBQhyRB5uD0KhdiyaYnE22XAfmdNSTpLZiLS9omNi77oQvMc6aRNiE45sITLC5oVj7MzuMeo81oDglm6kIAdT3ehnDucQhDVCcl9Pxnos9OYjT3tVoiLAiWmVsoIXW60587T5xmaz9J+WpFiqkQEVeUBB7YT1MuCk4duN7iZ7H2SdKFyGLUuHWX4602oSwjoCUn1KMCIBPKeFFFAhHw1Yq24j+dyKzHqZDEfVcRVOOj43ej3ZHaUcNY\/mhmb++4yvbY5Gb4\/L6I3+60JwluML+db3PC9YrNa6628QLkAqGTI2mvyh9Gk1ogf6BR\/Gkyg6oDlf5gbCpEFxWUxGudbKUjyMb53cx86K6GE7gZBs2B1b00ud9Cu6YoAr7wtkdfb+5HYIGNP\/CfzKIjw+UpCGv6NgFZVOdFCR8m14WgYOH4rjnmo0Qmsiyd1BHriQrepyraxIZPmn\/QYW1cSlX6wnjISElJwtDG2W9pnjYHgVlP6Zc\/0Ef+VHHhWG8REMwr7miYv27yRquuGHkzJaohtXKP+q6P6P20vwzmi+dt4Gk1An15FNGa5zNkr7RVsMeJWYVPYttZO50ydxWEl0VbYH9vWbAukSSJhvF7lt1DuFM7nwWJq36Xzpy554Z5CebtdfNpaQqVC1DzZxdzLVWdHLtVm7olRXzNuxXCr9dDpqt5\/Wd2qTaNFoxx0KMFbfqvuAHK7NXMOKwAOv1of8rE\/6SGCKmFWsf1mvdpFo5gnaHIjbklQbXcjWINc8z4SvWbrLKusGeIjyB+C40R3EnG5UJTDquqbiYjJEPgg6NB4pa6ueL\/S4MH2bInnt4lduKTZlVHf8b45ByWn1A\/fe2WC8n1XKpYhFaDhqMA2ec2K1DTnj\/P7+5obn5cGpSWP7SWRTbmqkJeU1k87ifLb8vy0eZXkRmmEUFanhTuh4YvWXD0iRk+r55ILbzrGP5M6BqVPt1zXD3a0Z\/hiUmGQ31NRpnZHMi5FYAd2QG1ue1L+X1GJW\/u\/7tsfgSFka6cezx4eJQxNQ0LHUSr16YpOrmQES9LbPTFyBYuBC6R5WIH2sCtuwqhEv7RQkHtMUEXRjES3NP03j0t3XSZx\/Ug6uproVwExTnxxdz4AQ5f4Iozl0hGV6j2hus7kcimMr+ZDTE++TjXQVb7yJcq6m\/VKV4H9aZi87l4SxcDpv23C\/gRhEkBFxiw3PwHgngTX0yQA+xlPPBujsM\/ZsxJvVGDS0nPHKteEoXFsdXcMOtRJS+ZUoJrRavcw41sdKDiOdexG50LFHKvPcaQ4i2RVQSSGbslVBd72csQhQYtZzhWjL3LjAFhEFadsJ\/e+v5oaJR7\/HEtSrQDs5XZ2xuDRN+NSu3A9VYFZvd3pxyD2yayJWbB8ioSviN0TmsvD6vWXXm03u\/m9KM2orNh\/XFeTLLuTdpeUWuOBCKubsLUOMCID0rUrxhY77jnpI2WS21OIBgp7wZKfwOsYLup8j4J3RYmjUHIxh2mZw4wtOrs6wfxW0APwWhy2M9ouhBFLZr3+3oG1z1aCl+WJ3lT3UY6cAg4ztVbRip4U7e0l0QSz7n889MtgCrmRgAI1H0zcR6+p8Vnkz6ibWlyOCMPSXFfpjNrp7TxaC0qLs8lSeMfP1cvdnWynIEJZzFb+a9TTbWZn\/cvyfEGMxFrL7009AnMkXAga+bQUaeUEYnEG4TFcWuDIljumSc3z50sb5Z8vgEkP\/719KD49RShAuTjmT8eTNe5YQoIFHHtjBp6cElFLO+y11F6qAcVrW8csnlZH5s93wLiFdkylYe+WbNbX5TddJdr5iiUsCT\/ul4cBEza66tTBYvpguYI0+z7qUbkRqVngMPE46T6EGZ6qD2zhU2qVZeSmc38fFQ+QWBZ1git6RBFSPb+hgEOUxwcGCrs+P4pCxjflupULItLv4B9nIxGDwMN8lvKsGUad73TYdFyHENvFbf8hVExgUNeObrKY0SdrJ3pb8hbeMZP83pjHdkcnjM7LCxRf0z38HkmF4AeHS4OG+VUedsSYf9jrEqAtpav9eOlpE+u5w3vtqYHMMv9YGwOIV6jH4LXawk4BVG0HSmwfDAf96NdaupXU+Aqj3pAr1Kj1XOOpO5qNIcemNSh3+kxhQt7dfE38AvekQ\/7fh5G\/eaSBBxCj0V4D0DSnhno66iIfHFm2wTBw+40g9IdXcetSWhuNk\/FCzu6wIllvJLgocTMYGXVW18Ie\/v5spjXFqULPTtTYYzdgOt32mTacupOzSAKhV3X3N1QKLXiWApSdjU5Q13\/gQDfMZ0OdJwwTIxT38hVIlZ8T35ndGhlSuClN2HPHJB80OmJIBzof3JvOpiQoFPADL+mXdiz\/kMq4NeWj44yUuFMRlhsOLN\/u2r4VmflKzg+YBMZwJiDoMa8r8tFekRuS1s+aZmEQqdCJ1GscXm52DZhPAf8TRD8t4Zdv3rtg9PiERvupSgm8yEBvuehJf\/4Zntmr2XJ3RpkngXspy0Wy0fL\/m2bE8bLHN7+LLMOk7tDA7k2hai2it7ocDjyFQSfjQ+BBav+GIGt8XReJgmW0kuaCrS4BZlguhL\/HdD\/nvM90rctU67V7qzP77XlkQby+LvRTP3jBY7Lcs\/nQxkRmLTV4Ga9kiA9+HfflSE+rNkEaFEXCvWSED\/RTy7Di23roYIrYM4HA2fkE\/uCrdhd74eLQFs1q0wpXM59UsMTZxKpAxxCK593mjTyIX0d\/d4Kg7Dd5bN6MK3KZnIAC2HVs0VPEGXBVJJuwQdHjzqDXJvfuolmfQNiQ0dx6cA\/nte2pE+aFAdG2focWOGw8SGXObXJ1YwDwlX\/UUgH4pMJtaAFABmS2hKjNwIqo\/FroCH\/mdLMoWsbPbya\/2MLYwnnxAf0bRQQzVuws4nvGf2WzxfyjRVjft2B3PHVG9GDRW9g29qOBxzjUhWqznbpKW6ZsWczSDXvYplUF6Kb34KGOzCbR\/GbPEcwEmbWYo4jEv3mWz4ERthMne5X8i2ZWn7eplri4BQqaLlu8u+e\/qr23St\/n8ipR98\/Y0UDgatZy9qoR+oPT2wk0o4rA2X91hF\/s3mBwAQlIbyCIXx9QRp34xie1tu9iNZEufxQ8r1P7fyRn3h8Guf2JE0YM3FudPCy7bvzMaUrzDpTZ7W9g4dUDj5Z8Jj2dzh11ogezOPChehmcjmTu6axIMopHsVeUQrWAIfeqqDp6j8G0om62N5naNAp9XuE7nQSJsqMvTFgJ9dfUgf6YI+GXsWb7SyW4A+YsKWlcLaK627SGw8uLgVuLhtPGLjIrkEfnsvgRVujVFnZ5wtylTVL06kr7r70EI6M8otPZX91DZLtYyKvcCHix6mbZrxBb183aIT35xMqftv\/+codJC0PHV\/LbjVDiw3d22TwkrB9FcOHI8gINOq4H055rIlg7\/yzKVgdYELTcO++iJoFD\/q84XN\/hcjGfTmERubC23dSuDaVl+sVTyTAOt3bS2TcNPV1HvlL2t+jrZmKyUtCNwRETcQiZwuOUocrxWwvoBbEcMT+8p6pGb1yIfT4JDKPBkrIiWQRtHP8uEHjg0zQcogrPwWjUKHf3PT5XyfdoCt8Uqd0sUtecMmBJ6b5uApDyp6Z2a+Lu9MBJQq78OL6eURdfQ31T4xc3K4LshSboTPxDBq5rNSkoeIghMiwscIst0JkMPeR23zlsuL9avV2N\/aUo2FY4OgxT\/WkzQyt8j1ktVXzA1ins1Mvv4FqR02sNrnnS3CXJr2hqfuA\/NAPhi3negSr2QtrTiRPd