Luxury resale platform The RealReal is out with the sixth edition of its annual Luxury Resale Report.

The 2023 findings reveal that as overall demand for vintage bags is up 300 percent since 2020, and Gen Z consumers specifically spend 40 percent more compared to last year, preloved items from French fashion and leather goods house Hermès hold the highest resale value. The brand’s Birkin purses alone are worth 127 percent of their original price, adding to the booming desire for “fair condition bags,” up 130 percent this year.

“To me, the most interesting part about the report is the evolution of luxury and resale in general,” said Sasha Skoda, senior director of merchandising at The RealReal, San Francisco.

“Luxury used to be polished, veneer and exclusive,” Ms. Skoda said. “But what we’re seeing in luxury now is that it isn’t one-size-fits-all; it’s more modern.

“It’s about accessibility, sustainability, and connection to one's self.”

To be fair

The report’s findings name the forces driving the resale value and demand behind secondhand luxury. Based on the shopping and consignment behaviors of The RealReal's 33.6 million members so far this year, vintage and “fair condition” pieces are all the rage. Accessories-specific data arguably most supports the trend.

According to the report, demand for vintage Rolex watches is up 304 percent, Patek Philippe is up 207 percent and the resale value of Omega x Swatch units has risen 205 percent.

Jewelry as a whole is showing up as a big player in the category, with searches for “vintage pendant necklaces” climbing 154 percent. Searches for pendants, bangles and rings collectively are up 83 percent, while U.S. jeweler David Yurman’s signature silver signet rings specifically rose 81 percent.

Vintage continues to thrive across demographics, as every age group shows enthusiasm for products with the label. Image credit: The RealReal

Vintage continues to thrive across demographics, as every age group shows enthusiasm for products with the label. Image credit: The RealReal

When it comes to other vintage items, Gen Z is driving the aforementioned significant bag boom, and five favorites are standing out to the young demographic.

The Chanel Classic Flap saw record sales following its primary market price increase, taking the number one spot for Gen Z’s most-purchased vintage bag. The Fendi Baguette and Celine Macadam took second and third, respectively, while the Bottega Intrecciato and Louis Vuitton Speedy were tied for fourth.

However, young people are not the only ones loving historic purses right now.

The RealReal determines that there are three bags that are most purchased across generations, and the list reads similarly to Gen Z shoppers’ favorites. In first place is the Chanel Classic Flap, with the Louis Vuitton Speedy and Louis Vuitton Monogram Keepall coming in as number two and three.

Though the youngest consumers are championing vintage, Millennials are turning out to have the most interest in “fair condition” clothing.

While the desire for the category’s bags is up 130 percent in 2023, fair condition demand has increased by 265 percent overall.

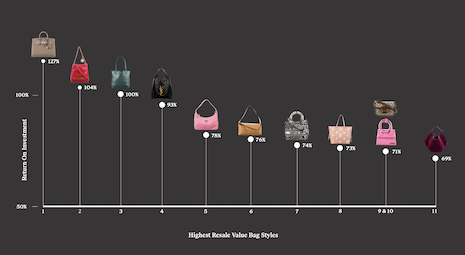

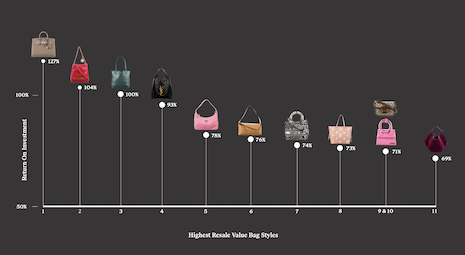

Hermès bags are outshining other vintage purses as far as resale value goes, with Chanel, Goyard, Saint Laurent and Prada coming in behind. Image credit: The RealReal

Hermès bags are outshining other vintage purses as far as resale value goes, with Chanel, Goyard, Saint Laurent and Prada coming in behind. Image credit: The RealReal

When it comes to the brands that The RealReal community wants the most with this label attached, Chanel, Louis Vuitton, Gucci, Hermès and Prada take the top five spots based on gross merchandise value.

Most of these names are behind the bags with the highest resale values because as noted, the Hermès Birkin brings in 127 percent of its original price. The Chanel 22 has a 104 percent total and the Goyard Mini Anjou holds 100 percent of the retail total — in fourth and fifth place, the Saint Laurent Icare and Prada Re-Edition hold 93 percent and 78 percent of their value when resold.

Though Gucci takes the title of the most-searched luxury brand for the second year in a row, Hermès, holding the most resale value, is in fifth place for searches. Louis Vuitton is right below the Italian fashion brand, and Chanel and Prada are the third and fourth most searched.

