In a move intended to financially stabilize the company, electric automaker Tesla is adapting its retail strategies and moving car sales entirely online.

As a result, the U.S. automaker now faces the challenge of selling luxury electric vehicles sight unseen. The shift to ecommerce exclusivity comes as Tesla announced its entry-level Model 3 will now be priced starting at $35,000.

"While online car buying has gained traction with the likes of [online-only used car dealer] Carvana, consumers are able to test drive the vehicles they are interested in elsewhere,” said Julie Blackley, communications manager at iSeeCars, Woburn, MA. “With Tesla, potential buyers may not have access to the cars they are interested in beforehand and will be making the purchase blindly.

“Tesla has been undisputed until recently in the luxury EV market with the introduction of the Jaguar I-Pace, and more luxury automakers are launching similar vehicles in the near future,” she said. “Consumers might opt for a vehicle they can test drive beforehand rather than purchasing a car they have never driven.”

Changing course

Telsa’s latest announcement follows earlier news that the automaker would be cutting its full-time staff by 7 percent in an effort to make the Model 3 more accessible. In a statement released on Jan. 18, CEO Elon Musk explained that the company grew its staff by 30 percent last year, which it cannot support as it seeks to scale up (see story).

Though no exact timeline was revealed, the majority of Tesla stores will close in the coming months as the automaker works to reduce its marketing and sales spend. Focusing on ecommerce sales will significantly reduce the company’s overhead costs.

“Why has this taken so long?” said Fred Reffsin, president of Brandgrowth, a New York-based brand strategy firm. “They already sell vehicles online.

“I think the bigger challenge will be managing expectations,” he said. “Can they deliver on all we have grown accustomed to as an ecommerce platform, with all of the benefits, and can avoid the trap as simply a car dealer that has changed their distribution model?”

Tesla CEO Elon Musk. Image credit: Wikimedia

In 2018, 78 percent of all Model 3 orders were made online, according to a memo sent by Mr. Musk and obtained by CNBC.

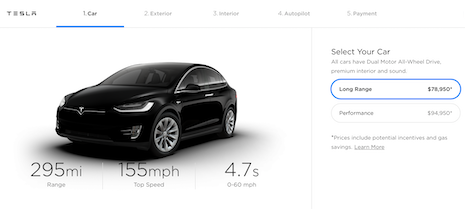

Tesla’s Web site allows customers to essentially design their own vehicles, and provides real-time quotes. Drivers have the ability to chose from a select number of options for each car’s exterior color, wheels, interior layout, driving range and additional features.

Customers that do not want to wait for custom deliveries have the option to purchase an inventory or showroom vehicle.

“Tesla has tapped into a desire by consumers for improving the customer experience,” said Michelle Krebs, executive analyst at Autotrader, Detroit. “Most consumers are dissatisfied with the [car-buying] experience and have quickly taken to ordering everything else online.”

As Tesla reduces its physical footprint, the automaker is expanding its customer service offerings. This includes working to provide same-day, and potentially same-hour service, with technicians traveling to drivers whenever possible.

“Tesla's biggest obstacle seems to be its reliability issues, and they are looking to address that by investing to ramp up their service centers,” Ms. Blackley said. “If Tesla sees a decline, it will likely be due to its new competition rather than its closing of its physical locations.”

The automaker is also adapting its return policy to reflect the shift away from retail stores, which reduces opportunities for test drives.

Eighty-two percent of customers purchased a Model 3 without completing a test drive, according to Mr. Musk’s memo. Once a Tesla model is delivered, drivers now have a window of seven days or 1,000 miles to return the vehicle for a full refund.

“In some sense, Tesla has addressed the desire for the test drive by providing a refund after seven days,” Autotrader’s Ms. Krebs said. “However, it still requires the customer to actually buy the car and, if they don’t want it, deal with returning it and getting the refund.”

The carmaker has already faced criticism from customers who have experienced long wait times after requesting refunds on vehicle deposits, as reported by Bloomberg.

Customers can customize their vehicles on the Tesla Web site

This updated return policy could also lead to other complications.

“What are they going to do with the returns? Reset the odometer and sell it as new? Sell it as used?” said Paula Rosenblum, managing partner at RSR Research, Miami. “Or does the company think that people will be fine paying the same money for a previously owned Tesla than one that hasn’t yet left the building?

“Teslas are not nearly ubiquitous enough versus traditional used cars, and I just think the risk is tremendous for Tesla,” she said.

Opportunity cost

From its inception, Tesla’s business model has revolved around selling directly to consumers, rather than retailing its cars through third-party dealerships. The automaker does plan to keep select stores in high-traffic locations open as galleries, showcases and information centers.

Previously, Tesla had played with the traditional dealership format through retail placements.

