Expenditures for professional trips are booming according to the latest findings.

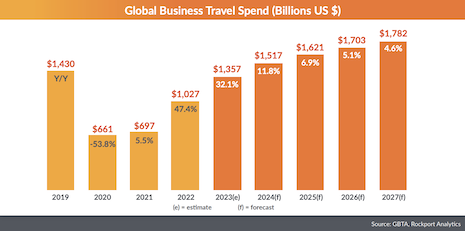

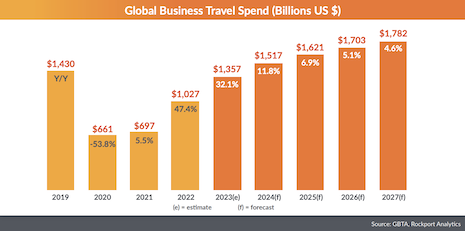

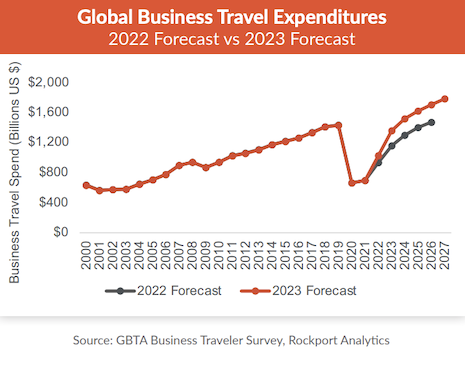

The 2023 GBTA Business Travel Index Outlook predicts that by the end of 2024, spending in the category will surpass pre-pandemic numbers. Forecasted to hit $1.4 trillion next year, and $1.8 trillion in 2027, workers around the world continue to soar to new heights.

“The headwinds that were anticipated to impact the rebound of global business travel over the past year didn’t materialize and that is good news,” said Suzanne Neufang, CEO of GBTA, in a statement.

“This latest forecast now indicates an accelerated return to pre-pandemic spending levels sooner than anticipated as well as growth ahead in the coming years,” Ms. Neufang said. “Business travel spending is a key indicator, but how travel volumes will continue to rebound is yet to be seen.

“The BTI data also reflects the remarkable efforts of the industry to adapt, innovate and thrive despite the challenges, along with the ongoing role and value of business travel to economies, companies and professionals worldwide.”

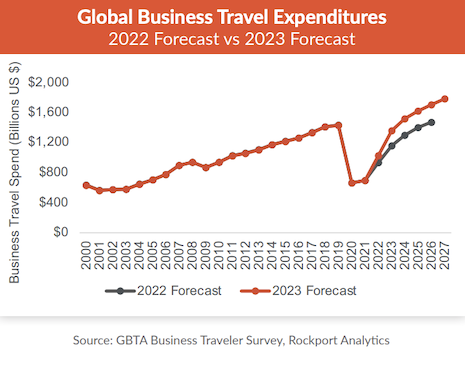

Compiled by the Global Business Travel Association (GBTA) in collaboration with Rockport Analytics and Visa, the 15th annual report covers the top-level outlook for 72 countries and 44 industries, comparing it to data stretching back to 2000. Looking at spending in the category for 2023 through 2027, this year’s findings include supplier-based information from hotels, airlines and rental car companies, as well as data sourced from governments, travelers research panels and travel management companies – a comprehensive survey is also drawn upon, given to 4,700 business travelers spanning four global regions who were asked about their business travel behaviors, preferences and spending.

Impending boom

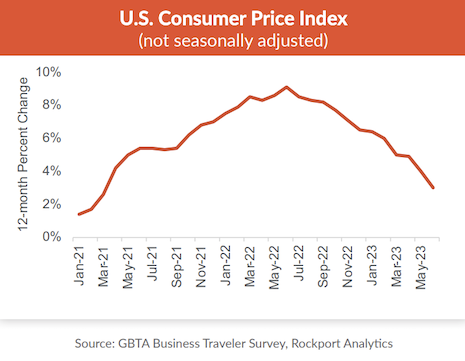

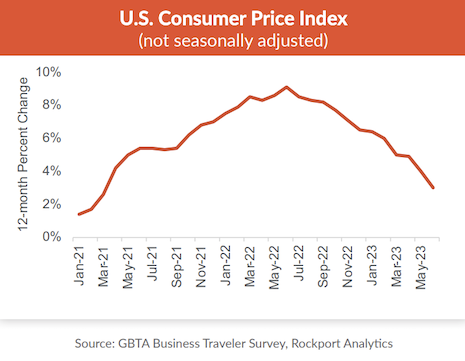

GBTA attributes the rise of business travel to pent-up demand, relaxed COVID-19 restrictions, the resurgence of in-person meetings, and economic and inflationary issues beginning to ease.

