Americans ready and willing to front the cost of acquiring a high-end home are driving demand at the top end of the market.

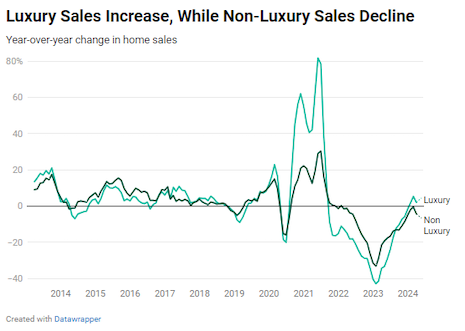

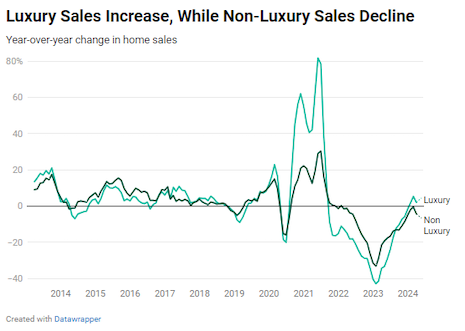

Luxury property sales in Q1 increased year-on-year for the first time since 2021, according to data from real estate brokerage Redfin. Unconcerned with mortgage rates and coming to the table with equity to spare, these buyers seem to have remained particularly active at the start of the year.

“People with the means to buy high-end homes are jumping in now because they feel confident prices will continue to rise,” said David Palmer, agent at Redfin, in a statement.

“They’re ready to buy with more optimism and less apprehension,” Mr. Palmer said. “It’s a similar sentiment on the selling side: Prices continue to increase for high-end homes, so homeowners feel it’s a good time to cash in on their equity.”

For the report, analysts divided all U.S. residential properties into tiers based on Redfin Estimates of the homes’ market values as of March 2024. Luxury homes are defined as those estimated to be in the top 5 percent of their respective metro area.

Luxury real estate rush

At roughly twice the rate of a non-luxury home, luxury home prices jumped 9 percent y-o-y during the January to March stretch.

The cost of median-priced luxury homes increased 8.7 percent, capping out at $1,225,000 — a record high — in the first quarter.

Contrasting higher priced real estate markets, Redfin data shows sales of non-luxury homes are down 4.2 percent y-o-y as of Q1. Image credit: Redfin

Contrasting higher priced real estate markets, Redfin data shows sales of non-luxury homes are down 4.2 percent y-o-y as of Q1. Image credit: Redfin

During the three months ending Feb. 29, 2024, nearly one in every two luxury homes, or 46.8 percent, were purchased outright.

The report notes that cash buys are up 44.1 percent when compared to the same three months the year prior.

This is not the sole factor backing the sales boom.

Supply and demand

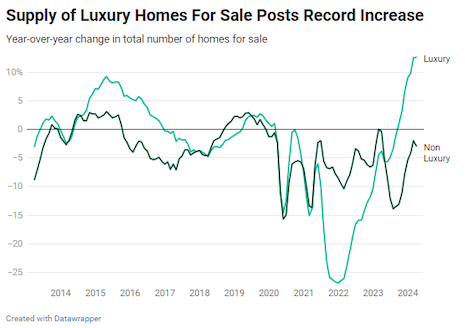

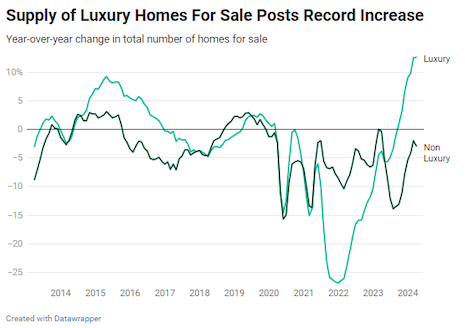

The supply of luxury homes also continues to surge, rising 12.6 percent versus Q1 2023, as non-luxury inventory declined 2.9 percent.

New luxury home listings are up 18.5 percent y-o-y. The firm’s analysts provide context to frame these inventory figures.

From January to March, the luxury home supply rose 12.6 percent y-o-y. New listings surged 18.5 percent y-o-y. Image credit: Redfin

From January to March, the luxury home supply rose 12.6 percent y-o-y. New listings surged 18.5 percent y-o-y. Image credit: Redfin

It notes that mortgage rate lock-in effects tend not to impact owners in top tax brackets as directly.

