The financial services industry has found itself under mounting pressure to yield immediate investment results as consumer behavior continues to gravitate toward instant gratification.

From shopping at a beauty counter to booking a five-star hotel property stay, consumers’ demand for personalized attention and instantaneous results is growing, and artificial intelligence has emerged as a popular response. But, for the financial sector, which relies heavily on a one-on-one personal relationship to invest an affluent’s wealth, the technology is poised to disrupt the traditional role of a financial advisor.

"Our hypothesis is that automated investing will bring new investors to the table, and not necessarily replace the advisor," said Chandler Mount, vice president of business development for YouGov's Affluent Perspective team, Cheshire, CT. "By simplifying the process for consumers we expect more first time investors will be willing to enter the market.

"This boom will likely impact the non-affluent population more so than the affluent," he said. "We expect that affluent consumers, and high-net-worth investors, in particular, will continue to see value in having a financial advisor who demonstrate commitment in helping their clients reach their goals."

In the ninth installment of the Affluent Perspective Global Study 2017 report, YouGov examined the how artificial intelligence is affecting financial advisors' relationship with high-net-worth clientele.

AI guidance

Based on its research, YouGov found that 58 percent of affluents expect investments to show positive results quickly, despite the current market being low-growth.

Also, as wealthy investors demand instant gratification, four in 10, or 41 percent, of affluents no longer see the value in hiring a financial advisor.

These two factors combined, the desire for immediate results and perceived value, has resulted in one in five affluents using an automated investment service, or “robo investing” powered by artificial intelligence.

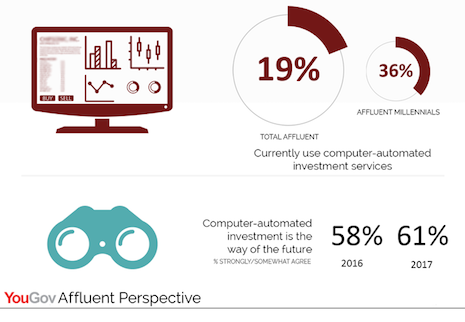

Wealthy millennials are driving this change in behavior, with 36 percent currently relying on robo investing services to invest compared to only 19 percent of total affluents surveyed. For millennials, many of whom are near digital-natives, online tools have shaped their lives, from the most mundane tasks to managing their wealth.

Even if an affluent does not rely on robo investing platforms, the shift in behavior is being acknowledged, with 61 percent of YouGov survey respondents agreeing that the financial services industry is headed in the direction of artificial intelligence.

Artificial intelligence’s place in investment is on pace to become an industry standard in the future.

Per YouGov, 61 percent of affluents strongly or somewhat agree that computer-automated investment is the way of the future. In 2016, 58 percent shared the same outlook for financial service’s direction.

Computer-automated investment will become the industry standard in time. Image credit: YouGov

Twenty-three percent of affluents surveyed said that they are likely to use robo investing in the future.

While artificial intelligence will certainly disrupt financial advisors' roles going forward, the opportunity to adapt to shifts in consumer behavior and embrace new technologies remains.

For advisors who rely on traditional practices, incorporating robo investing may be attractive to current and prospective wealthy clients interested in these services.

YouGov suggests that if financial advisors include artificial intelligence touchpoints they will be able to improve efficiency. This will then free up time for advisors to interact with and educate clients how to use robo investing programs.

Similar to other sectors, a one-on-one relationship cannot be replicated or replaced by a computer.

"The fallout from the recession facing financial advisors to affluent families was a loss of trust," YouGov's Mr. Mount said. "Few advisors were free and clear from loss back in 2007-2009.

"What made the difference was whether or not they made their client feel like someone was watching out for them," he said. "They communicated and placed the client’s needs above their own.

"The data shows us there is a lot of repair needed for the industry. It is too soon to tell though if this same sense of trust is being transferred to AI investing."