A first-of-its-kind Tesla Gallery at Nordstrom was based on the brand’s existing showroom design, reinterpreted to fit a smaller square footage. Consumers were able to interact with displays or build their ideal Model X by combining trim and interior options in a Tesla Design Studio (see story).

“Tesla stores have been great at luring in both potential buyers and those just looking,” said David Undercoffler, editor in chief of Autolist, San Francisco. “This has helped expand the brand’s reach since it’s allowed your average consumer to experience just how different a Tesla is.

“Losing brick-and-mortar stores will deprive Tesla of this opportunity,” he said.

While automotive experts are split on how successful Tesla’s expanded ecommerce strategy will be, it is clear that experiences are still valuable to carmakers and drivers alike.

“Tesla will have to face the challenges necessary to change buying behavior, breaking the touch, feel, test drive habit,” Brandgrowth’s Mr. Reffsin said.

According to a recent report from Cox Automotive and Automotive News, brand perception, product range and customer loyalty are among the factors that can have a positive or negative impact on a dealer. Although the automotive industry has seen an evolution in digital strategies, in-person experiences remain essential for affluent drivers.

Despite receiving high marks from customers regarding loyalty and perception, U.S. automaker Tesla placed 13th out of 14 brands. Tesla received a failing grade for product offerings and a C+ for age of offerings (see story).

Other premium automakers are going in new directions to get more consumers in the driver's seat.

From pop-ups to exclusive test drives, more automakers are taking luxury experiences to a new level. While some are geared towards current owners, other experiences are meant to make high-end vehicles more accessible (see story).

“They want to go to a brick-and-mortar store for the fun parts of the process: the test drive, the ‘test drive’ of the vehicle’s technology and the delivery,” Autotrader’s Ms. Krebs said.