So far, the industry is outperforming previous predictions, which said that pre-pandemic levels would not return until mid-2026.

Global business travel spending is soaring, outperforming past forecasts as more workers head on trips than ever before. Image credit: GBTA

Global business travel spending is soaring, outperforming past forecasts as more workers head on trips than ever before. Image credit: GBTA

In 2022, global spending in the category increased by 47.4 percent, totaling $1 trillion.

This year, gains are anticipated to carry on, with GBTA putting it at a 32 percent boost. Expenditures in 2023 include $183 billion in air-related spending, $191 billion in food and beverage, $395 billion in lodging, $138 billion in ground transportation and $121 billion for other expenses.

The report points out that if recession risks do not come to fruition, business travel spending will continue getting fueled. However, the progress made in the fight against COVID-19 is deemed the biggest driver as it allowed for the return to in-person events and meetings.

International travel’s bolstered volumes have only further pushed work-related spending in the category to new heights, but actual the recovery in business travel depends on the region.

Western Europe is faring particularly well as of 2022, growing 109 percent year-over-year. North America and Latin America specifically also prospered last year, seeing an annual boost of 73 percent and 63 percent, respectively.

Eastern Europe is lagging behind in comparison due to the conflict occurring in Ukraine, only increasing spending by 25 percent. That said, in 2022, the least successful was actually Asia Pacific at 15 percent, mainly because of the closures in China.

In fact, during that period, business travel spending fell by 4.6 percent, knocking China down to the second market in the category for the first time since 2014, almost a decade ago. Recovery is coming though, with the re-opening nation (see story) expected to regain its number-one crown by the end of 2023 with a 39 percent projected growth for the year.

As it turns out, United States consumers are going on more business trips during the summer. Image credit: GBTA

As it turns out, United States consumers are going on more business trips during the summer. Image credit: GBTA

Whether it be in China or elsewhere, countries hosting work trips seem to be in a good spot.

Those surveyed are showing enthusiasm for business travel, with 82 percent of them indicating that it is either “very” or “moderately” worthwhile in order to achieve professional objectives – 48 percent stated it was the former adverb.

These workers are also blending personal and business-related trips more often. Sixty-two percent of the participants confessed to embarking on “bleisure” excursions more frequently than they did in 2019.

The respondents state that they are adding purely leisure days to their work getaways, with 42 percent admitting as much. Seventy-nine percent of them are also staying at the same accommodation for the business and vacation parts of their trip, revealing the apparent necessity for the hospitality industry to find ways to cater to both professional and just-for-fun aspects of travel.

The road ahead

Globally, spending per person is estimated on average to be $1,018 for every trip, with stays proving to be the biggest investment.

Based on the answers of those surveyed, lodging, food and beverage, air, ground transportation and miscellaneous expenses account for $391, $189, $182, $136 and $120 of that international total, respectively.

Professionals in construction, education, professional, scientific and technical jobs turn out to be the most consistent spenders for the industry, standing out as resilient travelers in the face of various crises abroad.

Based on data stretching back to 2000, business travel is proving to be in the midst of a golden age. Image credit: GBTA

Based on data stretching back to 2000, business travel is proving to be in the midst of a golden age. Image credit: GBTA

While socioeconomic hurdles remain, such as the war in Ukraine and tightening financial conditions, business travel’s growth is presumed to continue in the short term.

And when it comes to the long-term outlook: sustainability initiatives (see story), meeting technologies, remote opportunities and blended travel are all positioned to make a serious impact. Whether they bring benefits or detriments to the business travel market could be determined by the ways in which hotels, airlines and other categories respond to them.