Tomorrow’s money

YouGov’s Affluent Perspective Global Study 2017 also found that 84 percent of affluents agree that they want their heirs to carefully manage their inheritance. For financial advisors, this point is important to consider as their role evolves to become guiding investments assisted by artificial intelligence.

Wealth transfer is a necessary discussion for affluent families, but according to Bank of America’s U.S. Trust, generational conflicts are brewing among young and old high-net-worth individuals.

The increasing longevity of human life is unsettling traditional notions of responsibility among high-net-worth families, according to a June 2017 report from U.S. Trust.

U.S. Trust surveyed 800 high-net-worth families and noted some stark changes and disagreements between young wealthy individuals and older ones. These conflicts mainly took the form of what kind of investments they are interested in, their attitudes toward charitable giving and the new problem of multiple generations competing for the same jobs (see story).

Even if the role of a financial advisor evolves to exclusively include artificial intelligence guided by a professional, the perceived value of enlisting an individual to advise on matters of wealth for high-net-worth Generations X, Y and Z must be based on honesty and transparency (see story).

"Millennials are the first digital generation so it only makes sense that they are strong adopters of robo investing," YouGov's Mr. Mount said. "The technology promises speed and convenience which are highly valued benefits for busy people.

"As a generation of consumers, millennials are typically the least experienced with sound investing, though—to be sure some are very experienced and very savvy— and by outsourcing the decision making to an algorithm that burden is lightened," he said.

"Millennials are adopting the technology faster than older generations—but there is some activity among Gen Xers and boomers."

