The world’s private wealth declined in 2022 for the first time in nearly 15 years.

According to the Global Wealth Report 2023 from wealth management firm UBS, the world’s total net private wealth fell by 2.4 percent, or $11.3 trillion last year. This drop. the first since the 2008 financial crisis, was defined by inflationary pressures, currency fluctuations and other factors that the report’s authors do not foresee continuing in the long term.

“Much of the decline in wealth in 2022 was driven by high inflation and the appreciation of the U.S. dollar against many other currencies,” said Anthony Shorrocks, economist, report author and UBS consultant, in a statement.

“If exchange rates were held constant at 2021 rates, then total wealth would have increased by 3.4 percent and wealth per adult by 2.2 percent during 2022,” Mr. Shorrocks said. “This is still the slowest increase of wealth at constant exchange rates since 2008.

“Keeping exchange rates constant but counting the effects of inflation results in a real wealth loss of –2.6 percent in 2022.”

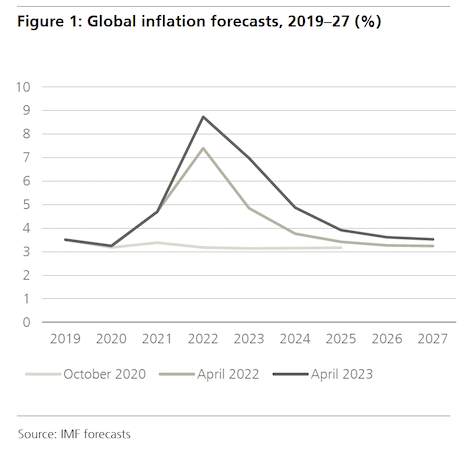

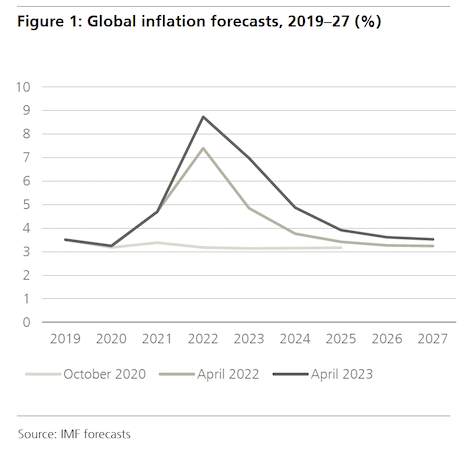

For the release, UBS generated forward projections based on GDP, inflation and exchange rate predictions reported in the IMF’s latest World Economic Outlook database, with estimates based on three categories: financial assets, non-financial assets and household debt. The publication is supplemented with information on share prices and house prices, the firm's experts assuming that share prices and house prices relative to their longer-run trend values will remain at similar levels to those recorded in 2022.

Wealth woes

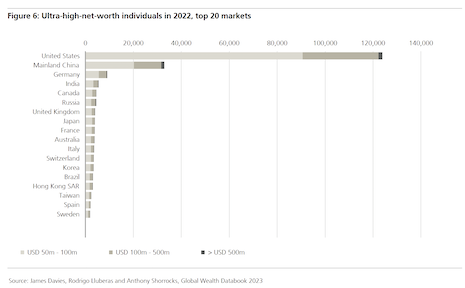

Overall, financial losses in 2022 were most prevalent in wealthier regions including the U.S. and Europe.

Together, these locations lost a combined $10.9 trillion, nearly making up the entirety of the decline. APAC also contributed, losing a further $2.1 trillion, while Canada and Australia rounded out the top five markets of overall fiscal downturn last year.

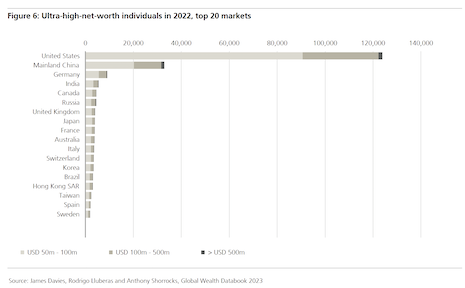

The U.S. represents the majority of the UHNWI population. Image credit: UBS Global

The U.S. represents the majority of the UHNWI population. Image credit: UBS Global

Some places like Latin America, Russia and India were outliers, instead seeing increased wealth, a climb that somewhat makes up for the United States and EU’s shortcomings during the period.

Insights align with other studies published recently, including data intelligence firm Altrata’s finding that the population of UHNWIs fell by more than 5 percent in 2022 (see story). London-based investment migration consultancy Henley & Partners meanwhile discovered that the Global South is the up-and-coming region for centi-millionaires (see story).

