Although the rise of ecommerce and social media has impacted the beauty and cosmetics industry, the challenges faced by department stores have had a greater effect on the sector.

While department stores are traditionally major sellers of personal care products, a report from RetailX shows that legacy brands are turning to different sales channels. Major beauty brands are also among the leaders of incorporating emerging technology to engage with consumers.

Sales channels

In 2018, global spend on beauty and personal care products reached $236 billion, and it has been growing at a CAGR of 2.5 percent since 2009.

L’Oréal, Estée Lauder, Shiseido, Coty, LVMH and L’Occitane are among the major players in the industry.

Skincare products dominate the industry, making up 39 percent of the beauty market. Makeup, which often overlaps with skincare, represents 21 percent of the market, followed by hair products at 19 percent.

Estée Lauder introduced a lip care collection, combining makeup and skincare. Image credit: Estée Lauder

As of May 2019, most major cosmetics companies have direct to consumer or hybrid business models, which combine business-to-business and DTC.

In terms of ecommerce, these groups allow consumers to complete purchases on brand Web sites, Amazon, Tmall and other retailers on a per brand basis. For instance, LVMH’s Fenty Beauty retails on its own site as well as Sephora (see story).

A notable exception is Coty, which operates as a B2B company and has long-term licensing agreements with luxury brands including Marc Jacobs, Gucci and Burberry. Despite buzz around luxury beauty, the cosmetics maker had lower-than-expected sales in this year’s third quarter with a drop of 10 percent year-over-year (see story).

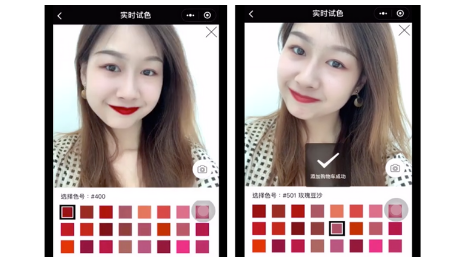

Giorgio Armani is introducing AR makeup try-ons on its WeChat mini program. Image credit: ModiFace

Department stores are also changing their approach to beauty retail, choosing to incorporate more experiential tactics.

Bloomingdale’s is capitalizing on the growing popularity of high-end cosmetics by unveiling a new beauty floor at its New York flagship. The refreshed beauty department has spa rooms, a fragrance hall, interactive displays and other services meant to entice in-store shoppers (see story).

Harrods is the latest retailer to emphasize beauty with a series of master classes.

Makeup artist Charlotte Tilbury and her team will take up shop at Harrods’ store in The Beauty Hall. The Tilbury Takeover lasts until Friday, July 19 and includes a variety of in-store events (see story).

Beauty tech

Beauty brands are also embracing technology such as augmented reality to connect with consumers, particularly digitally-savvy shoppers in Asia.

In 2017, APAC accounted for the largest share of the global cosmetics market.

Japanese beauty group Shiseido is using technology to deliver tailored skincare to consumers through a brand that is solely available via subscription. Dubbed Optune, the brand’s skincare system is powered by a mobile application, which analyzes a consumer’s skin and the conditions in his or her area to blend customized products (see story).

Italian fashion label Giorgio Armani is catering to the growing online market for beauty in China by becoming the first luxury brand to incorporate 3D augmented reality makeup try-ons into its WeChat mini program. L’Oréal’s AR makeup platform ModiFace will be supporting Armani Beauty’s virtual makeup application on WeChat, one of the leading social media platforms in China (see story).

