Swiss luxury conglomerate Richemont is reflecting upon a year of social and environmental impact.

Having shared the results of various CSR initiatives since 2012, the ESG Report 2023 is Richemont's first, Despite sustained momentum and detailed analysis in areas such as biodiversity and waste reduction, the group's rapid expansion could warrant further action, to keep up with a growing footprint.

“We have continued to make good ESG progress throughout FY23 against a volatile environment,” said Burkhart Grund, chief finance officer at Richemont, in a statement.

“In FY23 we initiated comprehensive change across our Group functions and regions as well as our maisons to further integrate ESG principles across our business,” Mr. Grund said. “Reinforcing our ESG framework, our FY23 report contains significantly increased GRI disclosures.”

Covering fiscal year 2023, from April 1, 2022, to March 31, 2023, authors note that the ESG Report 2023 has been prepared in accordance with the Global Reporting Initiative (GRI) Standards, the most widely used sustainability reporting standard globally. Additional methodologies guiding data collection, restatements of information, analysis and reporting within the Group are listed in Richemont's Basis of Preparation.

Hitting the gas

All-in-all, greenhouse gas emissions are up for Richemont’s Scope 1 and Scope 3 emissions. From 2021 to 2022, the conglomerate shares that total emissions between its 27 maisons and businesses and 2,341 monobrand boutiques rose to 1,906,626 tonnes (ktCO2e), representing an increase of 24 percent.

In 2022, Scope 1 emissions increased by 11 percent. The growing number of company vehicles in use accounted for 56 percent of this figure, with fuel and gasoline use comprising 38 percent, and refrigerant leaks standing at 6 percent.

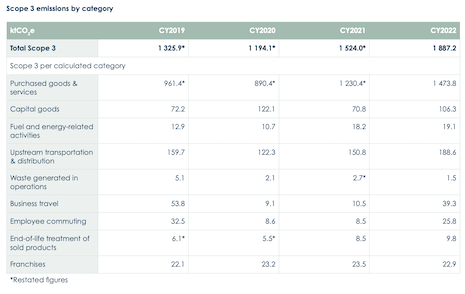

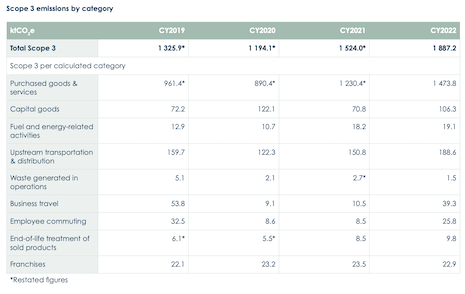

Compared to 2021, Richemont’s Scope 3 emissions — which account for 99 percent of the group’s total emissions — increased by nearly 24 percent in 2022.

The Scope 3 emission category is often a corporation's most impactful. Image credit: Richemont

The Scope 3 emission category is often a corporation's most impactful. Image credit: Richemont

Purchased items and services were responsible for 78 percent of the 2022 statistic. Between 2021 and the reporting period, the emissions from the category grew by 20 percent.

Richemont was able to decrease Scope 2 emissions, with market-based greenhouse gas emissions decreasing by 16 percent from 2021 to 2022 — purchased electricity makes up 87 percent of the category.

Energy consumption, like total emissions, was also up from 2021 at 3 percent. The group attributes this slight uptick to an increase in rented and acquired buildings. However, Richemont is starting to embrace renewable electricity as energy crises prevail in Europe.

In honoring a 2021 agreement to source 100 percent of energy from renewables by 2025, the group increased its self-generated solar electricity by 58 percent year-over-year in 2022.

The group is slotting in renewables at greater rates, as energy shortages continue to take effect in Europe. Image credit: Richemont

The group is slotting in renewables at greater rates, as energy shortages continue to take effect in Europe. Image credit: Richemont

As with energy, the group’s heightened waste levels are being addressed. Focused efforts lessened the volume sent to landfills by 61 percent year-over-year.

Water usage between 2021 and 2022 also increased by 5 percent, mostly due to upstream activities such as raw material extraction within ecosystems.

Overall, the group’s category with the greatest footprint is jewelry, followed by online distributors, which carry the second biggest footprint, with fashion and accessories taking up third place.

In the face of increases, Richemont is focusing on progress made and planning ahead, acknowledging the importance of transparency with the historic reporting measures.