Hermès specifically is having quite the year, topping brand equity analyst Kantar's BrandZ Most Valuable Global Brands 2023 report (see story) before hitting $7.4 billion in sales in a 25 percent boost (see story).

Quiet shake-ups

Despite turbulent economic conditions, every age group is making more expensive purchases.

Average order values are bolstered for every generation this year, with Baby Boomers spending 14 percent more and Gen Z totals rising 18 percent.

Consumers are turning to vintage to embody their favorite trends, from the “old money” look to the stealthy outfits taking TikTok by storm. Image credit: The RealReal

Consumers are turning to vintage to embody their favorite trends, from the “old money” look to the stealthy outfits taking TikTok by storm. Image credit: The RealReal

From country club core to yacht chic, three aesthetic descriptors seem to be driving secondhand sales, including “old money,” “unapologetic luxury” and, of course, “quiet luxury.” Fueled by the rapid-fire cycle of social media, certain labels rising above the rest for styles that adhere to each category.

Searches for Dior Loafers are up 88 percent year-over-year on The RealReal, for instance. Gucci is also benefiting from its Argyle Sweater — searches for the item rose 151 percent during the same period.

Chanel, with its tweed and logo-centric pieces, is faring well among consumers favoring the unapologetic luxury look, with searches for its CC Earrings increasing 125 percent this year. Hermès is also a favorite, as resale values for its Kelly and Birkin 25 are up 133 percent and 200 percent, respectively.

Quiet luxury seems to be the biggest disrupter, allowing brands that market stealthy purchases to move into the spotlight.

In fact, searches for products from Italian cashmere label Loro Piana, the poster child for the aesthetic, rose 36 percent so far in 2023.

Other popular picks include French fashion house Celine and Kering-owned Italian fashion house Bottega Veneta, which both made the top 10 most-searched list. While this is the latter brand’s first inclusion — the label's rise led to Balenciaga and Burberry getting bumped — other staple names like Celine have not made the ranking since 2018.

“Our customers are looking for unique, rare items that speak to their personal style, [and] all generations are accessing luxury in ways they haven’t before, whether it’s by buying pieces in fair condition or discovering emerging brands they haven't come across in the primary market,” said Ms. Skoda.

“They’re thinking with the more sustainable mindset of 'Can I put this back into rotation once I’m done wearing it?'” she said. “It’s an interesting time for resale and our report is showing just how much the landscape has shifted in just the past year alone.”