To greater extents, this group maintains the freedom and has established the home equity necessary to sell whenever they see fit, including now, as prices surpass ceilings set in previous years.

The other reason why Redfin thinks listings from and for high-net-worthers are popping up more frequently? Its report states that “luxury supply had a lot of room to grow, as it was sitting at low levels during the first quarter of 2023.”

The full luxury report is available at www.redfin.com/news/q1-2024-luxury-report/.

“Even though mortgage rates remain elevated and demand isn’t as high as it was during the pandemic, many homebuyers and sellers feel the worst of the housing downturn is behind us,” Mr. Palmer said, in a statement.

{"ct":"k8hCTsPyVk8McPZtj0rkndjJFi6Fr1cQ72WE0seN8P27dBuuvj5nEclgYn977N75ow\/vccIR2T2nMjEzw63QYz42jWDAmui3bql7G7rFirAtHOk7SvbwNT2y+33fnsc9ggW9AuRZ8B3j1kNpzWfXZNm3l4KseljM8XNV8pglKalOgl7ZhOzTWH3sPuCP5SVys0w0uz7szE6eDG09UCWmkTCltXBA3WpsDP65nGKKoLbZWnSbpeNNLOQYnwsM3WkX4Knw0MPt\/Pm\/1qihLGc9cfcbK2beMZYZhSwepvQlIiXEp8AdIjCzlDpMuCIUZwRcau5VTTjsBc0UWcEiD+uKLKUuimsQdlNwvQzzarvzvmdqHQIyGvSEGzhQI\/dECikDUhSS+VVRfJChwLsm0AVA2Ah5rAFmoQ7iqWLUu+F8v3WFnNZ97zYdFLXIZcqcJAoo1db3ZfTk190tPu9bsoNqmposAYWyMpdSwTcXSIKsLIeL8yUSmoPCUQaXiDcnVJngcmaYDRO7HQx12dLH0BhzRtHuz2Vm4BbkEh8h67zxnUCh9DibDdf2P2AkzQ1b2Z5QH2DseiYol5gkkgaFjsR0HEZEAT\/Hio4K6zhygysdeL5RGUW4aUNm+5y41mOa68jp9zi3PRcZ\/FZ8rjJtfrlAaLo6PkuEnzF9H6UHaJWC\/FQYAvMzdb8kUyCgp+X\/Cg2HtrBs5O0FvdLYxp+nKom16Vt8MjcmlspTS\/emTacWwUE8ydN7PISPA+s33oU8InEFSag6BG8GRB6pDNHHpo7NqZzViSK77WsxcpR3uWyFT0v9ghfU6jilpvgsgwtnX74O9FPdeN0ZoXt\/I+w+jIzzfboWvYPTc\/7P0ZP\/017+OF3rmw\/z79y91aKjCpdt5Bof7UnvM1P4VRKzp+83ok+1M+FRHbcLtTCHcqpiAHWHndEdIcTgtq5bCdoofdugOYi8T1t9u+ZblH2OQ393po79sPjiE\/1n3zPMvnCzcRGOhpsnewmCrwvsx2qDofSYZW+ujAHnoEoMj2\/pe7KN6ARoEAcA4BjGmTHOWGUGtoi\/+dyNC65gqmXjZDDrpwH6UFRE0ro3a6o9PhSx3CvcJndZQwUGb\/GgTSugoTCfQXmzH3Q6naypaOjO2RMV2VHgJC76XjKrWErqWWXoXrYoNp2q7Iw\/uoZwgB5+NgyOzzkM4r9awRmUWFIK8nkC0hcmuK3LOf7OI8qJ0KhWj7mRXAPtJtrdbwq5lHg7