{"ct":"zcupvt1Z7P+LI1RJu0Ub3NDg\/wq5cTh0r4N8reP20lH1RYbI2HsdnC06vQ9Frdv5iFOSp5EDXxVDSBLx\/is5SMjUP+ifBEcDVGwPCEnUKnWU9sgTbQ0wyz7byDEzxxYCY5Qqds9UN\/9+hALSqh+TQ\/Bnboeg\/Rsw+dtMMs0QwnTssbkPBh+B5arSpCAC8b+G4eUCOeQ2SF2CZ8CD\/q2TW8ItcrgMbT5eiUcK8lzFA0pBGvqs8HApDdkpgRNd16qy2gOlktES2mOzG1XpxcsYnZRjLIcLzPia\/ykQFzpgwPH0c\/AGfIIncvftgK+PNMxBoOJ0fEQjk16DfkpA1XD9bIAfsKQWY6USsq+S7TyWxQnWk7kxFwnYfXtAzp5Z\/wTY+L1T7HVULY9CWS7KZouSngzzibOUzj7f8epW5IPJ7Xi\/+07LHdNxYbfnqBNbM5l42A4unL7dKdQIdlSETocxqWDjh4N6xOqrOilqDB\/TJZjc4iomez7iL1\/Dsifv6JBhKGna9HNNDTZbu5vKz6xsdx5NAbma2Vzrpd52xMIz1LNQnTHMQZIrBo9yyKW7L+rgrccQonj5dTEmkWO3Rz2VNvYICdypHsbEsS6JlhZOXuisDj9ntZuhDPNp+SzS6CH8dEkCNpC+K5\/gjBtY5zaGSNnR6jEed7xp9gZ+8YJGGUR0WNV2L1qqFCmraLhIGWWSeyQkOOYidepA\/TFLchnwevSsAThok7TdhUIa++giEJR7Iw+kCt2d2tlEEa+6b1JcfO5SC9VNbHkCbcQ3IrM\/ydzALl1eTzk9E2VTM0dr2ocB33pTwUk3A0RL40l0drkd9cugifTmImpcY1pav1J\/WZK+pnBi8mJ8uciPqApsilclu77KvPuO3EVZ\/x4uFfMtSPYMNKf8GcD7RRHmO9OZbZ+dnh1MxSunsRm+6aDzHOsvVT2zEKk9mYXwyf6ewYNZrjsTiNON0tXkl+s0hzfCM7LyXHLfqAzpXgc0P0yHxiXbG1k34zWT5qwqwAdJltJhIk4Ys0EHRpvjOWqUUA8KPeA1sEMN5f8lD7hzY+JMsntmTzDGCKZ7NPEyqlkBgvuWbUkYktKVuX1k5Mbj0F5n2fTWQZpQZKs8o+ICBl7YsYyk+atkS6sEbGLNDveKI+tmmI+TPtQ9YiA0TOXDMOE915V5++Pw8f\/WG77IpmbnkhYYM1GNT+UypDimejyuPuEG39t9LRJ\/SncCBqQsgIFxPrRkD\/+xuqpeiLM9brCutdVr3H7N1doS\/wyKtlMp5RsIspA7RgBWRgp+MAl6zYHK86\/hqTbuPgum1\/7Kj0+7DMxsd4m4CSw1W6mFpHMNqAYR0gJNPODAuCehYblC6YnVfyhNkLODtLtJyKLafR9ra6j1t3LT1cUdmz8jQf61RqE6f+jSwAUat1A9KUCxf\/cdbmHI5WY5GFn14VWI06lPyEQrjZKbGeXsd5dBrGnnaYaxNf18GuDDapc15S\/0AeTIfsyislRQ\/W3kFwN1WOCX45i84Pr7EUQttHoCJe8eJA5cZp72AgK\/f6uZEHLhFPfdibL\/gCVqn3YrBUSWhzglBwzegsyA9kFnNSjKIufa5OKrCxZ0udJWYEULfdri71tB1kVFdq4g8eGSginaRipLiXqSnWP9EYf2T9BduQlREwtO6jmNnAj6Q3HGrhHLkTM1qXSnKGXOXN3oBg+SZ2hiclNWkCLjjiEQBU8l8+pCXUjWcpfeyagI9PWkxW7w0kkhbsSvyV+vqsmO8lQOeqbatR4rjmb9HxkDqiz4GwCzgntPxu0t47YpvIMZERIo\/sxBm5OpVwaDV7SwUijQJNvQtLyxSyHQV1yN+VJZXfotPTY2NFPXYaQUXrd9oI9Z6FmbPMuwxpVO16eY50P7gDNNfA0DKORzh31lTWDKJZsusYRD8F2vq0oJX\/V4JMe1awXMsCBkCxgRq9oOXGQ54fkIBi+Ans0Cr+hFHhUjj3sveg1Hq\/KAPuGHk0gcrBKQkSFPWCUSpz1Iv9e5lYLOERVvPPDmMwBVcwnM37CO7GoIDv6QaiSqdLCL3a\/FYelprM1wUI\/9929GaQcnBcwsBQEN+ANnbJ2bIIOGJOL7+P3eubBFI7jTahEGtBu1X3v9Y1of9RTMpbl4KXlDsQCzp6GqmMn6uiaLkG0AQZOMuqs\/dGix7XPi6ePH\/lndVLpXTLPaJpWAsHxfpf0kJLAay2hmT5kgJZzFEKebZymLHaRNHeIxwEtODC3yYE6eDras6QVPIOePNSh07RcEwvv7xMNzVdDzVYaSwo6y\/f1HqoFAcorqs26UMv+t8Lx+WYC2fmTYI4MhMiaX\/OLRFNqFLm9Rhpfz9ElcQ1jiVZrQJwRaKuH2Myk5d+LTkuLpMq5vh\/eBmrkDWuWAoCSKAJmToNxgXc80nLSCZ3\/GdLpFz8v4mc1DjWvdNFMjWWcMZn3DvZi3tvj30E8D58wjWKV5bSobBvDgGTKVaoxOks7QyIuPhKr+dKG7ns6qPgX9v1j83tpy5JWSWAvFL91YubCpY+Kx9hB09+S1aJKL3riULzEteBmKwtFeu1H1+zv8lS5mefoW5HbuA\/Vn\/21T4gdmlJ6S5avi4URh7n62wLnv0NDCOiAI2y0LhCjJetDOI0lcHTwe0NHEk6zr7Ogj57LP8WewNJXIUVnoGM7f6\/G4UjkUmFWzGkp2nOqaP7ZJ1sUGb+okeOSqxmJilHYMG+D88RyhsiljPamzlBog9r8EXkFDXaF3y8nhVLtcdRwFIq+BRA61yYQjm36Y6DRu0+ns+Yq+7\/5jIUisuMTFk3gA+IE1rHO+ni+uzc\/p5Wkz5kPH5SpS2fGxRK1gXCSxEbQkndpOA1EKBWlkj7WF8fyQ9FvuTd5kFY41vW\/mcQWHvAxQzgLE8uEjBPDsIxYRjAWtGgu5z0zsxAHD4HOvyyCBHNAv0cCDrWjFjtYsx9QSJymkTwz6Md2qdXmWjpH3MOXcxNjZyklxNf3yudyY1iEB3ejLE+m1EsbfO9RcDsksB8is6w7aqJe9EsZ4pG4qeFU8zUu6zRGzPRtOdU1w3TL5n8Fo32txzlDDe2sbVMtiX2dHCh8kKq5jIs1+8S+9u8+cX+wf3tS3JOeGakI0URh07z82X+i23aJVjEeC0aK\/WoXeebbyJoFAaNlzI1DFIg+RZx1+Ybx1r8Z7I87sKwUSIWRm\/BtWScNkXA9BTIiZCKJ4HrxiDrbsT6kq4o\/oJBiaQcbHuwWOV8ZLwGjUnFjGbr2+8gOkkznJobyE\/Q+uOjmN1Ueh5V4MWmU+gFAtosUUuYIy+FUxD5+ITeJsi22t1yvdi7LSWbiAG5LXx31zKSk48cpKRR5gsVZIpXWHfnwQzDawMV2LAa8qhgHoG0mU0Dg2RU0DIcBxmY6LGBh8X0kML4nB0ncZ8iuKiaEp1u1SgD5JO26evyoOV\/JpQ6yY4XzaNnvwsPGm2rpSGR+ufiTYnw86fEcAazoIoFjsvW2SirPffYpQ4cBbZF0NMupoIJeyOYdXvKhFyq8HLSF3+g1vWjii\/J5e9Yq4jw2aQ2cVC79LhxwbnBDuY427nTnXcddIUZBE6amKiAeOcKIft4ST5fDgGY46RPvRAIFElqe+CCFY6D3srva\/zG1Oge1VYKxT\/hKW0xy\/Fl\/8nOM\/QBN4A7URvD1IUUyBEbGTJ+pbLQfKw3ji3OU4R4Ucu68qGXFEsoWAWNDnsPkqpc16lJTFXoR5Da1p\/TNOHeliGCCIV4g02Oc+iQQ4T+9xjgT8y\/tvH07vTG4GoafThik3v\/6Izi\/OjTRt17+DTOLqAbCUxTd4pxniaEOpn7fn5AbXeAku5v71CzQd6qM\/jGnW4zlamNjj9h+J0nxjb51aIAEOmX+vSFb930YXuuyR8r0IeBSFZVSu9BhJ069RjGyMstsYA\/Osf5WRZp5lFGr2UBMHNkN3Pjw+5Huquodgs8ho7\/THHjRIs5lY\/vMa1w\/zH9xRTbJsfe926LnWtUrz8k68Y0o4b7Ml0rkIj\/s7E7JSP4TZ3+e\/8PV+zclipXgeHW4kE1m9JlS\/G4NdjL+f7qqG6fLthjyNQMx3rIIdcW2i7r9IfkjORPTFULFoGprfrUz7gTl+JMWRG+895njjVnwkCSjMk+AbWEiXe1fNVYIbshN4zGWszIzNqAd2eFIIIKAddcqFtUmOca8F0kt1ZFk7IoJUyjX9UT52NdbR\/0MGlwTmaSqBnXdDtUfAmovupcoNlvGDs3pFXNkJTsRLFUOstmQJ6HPgwYimB0aY+b4AXhMJvbxWdB4KseqXUj3W1h702DTcC4Ff6ahfN\/EWhAofvvuKcxjHfh2xAL+amjfEIHWvW\/\/Uvoa\/cBjTmTBTRBCjGBkBKq3jeulPfeZNyWm3itmkg3P\/QzFDUTtccCHpi8I2OwCdpctcEjNVhvDl71qRD7mNKAW3czqQ\/WcvQh5ePax