{"ct":"trDpHbl\/9G2Uzwh02I\/Gvz3QrwplP8t4JaCZc6BNx666W4CrhecnUU0J9tyHznQ4Nfg76eVOvJkEmGDHIncec7kv4299BYQNRy9NoKYJ2csl8MbdQeUCvUGF1FfZf8fIl44TZUBwMxJWPPgqTkuT3KdRCUBuDj1XiOJslhS1LG0R4QCYjoX+AA+xRDI020sc93AgbaP+q4cJ3\/Et97kl9+kN6jNWSzxbmbXa5bOQ3V2F0oMn7U\/WudeHdLxnEdeFP4C6HvbvzPjtOK9L\/KNRrVzMa0UaxJJ\/t64niJH6RWkZDpsdu6a4G3RLH8ek6C5k+VCRkaA+X9cr\/pGbLg3oN\/CN0fOlw5AjfIRg5dLlx9E2+8D25jBdhy42VNOG\/BcAV7pjp4dtemLxv84KCDxVzai\/OZOU49Y5hVoAjZY2b1Ouxoi9\/HLo4ibsMgZGlOa3FYsc4tEHUrZnJzYRn9KemIPGoGj\/v9tGzsKKuJpa4za+YqrcIU\/IM97unXJXHA+xLYpWgtvBlDDhvqmIgyfyuOTuhcTnRcf2YLExDbJceuZ9dunH4ZpFs\/rhs8DbHB2tnSW3ejSeLysJHqeiBgPUefVtoBKl3KkXo\/vouAsLl5sn\/STNv5X4bnz4SkwNpETMIIDBldbHAYrZ6RMoc5tgCXm1sW1QoAF9s2B3F+99yRPH6c57Q7lYQQ3\/wek5sYAScP3z4pWqcuHHvOj2X6+l1i3YshLy1\/zMH\/c2S9XPoMvDlvsItLQK+eUNdTq+vOMKm7X\/BG3VNhRKGz0aGgYzfUTq0Yof46p41QaSv\/DUxFgBbmW1WRU7hLX9Vdj1W3KlINOZvQrhs8YQueI56t7AF4hop3\/aB0U+7Y0tKcdPXkQtmsrtdsfrxWtqDq6npuBrFMLrPZisqwIy0YZR5FYWAA4MGObNISjm6blNwR5CEeFzoiiTZxzRJrlcNe\/VFsoA0A3x+M\/a1163N\/92QnmwIx1td3Zn36ClRh7LqMRMcBehPM1u5k\/4qQJBjhd7DeqkogLX53VTx4Zqj0uohc3bAcW7i+\/xh5SkLVzqzKT4XMbzLkzh6LWBsGdJmOCHVXy8kAgujHhvpOKR+KHGsG27XmIURS1\/MlxHq30MQT3wrHJx7J4o1HXsNx0ogzafnFEwAT\/GiEsdY9xVG2tHHs7cV4CR3pqadavtXc4uobtDlUvz87LaW\/shXSc+oaPFhjLKvCCnWq5t5soYmxGTMacjFWX4D1bkMSEBI7yoGf3h99waUqAJ2dZkbFqJYZCdfhkL3ZXZFaTjRAh3vxxxvgemltanCjEMHL5TsXoxHdes2M8Kt24wBwsmnyisuub2A6iHifrImLP3HhvS4UtFX950CtANWLuZ6BBxj\/p5qE0iukQLcVdkDA1AFXpn8QVDSs3L2uFMcWQZMa2eCHf6SBZgz\/CWT6aKttTwORIc8kLqDWNo2UnQLv7VzLF3\/p2\/FPnU5Nnh6VGEMLlJx+Q4Jcagkfm9Pg0pOE6xgloxeSwqvQQMBIi0IWP1x8Z3wDLXvr71uecv74HLfl6hImeZ\/aSLMX1SicC+Jx8fGvq9mW+1volDKlY0B5vRe4TmiTTIn4U8NDbdeL5BUurUTeGaR\/7pAoK9\/dbPpdSafhoSCLLENg7p4cmw5q\/18dQoyOln5aZ1TZlkkBJU9P+LYBVSYNLSGlBxd34aMq4k0\/8zi2mLyJL448SBMJtV8AlF65MzyqiD5UiK50lNq0WvyKb3yDfBrzM7e0Jk8iLO6+a4e4g\/Lyli1pgQgKKuUviHPw5v\/Mm2PPGtqNuYm06dH4p7k3qgqyqrAZTiaKzO784qFiQGndPBPe58wL2EuHUidO4QHEFTokTTVGdKHSoFli3