Sustainable shifts

Though scaling creates friction on the sustainability front for any corporate entity, especially one that is rapidly expanding — the group hit a record $21.7 billion in sales for 2022 (see story) — green governance is being tackled proactively by the conglomerate.

Ms. Ruchat's appointment marks a first for the company. Image credit: Richemont

Ms. Ruchat's appointment marks a first for the company. Image credit: Richemont

By early 2022, Richemont would install its first-ever chief sustainability officer, Bérangère Ruchat, appointing her to the executive committee (see story). This year, the conglomerate is taking further steps in the right direction as it phases out polyvinyl chlorides (PVCs) from brand products and packaging.

“While shifting toward a more compliance-driven approach to ESG, we continued to meet important milestones, from the phase-out of PVC to our gender-equal pay certification by the Equal-Salary Foundation in Switzerland and France, two of our largest markets in terms of headcount,” said Ms. Ruchat, in a statement.

“We are on a journey of continuous improvement, and we look forward to accomplishing more in 2024 and beyond to safeguard our planet while crafting a more sustainable, responsible future.”

{"ct":"KMJ39Mhe5mOK+oSs0bnKyHCNkJaf56TbAUMOCOhehWgZbb8ta73iLnScjIQmdgC0+E\/3LNxWrNQ\/pOnQXgSZgkAzW2LP6TF+3EaijHR5r9YwrhtWGSW2mp03ILSXvFOMLpn+3IDRmcOiHONY9Dv25Qon2VfD+BAxFaHkTMYl8w+wdFzjBlRUAMTpPG44Z5dggSEysEJqXznC0iEpoYgJsMBJsmZVkXTp7XTRdQoJPf5LEdf\/nco6wYnO7oXuCKurvDNCwA1Ccg8rakizR4n7KEZVWr9zqmyKDR0gYDaMuxb6\/+leG5T3BU61f5bMXrW+npUbcmfkdPgadD0+1OQX1sEtZVDZb8qosYDCYT81pBZOgOaaAs4ZyOgsjXvlFIqeGyIwpgmDgcvmYAJQkhQpmVhgn6MmZYafrfwk7Lp7sHcmAUqgiuOIJCIeM39GD\/a0LIuWx5AsvlVaHJgjq7MFfmkE6a+4gVX\/sYUdL+O5PviNMlYbd8EJPBNH1IqQIY\/3bJF3jEq9D8GHlkRUWUF0GgV+u9J3d\/LCao8pen8Tk8gV9XqoUiOt0aPNKtwIJXp2UZg394mj3qlQXfBZsH3HGyZ0q8fst45C1X+kVd+ps1bQ85OajmBFyjKfa+mBhH7oiMpNUbMfR1CaaOXhwBw7IjC5iBh9mlP\/k5DpXjdikExo+D3Fxj04tPSiCaQ2JINuIrjC8ZmlsLgm8JRIwPO4HjfxwS5C03YmnZNCdSQEuxx2jvs4lCuKs6qrbuK4