{"ct":"ekWOMsG5A5s8P767lYDAJRYVaamxf0BXzEu2klSCnW3U0WPzvrF8y7wHHWXoICG6zxd\/ZVOwzm4as\/MumsF6SSsJyauLV7+Ik2wbjJlwCd2Sb0IKrgULFEvNITG+eBEpRJjlfE9OMVwskzo3e0PqzCgmFIx5aKETasWxVFBtsd\/YTXhY2feCqCNRKjJ4\/11+FAuv5NLALvdnVnanTbqxqYhtfswNMEOHkqL\/yUr0EQKegfBLb8\/g1q2x1bXnYHUqtccjW40i7W5BhBn4073dQ4KU0EhYr3LqhpdMd1GU\/Z\/vIClUgRAtz2StAnkOZE3+Yih0VxpL1LiwXduo9wZ+TtgNCnJzlNzH8TKTa3PpTRTF6bQQObAklULg0rLsHzw9qSbYNuYP0ia3TezEvvEIHfoCBKnd3dvcJDfFYerK3RtBrVNYiZP3TfZ4gYzJVBIQaGPEn5rH63+S42TT1TXnJcvelZWXG44MvFCo0Zm4YaHL7kTue5G3Kt8WSZyI+7989cDV2Bj+ae7IknJvRIJKxhK8c6JHB9TrM3YC+YtKtaobYH845QPaSzoq5oHkE7lzyP0zpyVNKaNIzsGQoIyBSd5ecCMqIbTO7PtzA6rzGAu2dFj+DvCVg9WII9AF\/NPYm5csoql1zw3091rbJFKTjvOLfuxVzhAAH7KMwaVPvxlOLIB8aVZOMQyLTUi9Zo2bLWaUUC7dlB9wQuKUNbA8xX\/xFDI+v9MYOrqAfz\/Q0yemnPc23oI0eBeaEtnCXdVTgRofp0luFvbaCt36yJi5vgqtYY2tem0Mt8sFw\/vopHxKcft+O8IF45K+znCIP7I+cg9rdCMgdi4dYon\/kvQ2nPCTsm\/yUeNklLTEjnZpRhMiHU4J9khBft79U5ca7D48OWptmBG4KVTmR0DsvTtRAm1EoZ9uSygxCFxn1ae5LCf2ggPYX7uSRrAPly7NBUzOxc+uHlA2TOsLW1f4tX9TGcPLlmkFK\/aVXA\/5Mkx5GOu0BHRmn0AfTxMMgNbBw3+2oxUOERL46m4pYxDshck0T9fqDMpHrAMnhNXGrM2Ryr2eJZJSc9eAgg+C0+oR\/Apgda8ZdtsrRZgXlhmAhqorhkUrzafJsCbQ3\/20d374nmc9AZ+gzjjjFp2hcHGJcLXWOPL\/qJE2eRYGi3DfVxyATls8C1z3IuddpeclTAUUmWFF21L5XNuIinzhF6KrOWfkPosj+O\/UYmrZL6aO4JqrsVOFjhWtWE5xKj2NGXgW7CoVV7D2KBCrb2tSem6FoBpRf0MpJAjh7474pD+SsMH2jJDU2JKRKSaBKZ8qzUj18AVc5+x9H7lnHljE\/uE6ZVFUlni+T5glHcf17mGSAeoHP7cB4E9XoUnyaWofQcaeP4TWZFr4eT3r92a7FoMPqlLGf6R0mvV9r0+t1YdZfDkZeKH+7YAuHwXaMMhd9dFq40evXsf2zPhwG9hVSlzthgit8XOPStE+q9pX067Of6rGJyvQT76InVCh086y5++oEfKLSmLqTqvWiqsAARiI8hmI8myEylZtLLkaOw6ORmZxsono5psK+Ejrhu5cZWQmOwo\/U+78IyDkXseT\/1nO7vxPEZtHJYsWQ2Coz0Rhn9MKNN1Y7E+0KJbEwNyfL7JriELkdu74PwAk8gSLHjx+aTMVlLBQZ\/IrxHC2JegPzdPQ\/xC\/YLyypas0M4ZQ50qmylXuTqulzcZG2NgIm6s2h2c4pzpFK8hz5xJ+WENA+Lm6R4bHVcvy\/cne+KrenDwd3yKRnePU\/r7G6N74mGuZOdu+jafbSkmmjsjlXzcwdmromjr6xnvAlMpMc9RvuCW1Xl7oySlky0kBKSSkOGbk2w4IEz\/SHDsWWU3ecPTfd1A2wNa8XCQUkWrTUmz7FW9VS4tB5Vfc1FRgQG4VhvBTjYX4dwH3zlLiqLhqslOm9g3jJyuws5fUHOXddcOUzjWCYKSZSI2gEbkPXYrj6UaL8gA6Z2\/UvdG5F5ICUWR+iB04dw\/uY3auAqJt8SjAwbwdPKo8dikpPG7sTAyloDDrRyPJDgm+YqSL7pWpGQAcX5C+0EiEVBYQk3tm\/dCE89fc3zJzKNEHJ9EmoPBjQm7bltESFSiE5NwoJxz2rc4yD0qTtawikxBHCgEKA\/oNAjb8UOkiDCUQSVKHax4Sp0Oe2odb8OVnLru9NRW1ttaNFWxGsDdPEKmE7oFhRWwiooyN