{"ct":"Cxb9bL89tpOwHBAgUpLyzE+ZZlIPEEufI73OeJgcGNMVJ1kf48QxyouJN59Jh+TaAdADS+ChQQttaHb4TUQdoA3DapYW+Lty\/zC6sULzE+BkhAtBNgv07dJY8Gjy6zdjbNOHzvU4YaXjUTczOECnQkaU6\/kSlya7n1i7Dmlm8qAwNj16uEVhOpfx3L1uk2Ibk2qEfkbcNAgZSfS0Ju6grQlVBgQ0bWfhxWAoWtNcbtfYG6K22mWd1Ah2pRxBOuSOWwxWK+FBDzcuoa2bNyKTL6Kyi0MjMKknVUa538+YLoLfIpv6d1Nuhk0jZJVkmUZ3Y\/lyZoZMPv9Agu3KzHiWUDvsgGlJkkimKe+XU5FTtDimR78nPsbi5RW2DGe+V0FpMItOio\/itNW5QJsr9Kfwv8hag+KYXnUdVFEWI424Ia9PElXxFVg5qaj1P2j+4kRqlMey8WI4G+yZGUB57o2iNqlmIy9CtaEXBAzSBA5Rwn\/qq9yqf9h9v1RaEFZaaqsYt6ixgoGHlbT9rGH2AEHOpyMpKz7q97U6kmxjUSXvMtosADriSH6qbvV5Woaw3EAR2QicZFPBM9+sUiPZ5SgCnLbtdLuuDo\/nstu5b9fmiexmQVNPIggf+uEchAv0ADMhQdr2l3s0Dgf9hE+oflS1VTmbyqhVLZRjIEJbpmBlCYn7MF88G0uFzikZyVq8bq3Q8Ayiz5HV1L2\/i2inFLjxB7ChAROOS1YqTpkGGiwVjS66ZKbE\/KOqPUFOVeXr62nA5IXz9\/+v1H8mubRuj\/eUKkJqiwP88eWV6W4bobuY\/aG3818IDQ3LXyJT4FpfXhN5RBRfGbB3dG1C8rKlaDAvhAWpmgOEAfqKfFsYjc3M0o5MtceY7Dv\/XsFnlmQmXRn1UBcNIFcowbxo4e7Fqd++vEztOpem+eoSBfrV1Uf3v6YKnUH68kzghdFU\/VQnmrovxAkm6ybMRyquWpw\/MyCcKPCu1jMty5a+hqX34ZhfNnNxPKhSuUuEwD1TbcJaJO1r+UeER3q4jg0o3N41MFwN5vHZjpOuKhTHHfZ7RaYKix8MldqaNGI5TR78LzyeS4euq2Fi3nFgBODV1z8LeZ9dQxUdwEh+qXe\/E4Z5cR1ETKGHQplnJ6CjaNtJKPGmCwByR6U0fIyRcVkTHBm52fjtahRZABWI1FQVH8nXgtTVS0EJSng3aybtb8IvcWYvVmIN11wjBaW7JJRPUcXlvEm3F0cbPGD6NB8js5nwbOr1J4xsfF2N2rc8q3QWodfPaGvkSpJF\/HKdNbDJuAX9Iv5dmQVd2TtO7bedpESe8AhsdpEybWMIXEdLxKv4Nw1us6zASUKkVLuNFFiYs9nFiW3BIchhBn04RPK7RzX8VKjeZHQBimOESTeHmgqajC+NfhX8TD5MGfRHbiHCtES8P8jAH2d9vhWHVu2lanNXYA3S13R8G0YfmLocvAlpc4Z0iqF0AfdTVQQX9OR0Iizo+05ZD+5Mqlwac6iYoFVNLFztMuIy0foC1XXRjDCRXz8899EtqhyVE+Y\/VYQlMLD97zcXkp17yDCVwn3Elgi8EMB\/GLsIsu5EEWoixcMWlQrqNI7T7eNtxoQVV3vkSruG9vzvFzOBXRvQHQALoX\/KA8VLMjWbsi4NVQR5VkKLQDXQNRXLsaX3AHvh0ElbaPKXMu+9lQXO4eXrIFN2FeZ4dQd4dGOQFtIpEYXpq1Q7ws0SRizlZxMbnJ7g+KIGhEhSv44fqsn9dNX6fYbbVEJ36kIbODj+gSRkJxDbFhJzWGOZJAGccQx0oGGyIqDKtttZS9xS30rr8afSC8MJ5+m+So6+SmM3cwOIY0QZO7haJw98wtnQMaeKKdyi55CVW\/0U+9uCS9jIn1uxfqqFBSIDfCQVqF\/z4wvtIyxcy6lri6uPYGv5r8yrhuDpeGzGF6ck01kskEEKz34YsE5sHC5sUfEkvZTH5rP1wbfh74w1Iq2ftP9eCN3huim7kBbnWkfinGpMvXRT0JtV9lp5TtyPn2vHTn2oz4aRfSwK1\/1rPHbY5DfaPPa\/1uy0V9gZOI0PJT\/+xjZZ2aMqJQvMrYKlGdLy1jRLtJu9iFavcMWAVoWEbSF5NpbjrYxptwmmzr5tPMTeY50hxxMoNDj5CS2+akol0qjSU0OSlUzin4PRTg+8\/cyrFY207U3HxEi1YzCQSu2owJlAIpIgYSG7te6gbfeqg+6uGb7rtAb8rXSdfmNae+CM7dY\/wP\/uNvDmdtNNSt+Rx00sMSUD0d71wTcKYUPpaAqOpGUyIdGAgxCoR+dxTQe2tx9\/H37fdBkPZQCnHm5s6\/hSxsSXZMLJtPptKu\/GlWMRgF0aFwGt1mZ6ZRU+g8ZoJvN7+fcmuBto+xOFGaQ7jbx0E2aJA2eTHl3iYt7U61qCOY+zyiAPs4J\/KWfmbE6Iyu3nTp2U\/qP0tvvGceI7TJMMgGptgXmKKHj7pFd9fbVLurlhFTsKVEgUq5zvaLn6HshSw17H9B2EYETy7xBFRO5XjjrMgAXixB03tk2giTujRiS5+gOzDTO2nmoQAJwO5cNnvm012AHm11QUVoD9t5gWlhRIPL4UoDOuJffmsFcWVfvpAFz1QQunDdhO99qdiiMRbB+FVqLTvxfCvxw\/MA1qB03BtmsPmjAweIZcqQlhGfImYD5m8ESpFianWqm9mQjGnAKBUdJXV\/7XaIcWKAMbZGI+prvy1a\/tBeAKbM+24QN\/Qk\/qfyG8L08SnB77FCjukN8bf6ECzgGzsH23L5YSZMq3hZyDREnQkVH8P+a+b5rkEug1dkkkL2UDh0jwbjB4RgD9QR2UZTlrVfzrgzXGp0OAsGYJBxmiThuYpcp79HB0RFd3V2AKiGlvl4GKZJerWPVEr60mpXjm4sF20Q18W5fqNPjG+cfclTueRGNYDbgN1w1nTV0uWLNUbg9GZZ1BhWnYs6wroZnFz+SGvIAI4FDuYelN+YGiGelGzeRA5YLajEo5FOExGUBqFOIYDuAXmI5tvqRDn7QMNJFWrs95TpT05I0UzM6uqLC\/H34zE0wGbDaGTs5yW5Bw8NjV6rAvrAioTkgwHFq\/giqdRsevKuKVbR77KtjsQwFS6FZyCb8zADL0RiChd2Jx\/w6GGNTyE8pKuraicEYRy\/HipnG\/AHNuTl9VADtyJBYGmq+oep\/SkJaAnMxPK5z7Rg1T+xHzmFharA+743j3m6uJDsfdXlY1EtbRphLOuelcCth3rR1WG1xcr9jXUsQw07u4rXuAmhKGv4Lsa48s1GASXrY94oyrTh7BaTCuB4F5W3DL6E\/PjRYzYH0x3nDkbIcpxlTbKLufPDmnSSUh+WXUBZlXojZKLn2J6aJFB9XQj2eDwCyNioK3s8lSavq2e6c2UL0dyTq9Ut3fAtpoHM8K3OCR5FmYZucfQTJe8RgTxCdsdRYzYhplt9tb6oRAWy8A\/dZzI4nVr5m5K2oBkNvOq1eSOfE2g4nsgls1q6\/xbBmVfJWGQLZLfp8ppUFSgpoS6BqeIWf5PbVOzSJklNxqlplnm9E1Zjbo4eq7HBuzFg19up2ZMZqJBajNKaN5J7vb6HahGaAlduimJ1i\/px958J6IQ5p8p2fJ38N8xVLa\/tNAX6DSjl+ARLrue2jHW2n6XK+oxCxz4WUNLN0Z1+h7dA0e4mqB1KVRqVJ5xrq1roHo+KFf0OfyH\/kMEYm1pcfr1nO6j7bw\/vUhkC45c2W0TPrYbl18zX1HPJlr0PtVU7AvxA7wbGlOZAzOOWv+oG8yUkyw7ble1sn0RXV3lVDMSwJPrgytkItSPOH40asnfaWilGRh+a31VxwYpfXN1NGG2ZxU5DQgcEAddcmeytuWz7DawRlWttR\/C7RhydAVehX6GB401F\/q0im60MX2Zksorsm5hu\/TQCMMDlOiGBTCEPfdEAMnH0vVNh4R7PY3o8tNruYa3j2Yxcx2otjBovP1vD3agY3Yg42VhqBuzqx5BAF5ID\/97hSp\/mzMKB9Y5z9ZZoWS3