vtVuvIA98Ma4uEMKq4RHW32l\/yOSZIfY36it+tE1nUUU0cB6wahc68v0E7N5SoTO6FFYxv4L7nWivQwytEPYMm3fvpLjhrlv7XvzHSCW\/EjE7ZqUMiVH4K\/r5EPLcLovC3\/3Fp8jijREPvblJsZLCHPod1Xy7LNe4vOb\/0QHjsqRsmOevFg7pgQttuAozSN1ODHtR6wof0B4uaRlQ9W61EN3D\/kdAmMy1i7\/CqbQbnRhMHsz5Pl+0kfz5J1C+v8Ze4EdkP4hd50ZiD0oOQ5rmXc+roCcmL136qkeYVIFxl6K1GzMijz91i65ET6KU3tIstKHXiWTqNKPB2QSmwIGg5pnJSWSxb5L+zzY5jnEUQDKLnGwJ0knbnfk7xs7cpB13TbrLXICPgpBPkl0rbXKea0k3lHC8L3s7YsE4XQfvmMPnG6MeklX9i1nM+TceA8Bs\/82ij5cgQsNTQbB11tW+nXlWYZYUJju6u9Scsbzzf+HejigxMq11t0LVFNh9KshFkcJJdrmug79IprDe1LiSKykw6luLB6WvTPrpyFp01ctTkZqi6LofA+6LZvJwIj3\/XN\/PQNzHvZ4RAfmlGdSUTquScTeE75CraoyoicUeThntIAsdLf4r0YZnj4NeoehwIufKaaFZArd865M8NG1ZIdN82DfXSh9EGFqrxAcNsHvfAPxmEnwuJCuijiQIcI6e\/1GTD4Y\/fQJS\/pF\/sqvGWPu8zUaKIIeyIbOWYVqxHWT+VMAqQrOOHTFYPCQrARRx5bdIEbWbn+vTs9OI\/rtY4LPbk1XMadCnxvp2nFk4wz+kj08T\/4eqP+58MlLsZx85buOktCrD4JiNHKiAC2jgL2BkQ67c8UNmmAL8O6hY9TZMVH9EiVJR0W39u1QX6opdgttdFnthfv99+sk1YHM6HgsG9dS+Vxfo3sskYETAuBLd8XVtltssIc1zpwutE0uT2XjxiboyGl6\/y5Pd6bdfW3ncoKQGtcDDoqFUdNi4A+4TTc661fVddkV4V5HhUaycaWKn4SL7r6TmbBO1rMhYzA4Yc77jzd2qeO3pMosWNvWkj9a6RXjORNn0fxy\/++DMmCS6aljsaHR6mD0R2BV3ZhB\/LKjj5Md7t0p\/T2AszyWC29JAJkrvkl1xKcHZ7HZU5iaj9RT2G69zckZyjaCUZQEKMnwoW+7WPDEJ14ImFI11On8vN1Hnss1wjqS+XhAKCf0k0GGuZLiC7wlxPWqAmz9VML+72MhPy6rGjHSpn0Y4DP0y30WoA6bQKk\/YwuecHghsPD+2HYS\/RJpUNTyUpV0Tq8cnLNUOQUkDQFO7MkcCf\/hvuGCeLW3KFr1HzqEwSx1pKV0DbwHHvfepdvy+1Nbwyb31QM+tghBvyFU53mpV6d5eLLdOuRHgnBUK5zy9P7jCiXs01kIIaxoTTrRv\/ywjwMPZdJXa2SD+m2Ub4hs5mte9Wu14WYzaO5t21mTeGfTRCa2K9z4eQvUNO+RDE1Lj2JVOxbBTVIlSLQrzIPgKGqgJ3UqezreVWyxeiCBlFbkiQ1oseP5G4FCdu7Kk1tW9n0DAwm6IxlUDA3FSzb7Hj43HIDjjc+UVCyvAe7Fy5D4bwR+mUEWP66cU59LdYAagjkbb2pIPDswBM8\/+LcPzQ8A2yiOIdHiIucexrT1CRGJWbICMzQrvpmOw7Utevm24R+APv67bAY8EKSEIm\/q4HbqdhRX2hHDsZIizLiOTecvuaHOL2UgU7a8fKTXfcBFrqQjCk\/tXJ+c2XMbTx+Szay2cMUODPqk9XHdDt\/tLz7d2eVRaaU+YFLQygJywohyhNerLhuV7sOTbG+n\/9gR8bfKbD4VTyC5ZwYvekEqNix1npfpDDVcgXUeI2ioygQP0xMIMD6G0CLrkNR5PrIONLFf+1cve\/cYlvwuF+CviztNWnfmxlCIu9W6ZCWHEf5Pktcce3X11GC7dNC2iKZ4UWkGouwIN1tmTkJG4MURP3qH\/kGVyhZN3\/mjohdL7ZE6MDHKU