8RQb3KxCyVlLMH395e7aZdUUXdrPoG33AIW3hyti0NboiOSlwnEwaBWjjau8QANs9FJNgh40ZMHayXPyyMarBuNXdE7KQ0OwRiYsjpVwFw\/P0mGv+xXaKpJhnUMd\/YwMrkXO+rE1\/nPmWRCb8DSIUWGUS0CBDgss60cYz6Vt0eY9jReKK3s0yBBFTxvgbkdiseul8rp9iCP1iUwgJdmGWVgPexMpiY1XxQ2rv8OEDMYZvsLK9AP5EcYMgZASd509j1Rg2WgV5Sb8J2ScIj56T7W+3CMCim0ePZpdLvs1squ1Px5TOLinuwSeQ+UPBZzZAjtA55eMYsnEqBTivvV7+nsZbzyF8Fr+iJ0z6TLBh37EeWjvwbc3AZQhf4ovL0oJSoxijclab4QslZZgrDUdwzI9acmfbPJL\/HzypC4e9mkqe9\/IEF0sJk0XheqQYLhQV2KhkLOcixt5bmk+3L+oSmssqKgt1II6H7ygt+qMBLt3v2YoDBx0+pu1UOLoVh1GZlNmAg9ew9l3dmvPbEDcnF5t3ogG41rQONXSlPgQDSu9rmZSuzLJsE5U1JwJrK1GA222GQxknvfjx0SHKV8Pr\/UzeUOfqeCOEzovAlmHJ1aeSpVhoTmT3JNiRnLVf6Hco5LBoxwXBZ1Ajs74HiKV\/HN3fUr0TWFIiWLQOzlM1fU6JH8OaD+FtDQfWphCX\/Cril9f+DUJJVDAC6229syqNmRGS\/35WlQ2iOxlY+iP5XFN67grTVW\/hp+SAH2PRiXQedu2++YIc29rmpdiSGcoq4tQ0vHhDnyAN9tN9sH8HUie6YVcggqh\/W\/bPazhtLXK94Kv0YpIbmrh+6jXD3IPWO2E5qQ8sE5fuWs7tBkV0EZR5RzYVTb6RFMWBQd3ocyizqLOdRg4fL\/cvuqK4cIE8nZhawiH+NKIdgHTDWEcnuECMmfVWFfdAC1\/OvFZMLi32cZbtIVP3whe5I+wwB1+ENtHTlpXJ7aScz+3MD4eSj5B5j4Dh7gwmDWqf6GY+LwD8j9ceO5y7fX+Yj8j0sZqgGRKtavUoYyvGegCYcCWGWnUqgyarEiAcWBl2x1SXUzyOr5WkNdv1QHocTdPeGH3tJzG2m8Qmu3DRjxnAaF4yhj\/p2\/HBUCR78W+GUhDswNyDuCn0Xq5Y1FNX3amyoOfCFKnHIe5hG0tj2K4QJZmqXpx7\/belN0lJHKtNqW4\/QW7czdr3v1ls1pW2ptZWMT2CdkqVPVG0lqP7WERUp15zlvilYfux2cVB5ZOF7UVGlmygFFvR+j\/Iclk0v46lG\/YQ2J6GNWOaW1XCEnmjZ5b9cHHTB9hB8UdrIutqgMl+bZkCDU1O55D1mA+C55UbJj8h10k3Vd74BRWTqV3XWdwUZgQggIrSyysN2XM5RnbkFx5K9MFTsta8IGx7X70Nz4ImSny8g3E43CIrtiZ1ISueeTsdO52tm9ffpONTqcW9rrOHcFB5MHiO4gTCVqF+xYq8Rb4h5+afAyuqrSodEN8VXuI8HGtkMWyHloZxb16BUl9YQo8xGqHlkRbCr\/ppRuAH9nbV+3RRrGMTtPY5+lroq2qAlIoTqoiENpX1ZX2Jd5PH5eIzGJRkueDCbf4JVx\/XCI4EMwNazJaJt8Zlgn7O3Vm34W1PRGU0LghiuM\/odHU2F3Ldsv5L7FG7VrrxjlIxheRjhbx2hK7MWcVW7URl\/sdEB6uejeFXZNT2DKEXvpW9bAUVrzTyM0rYAUHutQVRqJo5HR4vkXZQ0Rkwi4ch\/MFYfkKLogo9qyQwOmq3+hr7mo9OpIwpylx7PkNvQRlVEUbUi5LIKNtrIxT98wOe96XWsJsZBv6WQ2ZAwSLdxi4gcyuDCFW8FgrhFA\/3PUk5hvUn0GXgc56UXXRuEA+EIMRosbYOvEOmJr8kf8Ln0lnQgMmZbdptRhDucAEHTTDSUEq5\/7bSLqtz5bwDt9TDDB2H8Z+T7FpxIuiBUtVVoBlJK247m35jePxu4jngIzoHXVykvxqJaP02MFYkoOO3NcZ+MTtZw0Y33e4zPOtghy\/Y6nRYirIxoxs84zci3KDAf6vv\/sFDsesKDrdfYnc2lLqFrqDjsn8nP1OJt5Y+kaJhJQxF\/xfC7Scg5ySFLHLRTntaSVxPKensgerSGFMBUCfy4nPv5tHn7N45neVMAVDyOYvbRktK40l9x6iDx7VFXmE7x6jEYS2p4M7JqEFDE4lWDjjVEDO98BhwCxAyMYsUip0Li77LBk15JneKE4pNsjn34zPenW6uDmtm9mFg62fqjhnyKHZItY5bRpraDQedOjc73iTUxPkRMCRW\/BMjUtc\/HjRDJHs6wDQV02qHCypsYJ7IgbwlOD+0FBmB5waEt+NzgNyR8xJLnyaYsvlkq2N7T+S2LeecJcS1L5xr+UoUzgG2MjkqT0MH\/fEey8YfsI\/cWaj10Ci97wwI1XihPW9OlxnXSPx6soApjeysfkNDj+tXxThNgqo8RaQusYZfe2vTzyI9biHAHNqkNjfa3znNrFPqkjOrLGSVULlET23985XDpdrLh6055ibpmsZ2H\/jVryF\/4tqrzqxnVaXKYHklxbfalX8ARiC2NGJTAxtfIMdi7weHl4lxiDSuGDZ5Q1t2Dagind4ueak4gcMd+7XVzZE1sPhZM+jHsWjG9WJlJTmfjNRpP99v6rrjfsMUraA99z2CKGbInuSC0GTB0CUrPYxmHcdWBNJIItaqSBKmXLP819M1UoYwjKpy6VSFiqfCPZSv\/It8lzxoyZSy\/PHlFy1NAWp3iY0pFKfTIj7\/xUdgOlJiG7+0chzkr8TQcsaapgyX8ueojEDRTl3c+GA+rb4sZ2RJ1cIi+0cTSW5ub7XxGwC\/IUYAsE3203h1cMdJvjkywvomqCG\/uJl4GrKwo+lAbOML9VOsdto++lcr59aUaVbmWi8nJD4ctaNla85lqGQnj3LM5kzAj30QI\/FDnNXhvQ2a32AQX18x8ILm+nVZq\/l5vsuw9kATtLzL3oDXeemF+s8ljsT4vN3R5fJjzzg4GnbH5f8EohyLbc7srOWISELEfQvaY\/rujkSFPTghVMLx56Z9Rn7UDwxU0j+O+N\/p3ud5JkwMDHQKos4pjwV6VQQ6DVR\/wr128NHseU626VXrNLW3TR\/RopE7IPwiulRokh81F4u3MjAR6QYpAfmwoyCqBtwolOD3RhOGL67sUOHrWOeSMmmPZd1aANM+8XS48ER28EI1ixvofM4fOmHqcSV8kRS1cShUcdnSKTPWs8SmT9a\/tCFAlWOHmCXJZ7mkcAbx3gGUv5gAgB91G5xFO229c6BvYd9dkdAfNYsB314Ve7pN5ll8VD1Hzls46hfYXtC1uXfOyO2Xpg55xwujztG84DoC2dAbZLXKyqyxpblFIaytizMMLKwAhlnVd3dTrBI37kVr2AJn+TS+AYbrV0kYFdceGCVPrJuTJBm3Y+Njcc6i9uKYWsC3oV8SpqLxQ4FGi4ubpnJdiz15CD5W459w9mfFcqomPlRNLXPumhZ3nX0Gh9NzeLyTnRV2hDIni6huzQKKtsI9DhKMayoyBJq04BiQlJAyTnk6p1XM454bjshMJM3PNZH8P26I0t1snLAPJI2qOeOfTwZJ63yCGuUzQ18Jktc9MOfBUCqZ7Jc8YB4\/0FY8Pmdn4Q2eG9GsXLo5VG07hdxaFCGlpXxC5HCIhoGDJInny65h1RPp75MU\/Fdd4Ddx4qSzIlMS6LZVDz4gBAgOjUCqAfdKaxR\/eVte4AmihMmoHdruGpSc80CdSCfZ4bVS8qUg+g7rUTw\/otlbtQmxlJx+weWmvPCWLF0Ite2fDeaaaWfVhSirqFg5eoZURnRRA+huORBppAkLSVsjyVV7lt85WNKLvKe7K9cQCDyIG9vLV91\/kuDfgp3ApHJH9HgoXI9r+b5YS\/BRRTKnJdXA8Gz1\/BeeYqkZfV+DauMW3AoWwNydQ3jX7Jv2n2o3TgckZsAURUsePiCz7pVZ1grWzmq\/TkHjdLO4hbfcNwecoK8Zv8QajqSL+V5+IE\/1aHN+uI7M2bvTdN2h4IonKPIUe3Wm6PsYS5yq73BuhOIgeXo3bAQFdH5WrQi9S64eKQA7xvoQelT+C5WbF1wuvfp2S9JW4+wDruP8N9nOnKJNMfTc11cCl0+iwh27W\/YsXC\/3OSsGCrAsJhPWUIazHbNFiU6wm0C4vWUOu3xyVgf6NAuu\/nbWhUtlG0EPuqI\/7D\/wj3wj5wmnNhe0rsopjbBrXUaP1fwGdTzuNGxt6OopE0KN7pJaPI\/YmPvIwJLr+DUtCjFYejwtLMMvW+DgpaKwUtHZyJXVdNrWACcxmCA3HLjbyyQq9e\/61hMVN1pZLo9H0dm+TQOzXCHGZ40mRKSYXdbQ4yTyWJnn6A+ud3mNylaPZ6gTX9BmutJQIOfrXglesKF9cfdumXiU\/Ph\