43pAp\/ZbVONgL2\/qQMwiCg6YxlKgni3s73XzsXEWUFZwp+nQoyrWY6dUsXJvOkQDdJKhc0tVtYPeyAYWDW42zZhlDYqsf63CH7MBynp1rl7f8NkD3Fiiew1bi0r4mVoM2H6ya4YhKyWW7iLaXHoyErNXgT7R1btZxLgJ4Di7fko4PCD+ial95pM4Utha83WxFlx1vcHzRdT9iOgjbimbooUgKVuATrYvQOVPZyUwcKUkGP6UEdglY4Hnf0GMZXd+YfEEnI36C+zoic309w1brg3u2BMo30N927+MaWJUtFrL\/CTOjeBnz01eW+nP1LlqCDX7bKahtUI+3IU4cFot7xqnnz1fXBWtz1ZA4eKOQMg+xsVyyx0oEGCOe7lQ9MpJeITs62OFQQBNz\/+IrjE0u4sQj1JHeyISwfpaeAIrs7KrPwPiQwoItCPP+xXLpEi7zGuwm7WsETpEOO6bw\/bvK+JF0jGoDwUteUh5jHWuM4XeBpodcmPicQl5GYNkm29DlqqnD65WIVXynFDOy6G8FB0gnBWQ8h1e35mBhJGTP6ZKvz1GitAMwN2WoabGl8DjKbAvlyraaYIbvPv1JW2DgPAcPqzCuRAlfQijVGlZaGQMbE8FljHcvE6lpf4jP9GB1OkBwUuT+JeMlm\/3UFnf3+O1B\/Uo7C9qsKVb+OEsbP89ezNXpHP0yDVgwAX6TrJXTOrFKPNssOoQpOiAl4rR2Zaqo2ESR32M\/H3lZRSWQ+r6JRrpMpRG2rJOSodzw+aai\/8i2Va8t+HFb9ZzVL7giohHVQ8\/0h55HeZ2weDojiJ8akiRfbRg3pAkrvgLLH0edxoA31gL6ZyILc3B7EnK4P5C4EUWu4aOQvvxOBIRf3RoBM44NsX\/69nbRw3VlUK2ftRSLDhd5xbI5+bbVaw==","iv":"168057865cdd3bca764192a8ddf4f7bd","s":"9c50d5da88381f49"}

Saudi Arabia boasts an increasing base of ultra-high-net-worth individuals carrying $30 million or more, according to a new report. Image credit: The Future Laboratory/Ahmad Alnaji

Saudi Arabia boasts an increasing base of ultra-high-net-worth individuals carrying $30 million or more, according to a new report. Image credit: The Future Laboratory/Ahmad Alnaji  Saudi Arabia is becoming a front-line destination for top-notch products and experiences. Image credit: The Future Laboratory

Saudi Arabia is becoming a front-line destination for top-notch products and experiences. Image credit: The Future Laboratory In 2022, Four Seasons Hotels and Resorts announced plans to open a new property just outside of Saudi Arabia's capital city. Image credit: Four Seasons

In 2022, Four Seasons Hotels and Resorts announced plans to open a new property just outside of Saudi Arabia's capital city. Image credit: Four Seasons