ipqnprVL+ZA8q8PE8PWBZv4BafyO\/ZlbFXUSjYVW764s+BwGW\/ilWwvKjpqJ2NYlHhmtN2r1YVDa6pgMKhICRzHtGuOTURqh+mGUmRcXk25dd+GOexFqA8GoPPQ6CkfHdOvBBITukfCj36WBrAp4rCqEau+Dt7nrm75+3Deo6RxqyKmRg1GhIH3d\/yV0Jg7co+IEcIJ08Cy2Q1Rc5V3+d64BTMpvicAx7qtvRMy6uhss65mpuXq1iMwD4mhEelmHRXNyvr2IyORyRjSnDQhlF5Fd10gVPxM69cOAQp4S73OvUmTxcW+5L1CtyjfM2itnRSF17YxRz4f1nE5ylrEV7xlfugeSr3KaP492ye+fV86p6hym6lDEG7YV7LoL4GUU5Jlqm0p1vCpxNCLpmBGP2C7cNPjlijoz1FDU55Twqm\/jvr\/ZpMRYYGY3gF6wfT9RbRtaqyb9mvzQpVllXfCVdWAvDLnati536nwOVPYqUEIoZiyqaaGm6Ww9oKJ911kynjLBGvYkyIJprwoYvZukJBX3kM4sZb3h554Pg6qYom2n+0udB+BpC84AhkCt6+1GMAymbklJj8rhGZ71deRzGZb22vxgC2KsYAM7xv5CK+okefjzCsCvI7zXnCEyFXHbWnvrQIODxnJEHbxE1TOa4GqcmiArg48foHwegDpGSI4sTN14fffw9jO1hqECSo+NyW2d6QFQ\/zD7bbOxCIYvo8+E3gZODp7P8jkr1ZKsboTQxrK9Pm87HAR\/JoPyu0rWgNyBd6aPHYhXq+\/lwzMUCc\/z877jQ6b4YUedefdy2Ve8ayEMg9QR+KeToGR6f9FLC14chBm1sXJHLCE4HO3jehfVsdFlkWvep9cl8x8kZDHRidbVqy6oAGskDaIV3B7sitFPHb1akABKqiFwfT1h8onA0DubPe9Xf+o3vNDYzlQypcHcS2jQdzVIZn7srzBftZTo6woWYAhoJReKrBNeqaFWMMncGcWLkKAjSlWmIVx3K3D44JWmCSTl23oeKNc19GgXSWfyuCNJH980FG1N9i\/IcPeRD8kIkJws\/ExJ\/txW4MHugRfSXj\/JbFnOLq9tdRjghupDUzEUJxiu6dxB2pyTI\/I5otQgqVvDP6g2C6qs8KqVxHkdjsLb1d2CrqRo2K51cNRdtMLI+EagqrzQSvUsnkvnzBN\/pGZRuu3HzouGpbi1cL\/YWYSRYGxyaDd5M\/2rWmjaqWo01mvhFjfzL7Sps5sQJ+58KeyA3YnLgVEeR1u8j4xRstfzVDtonsBBtcK\/iqNLe1w8RnrBciz\/Z2NrQVh6bU1EWtIM1mXt8Ft8alONgn8TkBgEicnQKQZpmgUFcecPGEJ4gKVfS\/d+3ylptxiKyqTIIB97tpJYqGRIrc0grRn9GKAfwSgmLwRYQ3D8AsJ9vn0bEn\/RmIdzAOD6ozmGn\/1\/bkzBn\/8KY28rh91W3DU2fTEh7Ahb0GlSCmmXfcZt+KD35tMTwWG+l9b+Hm6pTpZgPi7B4S2SueB5IH9EO4oKlg+yQRr9BEcPfBlMu41u\/jHSQbmJ0tc78vud2j\/T04j8x0DC4Gidwfh7lkxzlj5cN+3ONpaAa9CbQZocq9EB\/oVhN9QqOE5xOjLHp93kwwStgMe3lyVjl4YAq2VsZsdGDeyKwIgmi79AJR0bzCcQ\/fyvc0PUkXcVJztzebnrHmMQeTChOeAI+pjj3tsIFRiu2OO8u6w5iP22qjL72abCzI\/RoQo1TPZFkYLc6SeqanietpEyvcHJlI90caY1JDwGGvT+O0Y5ZsOJTwEdkboThIYX4tTWO6gEshpV6WWrgC\/LHEVHvapli8MukaQiy2mxx4RCHZAqjePO5aEOMghmoKp52z0ovw6E+pAhhPCOkPYaY0mHvqsZTOHohuEBVCCraJL6nCyLwXG+0p9DXCx+N82OWJydp3DkBZdqp8e8vjcVJl0FcAgPPr7xaRtPkZX+YjRcCasp5TdsifI7+ljKWicOEs4TBOi8fCwtX