57w8CDyDxViOumlTxHvIVfRCE5Ur5eUd1Dc1QzHXoTjplFBynihOHAVOGvOLdMzEj2s47yfHuKKBjxL+xOiUZ9WVBaZ8ZLOXKV69mNyXRtjFuJzRGnNFVo6MbB3sAbQws3Zasel4bLnNfeH4UPfHjT4ioR8sfXlfZQf34DOXtuNovo2eqKUREOZcOXWHJhtGpMy1FX1WtiCJIJA\/6eX+uJ+g3yKpV9K6TzxHUhUllsH4ea1lj25qiKTxcKW63mkzCo9u8JMfPvH3j9wcVM4cdGUGhTDHpchZJgt736FniG3e46Pkfwii\/\/h\/0n56DMdZPT+SZ5ORIbzp9oJuY3iZPE\/uiychLpCNEv382hfJdTgcdQfJMFHycqAvSDsbKCmUpSQnY\/GXu3iGso2Xu\/U4clyI9PrEx5Fee5Mr6NqmCh91ZqGM+m3iKK4inStpNNRKSQGIuVOWuhFylotAiTVdPeLoqtOzPH2Jv0DKqA\/XyQhKBiuelZJvJNP9GiKu+A9OOVVDNGFvBJWJHlPUadKDbNSY+hFcgM42+eoQWu0rHTtM88YrzayokC3MGwpK2iBZvwERuPjGXMKgtsq3JdY2N1Y8I\/sZUNljjwGWSGYXZP2hCjkifu\/zTls632gy++WC+nP9gslsBulccZbmUlTyQiyUto2AzMU7qMFMGhIxJ3U7EgZAhAQW808zySO19froM3NtvhE2MLh\/QOXd4J9esoerWlJH809qwUs0gj+FjvX4+D6gZTy9Xxeltv4+f5Sjg3j2IovoZSYOGmQxiJ0QJUGIan6hYYnUu4v6siuN6ihFE\/gsJT5IMAg4slsDyYgn5xC8LWs0Tz1b\/ESz05dICeDwFhiigX9gHprLRU4icPiRnYiTRGhL+Beqm8on0TlXbfDhYU5sbIHgLt0mf0A2KMXXUJc\/WNi9Xr6rGpHPH\/vLNIwal\/IwNY8\/WR3e9z0YniUA9Mt+vdqnxJ\/\/p9iTNk66dAd63zToKWm0MU2qiPIhfwqWG5Er1SMEUJcIeHu\/lw6fwa6xzfhg6XoAECLDAiZAaZT2tA6w2scnd4c0Njj11cXuJB+ncDU5T7hkSFN53O5+nzXqbLMcMkzSybI\/0VzWnkQjUJH7lc02Dc4eg5l249w68fpPGqA2kqfZ4B4Ge8fkJyDfkcdxcX7oQzuBRLPTPv4Vp9qfWIHY28yTRBps7xLlpyhLcZlhy8EyfIQh5gv5RBKE3RtZI3Sbb4Er4IY7TelPEoicqhjgB9AJr9IPI+iurHFIkauc02QgLdfz4QSAImv5oNFBQqkWczhJAL+UUjsodE1wF+kiPKa5ha1uMy8eATWtEdwW0gMq2cs0Di6SjlQJA5eXd6faBdBdFLnDqfkrMyrqNgxZlu2V5ySaLR6OZ4lQAVxvI0w750k2J96mMuXI2Us47eFvHnmiAIFHwhNSE7SFOTUw9lDPAGrHFhtgnEMUuAqhf6JFejln\/ye\/mOi5jMNOjs4k7gtVa3pi26Uy9yT5qiNFf0WEgBk1he5X3VTM2aSw8ucQQd6DsDjrWvEb6dcaQVBjj2zO7twuMs2C7NBRdQ+7QInF2ABfv\/srtlKFmaIols655ddwNKeRCnv9qA5tYkRgVamDA9G1eZ3VtzsqdmypzMjtGf6usRdCQYzkYaln2EIZFhrqZKfQH42wkMjuiA412F54TJvbcFS6hRFjSJU7Jw4dlUFlAUD3+s48Y6DtgQIIJCIlZnBND6AT\/yY\/kT+JnV9cHO+T37ukeM+N1G6Ww0gCbZr0UylJRDqlkBtpK4wT8dL4KQL74+Wzl\/zNC8Nr2mfhU4mCWOLYxlxQ3aKDX6XGQtQZBylifCGkkH\/F\/eYnKy6EktjudlN6ethDl6lthNKKioGcPTvdqbq\/o3HHN+SVUu5fqhSXxOALKg6YBXvmF1LrKo6KSP59yr1ixS\/p9jbErGQBoCylW\/uNA36uRVG1uX6KI2cq9PMirVpIoMlJAAJ3KlcYrMxcQG5r2ElLL5nUvJLAsifpVVRC8j42efW0tfd7KrMgaapbL9fP3iOvmkYWjnfvfKuWGjCs1VOsHhiY+ESPYKmA1vSk6eOPMo1wU2wWY12Xl40ixvL+dt\/4Az7rmsUT1nixe41XjdBbCE7H+nYGbGC4\/ViA2TvdDRjxyq0ZBCX7K4A6Fb+\/pc4RwDeP7UqZ56w0ie1kueJTVafJQH30NA2d7Qjs329ugEiv\/p6vDySJfexA9q4x9OUPey7MS64SsKQTO7koEJvuge4hHjkM89i59pXT\/NQGpdVjJxS562shbNP8KK+pvJ4UPg4uVXl9evNrHRHu6oV+p6Osw5ePbtF8pQDRyswN2\/HTIuPmiD57FDDq42xZTSsw3Mmg9xxZgVtkSR2KGKr1kN9XYanw+MjNY1Zfc+tKtlaKyJu8\/pvrMsRhdsux9MjpzQGvqOhdQDoG\/59WHZ0DKI5RgTUoFkvRf5CvAkzEnaOPFB6GbwFJedXVRg+M78sJv8MhMGj61mgiVGEPXEsAfjqTSpxULin4BL\/ogwUrX8q5Z9AzkFcprPvRq+b\/h4oA4tYqW40rlqhVwt9tHD+rIhzeWFbyngxNIZeGSb+eacCCebrLMJn8tGs8kR+4k0No830uEIE5+P1MbwvKKhLsrdmtGs0FLArFRCyUy2vmJmM1tqjLd9MwvZph9jMQygdKbXmFvNau\/ii6ufeJSavm7vFAhSzhZckTJmAEInwfMPX4FA8f2uubsI0C+B5vZIhfrshvJ0ohWSijKZIi6zN26DSBYfM8NLxgWmskrVwGC2ze0z9UFC32W77LDxLyhaOhRQDiAViHiO0cFE\/2GiXE\/QEyhpX5B0xdHDEBNez7fCOue3YghjWeqscJAWa\/HBXmP\/89JYF8VJgvq7bwymH0FUTMiFgAKPZ1U0UgViSfcjgWkSEDeYaG\/L+2KqCMd1sCy3Q9RL3lfngnzgDiZXcgYLQWi246uEbdPtx2wWYRTRvkPbCMtAGrZe9OhWLHw+f+0iTB3fBPkzl\/5yPZ+Y733HvA\/E\/UakmjHztdraJa5F\/AQ7Rxv0mL6GxY9orzvodQPBX6VHQeAX4KmJw\/ZpLOeas\/TBYv9pPtZkBxrhjWGOWG1N618K7djRsHiYO3O1MyZHjdvGRSHZTBnFmD\/g\/3trRChzl+0DRPaSUghKpoOcLr7jiVVG3QEh6LJhj6NaHaBguR1difFB4AZ7g9FrumjVUth4rELk3y4fvkntKp5gxhCwsF3lpJNRJSC92Y4zTh2hJKcHLVbpD9B3NYY4DxJ7dJC6znIN7\/mkKywoevK+K7YEstxRkwgh+02ip1gIS3X42Z2BEnwSmI+l9mBXRh3EVQPAuPkoGrbSL+wHCxXi2qi6ntpCDDGDpxwZ6UJ\/uS5CMJi3\/RAd4u+yfhIrWN7eR+OUd\/gt+1Jvb9fOqeL+IxpryNvFQXIDlXaAEvZqL6hXVwY\/eKUoj5Z4qOsVX52gkoXaHGBXVO7WxyQT2JUjsUZnh5W4pxgwsgh\/Hctso3tjnFUnoD4Cv+HAJH+r381sozeBVzDkjM2S1OPK4T2sGmCxzDAJxlkPWt\/G1GF\/tn5VGkol5S03tCpy9l8yK2y7ASY03+Yc0bue+RvDsoqsK4YHgzqYb\/3hM2wHHLWo1ir2Paj7aIcXL29msBeTMwulAkIqrUu+XaJokpmnqo4KPyznotqgGnXcwsTQJQPS61Bvqb+Qf7\/ag8x9YlISo+cnn8MvcVRfzIcBxQzZ509wA5SKOWLpVoWh1Zfh0d0xSCw3D9h+IF9fPFGZa4G2rKrgqXYaypPXiy+apOVjwxHd113fl0RYUCBGlu74g9OF+g1IC7I0ofantoA95FoA3ZS9PsbIAMPk49mhyrLB4C+hWk85zavoirzkav+Fg7Uis84bu5iizcx4HFrBoznJ7LUeeicee7KVwRVJW\/eozEvgD3BxcIFAL\/IokY+xBDJAVtKAylkpxMm6XZJogcDpRpk\/koRrPkdrhat\/HmiTbbfTWjCDQnazWOeO6m+