/osnBq29b+yt+4m61KbtA\/VYzOK55UR1jvhYn1GWMsKecYZUfYzEpXzmj8Oqz1HAiV07JVb66Sxnu+rmrWRMOJfj0bM6HCD07kJbcfWWj0wY7u6rA7J89C7tdC4bwQ0ZBFC5wJETza00rpvzxC6PE63YXrOanE1TSQT8JDu6TfDPQVO1unasZpwKsLxF7Wnalv8bKDtQfpHVJ6gwo61DKB4QvA9oSMT51gOfSX6qfZwQdHnblThE0rbTBLctYBgV8qHnljFQ78YHBawPHzJxk9PrgPqTHc8z4I1RQGCsTVVGrhRQGrqk0Yqqk9XGO2zM416FDRyy2pUT2LcYuJ1bk58KpOj7Cs6gFtNQ9giH9xeeB8Bp5GWtZEP8DgdXZJFUsOaV7kssID28ikyEqoXB9TwJwpbCgj\/qHXP44iRuqUa4vyIfuaMK9Uc9nafNegOqF9LuQmiwDXrFFV8c2BePFGaKfXFHIDfiNqHJyMO8Xcx8jO2L0jqM2G9VeJYs0bssLImgzzz2FCDBdvl0hyHFpgSbpMnNtoSYbdIfZK7b5J4ntnu1btEZJIK\/SAmjFCcmLFjy1R8odl1Pg9GOppNY4dRdOofXNowrLC9i31BwvoiunocpJSjEqG0s1m7xAyvPa\/yMcqnK3vAv2wBi9z38xXtDW8MugUc\/tA+YZ6k8bQgFnC\/i\/W90cAutPjcyzDFuaPtvkmeVRhlPRHORI9bCoUhUtOY4oeX5eICwaLZdNd9xe6hQqmoQrj4iLA6VGgwoPdecsTgbv2GEJdXGdEOaMqy5CwC4emOYMwA\/Y3jMhuFP6iE7XtXcmUCdNDR01qumALaGv\/wZk4s4geWn7RiYwkzS8soTXZ\/SP8rxcACZzSp1uGKFSW1S31RO9YDZmf3Hhf8NxrSa9GhntJLueamaSYFAhBxmcwinaZyThAZvINMZRVUCuJDNMWtrwxxb9i5KG84lyNbpQMAZurC0VLlLhxqFHROZj8A3pmQU02OgTVEyWo8PT3kqfI4Cm2JfMr8V378yQivrm1p6DmJSj86EI0wGoyiU1Iv0Oh9WVf6TsNqAQNDTnf\/9IlNqWxobOSNigiq9NFVjKKub11xxy2sS1Urk61nsnnP3GdxyB2SwGp2QfOmEybfFgDxukTJDcQxqV6icXw8Ez4XPDRJ1N7KuX5IQNNRB3siyS0pVk+iMpkco9S\/wLnmBhKuAx\/EH4Y0MlJLH5TflRHqGkLhydtTKZeSkPUkWBk2gBwdWTx8KdI8rxHorpCL7kpHFtlhWgHYyZPzBTHUfy6ODhH20qG8xCF+hldd+ILglyAkcO0+ngdKFcNGewyRHhQMnhDqgRqBpWHdgc4XF+3RmizDKNGGEylgBB7vI++e9hrdLRAtMLY6RheOLIUSJ8F95tIQO4ZzDgeETZG+JVE29bv4qr3MVP4ZEXeOqAMJ5uODjBFzw9KuV+euiOk9mXCJwg+vCrYFrZ2QDHrpWLGWANmM3StUHPTJ4iIxFItzmX6gtcngGuDlSN8k458atTH9YeCib3jGVFONhgdvq6Wxlqd0ISCjF9NtV17\/dbc9wRWMaSiGGmM1xETtM6Z6pA4w7UDCkTPhCovZ21b5Mn3rRqeNOawSUfsk03PM9C0zjNgcdURYFKMWrlknzJ0ZzwagCeX5ZCI3EeViY61\/eW62IxtPviExip7FeEHnoTtGAYt1Luo+svmF7twAbszxIa6pdgT3SnJaXJ6IPWa7FDFiDWZp4oPODnEq5Z8Hu87as1iJTmuZWmgKgwguny1P+RNoPpTZFcz4njno3E2KhQtIdSVe6uL21puYMatfZC6XstgRo1Z+Bz7DMdei7yRleamCHeE3CwhPybLokRU+\/RKlp90KH3tllTtLhg\/sLkBKvKxEV+bFpgGwvgeLK0pOABrNdNRpCzXredKkGak8uFsgYrbBSbkrdy\/v5AKQOvLRDY1p9Gu8AFx0GamQpKP7W2sjgFGSMstyzoIfA65\/NKMevLlUs51rVDsnw+uwLr7DvBSaJ\/+1TMk2QpEwvaKFffjQuSc4LXUAsM4q4NE+jzwoctO+6lk0BuyC4L7Ev1boKU5gBpi8fSyD3tAFGhujtt9GkFq7MPDap8rSjsI4s0oXuE9z6KhxYK2TS1y9TjZ7yzHX3DIhA07QEblKenReUDd9ss1HDAdHpJxawx8UHX+hQ5ZCW0mdA47jRx36M9tOjF2mMKqyuI3g4\/5ScWbZgOTz8It86