+n3a60YzMEwsTCTKnprwzm9dnlOU\/0f63HSeWQD4vhVLIGQa51UFrKsYlDwp2Pb0Z\/l12DIInolNhIwQbDYbzCt1AAK2vNmhJlVnmesHCLd2wcPJ+rIeNWkdketZBfI52e4NZmoYFpFysGondp9VGFbzGWhtjkfhaB4SorFEEf46dj0QKgEsBjhFaMEqZ1I54tJbpk1+x2EKFUqR6XtgDHiYvxSNdYhHqcTj4Gb1KNR4Wp7zqZAnCRkjx4DZlKXY551cdeRsFaSnV3bM7gMZo+uWlCAm1MDWT8xATOitH2YoWhTvgeM5tVKZkAeWH7VzH1AdnmqUaC42pRnGN2kleHRFfrpkJH6X10fGeaS96fNJQD3WzDt\/VgXuoD79AZDusHr6Vp+sjyQqvMuWuFOOlqgDxXXt\/r+c4zVSNgEetphGoeLW\/rbE\/Mn6U91yUx36KjC0zgD4l1PnKEIK0aJWYn\/r8HUgelkLdwWZIJBn4s\/cC4FA7aH5qLcFI7P76rk7wrRPo9cHH6B5z8o5wdpM2LzblEwaqFnPQ44dFnhtvM+tCFrxT03wJMtE32DlCZURLC\/HDEWmCdScwV2C5C2Waw3fssaBI4thJOBR7JbmbVXZiXPaWW7kRNDOJ9nP0i3U2\/BwVsrCL5BxN5\/q0TOa5uEMkUS8T4W6roSZur+4YPixDMEfy\/sXP55VAskYhwQkKVZ2QgW22a6Cxna4CxfX2nN7wdu7kVQXK1p6jPUmUAeoAnR0SZMfNgSlM6g2KajcQideS19YHGoMY8tiqmzzGvrBR+iHUuBPwi6utoVLVYmPeE0nGkRZ2xIspxVWsr8bSdyAQv\/w0HUynElWlCPKiQOgDhenQQfYsvhs8f2eTgMRQRh\/jO9uxTVmIMaGyQ7URnwWUOmW5c6FG9ZW9Akq9GQk5Bw+MgOw9v\/uSsjCDPqpqrRPyL85fXYykULYQTIdNZMJNUMEkTNwzhpREKQR6WlWdU4pJXBYjvz1GDrJf5UxKmbPxZ26cWB00EmGp5eMT97SocPX91Vot6vjXNd+uRLC56BIM2ChShWav\/9kYxAOVOrLLzF5Jovs\/RIqwltlWALR1eoCOZYIwmGWaBFx9mEAWcMwaMSviDEueDY3XuNSr94T8Kip2EsYLoiUcQNT6JctEMt8rB2Mu7ZmZssSDQ4Cr6tCn3rbPiTFEOiCkJdXjJWYUSTpw8cUFJMdT1on0Vy8mY3HX\/4Hose00KVJC2OwkVJYCJ8Hs1rjILgTkg6iiR0ds5lEUNQBj\/q6XQRaMh7Tn+x7ZB17CAgsgVYOYa5QPWbvliDgmpLoaw4Yccq\/zSAQbrJ06Bde0ZF0R2KzIgX39Rzkds2\/qJQzjHDGr4yhpjTwj7fiwqk3cBBikwLMBAsL58on7mUjRrCDR00yy\/8owJhgs8OvPuHgWaPakojNxKN5t\/JiVIhQCOGGPsF\/+K2kjmGzndVBObjqPYZwpnI91JtjbZ1bgytcXqfnsm6zRCMC1FnEb4RBO12cjCxhY3j5GFif5Be+IZrK7\/Rw5\/vJKuS5vURtCPcqt8RMZsPbl+SfHdGw4CFttxKNa98cV60qdY8PWdPqjB4mJPBRIkPaVnPdyzPnfE2Ddy8CNl2hD5+VoZp4C2DoscgXIE38wLcpn9IY0lp8hbJeB7eAaTCXwWCgQpjXArI6eCF68BmStQMW35NGXyWaXXL7w7dIuq88TgE6cgrXBAwng1FAJb74H6WfD6kOB5iCrEkrSWgOZyv10XoUo7I3yd+rtD7k\/pkZxuVWg+ykBTIcbYA1b1j7qGXWruMe1apHt9IcadzeUGOg9L5yOKJeRu6QMIRy+vkHvKKs6g8CFLSAXKfKKYmfKYCB1WBVxAiJI5sbOHBMyCiVc0pCl3YGUyyDVMlULvk6+BKQw3KtL3nINgeZ2htEWnnPwFQmiYdx6S9jPTldx1goLph5bneV42\/fe\/xqWK\/WcJuH1pmt0yAWPig+rOmr14g0NSK0RAtBa2utQHjeG