CLOPepvcjDZloGy98ag6iZ2McuIdLPtEK9xbDeoGRSt1FMPjp8NBArJDBcj5pS\/gVjnfDAhXKRRaVpJkIyM3wNInbYcFZevF5tGYScg7GKcrJcARrKLcbMrCpbNypSNFNmViThz35+bAZLogKAwT43thgdg3jxPHmepXQ1BLs8RcLlLrqlWnF5YYUVVvuR41vZJqhKApVRkD\/CSnsi3pfNTAtB7T\/FTmXHSgAClQkeryyBL1r2c0WoE3ko94qrb6a15hKzTUYObiyONWZDsWC2m+VryFPFAxxmma5qC1YiMuz\/f8ZlmL\/KfCKc0ktRMpjRJF1WF7nbJERKUNBJUIJkO3nX4UsDbPra\/3FerqbanI6CdcjH3BCds3EJgoTzWsiwWCEMh1RvceqggyO4Aul1Rf\/EmZgfB2cvU7zwmrAWnY5v9AHztfQvStcEoJRqylNzYJ3zsYwLBeszOX1d838QX5A\/MCtEfI788fDoC+dl5Ch385GlBkrSWwgvuFezepvNubU\/cFwL7tyuTHsH\/q\/lTqaXyWDqKY4mxaEbH0gvPNzWHtlvkxfvdeonXbIjcuuJu+FkADLOkeuH2HHh4gM+8qPbnb8Pp3fmTrIkEqUJTZ6LE1qnz0V6twxI\/O0jBB6wRLshTu2QMofQHfIKYdK2Ctab\/\/VE++5bHjw+Jw9VbzrgFlzxiPgJiYwoR6bDanRTK+xGU6nvB1x1z4eNDZudRs1KMr2f1yhglr\/wvuI2HqxJRAIYqHISPI2r+F3\/HK0AjFvx4zIjGb0cwXaAdaBDKRRRKcLoz\/0WyTIICTv6eSNbmRC7TBHIbK14NptTpu0OH6K4Cw\/Rz1mMBKDj9yn2mib6aEFZjKYVlKRbWmkV3vNL1XrQefU5TukdZNPX8zb\/0tE+XZ3RfAV6FtVADZqxOkLoiLUIPj8tiWSPhMkudiHa5V5MT4gx1\/Taf60m5lAYsu\/jSQNutZ2DlDYV609u8gCcoz2LsvNMVbvqN6YL5LlUwHGEtdNFU5Zza7Ixqjgio1AIQze2vzCWJ8dGzJh4ij9d5jaXW\/gocY8MnxhDKY+tKuUr+oJesw2ALdugEgQcOEzfzWfAlJIVw2FjYjlJ7GsvmJqYmFl+MsFg2b\/ON6NW\/uzn7sggc1MjszMfgCi0814FY8IhlXW5kv4Jx+DjTaJ8KTDUXaxAc+sfRpsrXgcjxO760Q0IA\/xuiRMiyOwROVo71l6Ob2idC2L2NzrzaLPv1dk5WaHDfgFACgTxeFgOhpl4dA088kxWCsa5LEtf7W3rXtDrwOPUpy2WP1XLE\/LOnIQKvqIMmJDQdDJ5j54BmmG8uFv0ibDaVnafjyTVaaFiuQSgsh\/u03DXt4pu6PFay3OBG0qEq\/isl2ms0vDT64KiKnJz9cpgrQgSyjfyntpLUSKnAbq4AL8ydfa5BzEDeTy\/UUtmLT2V6bLEMOq8aXPXPfjxY1xb2nlJUDmKaREmV90S1y2yBP3v\/mEwHSr2hW5EGaduA6eoFIRtt8EpctPOxvjjXwXts6SiGrNTuRlgCdhaezBgJThXv8Ifcc02zYUz1MNrQv3vc6d\/1oKoYnwXjr\/svELZSnx\/GWEXwGo6okCcRWO7k5Z8BdxAQKvot1neqv2PrH73UynA8EQh+lkfbIDOyMNvdojypIoDKZKMxE3RN+wiqy0P81IU4eptZJM6lrF12tG8J22BKwszhnPmLoPwuogu\/3Ej3\/IbKtV581KIZzA1GAffDknu+WXFmpe3buTyVlugH3uoCALe0uviyC9wF9\/jwWGoRY\/+7DN5gga0S0Q+xryP88+trbWMgRxgkPheFzcp7Hd+spB\/RuSWfPzhHBulEZ+aQXfzLOwmbMLELiqLtm9\/m0dgPmWBLou8siebhXa1A1HjKfYDjPM6JP8xJsnEfONJaNONp0oDFsJFNCfFtto4LADqhUj+QlOaNiqP7QmaUKncMgxwyg93dex9wTJAJ6bp4rmKcZ2liKGZ7yIpFuaB6Z8AapNGvoKx9rqENhTu18FjQftDEAove32ZLNnUlns+G4GvcjGKg7KYfjgZCCdthftd0\/xBZdelH9i04MjwVAFyV509uNGsv6DuWOsNoceYAwdlUk0SlaWiq1tn8Em172ArZAZlvvbjAboDFkh3qJ3sQBip9zsEXbjWTvfKA+iaHcNfCJ6SyMTor31CekSP1oZqChD88pxvCXXg62H6odwNF3fkqC2iIOWQWGOuDq8Sj0o4Pg6vmiGpselQbPgmeDLuhWLN7Y06Gu62BecHiAOUfapd4QVWGnWzXR6L00uE1PlkPpGppTCayDa8EeanvrYo7zyzk1\/V1hhzkbHfCLIkIBwUmnmLhDVb6b3NvabJfm2w6HFBAUj1S7jGeQvdwn0Dqr6ZYFQs\/+ykl6FNcmlNCLFQvnSFJ1j05Uw3Z1+5+GjHbe+dFQChlNguCxih+DIh\/S7s8O7OJyfpovcGWk+XH5TywQILKD5aO\/\/FBe+mV4q8SwU3WWgzyKpPO+fsAg+7c\/0RL8lOjMSrhj5FQDI7SDjJ25rjXIMErXoGW+yqx69UyvwsxKttNUwdbxUsWUkVg7FnozwA\/\/zUezvB+J3aW0Hs\/HPOjwsSvLzlBzvw38nfVenp+bihtWbAHmOuKgQdwrx2Ot50ISN6wIhIAnMaOuht\/pFqZ6ymWQkDhIKthmC6b\/S4DITEdIviky0VntwkQgtjIGzTkPOKPmnxhhdtRYyGKl\/JLyDD+h5XWkMuj+7Gb+x4U9HeamQSNlcdTEvB0lThqxFA6MKS5aj+ip3RpVo0ZXBd26JhvR3KRcS1OLIlEbHJjkfVOzzTPX12Yngr\/6rh45LjNiFag1ZovEsZ7CQ9f3fi6hZuO47pBDv8s3y9wlgzPg+3C+2859Ds+oSM9sCH65ypLs1APyXOf8r42j4TN80su\/Zu0p2UTxAK1pD2H5LFh5HsStX4YJTK39cfh8JMItOTVdM2YPCNOD333jfl0WGcenMK5vMMgc9bGvazwHDD\/YwLjlXJ02Z2WR9qu53DnVwnvOKd\/K4xa\/uGM8AdPIyD","iv":"8fe8e4c26b0bb215f705676e73ea2375","s":"97f41ddec645796c"}

Having shared the results of various CSR initiatives since 2012, Richemont has published its first official ESG report. Image credit: Richemont

Having shared the results of various CSR initiatives since 2012, Richemont has published its first official ESG report. Image credit: Richemont  The Scope 3 emission category is often a corporation's most impactful. Image credit: Richemont

The Scope 3 emission category is often a corporation's most impactful. Image credit: Richemont The group is slotting in renewables at greater rates, as energy shortages continue to take effect in Europe. Image credit: Richemont

The group is slotting in renewables at greater rates, as energy shortages continue to take effect in Europe. Image credit: Richemont Ms. Ruchat's appointment marks a first for the company. Image credit: Richemont

Ms. Ruchat's appointment marks a first for the company. Image credit: Richemont