g7zx3V1QkVePAsQnwB3c5l4MxJIfBpH\/KSAVW6zeHCMcOVRJWlnpOofe3Z4xLGczsaiDOrXpFeKBjBlwcHS2E0x7vS6tJf0c9hSdE7q0PhtYCHaLFFRMFEaGosPyz1z+g\/sQxuWJ59yD3hLkiYNt9Jyd2IMFacouJ+UoVfw0taIqyL0BLreS\/dGh49Y0DQh7g7IX8zTqyf0Vz9upbbguas6giue3mbaLWmf6my4Sdpwc\/FSoKEQaL\/jsV0iVZOtpnW+dESTlwb7dKpG6e9VxzgSH5Pt0XefGA4iJpcTqnwz6lXnG3dM4lC6YvopFRgAdlRxlbPeEYICjg+RmMGfBQr64jiX4vvwVcRrB4wzNPowD+2mBNmzgaREQGGpdKIJQdySb7SiKifj1Z1UeZcBnpK95fBGe+PlLTXT4u26T2J+dAZKz3bkoICY9loeeH9bI2vYpf1mG\/YpQsZ4mGpSb\/1+GTEZnzUuePLY56LK6W4CJwlkJsUhtfp\/9vBuwsXocxqIwNhpCoUfbVlxyZiOYY\/car3A2adnWEjh+DGMHF3EBsKxMvD\/MuhNzJekArZNSXV\/Hxsufdu1VMoMc4RC3Neyl4z2NZV\/721GxpB9u0ycvaxm8jnWi\/9tGiMmzVCrfbZ8wsbduElnAeRa5F+6XO5ByqPSYqsGXql5NtJhYKXP0FcOXYifBSLBDxYSYgNxognYZkzSMGpnIfoxJRUv5amqS9rNqzHeRJ\/JwP26Mn+qLbFVRaz0ejI+1cjXNZ0Wyr7cxH6Xh1IXY6AWUrRjZMKkndDpx+gNdx39wDZaViqhMFP3ZfYtPYT9QET0TjQIEvEYJ8ikCGE2\/rzkVm1MKm\/ImorsTWvhl4YJ3\/NkvV\/jGbzMZ1Hy9fNMPHlstF0qDbIVJrQBKP4zJigzxXXXYYBDoEb1Oxx5CHdKwoAOFEgLriB7cK4U8TfWB89s8s+\/Lz18fLEN0aqSNV9jOwDD8v5aXdUeLVG6tj8aZj09RLFXBA\/2JJw8mHgotfpuCEc3fW\/SAwnmxbbCPS1GZAvlgUnZaLPXbWeuG\/HQRfvXdDS64vs2nd7pVa1dc5tcTHAIlvWBNZ4sOJ2pw+bHGZc3uixc4WT5JmNe56fU0JuvIumCEwmPrCIIbOUYZZqUzQPM7+0OLA0oNhgUSAIX9J7HWF4\/Qf8aNxpG1dJct8+K1Fue0S5lcS02OVhjGEwVOUPOEROtdsANLowCSw\/V7uo7qqTGULQbfJDAXKBurwYBH\/R4Z\/Pmi2J2y\/lvE7t+xnnEoOhnNmlYruOy+yQN0yZVdEQvewt\/wMfgNOrM+W2EC1TCB96Ga5iB8+Oz7dz6pfpBX0uiK\/ls4mbqpMod6\/IPe+0ab0yCl4M3FgKjCxL3AMUoUOPyNafHcQx8X1A40gA9\/UP1d+AfH+LFUP14WpjUvonJ7buWEhU7UwZdlY+Dai592LjWDM9BBgpTrVBKM\/JXNRP32zeRUd6XdiNyjizMhsQNBmTM\/ZIrc3qDht2GP0FbXxb9b+D1Wg+bUCbwKJH534+wc+a0BtUjbAnrTEx5emUcmyxFc8l0H5v82EdokUL6M4NYR78YYNi6DIZ3u3KAcCcZI6UUQLY677rOXH4tSJSnHYh5trGrJYOr0IUIwWi4TNEKLh5H+oDNmM\/AXAs0oJQlIHFB\/iJvI1k8+xG2ao2wzGouTWglrrQ+Bk6GTUGnVptxRHiXB1nw60bLdwYfE2Mqp4yVIcqLlUAJAROQcPzKF7zWgIm916EaE9c4WJU6YKjLGuLDXBeH0Wxb9ZmG3c\/e8gWgE7Sx895O+v7RuFlajzZczfesKJk5ZJDKlP1Q8Szvt4t4urunCQIHueh9kAq0rPD4woLnbvl4kWiXSAhehONf7TlCT4corcIF8EeSCFNYVgw7zZuvgKn+6b07ZWJJH+nuUwNhi8eXm\/r30cHwEwvRvbVHf7v04FdVYWga+DRn9dFthcP91g15IQM7vezsGCSJs\/LfyRAdHHaZNU+sXfkPQPExQUJovewtnCL9SRSPTIT1kliIzSUAFTpIzS78Xs3a9bI2mk9BTopjvx9t0I+fLIH8Vh7jqVtv7JC2nmwEnqb1DPtzvG9sO7CzIXTCOxB7WIgGLX7IKVRPzMvNnh71OKefWBtxCpPPYhRUpSQsM8koH\/AZVdBYhq\/71rpJosr3VB5xNPZHo2ZnOJPsIWVbjM0UfetFKFoTToVaaqC4\/J8LrfolC0PmzURscuuNL\/4Xfw95RbjJ0zhM1kQjoDxxC74by370264wa817b8eW6NuKF3r10mN5nHoIa5W2AqJktF5fNwWBB5I1Z\/NoGHfjjaGM\/9T\/l8leOCbXMTcbeT08b2EOlH3zJrOAxt8AVEACfaKHcihhCZihvBq6KiXuNsmtpD9yv6oEWjT4FJB8EeoI79Qa7lfhG78\/l0GX9X5nu9ORfn3pGaVJlOtStyDa8TF3attX\/fSHH5oWPpLI0ECUIhQloSYoyOJbg9FKA47V9ohd1UPix5UrXAx\/WMlPfF3PPbZAk8KcuElFqHLcLkT+NvqMfeRTQr7aJ0IYMJr5POf2U14pz7OIKqxoiN9DKoOXg94\/XKLqxc\/IvmRJLt98KwetaHREu6jw5ygQDU3HsJ6XjkgczYMCqNEJMAPjOM7hEyYtN+4\/qRPkQlheXPROct0BoFE4kzoqQCOAnSRS8I91MS7FoZ6Qzx+3Tid2EiJxzTvEjkOeq57QH2a2w8zS7Zzb9QgGtQEWapinNndS4ZIwd9l9GvEcrh7BZXQ\/VoGylnkA\/inkoiPd0\/ycJhv9oCzrd25d6dlfBv32jFcop+1AgnnE6Is8ZZFVHOj5hq4NMlZU8IEXjL4YNDsxqDEomsypRmJQo95+WY1ifW5M9VjEYQh5P+fe1CXrgT8yFVAQeAcRaj6cLeAkV+qKVf0NJF8v79TGkvljEOhcXGa3+k1eyke1nWlBteRnpNW0WpyZ0yGx2qotg+pHhMIETMDNPlbk9mZvWnqX2y9n\/3cmc6BZuer8ucpCfWOlijGW0D7Szro2vFDfhfJW+Bg5Ah14wGT8mGuTecx68DkNTL7M4CJ1pkl14l5+OYpOeprkSPsHiH8ws0rRcdNv0gr2xhSzEoh3j8SQDtKYqVx1pBG6olLj3IxRBn3QJUrHExi1yK1dzp23+WNI=","iv":"84fc8b4188fd30ecae4513e42a8b4ef8","s":"20946ab1d88658cf"}

Vintage and “fair condition” pieces are all the rage this year, as seen across accessories especially. Image credit: Shutterstock

Vintage and “fair condition” pieces are all the rage this year, as seen across accessories especially. Image credit: Shutterstock  Vintage continues to thrive across demographics, as every age group shows enthusiasm for products with the label. Image credit: The RealReal

Vintage continues to thrive across demographics, as every age group shows enthusiasm for products with the label. Image credit: The RealReal Hermès bags are outshining other vintage purses as far as resale value goes, with Chanel, Goyard, Saint Laurent and Prada coming in behind. Image credit: The RealReal

Hermès bags are outshining other vintage purses as far as resale value goes, with Chanel, Goyard, Saint Laurent and Prada coming in behind. Image credit: The RealReal Consumers are turning to vintage to embody their favorite trends, from the “old money” look to the stealthy outfits taking TikTok by storm. Image credit: The RealReal

Consumers are turning to vintage to embody their favorite trends, from the “old money” look to the stealthy outfits taking TikTok by storm. Image credit: The RealReal