TqCPErk0zZFQ2kUK9KTb95a30CST319n5Cl+eEMljhrBRJUFTlM\/EyD2GKucNddM0SWOayzh0iEPtk4BUaQ5sAVO3gajsiFP+LrPdjIsowcjdBZ08q\/S7Wx3qikhrL4tFrZJ2jbXT6dQaX3wxSljWHnCS0kEksStHalmku+5pDR7Kb6FvUKumBaaewEDUGbleom+WyZM1+iiycqLtH1aVwg9wF5U0+6\/uYsRJiiu1AI\/U8U78B3B3UZ\/pM\/yYrB5xVA6EXTyIjJeV7nNaQl4GygGcHiwh0QDst6g0CLF8IpW9kYv0ddGoBxQxEbCARNRT+Kp7DzPeCnUUrjhdQgIM1Ig2\/mkD\/AC6bx1Spf05BKRINfEWnYVJoKCZpgz76YaB4AyqP64OCvJA2438E4cuO+mgzokNe2FqE9YDlH0LcI1zagIGQmh4CcNHgMCLcuF+1yBKRsCi+I\/HyI5LeKOq4RlSbELIu4kdzXrZb3511AZDCfA3hYAlr\/8LxRqmomelRinL4BCNzP4FR7c6ggwjvyUoBQJBpYggu4vm0De3homoRCS9bR0uwu9J6Ysi5zYU5QscPWD94gg4QVLRkcNLiYFXj0zXLYq2dXPO0Q7o4R669BOaKG47ZoaRpyz\/pscKxT4GmfilED5see5EeOO4e\/BhR3e5bu8AirnOev3d\/uJwVN2BhIIsV8sqjKRSgtJR4T4lGUCxxwzDwiSpwA3i3XX4Vgo8xw18u6YDDsVhxNxGS3LZp5Xa9wCszaTHle+qmgHbcXpN2b111NkV4xKXUU96Za2ZMT2ef5DxRfB9XFHgGT+7fJyQRzyX9hrFZ9C9iKGPCPThvFu3y+aENT8tsIL4WJI39PlGoRwg50a2v\/KyKdj+Dde47VHUy+R3h1bAWXikAf9PiC8EYh\/ixTa2KUXTQHeN+4OrcFvoLBPl0Lu+p6Bg7TcbxpD8w\/MWt1KjNT4Knam5rEKYD3zOfkOloGruja05cy2iPYQ236Fhdb4emaShzoitBFjxHlXxE\/QNuQqI2HhFa3XwkFyRK2r4two9TILDHOeElR969qMOSyMNKQdpabKfwsgVpdTY3s75\/PRIpu0sQNuZvfdxfyl0rrSf1tRzmOEvqz58BokeAP+zqL15TwO54VtwJIFth3U9GznE1uZlUYi7bLuf8583O8PuQjEDuAbeMIqzm++GBPWP32Gkpxfb7OjNhUbVt3uMUcUexAPiFs\/Fiz0agwnkpK0jE6uZOK62a7J0rBbvYs9wEIA+rqVYW2eXSIj+rB5BIfNa1dMMO0aSK2lJNvJUS7GFh92LlPS1I\/ZCYvh\/4Pvw75NoppH\/vXNJ5jPhyRyef363u9Zf52rxrdtk3IJ7QW6n1s\/okXd5tsUqY9EqrN465sFQAnPaDkVVS3uEOQTtSOOwoGqHWjJhQl+qBmxxdwbIgWIuJ4ag1UQeEA0WJFKkIKUTVZlFYelEjiYOcjpQ9iAI4M4qsIgn4sCvCSnEwjgf10NDuegDMviBm0jahRp9cdCcbIfyzm8NjSt++h9xymP4CEX+t6+gf\/AVaQuuToizIav32OTZSGF6+9vRbJgWsF\/5qjl5EZfPbIW7hkcGJmIt8KcekKvNd4fYgbYqkB4mHnCerzWDVqNl6xciwN6J+7yLD7CLTlcHNat7I0wytIolF\/qyoYbwmX5+W04btOEhBqNpo0+gkjppHs2lZf9La+Lp+jt8jqwyAkexfs74cNUOmXzdBZWWhoH8rrh90sG\/nbwtUesB++vYiD0A57zQzmqn\/JhvqROGFKgIRvW+y1vPFJ2ty1fzu4RenQKzuGLwD7DcEEksvUl\/jF0AUBRkiL66dRWsaQKIvsJEZx0Ertw2JISjrAW7YvC7q0TsuqrYSInesVjpr