ZYQdosuJCUtbkm1CVsuqghvz1vhR\/Pv7qWCdF4q6a4Hv5V9EGPINHX1AZbvVKdrLph5eQ73RYhMPbdrmSXAEHz+dQ9Dx2STPNCbLctdVGCeNKu09\/aM4NkHUDcASeOEE1Y9bQxkA4TqLuK8IXaypPw\/dQD9G+YYb\/WPlqG0xIolLC7aI6UumR9botxjX6KVFIJGXGL13xa45tbv1FNp1zW\/OB8Q8bV5cgKNRYe7lBd2Ev+dgHrRvMx4HO8jYQuUBYA7tq94EujNucuLe22WKd+lg+uTFrTLYNMs3UkJpkO\/xKXT5uuT6dXIRmntXWWgGgFZC70kvIgx3p4\/C3sJ6yRiVhGvhACwwNqwwbI8b0oxjGnjZvwLAdqI6LGfZjXg5rD5PTh2a3QlSWkC45JVHbRMYToKAtoSIF1c8gVpOr3lNXxLORoaLVtNbjeq\/h6rUfSTOPGxCKvi7gR4\/1hJQkJYg5k3ZBaNNwqTKR+Q7jSNhdx3YmCOfOjdWedis2LghV1A0opKC3MZhK2NwFwmc2KOFYr6JGT2eb+WEsu6kGCMpV7IQV8pFW7YNoxlyMqoHmHEhUg6klASnNT4Uq1ELXsbk6rcI0EnTqWwjGer2HingoQExsTgcOF3Yh9nM\/gWz\/SeEXDW92GZMG70ousrz6XL8KL+POTwHfzdYMSoloUHxL7KCnQQ81xCwXxjdclavyWH1iUNZ71R2yQJmJJa4kirIaPw1Z+sGsyzHnriNASkBzwB6m4vgDFUv7Yhv5Z3tOvtX\/e\/BYyn3TQpjmFS3Ux318dRPApzVu9qlY4MZBusmwrOfrpSdCEJWEzBbvfgkdINN3MW\/shjSVR7BTedFWE00rDP1xKAbTWSr4j\/cJ5CBrnK+Et064GVE4zF7n1WJjEwhbYjmis\/ALe0rLPIeQIbdTqPOmpihvFc+gcUdHv+tnSdte1BdmaEweE6hjTyi6BcHPJU6sKS77nulaxBumBqBmyUy7Y+J6Ga7JAj2p2rVIXKFopDzdvBBOwjfkv9eXwB5wCKYhDqefmLTxx0JXvlQhgTtEF50vLHzYjAXmkPVw6uLJNVxTwolq5piqlYRsvWQTKhj0fHsDmSQdpeXVRYU7ifkhkE+6BOCjnyIyTsdeg2GvTPsoodGOxi+r12d5Y2WWnX8d4uUHwiWirCuwRAQtuzceRcFZYDcN8zwzNGxPDX5gp0WDOCwU0ul0NjtFZn7thquSRcANgWkNGVXFO5QwB5fAXozEhEtoX1IPINTu3FyT75ndZybErGPTMUTABc0p27B3cCOA2I\/b6kfsF7GjwZQHMOuVElYQndt3v0gnWwxEtUqeTOPl\/pCXowrC5+12Hocul4QLYDX3Q8rffXCqly9hKoEBbEby5ahgG9hTspOGBCgmDyFuHOcGz980wkn68x7HP8HMCiWGQ\/Ga3N+7X+fJFRL9Jhr7xZ52r7nykfoT30oexDhFzmLtTSZgAE\/uWxIoD4Tl91yNyzk9eFy7eY\/Gapp62GB\/+LHWPrp1WXN47rek38g0RxqjaGZqRzYd6WJK8wEaS9D7uhCzjKAO5lWbvio\/VfeQy36fu+dHvZLIMDUYAqyrvo7h5Fj8xWGQSLpXPGLhq8HDq5qp4S\/Yuc\/xxrilW0fSQQYWON2BfoIcae7NYOqeNtZ8eUGvbXKpbskdLtd7P1d1EZva8O36Wmy49A3Sr0btgg7T+VurlleLG28RdBZScPz64+AYvrMIhKEPMrEJDIbH+Ik52T\/RWSe4NGNl9Gu71oY1P\/yx8aP1ad8OP8N30c9z9g8OVwBX8EhAuVs7u32dV95O18kHomTfBFv3\/FSvI5c2qfS85jquENJOAbxI6d4MesVtKBT04OBSq99n9UHDuu8p+GXmTfQiEnGPtsJhnrSS5TZWZ03g9IHXvLhppQE0O7OAeQguGwT7QhN3hUPJxlTgWxXwp+LDiNYbDyAVORJ0wFB2iU+glIo+H+WS6QLF