8aWsPurIfW4sewNQvygZKMhfhwnJOYtqzdkhlvU7HAL0vsfpCq+7dadFesJN+jsmRa4TID+E3Q+pWxUpydnF48FCR6OWNbmP+\/EQdaEm7pbVNOsR4KS8AGrvk7+0durdOeVsSId+zzVLNJfFWcCyznPTV00xRUbhqk+D2ai4QU\/ByvDniVc2milMy6oN4xqyqn5m1BvRfWQDusSyM5jYYxHAV13AerT0RqtXWYpt4QBVi+ZBFJ6rv3rFC8iv7kJmNgv2yfe78IYXcFl\/04bb7QqgvRhpm0ID2VIMvsaCzZrX4ii5W9kag5lhkf5uwdCbkoYmeEJk6GLIrS1n5FTqMLcjNmo5a1\/y80cmMgFuSXeDUFjj8386YJsGbkNKRWtnVV3lHSOm5JS32jeDMIwwLYLPXE22+gvnlueQFiV0srmOlU0OSnXNkAl93R6FxEEFLAr5SqSojX2SL\/qGboYQFFFT27YWmbrralBaQMDYGftR7hMBhXdZwJgYgFHxOwyJPzQiegQpvg0y++omD+tM\/ahK2mdZsnNmRq2AzBo6GWjk9MDHjLn5IjMyb1RddEkNnvzn8JPyM0Ee5rdEfjL7iQPL6Ol4O3DwauF76jHGWS7NtjQ\/a5lPNcjrBuO2jdLEfHM9HOrWboReMpmiwcftsA5oIRfABxuqAuWxKtqmKaUK7\/C9tqltf4eW1Ek2C2oIxtd5Yvax5FgGThDUckE5j3+MbcOgx7f7MvwHVnHcy1qQww+f9U2yu4P0oX8p1Vl4d1IUTK7bDWR6LwnSkUv7tS1a14aaOQhgfaiCyM0kmOQNccRDfdXXBrkpQjPVB1qSLJXF12pCo3tH5KmNlYJSNVe56AcTQ2i9aZIiIw5Q9V4qb7gfJWsA0Sz+wJovZ2bngc\/MOoIaFTo4KpaVXl4Fs8si\/Y\/c2hi7+wB1loDNZPqqS1QHienAf5fGBopF2+9UPML0btYPiCnqdkk63a99J2+E0qmFJKuTPHkn8+JpGOquHAN0gLurwUXVFG8nuLXJpfGZndnWdEZ6BpXaSFtxwqpBVOPTx5c0yy9YDbd8OcgkqF+BzFbLDdxNrfbPzuOODRfZj24F3n+vv1alpCrwVlrl2NfpTuqOBvJ+IYSudY7So9UiNJGxOJ9hgHoOfF2vC15BH6pt51T4+BJzlUsuIgvQavAMLS6pb4ofguJFCdE5uDqbnXPkR7PitVCKTVwF8SQQzjQkKWNGFsRvOoNZjRdP7n7P2S2t1997t8T31ZhbONTmr1azu\/uYRwfKUPZNJVjH5zjtVfzlkzy4y9I8u1MoBSKWcp3w7v4Fpk5Vx4\/7Q\/M\/7YrMppAtC7RzK6GicyCt90hyOoVQWgA28dLdJU+og0bsJwjRdtkldwQeY90i3YDEr1tAKbkd5\/F7yicT3XOM1xNbz51spK9sFurWLsAp4wGzunkLnwwHNA+0yP51cEq+hug\/oJLZvBbK6Wh9YYA4BCDd2YGgT22Dld9cRKn7v4pjukZgEBuWc3iMBjglWUtLllCKEZlNDc0c\/F16MpuepmuVxSn98aCYV06R9tOaUDoxIDH74FKyoj5M35dzFmDWP83vQR7URstXipm3zpOkQtES7sE4hWg3OouxHuIRK5pUcfPt9sXyybDJKtn+5CNi3GE6X6Uz5A+yBQnlWmny94GQhlniUO5kKuX\/dmb1YFpuBCLecLY8yNDLeIW+zfmlWdt0CrDC9zfRzfv4dlTb32KJLzLUabw\/Kc+5aW4r\/J1Vwbdep9r5OgVFFvJOcHvYFP2pxKcMOArRXrsHhH6xDcmYGutXoIGJT0F3U6eul03JRxIDowGiBuQW74jFBEpR+OGWVQCiuUWWp3fOIY8Hp9aLtW3I0QkmGApJ6soekQ6MBRHYqkPj5Wc3gwJ9sUzPgcFE2CHkYgb3zM8IeBe3gb0FWR7Bo8hbUnXtku36pYSZPi0cDPUxdrUQL\/vzf\/\/oTfdqx+nm0XQdsO+oCT6FRmzmhPMtLFVSrlJ6HGHofaSGkoqprgsFobNcymcl+MZt8PV1yqAVLa1jSdmGzJFfvkKEzJykYq8lda5BomgiAkX7758mfwv9MeMEfT+ilaI0jp+NmXcFDgLKqAQ4D\/9oTUDLiwEILqS3RoxZUaQPqRTOqlfs35km1qX75Qcf4\/7rFa8bxAH4kbdCbhSKj7NHIqZNZuFVjkzeDAXT197Spn\/z1uvcSMYrxvI98onI06sw90Ht31blcsHEA6KLqY9Soj9I5XTf+f44OagbhQSn0axLmG9cfwKxZxxFuoK\/vAKb0+69QoYTGLN0f6AqyLMM6f4QK4UuxGlEn4nupSQFBWDvZyl4uTcVsl1CdhKLj72um\/nDrEuhyW4DvAyiWOm6u7UyfmdLe5XruXi6U4UBCDxlZOpTc2qrIwH3HtMzkOZQ1mfKABsPhUMNO\/zNjCkFEuzrL0rlqVeHZo2txm8o02uLlYUy1HFW2BcfL2j8p4xw0iDgqQ9ocrW0sumSi4lEeefOhReG15F+KgF\/5V\/L6bDWlwd16inKasXqcaoLuKm3NTgT0yUTs8djpEmBMj2jbP3XBcKdchRg2CnssoKxSHVLKGhkIRrQTroUFfpq4qB5qKAslUY6WAHfA\/LLWgD7733Po5HrQ1plht3rfoh4J5m8dKUQok8B3jzlw\/xa9uPP\/VOX7MZHauaJJ2QY5kF2g5La+tqLAGB5Drt3HPT2MK65beqqwWMjsE0ywkTCpnAis1sIIIkxiBmhloQgmu6aliYwylhF7AFguEtbswlAZa52F8tejPXla9Gz1Y4N+UtyLWI\/\/jk6NPRwLxhyPfINr+l7PeHt7BDN3MbNMKMMgFukMh4io8nI9aNTlUM0gmXrm6tdd1M0m7zj4GtAe6Sp0eJsF93fW50oUhw\/S7qzKUQpU6P3gpC0J3I45LNw47nKhWqT3ZtZsy6YBO\/N0xqhFnYg=","iv":"b225012e5cc05cb212b486f0d95ee4ee","s":"a1763f72491feced"}

Workers are upping the number of trips they embark on due to pent-up demand, seeing to the expansion of the market. Image credit: GBTA

Workers are upping the number of trips they embark on due to pent-up demand, seeing to the expansion of the market. Image credit: GBTA  Global business travel spending is soaring, outperforming past forecasts as more workers head on trips than ever before. Image credit: GBTA

Global business travel spending is soaring, outperforming past forecasts as more workers head on trips than ever before. Image credit: GBTA As it turns out, United States consumers are going on more business trips during the summer. Image credit: GBTA

As it turns out, United States consumers are going on more business trips during the summer. Image credit: GBTA Based on data stretching back to 2000, business travel is proving to be in the midst of a golden age. Image credit: GBTA

Based on data stretching back to 2000, business travel is proving to be in the midst of a golden age. Image credit: GBTA