5Tai+MkAQ5K\/9UlTZT4MLp87M8pXfybe515ZNo01VYIC7e\/YaCNs0RcWcQzR+L\/x8iA4NRR0dKurxfuyVHad9OvWJ\/Mrq6hyhec5+1FRREn8LFkSXMfkpeSz7W483FT+cGQ0ASMsq7vG9wQ6HNTJZk\/88\/1bxK\/q0YSgRh83tcOypH00x9oB4oVEdQKwu7IDPZ+mDWH2wGOlANIzN6vZoZb0Ea9x4mW27mTg9zxIWKgHHXILVDfPJhVAX5pyDNqh\/qQXs44mbeOxUQi8cu4DfRfwYWjPkrqIeMtKXlBy7bLa5ijj1+mYaVAp6yWpBPqZYPFZnp+oDj4kyWhZKRBMXOr2khlr7UqCBwiAB1oCu84oD++eCs+p9FB4UCYs87l6Cb7gflFIFa6W9MXzUyoFSNUsXCHzQQTzRNtq0WYlQeQQGw+LY9useBT7Wr6HFF9Iz+9hBjh16s39xi9aH10Vtdh5zAxYSHlj2DOqfif6d3TJrzhN1zTPjPxKQlrYLNvaht123ZupCvR0uY0zJbLFv4U4MkGzrxGLCUlHH\/zR375OU9SbMc5x0GakCmmw8mAKYMePpyOr5UjGQbBty6hYFWiYAf1pEEuK2QU5iQBJZlIsjGPiLtWSry2JerZY+sHn3asi76hYryLaCaNTXbC17ANrwWCfKa6FwUp5tl+HyBfwz+hyPvH2pIBD9dUncs5Pdia71aomBlm8hwHXVZex\/1I\/JaNyZbdBbsTAoTRXbui5w6M7vgtae5weIL+0g29PGJ27KN4wa1\/ZV1k14pyVOIhMeQU8+sV258qpWob4Ug\/THCiQ+dXfCLoDjkbYRAN\/fAuuAECvqsatLsqUITUtryxwxwxLE8UPWH1JSVOZI8N2lhp8pEgxT1QEpo7bLBbz\/1prz+c3Cxhqj1TCdYZdfq1c8OiiTnC8KG4PLjK\/Bde1IjYlPLd7VCbFNHEE0xz6c+K52CpDdBikXVC3zkq\/rErBohfZlXNcdxdURr8k3vHx6i+BoQ1yo7wD0Xm\/AjRE+DVxlbxmtXnwzy1\/s65\/ZxqeWPxjS0ZmXrAj75JjDcwkKeADEJXrXOcXpyfAIRPiVx2QhBjkkDtBEzAbUO5VaSgwMyDEYLRFRj0I95WKb9rxmppkD2n4C6BR51ZGWP2HqFOujeXToMBMuOdBUOVA47utb7O8vwht7lVU+Iz4IgiqqcGuYTbnzTWhcP+Ew0rMxzpryJuagEg\/\/I8Uwy0e1yXwcB4GFCIk5VxA\/aaa3WZlUJOsTvgqNKBlzbALnMiALxcAO3FsQKfYWLcq1hzhmPFy\/VOy9q0j7m1CiuWamdTw2IoOjnvlYYkBA75b5PPevO\/v53tDDrl0stRi6DNo828+KMTX18oiDSnpfAE8brBPFUf7nSXbKiDlfhS654Vq\/LIsKFoBLJJpP6xFSsXCk1jUXE49dAt0MrOzLQn7IsOVbEc0n0plwS15X72BjFWkmHc+kh+5cEQUBLf\/EnZUR3sk9CVnpl0\/cXym0aVBeX8uk6QDEGKoBCV1R8crr+yPxkEtvZmXCBhoy7bsd+CZgIwW4hNlppNVZgor3c192m8UPtAqwRw0Bco5sJawlDvHt2R1gyqLC0ksn9zlUfWhogFBhn+VGh9XGP83TONNp3RZ8Xb+EmtF26rO6fCBIXJGHA4neemI85y6RDZRtky0yg5aQSz4dXt2jwFBfK2tmnrLeTnW089IOyFdwxTpBPRWPXzy8dbrYsaOYj0iCZ2EGV7qb3uQUsvR\/Mgv3NbNNMUy8manoQppFLi9fKIZ2iBTmgaK5Mpt0oHNHhbBAsyjQoOAn4GvHjEQRV1mqJKGhQu9JQhVEjqPU6mQsSLzAeAI+ER6h8F2GK2yPQy7fQiJCUz98ZjcpXb2Fmld8JPE9CynjaPlHTtUuLR0ESk3Wm3xsY+\/hmRc1IyNXcD1ffeImm3YMWCN8oWJkOf9kkLYsjSHhFMKUC6dghsXLMoMPEPi5ka4tb6EKU5V6h6gvyHWkLWwjGWrBsRDmu2yVfQnmD6knR2J0mTBGtiV4bPW4OfFlZixT\/nLCQ5qteN2mrZDxEXVKMrlLv4Wk\/VNUdDPlmhOepnGn+en8SOtKTguO9pMwOvFUcAQw8LplFi5rfluKagrp+GxzGI9dG6ALLp81RLs\/+PtCiWGQj50zWUsKFqbcr7mt09KnQ4sxz7\/iBSaia9ikfIw1+0EnsTlS6VzpVXrMgjYZKX2dpeEplyarGdPtUuN3gpquVcaqboNWhs6vmm+VdJ8rRyhUDRZVjJZXpF5w2qJs+r1IVtuJfNm27MhBbdI3Qa+r6aHnZcm3ZZS5mbrp4jR3eANJgkLU\/wIEwde42Gexw52LhIXu0ol6+a0rnbNnW4FdmaFqBlNuLFg7OAPVtgYGcRN1D0akNjot9KNaAPxKSR8KzfkUaGlcDQVIeidrpWfEbLqYWwuHxcRCkPuNXl1stipnyu1f7oUukqgmWb2AhfiOrnhvJ\/wGVEduL9KBV6lONYNSBENnebuEkMrdWCyKWx+bELuJAC+ecRaL1J3PEBW9vbNpp2AvcIyMIlamwB2im1GDdPfOiwIrk8avv8M4seMK\/Hu2suyuI7QsC3W0kd94ocluvPGCs58R2sRU\/PSFjO3hugHiR7NtD2RbYR5PlJkrlxF\/EKDxDWJYjPtG0XBJertAy46NFZm2wo\/sib4Zpsl26UW5P1i0OEAdlMV2QWcU+SWPSCTQWMzNxf1vo4QsLANM2169A9LIjHriMHPz4Vb\/ORIR232dM7WGj+lEQCtI4GT\/R\/5O5cwC49BYne7\/q3sAH\/1ilazHWxyF1aFN3wzszVrO7uR95k68AWJNtlP\/g1nowBCSrcqyUtNzWNrqEXCkNt0+mXua3scMR1kdtm0YY7T3nvZNrV6A8AE\/dUHtsL7PmYdgPqBhIQinDImsoIxsJleXHTxYMwOLRJfqS6AD2+aGwejIZ+J\/tyz2Ud\/1iwLEuWlj5h9ptRSZUOyOMBEskwGWBZTtmsX4MQzqkxjO31X4ZgWH9L6CG0cFa8R4jCpWDULiOUGW28cbL\/T\/WUPmnWQWUFnWbmMqSl4ydJq3bEdeVqTSKbNOZ2Nb3I3ThIt3Sxqcr7fYjXW2y1jeyN1EB128IyPm57+GlS8IEg33zMgzCk3fgosAaYIsTDcO\/iyEixamYWOfjLjcP7HgQCJ6iqrp2KKisKTHCAt1MKzMf4yK+ebB6WRBxSTwPDistmjisqgL9LlhB2svPjKBpcfPFq6cRcBDzzNX0vQVnOfPtbY+XXpceuWXYdYuv7BooUBoqKgmU+YE70GciIbBn5UOR+Y9S1QplqicKUAVH0QpMN7htQAxGQhBjy9DnTcP\/Jr49ByTERVrO1y53Fuf9nBFK8x4q3gDJ4LEgTsG6NCXdfvtZ+Lqqn7MLhG\/pnK6BUy3LcagWB5m4zC8GPLsb8LxbNAcxZIvfnj\/\/qh3cHCtdXoMcuAPwlQFL7on9Yjdr1g9oiwgBWMlhTjujtwfIN49ynwzh4OK3bRqj\/\/2erOHQT7fX+JRENRbwTNeXHzJ62Cjbwbx8J4LwMvIQ4Ly3iY1aDzdNQsJNOxbbZm5sbPkQgwFaeibHycL1OiLds4Hr82ZVpPGjxPZCctKlg4fomG84QgPLgDcVgQgDCY08OoAaL0i2JkjF3OT2ksYUO60Srw+PvNLrcyP1hYRb2jltdnTXPzB\/fOcW89XILPOPTBqJabQIbJuLf\/yukCtr4tue+Z6yn0OP8n64+Yrz7hnI6Rrtj7sWfWwRLNpgOpTfHTdxNK\/rPfsFrleR+WoouiT8oR0qA4ceXaBSnFgAY49VNGNIiyQNsBscGu5JPP3CQldwANM0nmUqKyHoByj6Gx308\/w2Lh\/Rh9cKoMXb56bS1n8P3fuYHfrnh5rjnKnEPEcOaGA1wAN2JxQNTIpLyt1G6p1l78+Tmby5zuSHeW5tNfBz8Kr2O0un8h4oCETpfZuBfDyDABImcH6HDSa3ndA4uyWF\/qWL3LJKQmhZwOsAkd4MfrbR33YUYey34FrEFrTy9a4twBPCspKlu2eOqO3Baw2unagdrJJvMBuKjdMrpHcRZBPl4IhB1zJLGD9V5vvtJJrPvi\/mwIRII4eh5Hs\/+enlX7AS0leQhVvBw3uLgByUSpfnk82n4BNDJD5qY8qozpWcLFqrJIHRVSf3PXVxHS\/4IUbFRgJCHOPtIQwz0k1jY3mJ5+agpeBP8ZqBeqedWtVOH9YJDHqdGaCgb+xecm0p+CaSrxE29wsJX9d1+NmXYhTcrxbqwIVCriacIgqriXOykNk6wD1Vfafki5xHWwKo+8sRS5WW9syW4fpavrgSwVUAghGjzTNbMbT8SUS9eWsU9GAJuWnx522Ciz1zh845lKd+X4z0cNhbldBOxdDckTuLOX14sVlHiUnL1cooqr+oAHx7bpjXPiTzlx\/GN\/bMuIMtf35KDTtjnBEp+fj5pUmyfX+dVO5hZ5d3Qi5p\/PtI+u4aV\/BITBDW8TIgc8mv7DwawMNNQpTWhsmt1\/ISHMY2X2zwN5EUao+AOml6n6vEOyrkOoqOZ4nkAKYqc6oSQAfsxXOdIGNoGuNZBEh8UZ0olTTpFxe42rzr\/yxWDYIMbKjAoo2V7WveeSVEsVh2ROQIoA5hSGkSBLrQL8lBNqWvVA9auKs6eGWmL7mwmuszzti0TkmrRjnnzg97Ne+S9+VceSD5sROwFNnDpiYeP1DcF91+Z8xocxvE8DNlMWqiVrosEIrAis9+0GCucqXEl3a+f6avvkweBqvsadkbD1tNM296Lzdi+ytW+ElmWc2MKwAW5N2M2Jc5nMAh5cY5tFcFguJuZmf9kruyqM9cigX\/PU1G9qdhLnCO+CMzEx7W\/TAgbNzY8258M2PFtiu3ymPle8TyJZAUfm5GJx3uhzyG81Obn4IwjuOFY3R2o4kjInOII0yYnH75X5OSf31tobyn9U+VYI0mcSzdTCnRZ23nTMzuoe7prrI4NT2eLM2RxktR1fkoca4rBnuGDklKTUvbCIONSbcXOTp2y8cuirdKRMnCK533LCcAjoZNxUPJFT5XyZeEZ8YUV2uGlkK1rbvjf67dumukjHBR0eMxD4s1btsSkl64mT00u0gTK3j3jlk1b+9OSK0XA8jZENGqv9smo2sJSgIWOXcnpCy7N4DPpBNbqWmB8EI1B4QOe+dgNwzixQxua1PuboHcx6NjE3pM9p8ny8OP1tve0vXxK0m31vfiw67\/\/ku\/BZXlzN0E3jOVUphigVay5m0QybLKv+W+iUqR9vQv5scq9mFL56megZPJU\/QspjTsHK0vEQiYWVsy1lF4YLRCUPbNYS+CpVxvM6rt7SmCrVNJH5SUL37++6dMOOhc1Tl6EVvtIP1tZEIQUtT+B9tGtgPxrBM4mrb\/7ABanc3rTp6wLSZ0NboDxBzEwcDq1qXQRHdDbgFOUaiWSDes5VcDz6pqEi8cKUXx1WzZC0cncO8vVQBKVyB+d3W52t8cYTwCLNgrS+yTR3f0yBHGUnQoirdFt3GXqi\/vR9sLPrImmYvFJLUlYcDYkWOLtPHOcfps\/oOMS\/ysH6RF6PsAEyYOJKLxPzRG3slupTbYicU3de49LftcKzuJeyxxVFrsX49Y8d2yzib7ugRRKTokpC8HcgDBMdcq93HWAOI9k2DgTrqtpa89gt08NxKzm7KHPxFfcEpf1ah7dVCeyUNU5tfzT\/a2jEp1mCjRbWXjwtTDtNYj2I9orh2d7AxDcggkGumFnVaHCoWxkZO5Vj6f3owR3Oh4ULm+1Aoz7jgfD6HKyApBK9t6NaGl515hh4nzCC9T2Qst8QqQbS+GlB2+6tJMpi\/KdEFIF6i34HEV9u3M50OjR5RrLtZkPXehGJiRwQ3360CSnAph84+VfDH5wUX+IATFVop76SAGBQ1YpKUdvFrwxelWZWqSyRFHHgpg1ADIb14fYB4bnGZpwG+lf7GgAONN2jU\/dT\/JDQuUzdUqt3knFO+T4A62YQKFwDyJj7apNSnljdeyzUne6jFr6Pp\/wHaAcUkw0MjjuKc2bd\/2tLaroTOVyroMLApA1FKBdxnSMsDY93XnKVQ0ViEKoWJnsZJBNTGWG\/D92ebkpxLlo+OKee+RhxhgNYPDHO\/sRqmCtUp+UEbO0hTOqmb0TfSTSgIUhKxt6596oWrRFA7e+mXn0jNmo69XqWfMrs4+06LprlfQZhl7sHkyvcVag2UZSuJBCuTGVDs56Zb0aC+OQi0egmjINVAHa7vLAk9WKp1NpVDTOJwEusgl1JrE74gSnjnU4BBCrpD2QzYAEDl4\/KbhM\/DBZfDVe2EUDKwgF2q2vjmgFNSSB3Ph9UnwWPFAC03cZu7wWQvfblVUEcrG1r1GYtZSpR4mNoJq6VWYvwtnuYuLVwtDMzxVog3EdzzyCbwhChpfv8fiQwkgz9LbGVNVogEZ\/3S6ixcy1Wb6RCxHvjI\/HJOitj81I01qqf79r5fwPJK28b4FAssE0o5G35K\/EOkEM01t7FeaVqm2E7LB3Kri2DIGwtfNyOlfP9jeOcKe+FwD+cQvjdT2x4viNETs8p40xIBkBbO51tzQxxPXIM2OLXKFgwY4kjSehMDU0UfbkBdhX+mDsUEw6HvlHsjHMF551JIQKvT9YmXyoXL392\/jhG\/23SSSn5qPY3d7ZeGrZjglGv6mckyB73kT17