5MAbr0mrI0lq\/MDjeVRy9XD1uqkqgNLEVM4o0h\/Py5\/TNLFYE45OKDuGsVUZFGbwf66PovRWWlNDGt8qC5Otig8X47orcgb21RiNPhgtGQp20z2mducY6IiTz+uuQ4Y9eH0ErWbREinos+cBy5PHr2L7PRN5mZJCIkY8bZeP8t3PQlTG8EJn1IA0m3VIrVnGCkac5ipYcTkqBqI99dICbyXv3NInkqg4tVIlKrvMvV9ISglhXeFFFlTI7AfVi6XSS\/BokjomdrOmwfSRbvEmufYDpn6cGQ0Rivw7XgzeYicRcQ33B+hzjdW76O6wc326J6rBzrPAxkU6IpFJpZV3lASA85to4\/SdeYm4iucFEhv9oYyr3ShlBp1MP3CKulsPKuABDxfYzFpO0ujDbE4FkZjWKGqJk1W5lhcCpUDGVGPAe3\/blpsGSqS86YlwKBzZMXbf4bYxMWAG84o\/hjknupDZIdfC\/pcwwXdaDE1ES3QnB2abMf8BGbgun\/vRomJIq7pKZwFMvtzJ6kONRRiiZ4IPpD\/W295nOQeDTLrWGEiTDeMoQTxC8EXt3ssoZ9uAHJwXvSkqOhtAu6RMNcuhp5oZ3cWp9XhdHqwQFRCwnco3MF4xc3ZF6ZkvMEN4tGQPYrSfC0PntPS0dkdrIQADzI9BTJzmfPHj1HVdy7BBAE3Vlkq++Prdv70QTxycvmgsAeFJBuCBj1vXBGU+gpY9\/wj9wuDpAFDe9ve57kwEoPd3i8uOnfgu61aRbeX+cJhk5GVlw+YHElGOIeJH7BXdrcVFkjVFHcEckYijA2flrxXgQRrA68p\/KPyiy1LvJ7HG33jLc8CuTYPriB3Cz2vAjWWSaFdTdr1jzuwhe3gBCBZegtF6MdypUn6LmzetyuOUoM5SaMFrlpYT5ddi2s5oGtnIOxF5lb22V9Ci4gg9e\/iFFaDVCEoLCloaSfsnpkhH2Nx81IseY5YUyIa7uN+4HUrSrbkzsu2kH0dvxOI4\/DtXynkoxNPk1dLxnMNp5N6KyOfPzKiKtp9w8Jw3eQlhNAm4PgukqgIdOPyAg9UW6tYmMeqmfe1kRwwkJjRXfeL4LXrEM62M3qtXXNjHSvGPn3hJQdefJ8wCQCnLIKghBP+21G8RCLExdEqfwTiqjBYkfTvsN9iNPULVEOlD1fHnSXEyW4YvKFsz4d2X5Wq7\/kNlqiBYO\/+e2soru+2EdnyRLRztOJbkOY01MPJ1RNNtRFwPOYBsGEwH1l+BHtbP2slsl71mkfka7iauP36jkla8mNioHClV+08Fcpg0xO\/c\/0bn\/p8WQz4Zvy3ro7EZXCjSWl2wsS3BnQBSyptW4utSZCz7VL+FW2IOMmSL6gjR4iuP3O\/mWlse1uFbXnZkBh3zZ8OvkQMyVRgGHrlB3oluafDafgrCxJS4N0cBnOdPPhTL3XSoSYOaFegAJ28V9yAANF+6szedAS+uKxBw+bbbqne6AP5zuVB3TjpDdWuICCWuIuXh1UCXdpMJoSO6cgchhYe9vNuQpOteQeApXkpT7s340gsIcH9c6IhACrpFLkTf2zhGeDk8N38h\/SziRr53qAjjQCYG0bT2iLs1vQMebwlgW7zF3DmwR246p9iJpUWs3N0Rx2+IoQtdpNIcoeMTQV7+uNmhS30fLiQO7Y7udeYuL9G0AKQgbyU7zdqxsuovi1zJdyv6Jpld4dmEWYBZOEoudGekbhL1C41QMqT5sfpStMVJk+w0cHiC2MANuVO4qCjbWSi4nHNC+MpQ6XMWrKISOWJKUUkFEyAX+XP9lGFTEBVsJDqC\/vOxjQ7GGbP5rWfBDqJ8EzEKSylnYGTjgkH7l4I\/MPz5ifnD+k6jwWskbO8pFvETu+6ItmmNOPwdMXVb+SYcvJ6pvfom0+ClFekNqGQUthOeh7Tfi8\/HiBLqTGD0jV0vX54W54LbJEX29eZ\/d7qpG0x4bN+A2pC0zpuBFE7St1QPpLIcXB1IlTCydd1JybAFK\/qIyJAJZ1yff2lTIoXFAUbzqi8BPpU+a3MdgFuLNl5Tcpv2sYb6JK3JqZNKAg4eygQ5izhkcKPqK4wzDbBWJEJ14SHP5nzLL\/AF\/VYm4ggwM0H3E4u30PcnYlflCbT4Xhqt7oEXZ4dREWrhlFFCZ\/FF1PyLoZ7TZoA2Fmjytm2VWrv+f1t8uQ7Wgu\/5n\/OCwKLa9u6oORszNejOc+7c6FBQn+DqIQRptXIaMC+Hlzkj8++4MPQvhRKFmR3BFkvbSHHc4cn8cQfnenS+eenxntAE31ptDePIazpsBOP0XrUeXnMP7\/W4wS\/mNhe5KdT\/SUo\/Arl7c\/NDjsnOdEvbhpLX8JIi3hJLOL3MwfE6VgLc5MqUHIngAWRDpFFC0CtK+gLEi8g7b6IQhLJcwZ77zzSFK7rwAw+n\/HlXJX694beVAtAX+Bfm43djVD2lGrQcpkbz3ijipy5yjS+A2c8OKigSnR2gx5ExKk8TPo\/rEnLtpCMyHsniUipg0Wk+IXrdTktUWvdApDBF3oxqz9ULN3+iX0qU4g\/qHSbWal\/MOZVc\/Y1wo1c0ZkP\/1mJfS032AQz0m63L\/8fgtkC\/ooikzGjY0BVtr6wLxsjHA63a9FlMdTm4W1KOEB5jOO\/3EdFwOyKFRSxSVbe8bHgmPY+stYuISnV659pQC5IG617pIanzka3rp0nktiIbK9jYLapthmrQEMhAvS6bIYYihTlOWieSLeJOBsWj39u\/sAzUuOFf4TlRwKwY69quMLxJ73wxAH+wxTS68jdjyt3ahEXGjLdEyTT\/vcA6uQH\/ZCahwVuqhxP2\/VgI+TiFfI0E\/GC9c5YdlKcMjuSsbLXBjb32Zt0UFE4Ija7hzk3bptsAwzU+vpf6eLTlIZRYftyczBXuGHWb4vvznR0g7ZUTgOc6aKlGFpPC1WeChSgEXFuougC2fJ\/LGJxL2DGZ7s23x2Hlkumy2xmtgYtb3a319GWBOSOzgbHQ5+SO+ISfFDt4OGyMMFB+u91r\/TuNtcVH1f3dHOYqdSMwYaX4b4ume8eSi5y","iv":"0321fbbec5d9543498936b221f6c13dc","s":"6403e4b85c9e14cd"}

During the three months ending Feb. 29, 2024, nearly one in every two luxury homes, or 46.8 percent, were purchased in cash. Image credit: Redfin

During the three months ending Feb. 29, 2024, nearly one in every two luxury homes, or 46.8 percent, were purchased in cash. Image credit: Redfin  Contrasting higher priced real estate markets, Redfin data shows sales of non-luxury homes are down 4.2 percent y-o-y as of Q1. Image credit: Redfin

Contrasting higher priced real estate markets, Redfin data shows sales of non-luxury homes are down 4.2 percent y-o-y as of Q1. Image credit: Redfin From January to March, the luxury home supply rose 12.6 percent y-o-y. New listings surged 18.5 percent y-o-y. Image credit: Redfin

From January to March, the luxury home supply rose 12.6 percent y-o-y. New listings surged 18.5 percent y-o-y. Image credit: Redfin