{"ct":"yqAk7VkvCQnGbqAbfi3pgWg124yH4HWf+N+WeDT3yLXhIFo7hX2MmLAYsbv42hFTwA1j0CBQ8oaoIL46JTLG\/BVjcGDuELZvz6faRagYOSSRr9VbExt8p9Ji2vnMTXaq5\/amBjyy+PO4ZHqcg6FS8757w48ADPwy3x7hlP29B\/N2fXgCf2K3J0uknjVgIVSyu56Xyfb3AZ+RLBAoKTCKCI7gWCBqFfm8bFsmjn8\/kff5Zgq5Eh3XiAO+2NZxNxoQwBBlHxNXVXL0owOBpKx\/IlttnhT483mkr0+WOow6fYBx069MeD7VqZ\/quI3ZMUBZNe4VSGLmFEkvxNa3fayxSvncW7eQsSW2C+d8DFf4DaHSJQn9L2XPrcVWThqCahdWJ8+XOYyAuS0Hhhtw1iu2kaKNTN5hZGVT2inR6udXxLmiZgDOkHtPudXxsbhc0HQUEdHibqSUL8uIvhOpfAMaUGgk1dWzvhWjlogWpPW+auy6w2V1B8t8dEMPl\/t\/VDtbmAVTxrhUT+O9sfO8wCVLhrP\/vRhNMK5ePGGYz5L0UhiRHzKhwTa4lGhrzPQaCgXLKJ7KE7WT2+VHZtc4iJdtXKJe2bmHuBFOfya6dBgsHFwSdXXI8vJslfxyZLSJr2NdPDMmrbhF85cesTwFxl7HFnAd0d1UH5Boeax95jXPiQFpcuQ5aZQycQ5LMghYgicKc2WZuumBfOj4HMaLG7FkEwfgDYPiG\/cKwVPZcrMwW9m3WHZVqiT5qPz5CtnTCQEdR3my9fGVD81klGvD9ivWiVEsNlZu\/IkaACpKc7r8XEdVrZaaUiUk+UUqo\/qJliLSak6EktJSZNZMen9cQbh4s08xJ28apuvhUl2AxeC31s7UTmjPoJdHJuRshOFB2kAzxpl37liJz65NuBOVi5pvkJNCk+H+I8AktBX6Baqwns7cLN3zRonVUSsvYjlxyLtiTTrL+8sn+Wd6Wc8Ze0p1c8vE1syTnJtQrPmLHoYOi+2dGj7SfHDE3V60ROOiaGpw8KzLOp2X4JKWeRGuhGBTSbVF2FjfxpKaRfEkhkWJr6mHI7fM7de061bXmQIBm8vguQkdbFOEDHsqy\/LB7KbYadS3CpmibAJXYESW1ezWuAsybjUvbHP61rsX9mHYNgX\/i1lPitcq0NQSlHOBJCXGwgwnlDdWMAGZnyeK95IaHoDdGfZZ8R+MdRixJ\/5MAtgTFahUlVMBVJZkaT7GUaKhz+N8v\/fHP7vC9wrxML+1wf3aW9er\/5iIMEgxWB3cu4PJrQoHHUIv+wWYRWhsIQkoI2hcHOuUPWdoOYh\/oNh1HnCbcdGXjISkOawOY4UQpQVklPKjVI5Ca9gib0zohO1ay54pTXcX6d6Ti\/xY9WRQnAUTRnpyKKbXEqPtVF8kSC24qKpmSglJoDUuPSf7dh94SBZb8xM4xwiUgArrsPBs00G9Rx0kZ2bBqQcSwKdIzn29hZ9UNA76M1Jdekyxn9X7fwixCsboEvA8ov23WKcgVSo6Wsy3PgmxW\/u2d+TwH37qtwO7peGXctrzifpyWLMGVhaVoLgSeaoFjZpHQcJRa1HEbQl+9Az15zxbcK1i8GLIRS+MUpAjy7mdIIymZSJgLabQ4fDghiGzghYyGL+EWjo5IJVnhKQQPRfKgIhynZRndJ1BBbAUtPyEmVsQk5EZVvmlnARxx1zjA\/WrjRJTeMY67WXPvO6Y1t7a2tNyfN4ZH4vabFTp2dIqWfL8ldm5Afp2gXnApvDjmfFg0e3j88ZlRVui6oOC8+2bITJ+ye0j\/66p2pNykLjIAE9QeAGXasNSEWoXwWs4INRRRL3rDWw\/7Fyhmw8AHYR5w5Vm7R65zFrNnaaZk9jPNx8mM1dzNkTAb+HRFHPy\/Oa0w0rYEGo+TZ3Y76jeGJ\/1x6j0gYacboKnKJ55o6XYbKpMQLZGY2GUDpDUPAdrI3rb3JNGFv1Sbor4mY4v\/HLCx3w0XdoJQX3dSm4BmXzkpwk0LTfiKWQpmMI+d\/w\/2lxBahLbACGQ4NiZdXALHg0CKz0CsCv\/YfVPXKVbQBCLB+N+K4pFQONljcHub7bMrfw823mtvatq5adhbX2cFgTxRtB9Le\/EAxMCXFu2UiH11RAyuyUGK+jfd+Ns7i8JsgiriMb9Te1FZmPfY+tKL5OlKeoqlRICcm+vMaTGaZ\/8FiR99VaJtrS4eGoEGr9ZC9ihP858zIyvRPmwkT3FqPZe7NhQPgTiuibwKfKAHKhbbuUf1WVF5WZOhtA4sMzxEcJW9irkHnZQJhPOPgyJ96N8vQOmbrLlFFdTrnZVT8BOaVXK07InIusf1\/tWh8JPjrnVG6Dy06xR7voqHnw0qmBstdIUCtxF1Rz1ZeD93FujKrdd3JyXCUQylfNdiwYuH2ffrb+7QAdv3kK98iEPG7eu0GxGRQajBEfHAjNajEvUqwWnInpRTDyEMf6ekH81bTmryM1kXFzvdhvSCysK\/JXpG\/UJdq+ltv3FJEdm+5Cb0DQugKtH5MplV5rHXL6yiNvvwtAQwC2SrXZsy4Ws00Ip\/JvvQ5uu9yUOWFl3iF5D6mts4Y50zPaA3Z28J6xG1YxFGrcL+38aGxjFjLFHcSas5o05j7BxXsgNtV1t\/UNE4d8Vn+lJWmzReKlWnThzPyPPV6Aet31WGkiOHwq4zOLk6qfoxuB1ZOvF\/9BzqZWqeD6qAstwGtmpKfyD3mqdFirxuofCL4mLHHso0uf28dKofAwSn5YoK9VCPT3yKOFQzWcNtv1ikbMkCX1mpQUwXSuOvsxD0gVB2r1Gx1\/RnkBWiWRqdbH2ErwPCSVaMeneLUFaAukj0deCr4bSfMDJqQF6S5Xy2yjzfUvGCLtkhbZGZAG\/ABnr0D5c5b2wMVUDJ3t2zziTtIHtXEKfac4SaX4agUJO0+q78+qrIpFaYOao3l0jkLHNa2F5pko8l1cwy93W4aURUcghAFH9Ew4hLctOQrSh08x\/eJ1vGTt1dj4SELCbiZVyRsJxHI\/RXQB66qChN4aFG+sHRHKfyo0SLXdjFAoQadKjZbkMKwHYWRaZYfMITVti3B7QhvrLDU9SFtT3YkNDshM1Xfl\/5xYlTJx+vmBC0DCYhz+PZu698kRHA1yXCXO39Y2s98jhCzKkzrpazaJpd9bOLjGBQGqAcjIClDNpP7ByWUrrF+zrCwO6Gtk+AV4FVnXsTvo+dy4My1L1yrLWFfeR40ZXdbrfNUc0h6BUjSZ0\/9y09MSH1Y4z6ocvMWcSfuWxX9XQgaToTyELBT8Rpj6fFld8kKF5QLQf3UCajSy8Fcx1KY2BUm5ciRaxbQg4VEoBxSOIBujDRdRlZ1I7msouOsMoncsY4w++rlrRSIUksjGze8brOSLFDn1cZME+tIEWZ2ILX4vJlrVxt2MXi2z6MwtIN3FBkd05GGqyDbMyQbFSlH3vC\/veTOIe+EcWZ9QaiLLocWO0Y9lwrMeVe\/Jqfl9T+SFID5KhwAIazOPsjUT5TdRe3cNOhxpaRWfjDHTjcyPJYjIq0XHwjAcxuMAxLhjDM26K5nYV9WIL1s0HCUZ96bGngi0BXdwxz5b4Ytk2IXL4KmGt5T6JDxnW+DFW0KatJ1Dm7SHbPPYSZzVaRLAyMwDsFk2aWBCVGmvxMBiCzeN0eFhLmFB\/uRRaxNPCobkqhTfqgSbWtblF\/vp1TZ1D+PJzACzRRakmPmtwjN7w7DRDBO43tHBt\/3Ip1lGcoIyBV2WH+sC9zeGiHlo3q7D8OHi3KTGK3jP+G\/s83BVIz5xWe5B9Vw0LtIe5J24KGke46dTtOTKk7h6mO\/jGumrEYt3s\/biKvq7I3jAGdzdSmL41f40KavDD5C5LUr5t4Z8YM\/hmk21p4Z3hpox3gAqYVNRFiJjXrZ9YqZoq4+6j+hwHszWOg1KMZvCYdm7Hjsa2dzkeRVQcoH+467TkPvH+tbCQMDJSEjb\/Axl7TdvveANPvxOqHonQKOzgIV+Eu8MzVrdWhuOR4k23zeNesThJs\/q6kzSXtZk5B1GRmZlUB+GvHpobB\/fGwORNHbkguHxrgXQ0cYO+IOJrcBFrztBb2JQp15Mt55qUDuemaOitjF7Hrzg2FQDV37usZDkvFQYyyZ\/vftqKD61MKTaKXTE9puNwCwsjS6m4dhsocqT92PefOunSrg+YqPQZKoV66E8r1TAx7uc01xQvTyiiV2THwjMx0CKvIUq569bmKVrcVgO3kwioEspB2a2bwhJPjbGeU0AFiga9Qc01+5cpMLsC9UCBoEEsGXgzHkODa\/lZxP5Wn7selYaHQrfLWxjCTFaJIkkpwv03V\/u9h6ksuDm0CrFAn5aV8iLVcWDQoix\/srfbbEr0AGEcVqPrSh1eWpj5+zegy3vMaE2eknbPVdKT4NeNOJHEgoC\/8y\/\/UfJLwoNbZ9HiBXAXokKsrsaWl6wrvSK4lCnsmwujPsL57YwgW0lkdxwIIJdpuRmHbppnBcMm7\/zprrB9XYJy5jqbA3XghxFtaCItmNmUv7Eb1t+6AehgMVOXxhiRZQK+hhgld\/QeNMVpM+N4JOP\/S5k2itvXP1QJI1lXw2uOTaPg5OZEpev3dJSmMt0eFjqY\/R40k\/QC33KTx6Nn33vZ5BYHKlXjaUHXyoW5U3mXLu+1DGIA8URcqbHFR0sh\/GnKalP1ItCEpAN8smbAiDP1x2OR3g6bbNOoFOfZUjlhDNR9iGUnDn7QwiTR7PzXoXMUmgzmBqhP398e0H4tyAJsWDX\/7nSz\/+Y2rxlU7KiAG6P+KIoK22ca6pXg5AsInYFqS7YyZbCNNqy\/MpVQYoqdWkSaxO1Rjrct78nh9VM5jvEBGwZocl1AwP4DJ2WSRwnS744FK4WbpB5rPeT1TnV\/2YnPxnf66D7zt3inYd6xbE1JD6OpcpXh9iSsoF44NtbwHlc7q9WwZEOEumR6SqC8nPIQXa6sw\/9VowDq3W7tnGy76qbKN5EdwVzcTbT7jEoHbmRoM0M8+Ro3qaf+blKxC2wsOIK\/NApgdeRkqILcuoui\/jhD2BzYuit4q3\/qSzZHpmr7V99fhVoc86C+CuBwv\/N5zbAS5E23oSHMq6jxwlmL6jObubLCOI5icuIDPXvac4YGm+mrN7RyQUa2bQjIDgsOyfmC6aQu0Cg+54gdIdC7TMN7oB8usrLJbLvVfTT2SN4b5mWpaotzg+a416mAS6TsUUgLDpwJFyun9FBbW+4WJX6Sxe0aRpUHjf\/kAflRdllCJqWeyuFmCHI0VoULrCy9TB4Cd9RsL\/bloPJJ0eE3kzZqSle9a+9r5dNldTENPEIVV6ZxGc9dv2Dz\/LlRYVHzKVcY6zCxMOUD1TYAkGm+16zE0sCPKzfW9OdmwWDGu2NQZU2MNFwWQACTRTrINENdFM2K\/vSRfboleGSt8Xmny495ONJ+pgrXmBy7IzhuvQBkTc6HP8cQOSHNgG1+4hoYzASNoc+5\/sOJlENX3tmfYw0mYODMJq5LBx9pVhVU9pmihr1i23as2XR58f2oAQVfoZeQpNZX0pGccLIYI\/Un0HfVdYxT6mq1RPQvmFTglZ\/HwE6xduTDSoDYEi\/3g2tiCRA2Zp6EiOrQA44\/LgQIlG6U8u0WfzdrBqXmu+AEUzILwII5fJKPwoa9W+S0p08EOzElYbSctMILD0tG8e4NIOy9792RLkwJcGSBGtxljuIG6UAxYz5jeCVdf+ytDgzkMzapJFnjX\/YNj3HY43bKNk3p2W7GFhDLEXN58x458vgYd4+zA7AZ37pep3w\/jQl5Nc3tneiPlvtSmV0pFpXtoCUxs3U98rSlO7LuWFKIXPQchNhTPF7rFw0Kn8CeAsRf0IEWRAO2c+F9ggqofQZZSZfEWovMbBgMMcZMNUD+7\/wmAc5+gSQJGZaleftwCfhuCHO22n9kB6qqh2wyCEFfKsRxS1TDNGdxqFe\/JkJ5o8Tw7vhWD\/zezP8H5+0\/sQjNd4bN3N+wTyUVfON8vTkiDyD8kDkJFvZNHtFC9b95AtWCk5xlLYMEqTZplalrKohJjfJVM9NclNYh7LKK9DkEA6unHpIj+UuxtJmJY8NQNOB1RGK7N9Dkgcjw3WMbZt1hiuwc8QC2eNRKwtkHnQkK7JSek8yyz0CoqrcTq\/VVjiC15ITukcw4bn2FvF55mXxdF2S\/VoUpMXW2mdMu0fH1VENOXGH1CSDZr4xAXjZpykJXmpdLoFpzXE9RYoAx1BDExeIwwwdtAESTznRxeNqEt7C\/g11P5bpGQIYX4GrxZmGE+LdcrtELVY\/razMEOY+6G07uAyGZtb8O17Jv2v1we\/0n2A0lIlU+1al2GDbYrzOxw9ysJ\/NqBBDJulSaWpjpsQO7\/yQxElb0UeS6XDwNrqnZCbDQqF6gSQYU2IMmGNykz5zZ27OHUTD76ISgWOtnlv57oiY+9UfLQ\/bmA55mb3hvKOFRMexDZ5OCbqb6Rp4jS21EcK0dVhykN+SBETL3NxsmbrM5h7Cqu6HLjd0TzEF3fBjZpWEWyvISe3\/Ow6RPQBiwRQt4A\/AcHD31LQkD2p2f6wg1SjvBZilyAFaPZ9hcQKhWqDJOBn8vv9RIIwsza5SvSjQqVuKS2H5CRMP89LEMpQXcJjCKQ8Ex1gi0JHnNMAFKc8MZRJ4BPnBtfmLCWOLm64pxlNhQb5PqaACOwN8bekc6OAGM9PYXhrbEflMp+ZVMwG06XfuWi7uWZ+zxs2bfrFfy7k8+YHTdXJrtPj+uk+ykde\/ZwBR2PITJd4m2DgEfdEnsSvogGxGxn53mm7WPxpBIqivI17UbKC9e1Ul\/WU8KBly10c+ma2Ns63jozr8o3yUovO82wR8G\/Lp4Ro9ffGex9k6Ow+33vekEQzG077tNX22iOkpBxmMfXcEnDwyG4ocv9FAHM6NtqfcGg5VvKLd19WUqaa9142sktySgj8voI5aOElTNuO7CaE2dCsVTnyfdtKC34VjukK8el6xF+21117dujohXz5bkg4MdAIUlGltju\/DtwT28VeRfE12ZUsYUeRoSHlRU70egRA4RHt4\/HbGbsV3rDIJJlp83v8\/24oLfgFTSVpvMf4U\/Lscs4dldiRRzhHTyvn5tGitdjzy7uijwPgvGBvoWqoScTL+gIUryILkfVc206M0GZ5xDPPc1BiMTozRWZmip10fizUadyw3eFStP+WJkmxo\/VmkZpR5uMwtdM3qyV7yrJGZq3Uf0xXsk51MbpPgbShi8bjRaBaQVvqgPmhkI2yFckXXS8wXfzCseYrXXW\/LhLN5sIZRw7SlYNRSTCqZKhLXhFrIVmLoGeKn2dQWNxiLPeqx\/+F69yYYfpIiLkNexRvjtSCX5XVZDhKp2QCZ2+EcOEmNxiVeaNZCFIr5otdspWzUW8huWust\/Hx+KHNMyJoVYhX2b96PLa9PjkugZgXBklbV\/+pfjcLzPOY4dZq\/USf6wTSJ9IbJNL6LmYIqcMhyKkHD7VL6rQYy9Qm8aeveh84w+4SAA02NhHU1jvQjguE98+CcQXsLmIHufdlCQmtL+XnoiMGX2iiFfzzFTg0xBoVi4grgfvr74IBgCYXqi4XC39Jif4lHvGLK+HvCVVj00cICWvx9\/EQjVkk3wEmJKbnNQCPPrYJyxUuXTj43Fh9C0c5jjzL5oBC\/PccSPz1nXd9+U6Ylso2Hc9QjyQpE1v1tb4voTPOwapwjcOssMjwHnwSFl8o3o8LPYy21UBePVMh9iSned1xwUVnI9d3rUNO7k3J9WISgTbhkIlJ4BcsSMLtBYi5DT9Kbq+\/sg7wJEdK7Iwu6BI2\/6RkHlyMRhkOEkF2g8x2LMWN\/RmsfkF\/1zzjovFuJwWqMgChu+MTSwXKFZcmaAmreG616YkPX4Fl+M4QgI1uuDWPdAhK03S1reUdhPvjx8cSRIaJDRmKFXE541p\/T1jF4AsW8jGrgZ9drZJLXPTS4SS+SpjRnNEsaoYFlVchg0TV5FEqqNXftAZaB\/VL2lE\/q6hmqz56VrYZuW7+a8Fq85V+KCPnc2ydElnPMA5fwYnumWZgUiko4vFepM4DsWErlg\/tt4Qu+QnmjkX7PV\/PN7tIvdcrPPXPG0EE0IYiO3v+27VZmGVEa+ovxdc\/4PXpZaPexVkV\/\/SFNmMzrzVHfQ6B42F4obLqG+P4HRm71xeidHXdwc+q\/lGyCJQCkleLnQUtJ\/Ql61CUYa178RpIMvWppmakb65L1fZppTh6tpSFXdVXYsfvKJGzVvUfS4CFoPI6u2xHW98dT\/Xf2HxHFOG+CfvjU1xh8Mj3YHAYP1dSqsh54MKvi0VWZjeFSlsAdww8mBRw6+wqb\/dZJ3pMJxkdf9L0WvGzK7KiCO15N6zfPeU\/gOazV9jmNHBwG\/c9TIPng1ljrzy4waMXd5WKtlnaDxPUhZHuCcXZaZ+W5TTO5iM9nDrghsAXGo4E5gTpHONM6YTRzHKtH4\/vJhdSouwoJSrnoEO+9AKsdEGe0cO1afSKeJv0zp\/e2+iRzMyOMgvKA2Vd7dUXFVhBD6WxOUQ5IzU9JMZvcMlyCrH\/zzykLRzhN1ul1qswQNpUijnHsOO\/gQu9IFSOeC7hm4qOzmmxD\/ji8ErUkoOzD0Pj1mAJHyM7fh7d779YISkilQO8lIuFkC5mbjZvCP+Ixw7PM33MR8CkcJIP2KgNoeoQ6E+Dss4lSg3V\/baOZL+buA1cYpywQEqJq5iGVAF7hjtlkr9AKkKV4lUPTS8P+E0PRd7jGi\/N+WqeMPFn6uOGbjfX2Emf7CzZIwv2KdJsYoINwWcUZSzpZHYpXJ+T3QAD6vpr8dsvq6vGjisreIAXm4Wrsf3vhYBTfEYzkmaZpgP+XeJLEjxjWnZn+zpcL6gSmpujBmXdL8nerTxbt4ZFSv0krzAUjhY9jUdGUlnIVuv9g5+wtpuh2sFajftrQwFOfC2p\/pGAY6aRGJaTZp3d78LSozsuECL2OgDV5wPFtoIhn7qpefCQK\/gWZTGssuTHOOqxO6xpxlVT8ayFPGkmaqnAgVMsRYGm4KRkj2a0S2sx0I5cJc3hTUkhSkE3tf\/PGvKsUvSrssj9cMkBfI1hDbvcfaP\/UuhjElQzxtEHI\/6KmKvfYhGNjMyrFXbPyJzJ9ZlnNbqN3xaENtjqpkA6DOQ76Z4QCuziJMUShSy1yqCXzs\/79eh\/iBdLfkW183rU9lEt3QH1AOn4IjVHa\/Ixyzc0o6R47yLWSyld1SwwWU6qIFE1H\/giGXnreuWxeVMDiJdimfjHTBqfp4YdT38v9kf5Zd4agwYuwDQLcZj4poecGZGQREboXOwj+wdS2qo5xTwMx8lfI\/ATrGJs9DUdPONeDlrD\/e5u+jkDKj6aSSWocXJ6ESzO+jZ8mqOy+qifkv6Tm6UgOwk6fsGLL\/nEXv4yW5h403MjPL6mtlJKg16ZcjTCBdNBs8o\/tt78yJ\/x8VkmMu5da2PhI4b1VBWZep2NtKKTMxSvUun\/Ms77Y4NkfnkM3WeSZbuq5oBHgSBNey38sVs3xyKL0UpgCR0eM83EEM\/5S7l3n8EBNST5puj1hELCETTEkgnrKWB7Xv8z48BHmWYYxnkJB85z8oO738doWKw7Sv51ZXtjxM5MhpyU7KK3yL0r5k4mN8AkpaZP\/6Tk9Bq7Vxi+C4dPSBanzUGPCyz0JzxUa4nF0CJRxd4p1LE\/vTW6vgVvCxVL1k5hZZvayvwDWPiIPxIQfOawTRpmc11mICUNdZzpaJqhHbNuydE+xLhkcjTn7Rtj5yx+Q6fnHidFPIuCLOFICsSXUSGyf3BlssIseKrhPzo9473nmnj2P9nzg5QvQDmzWSAUouvqzm26mStEd1XnZqXgbkgAtlT\/T715CXn5EcgFVABmy9kw9yMhSbcxSJiQPRDge7NEkwsrt9SVpNyQpCVrO9vyxYVRltEYDNglYZ026vgjEsGHr2De48FtIXt62P5FgxK\/f\/TEghMuaFWdJjTaavFHmiJTE6Wd9yif6YhFctj6RqMBjA6CQ5SX3gyNQl1yRwJkMFiV8wq0f+5tbR75SHXbtGOjVwjQkWYseNiZMqa23AhVKWB\/2HSMmgUG3mW6Z3y3gz4BXrwC+46x+b1ul14WFGmRh7n\/sB2Cvdp2h8stlGacWknQtSFeUTJZCnvqFeVRz1GMCSVCY8fXq\/fwxu1GbDuJ1mw6dmBXpV8ZortHtPwowcDrNBTAMVClHuO0uUExZ2M4uGNpjmQMqqVDhUHvo9z5LDPSRlh18fixHMjrPj9nlLY+RPGvxL6eh\/e1\/UsugSGcwdfebybYimQxdMiyAqpHGt+Q\/uADQ9WHQZkiXdFRRYFiQYzca26qIeZYi+HbYM10dbvr1RFm1PcKHRWAztz0HbOYm8WpYxguh8fv7rRsCYqZYD1OiaoVTAqNGBcSQavDAyo41cTvUDdXfSDy7BBMMy3SgBhMFZ\/FDSkvBGIxbkidKkVtO3FlldURsRgr3geeoGxxLKZKDvmGIZzD3SKt1edKTp6ycQO0Rls9TdjMcO63LrNqXOhPu51+gfLew5g8YSYjh7fTHDq47h\/6HoUdPDfyuiQOFhs3tR4af1ZuYwJlm8DrcdF7vM5vWXNRchXNIVtquX5DvPGvjxMN6r","iv":"0212963a11c8373e188de05336d063fa","s":"490ef5f0f95a0b34"}

Financial advisors still have time to incorporate AI touchpoints. Image credit: YouGov

Financial advisors still have time to incorporate AI touchpoints. Image credit: YouGov