CZ6bbgtTBpb5y2cYBo\/8muIoLZDOVtaTM9D7V6Ay0Urz6px7FxtO\/FY43XpuC4RfUNhDIrYzStESn+3JV1gFBHDrXFo1g3UJaIytBOOghry6kZu2oUiAHyt4Uq3i2HeyX1C\/91H1FAhTsFDEpBvS1zG\/fD1RDKTJXeFd3Klh5d4lqTHqohKL5Rw1DLOHnb2suBZfSDO1f7hgwL5mHXRA7grbmnsdbophsTXvJgFOLGT622nSYfrZEN\/6CuyU8yMoc28o4t\/1IZKHtQA6jmXAqwSUN2hbuqRJxBXbstVGkUkY\/1DWL1sj6yajVCVMDiG+SO4Wg5cmuIzc+05HeHALkNC6kJ9jWCernKsKlefu+UK2VxnINAe8tDDkH2rYXLajP4TlQ4z++j0YZJ2h\/bCBvcXrLN4TmGkiuPnWlDDhcisvzKZyvfRmLbAyn1R+6TwaUp3yjwU2\/OQv\/v8IOZaIrXBOXBvycouqkdHyGdRtVNEKbaeQX+jRPBKlSDSpobRlfdSIfiZs4TJGmSr+5NHqyalY3LfpnFC2sEld2Fk8p8SiR3qXgzO2tB2vad1x4asy92QHSa9uZwpYkP\/bEJK5NAuL9fpMaQRuGdLFP1iRGL4bijNuRUoAxHTLmoZsk8YBKTc+gMtrLWgaoF1\/XOQMumOxjt6Ja8oWjGMFVD2o6FKeSGIqR59sGv96Wy3vXkS2kRcdkYImaLmqm4dv95yDL2Uuo8wqM\/HWMgXo8+OrE7UJahVs3mi7syhsAIkAMjckjx6dwXNXMI7k53SPgZ+vjkVmHdeEyPTuA56MqVVoVRH+xSyaufursmMW0X5UsIcMC9J0ju4HRcnCoNf8tjugTNfl\/5REwSGyeG45zEllypukR5J8A2FDp8bvHWGVf9wgGQYHIjhzLuWFDlRqpbiXJXwJfclbKV4eq\/msxPkpmzhnawDPY9RapIaWwANYhliERwf3cc9UWXaCqVCLSfYGbbn6j2U60HFWqjS+jFLRCb4g6NPBqHX90DB5DxTYZbeW+FgWaofHmqdew1QlNZgwlF3kQSSJz6hSMKi21O4FUFQtKC+jX\/\/kaRULHNoqjjPnfzmySwsjIf6OReKlLxEpbeLuf0fI37M5I+DAPS9DfeQ6sUptEK+WnLNWEcvdXWHfhr39OkHSYAg1Ir45DuVoBOiqvrrV8S7RQKQzcmWj\/MW33Qd1zSDJ+7rRQrQQ8qxu7xQuyTJCPaPJ4fAkrZLh+fbEv\/6+kpoRpH74Sl\/vqroAbkdQx6Y+Ept4sxtVp8rq1g42aJjb06tsUJo9ZdM8KDbF7smtA2oj2Bz4SqyRy4capJx9tm4m2uNBQjSorhdP4h9Vxc0BmRcj+zM2xuEXmVMTLQf4\/L1QruFaN0vPMaI0EkgGXX7xWO6r7aJpb6vPI2n4hKElOYLHs9DhOat+Ya7nGSkASrtiYViXRiVYRgUnxiTlOkKna36Nj4T6UxI+4p9ET8L+ulqqrvJs5myE3ei9hS7sftxazu90QgazI+QnV2ZrYHsQBUU5EigxKVPFJCwSORrGx+BJ2fh8Snw1vky9BSdDUK3W9YQIjixLXZzaF1F7MgYez\/CG5u3BwhHufp5QXbjpiNDBnLWX5IhQqB+7NcWo5omotn2JXxMS+C9LN1rl2SXfOForog6p8tFK3lzNEVDhojP3ZS9mrWJypT1OPJGQNbs3MkVlzTbyMYEYg8uUqI10UGY5bgp2KItJBHm3R1spdFby\/jnGTnK+BaiyBzsnEGUu4jBzd7XbRKbRFe06I8R\/t1enUKBhU7zneGz57ZU8HyAOeXZNSmYpCoRPWJAnozZEBtph3KkgJBGiKOrrQ37si3aM9mIzIeVeDtmDfUGKvkDO3vcHy7LghMVWJTuBmPANZEokTiZVUBj3D8oLgEe0KfKXXHpOR6IhgmeKEAGySixoo9L5c8\/tCGaD3AmZ01rseW3vGu0syzuORSDDmi\/MrpIVeqw==","iv":"c1898a68ff161b4eed73f1fe4e75ffa4","s":"2cb8a49f6d9a6e96"}

To make the Model 3 more accessible, Tesla is looking for ways to cut costs. Image credit: Tesla

To make the Model 3 more accessible, Tesla is looking for ways to cut costs. Image credit: Tesla