5O5uO5l+c7yIC3Wush5zuq9vpiZEH4HabjdR+AwWXblnnUMWh30ww16ZrpNxOyGVuY\/K0EvTWlF\/EWl\/soCUPY4882gORgoIsVSwNyKmEMzwjRe3k1ZShP1aJfqoiogHU1UyHBHctZx9IbOj4Qkfmlz+ocmB2tYYuMtethvmYhfT5O9eWsTXAV9NsqcEmPssCj+b2cZsTjh3IyTD7CqUQXyKj8utz3TQVSWgjt1pXWGsLTfs2MdAnVrDcpKx7TC3UBIWl+mbpB7Xmtjdm7XpSkOLOtsOv8yoKJLJ6pOduCpHxBHfj1yYCw8j4jk5Sv3MFM+Ityc4BS3JV65bntkA6q\/T2eggGYflVqWNrw0E4KhjynBtvNqWKwtjfOL9t83zMEiXOkowyktQ01pbm9sPgna4dxnfxQM5sWjmjZudnAgXO6F17paa06dYpoZOdDMa47NsAyi7m7YTk+6lE92ZhG7XVx7Ne0EFsEdTEkT3TOukZXsDe4XYlQrI07clCic9IyaKO8zOoZRmB8TQ98pmPRxQXpGqq2eHAfGTGwbBejR+vuzu+hsGbNkPsEe824XsUociNf9n5OV5Ui8QJSuXxzlxfoWRGWo2ai4UAtyDPCijVLt59BPxrG1Hiuq2v7AUMSo9r7HePPTjpJJLCghrgrR7g7ZBWIdtlM2YovsjJZFSmXsVLEdngdQkJOyfouLEfh8pD0OfzYogIZ65Q60w65R01MFxhIvavR\/dzXB06MsUglIv8tQNsq+GIA68T18TNEOfR0uHeGKxHD4Ryz0NQ6Ki8gdsi2Kd+lGbzXj\/\/IjpG922keRrP0Qf\/LguGZfbxopOqmhGf2kJoNPz2\/xBvxY0qTxJEaK4Hxvz7lSWzlkICTSF7Eks8DtCPw\/8LPxl6tqAavb63xkSHgJt3DwCdROARuvSoz3mExhwNHWOicOJoUKT3yMsuSWcSo9\/s9o4ISz4nORfreCWSolGyCf1sFNisV\/9e0xJTt6pAtPImQeMtFKX6jZ77mDNO2TzsV120ETIhX3ZuG+HtN9WbVTyC9rEYPqW8j8dQMZvJzcTk\/1yVcpxF75RsYHJBlwffLKNXXGneW9osYkBxrYy1DJ2xiSUaMgewH19B4ef69bSfH5VSNdInJjabIjPmkP7ZuIwDfugRrHvMOxbhkxbtQzhbTryaUDvb\/8EyDrEJ6UK0jbTa5++DvAaNgVmqWXxf5gp9obKtBDcSLyBgIbgGtCR2\/J9CZ14wO898x3UmmwaeYvvRMb83N+yfsrD9hdixIEsVgDXDQnX\/4SDQzwGppL8OExKpd1YNjbgmaM6BabYlXmgOceykI\/GS1dhoBWyUVRqDJsCyGZ1g+Qae2ajwOn\/I01IJlAakhZdcM2i1543SdBVoOC91efTEF9emHygs9x4qlJ+CoDP4FiBGAZ5Jb1utKHDXtye06Crx9azQZ4bEwJIbcmOa0OUUXEOoHvJjhhSz\/e8t13824xLUrOWXN\/9dy7E4Gnw+c8ka38kpYdjtm9I\/l1OKjzxImCg4MQmvpP5qEjvlQwe7inDLmSEJMBndE8XTn64lzQSyPLRtJ1jLzrD\/quVuNdrPvlKXP2Q9Qp3VFBMuufw31fcx9GyG3j+s35WYGzu1hZanHtrKnvxhwPZms+QNXNU6b5xir49DwPSk23E0MJbVJwMW5MQcU6azBTiCdr04lMUAIOEUKJW2FFzyh\/RvP3CsAlC4P2XBMlEnm1GzjBcvkC+GAkdRzms9cmAwn9fQ6i9Sze6WTYPUE9AFJP5IN\/6Q23SJL8ILOWnLBIycolfN+pEj7pTlO2Cnpx4Sy74hUMXO6SOpMMT+2nMMot7DGArVoeUg1N9mDIjgNtgx+5mjqh5rHh\/hdS2uwE2D5wRnCwaRwoWfyUu97G+FwvEqkyEV7LyNT0eJML7uz44\/D7TYXGugBF9LAHug\/rPpypahs5VnS\/ClHmQUWTCMLjp43N8srAyVFOwci8+snn85YFTudam6M0u+PW5KAi9RByLiNrpmVeYttjdANLaLyDkQfJc4qZIb7GgiNP3NPY7+JSlWZcJJagNqcSaujlbvIuVt2RGKxYceMZ4YrQzw35+SEOUJejUDSEFbY44ZkkaToPHc6nYvWzitoNKmEBNX4UR2B8dvioRyo9PxEYuiXyUPhh6l\/SFzzPXAV5Hsg4bqhXlBoPwwILl4B3Z75hDOpobK9zoC0CXVVl6GnebmpYBQvMN4WYkoSwUDfbf1G48iPCnns+EGYeZgVfF99zut76HMqH6aFWKtNXsuTREdRo5MVCVMDTnhhoOw9E9Gz2qwRYlG9nGBA\/u0Q0rmzhfwgu2tfaEY5ZTPAlzJKyKDUEd+9RPWzm3iBaTwfVACp+kqwLuFTpJBKOcnggaDXKl0ArLRQKezo7xQMDxELO212A2MRR4iea1dkBBoQ5FwtYMKmgKEBEd6IISK7oyJNZ74lwszTYMPJ\/A4mkTzv4X9esqerjIbfT10ZWVC3SzVy2WO9xPyonxLpJcK2vRqCMLwqp5tOCnI68dRKhoN8whHcBYJ7vLrkOhBSzbEmcTG4z5e4zHkuyEejZ1wHaVKTBC5FFK27f8RRMkTsIg8aWd9722YGPhG5d62inWwz59tBFIEh\/1DGuuYXOrV8juClgizl0pb5nqm508KqyJe8HpHRtjOTJQGOmrT2+g5m5J4Oq3e71OXQAQA6wISFSHRcYQB2bkrvhnWfa3n1zq5N3dRpnxMu8a1X6NjkPOII3TkuL5SrSZrniQKHO0or6\/8cXjVtIrsZaKtTFUeYuFdILL5QDz8YCBDSXSEFHab6JA9pRc\/sQ60giW8aG6WhpEQEa1thdVYDmXi2Ek3RzjQWnK3PvDXf1wfEMQ5bk9C22wYIVKr9PowzPvYTExpsvT1RA1fg5SCqX7mMCmLe10a+OYotO+1tkLqmXOAF8mAVC3d\/QHEtYT9TwAcMhfkmjxDlZ6tofJU2aPbxOwWvoaEHAQVT6SGI6ZWcpN\/N6W8T1Y3R8Rgwj16KHolR8MjWKbkZA9AxfRsL8VwQrYkWv8RoKs8jBP9gC1aCqMDw1F3zHucVz0ny8j4lN2LHJg\/EiCDO8R74p5TeicPvt4p1g+1zlC7H1cJpl2rcl22K8yfEJqPN1lSp8jjeyFk8BSoluppb5FJxQts\/FnYaDXMFgH99jLj0Xha3ojEQagbiT\/hkunZw4c\/NDj0ZK161wQE1cgZDIX0Sq8k6G\/iwSuj+NLrNeXc5OAxsyZj2\/qpZsdXdvd205AyGYwovqqBQVWLI9nuFy45tA3RNhVkErmy4tFSYDoxNvGE8Rkpne38c4Uw0FwU1XFaYiyZUIxav+GSIIIk1oH1iFKim33B1SUt+WtoJpZU2plhzD\/I5liDNMT7vcf+X0QBW+T9CURk1pFerbdo3y1qmr+9\/ae7dhsq0rjS0tYfHnmbaUHrKNGIUOBMJPSOsU24qjG671gUUr5zkfnQxIoNXYIdiriqgtuA==","iv":"438de015460321b838228fc429d7265e","s":"6f317e0b16cf28ac"}

A new beauty floor is the latest addition to the revamped Bloomingdale's flagship. Image courtesy of Bloomingdale's

A new beauty floor is the latest addition to the revamped Bloomingdale's flagship. Image courtesy of Bloomingdale's