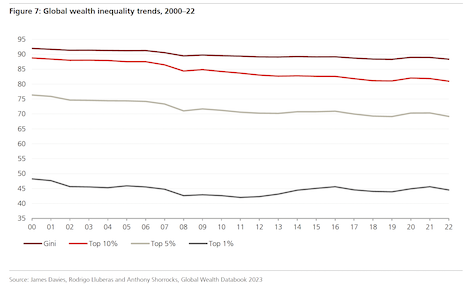

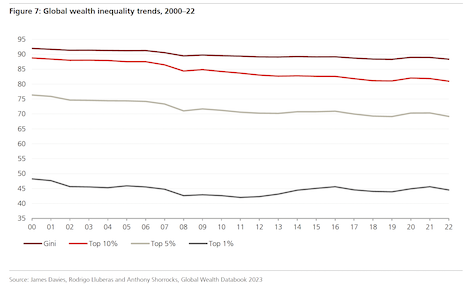

UBS’s findings show that wealth inequality is also shifting.

The top 1 percent of all earners’ total wealth fell by 0.9 percent, with the population holding 44.5 percent of all wealth in 2022. The total number of millionaires also slipped by 3.5 million people during the year, a time when there were 59.4 million people with a net worth of over $1 million.

The top 1 percent of the wealthy population declined in wealth for the first time in 5 years. Image credit: UBS Global

The top 1 percent of the wealthy population declined in wealth for the first time in 5 years. Image credit: UBS Global

This fall in the HNWI population is attributed to inflation and the American dollar’s value compared to other currencies.

Despite these woes, the authors of the report are hopeful for a rebound in the coming years.

Short-term problems

By 2027, the report states that global wealth will rise by 38 percent, reaching $629 trillion in total.

Overall growth is said to be caused by rising net-worths in middle-income countries, or “emerging countries,” likely referring to the Global South. With this, the wealth per adult is predicted to hit $110,270 by 2027.

Inflation is predicted to sharply decline in the coming years. Image credit: UBS Global

Inflation is predicted to sharply decline in the coming years. Image credit: UBS Global

The metric stands in stark contrast to 2022’s $84,718 per adult, down 3.4 percent compared to the previous year.

With wealth forecasts rising, on average, the authors of the report estimated that the number of millionaires will reach 86 million globally in 2027. UHNWIs are predicted to comprise up to 372,000 by that time.

Facing subdued growth rates, players selling personal luxury goods such as LVMH (see story) and Kering (see story) are fighting for the attention of these shoppers attention in the midst of subdued growth (see story).

{"ct":"yTHixCOfaekDkXLyuSqMtrkf+Vu5vVOScfJbZB+j6aDP2HRMrGsQ8hZRWrgYRo3lLY2A9GG7bjL3x7F9H5qc2MdRCPsMa3kPIH10fRJIgy47dxkRdS528UBvFnx81OabqPJGdQd+oX086ZL6aBYIlxs5+5\/T7CtwEsCk9TXR6DxRbRjxOIZ\/qiWPzRwqJE7SgmKDk\/i7lUzwbdgPk2hDHHkczqEoIOujWpFNMAJNByHhXyTbcqav1k4Ze3XkEPUMkW6yHPXm+1EXI01YfvKGdIwiZ5dRAdlGj3\/2dpzyFOBytpFVBUCxa02+bLg3r8jtsMMcS6adtzJsOLTKBluujLgbJQQqjOWR\/fwH8PzI9lDCdrVTQwHDtHv0mkoUPNjRR3\/yD2++K3cljqiBsDwR5GA5rtkHfWdxzpDENezEkdrR2rudTdJMkNv4Z63vXolwWHXuYQOVgqNHOhA9owF04WfpKH0tb+FKDXqgF9l1WP7SzV3WtM6Z0CnPjDJYtAd5G3MjoLMHtcx0m+5qO2Vy4l2SFXbX8FAnWeo0zeIbOo0a5sVg1cgRruwY80HkolI8gmdwfAJkmwNCKvVpORVFFLot+qeE\/8o2XXhc5cuCzDw63cMdK2cDS9EwSh0SFqmp7PYXEttseDUMbRXMKVIb77PijjBDPtvZbK8KinNE64khVaCL0zNQo1+u5sQVMwvR5wNn7XT6HdZM2E8f6rIsly7mBl6F7Avwhps+fNVzILKoqOOdR272DSALdMSsKnjfGa9FSe4PzSQKvjTAmlNrvNCm\/2GsaT6ow0deAkaueBcxLhRn6356LqCpwoss\/29o3LBocdCnuGYV7JWHXBt1ihJzAlG7EM4aa+T0\/yZO30AmTlVU94mTC\/UDGH9sx+KyzTw2o64FY+FaZUrhvKOT11E7EAgrQGZD3rMHw3y4TbSHFNsXTKCPdqJIuvBON1OZrSFrh3AOgAR1\/5zx0DTbu+XXHhQN9XXYNa5qkM6QLCZ6o70F9TYaIa5yy\/do\/rHlGz03IgPSoXTp+ImWqCohLrq3cepyhlvFcW4B4O1Fb7cU4tp7dtqb0+cYypaKzaOqQQilkxO1Qyvt1zh5ylSsy5Yu8wDGEqEHO2oGfSywZTZ\/GWP22OSiqRJ+LRxQ0DMPTUvrPCr6A6EMQM8ZqDYK3BXgepq\/MZQ68PjtnmM4b0ncCmjetYagNzlTzuKZClrNPA0FAWqDBXcV046qtNvrgj3noxvYDagH2iRlkAzjPdYMAAxNRPb8z3QRVs+qh26QFTLsy6Mzd39XOPibY3hjULC\/LCtfJMgW9+TP\/0q0iwfYep+Oi+Upky\/EM2enT\/lsKUcL9aa4yKjlxhIgKbTU+5icuPRDmIBS6hGJZkyMVlUPNvB\/4owP5UVvEK1jwrEDeX\/XlLwx384EPXLrvRban96kSQTeAYhonR\/tFJW5r0nL4Lqulhs5asEgq7ZAXwCNqu4KM+Z9OgBCagwW\/3pD4wH3txxDuFHfGKT8Z4jfCHsiGXIP7e46d72L3ARlNIX2vhJaF6uGLxjaZTp7NvvjbmiCLyJV8K1ZKyw+l2eTvFl748w7S3GMfIjdzj4Lar3qL7m7yGK+wBucdCHF6OChAkg61dGYhc0EyfkM2Wejo9RryuCIYo7bC0HrgMwF73ymL5eXHfMVDr9+WukDJFpsZQxy+9CVpSTTqg41k5+tv6dIFy5o50Qz3DR\/6+mB5P87D\/fjuEPTtTpX4qZ77YR1pbRIxY2RpgfVY+t\/r5hcaWNsMr6+QpNRM4B9K3HZntjS31skzYxrVC7+yqCuP6iRx6jEnhFGDC0Z\/dAyYadZBqn1jJF5MeDf7aNNmPuxvV2S\/41KGNn42q+M2IHuBqyoSAG+\/ztgj7d4y5rRCZo+bZjHm0LK8o+rBw4c\/RoloSUUS1cuMLC8PHdLeY4pxuGmEo6AcexB9p5t6TflW1fElrfTVzoGtKA5hvRmP66lzR1WliZsiVi+ZsCwC87BmYtjSrOf5ArdEH0Hlj2Uwqt1wQhVVfNC5XYb7QSoH+aYGPyULkY4n90qWFmopb+gQqer++22r\/r5BagSIvMF\/\/vNAcmtXnSvTJNRRYIhNDKpaZaClcrrvaY8KQQI72HmQycCcbh0NK8oKHydFKqkKnLglF9g6pDd5js7dDNnxvEvOAShgi0Zuzubv4DOxYD4ZST5fo2FFzeXyxNhH0\/oSAvYJrM7iPvENKGCXUmF096AlvQbWGh8N+g0BjiL3TA7GBWNcJqxm9DSxFSXZ4zHJ3Tm7hEIQhMdJ5Zs8nKU4+y3fRmZxa4As5qUmy0WSClx+VWs1\/WIz+Bf1S7ufVmG+JzmNuccJAITw\/WyMjupbk9q4c3nR0FlsO4gYG8lGsblElRknr6wkjeM0qB+g0s6BiX2lTDPeY6ay4k2hZzoYuUUBdX40lHhFzl6+6AucDzaNtB2c23Egy0h9hexn60Db2Y9TN8uTs33Qc3rZPA8RnT\/Uf57jBoldtjg+MD8\/aE0CMp69fPSijelKyRgBbJIG6BRA8CsqrkRMloJ\/EskEV5BR1wf\/M3\/LeavrkWNZE0ZQWBaywJlYBLRWvlR10y9\/RDh2H8+3XgJQdGfh1l6ODfLCRuTkksF\/\/iYs71ifNsA4bu8ly7kX5ODUfzgk3Td8FCiVECgPA9+yXgbfotXyhWU3ftISRgMHuEzZ1uf\/WQ9bKotpzycVUSF20QDgjlDkTaC6pdSea\/3n1pJ5+vlcRpZhlu\/+vQ0HMaDuGUQeNTibk\/GHs+qpfYz5VRaEY0gCCStMx\/aE8KgFk18wCC2\/GNJAzJLZZ4ADY80mswZw2toKB0vFlSeYD5ZvgKRVeVQwQRvSRIf16uzDz3D0VpbdCkiQIg9LTXGCnscdZWvjczQwZC3VwTfVTkcboKQlpELNxQ8RsgzVCe1heDA6dQqlg1FsM1NaJ7+AwG8Nb1xK1nJrPnFH+XSZuPWRC8qc6NAT\/jI+XcyTnlVgOvUOuWOsxJb1vjslh1uLmHvUR\/WMe6vHIY6Oz6cEZLPq\/BUu+XqDtdWg1B2onZB0xQzM3WNdko8y6AP1YnJu5s9elPqDG+wCf9ZFviGHjrULBHWv0Tf9jS23lsdB0nkiF8dMEoKCwDLmneacRfeIMdcB93xtLV1Vgyc\/gidxV+yNoB0ND6e1U0OJxmQeTRNpS3bjgmVYD\/DwbmF1h1RN5Tu\/769g2YZc43RmI\/l3XIenvsZppoLX3AIVjSHIDDXEbDYEcxvRpZkox7JE0\/16ypQq+W\/iYj+o2GL8gtnti2POJYtI5OywGO8FAFmSh2F72Zx2RTjdAzNvOF0cE0Rljuml+Uq7R8XCYX6PfaG8RWGKcbibI+MR9TwDqKwTMGopOTdzFLzTpEHuqdeLsBW4u8UFaBgPL7hZjFDCLaxirN7cHWlG8I1Oh9fTFjwqA9Tib3uqt5p9NMZSRCIQuxEP0k0jDmw2X7bLymf0iaN++mSEGeLlOGqrjoaraYZv\/etbctHeVAQPPKs8m5TlpMg2USb3wEAHQz+zW3AOGvHlB4Eh9l1Z1k8lmtGy2nncSpK1TqTPeNifkMk6oKXZKLNCXqSqwMcR0UkQHwyLrjUvgbWpAJ1qtNTZtM93\/ilNt1iSWgKYzQREmPS000gof4167s8geBiz93Tr85xqYwqc9yoeMz7NT4n3IP90JF+C1c\/jQzIgv7PAOlRw0nm4pL9l8sR\/eAcQt+4kEHPnOGKTESOpHL9583jyNDC05oQHXlIE1Hi3mQcCw5rSwqD1oeq1ZuhT\/Bx2NgMQQZv1a9hwnHsOaVLmo\/vQtKMb3F5a2CDjs+TusZ3oY5HkVFd3ZhBB5OnMqi040s+vqmk+\/PV27y+Mq4khkghfHg8Aoej3JgT\/A2dxwsFDpiVejslYQShPUT\/V6KpewEknvYaa8qdYri96IbGOe1fb687Z\/hJvN2VFyVwePeuM3x4HtPO1zSfggsgfDkjQhMaikFE4Gy0KQirTUXaT7SHJclYqgkfouTUu\/mxrqh4gibleA7\/SGnFIMbkO17J9Ld\/0o1c6UidoNh3tpaPWio97BJjEoZIa6Jxi0NwZDdqe\/cJz\/2VHbFesnTX7NhtF9AmZCmT1HLZuCdLR6W7yMiQCo0tnswinWda3qRuG7ofC3VxYftwGq6rZnE3GaLy+4Uxr2jWqOGrb2SU7WwEthMM2cXLW0Y8L+RX3RAK8MYzvkNDlWo8Bk9e7lgAS7rUW8gVCSdDwpa\/12CznqDbYzP1HIuNSM2bCk7g1M1lm6iFsLKcPYfbq5gipdiPpvC7Tz97GF59tOBPBq524S4PKXroJWhw+jqf2ld0FnbxAEks4mGIo3A9Nb1bQl2lBmcqPc8\/4JvKr5rGlKvyyzndf2cwkswtT7AtdqxxdobBuv5VnIVVSPzVxsUASR0OfR2Tm7R+JO0cjrwqmFQjvpuxmgLjlWbhFLwUTZ67MB11ZU3\/YKVomg2mxwNdaBaULYiMfDBNfZCxP1x7cXbOMEnQjlpxhCErSrqByLF+FxZBAk6PruIUenjuZyxAEmMdPgGTXnGDdQm9QbXuy3FXk4aiCrisOlqYVFDfamDD1v3dUrhJIpRlCIFlOf1kSL3BazyAXq7XmYVKo2kxwSIAu+RRnQ8Le5wsPEn9NS5SlRyfy6sJZO8Z+qzd4wVscHLkNxlGZwGAxEfyCiHctrIkIEkLVS+fjjwIHWcgzeRxsOVTwuEQmkp5C\/hAp7nRqlXF1t8KmkzNu9bajoq3wMtG4ZRpqJxo1+VUnrnJQOBcppqSKxug8aK3SP1s9zEUUQbSJe7vI9+gr8yb3W0AzQ+IFSOhgihtkADaU\/kRf55E432ZPLVgOUHTgdr\/dOm1BjD9zVfwfBgYoD+dF\/rAbdMwKjxnjAvXjVxf8UnLHPEazZBh3mTFlUUa2jdLJM+P+h9wpyLGMrkCTrjo4HdwCD0\/Hh4v9x6\/G80TXqhn9XkX3znR9mxE4q0PyPlWWgsLEae39ik\/+G3gVql+crI\/v0y9J33pKwuNL2Ro\/7Pf2sQZbIXIM7kw6DL4fHjHRkm5PHL1HkMPNkJdVHEm\/w0zuhJ3za0I2eqGdwZqQQ\/i48i9IqMdvS5mHxcy6BIOJIowKPwS5C35ayPTBx65ye430UJiffhI0oCV62+XqWVJd5Bo37FRRfYQZ+O1lge4NW9mvTaAiNUVZqZsHe+NpPQ2bgvTHguMttcS\/66MivufdrXjiQhHZnuWtLStIzasKxahrq8YpNEKqpWcdnJIIXb7W\/y6x56MImNBO+\/gZIX3XuuIxm3k3OfGOAh01ZNP8hmpkAcLg3wA2Pot1qQWxOr2cAle+oxmjQjxQygAVwa8sKc41kVXTT2Iha2KsmldxdgX\/WwzrHr+\/JtaAa+PGjP\/umi3OFTjNO8+Utbo2xyiR1Ti5BbQzdJehrCM6z2LBO6KDH5tMvMMW9X5VDSF9l7hGWNrLdcAG5JvYhgZkhe8DdmxfFAzblti6xvbF0\/eviMKclbnORO4PAtqlRENSCJoeoEWrP2JxnX6m61KuQXUqEVnvcnk4R3cCKf3x43ca8hv934aC0FkAFu7B2lH0iQPTnVRWi70BfTHshmhutTWUN68e\/X37dl1omTWgD1OtZqot7nM74UBH0N0v8soYuyYPVp0gwxM5Vkwxq5q9f9c8iFmD7sqx0VdJNW+s+rngTh8rcImnlA+dbdCpXHJUjM09j1DbjXcqrcKXQ0PBEgNslRGBmBK+8RIGUVQB6VkcHcG4lHEWiOSHHmtLdesRF2xWFR0Qm2jmND6NvKvCAOrGI+ezXaYqnp9LknwPnRaoLd3kDw1GYRVl2O7Dd0MHwYvUhayhyelU6GIDgu1e3+rdv7VmNv3Ui9vJ23cPr+YVdUPSbJ4dGuRX2t1mMbD8HgLyA1wMgG6SUNHtSRJj+o62toBwUnu2O0y7vdTfwEyw8+9wZ5KZNA2Zc2aDhHWNy4x+gw0Dw2MuHoESJn8g16QMo4aET9OSPSqCCKa9ef98W5V5AgZb69yI5vQZf8ixA1WW0dKsAsQva2Qr95UDp9XYl8na5DLyL7kx\/5Ud\/cdm8OfiWmfPoeb\/ivk8Ka1kHo3hlH8+gMYAKsHnYdlgQoPUM+VtIP15N+Uu5YFWVf2eykn3k\/\/ZeDMGZpm5lEX5vr2mzbGqCNOex3kYouIOG0wGzdkaep85em6+YeYdSamuA7DPa7pe481RJuUv2Em3b\/Sk6CizQLwJTtvX\/\/7+mLnW8HlQYhU1atgd5m6ia6JcJLOtJS8zVISWMI6PKTx9gPkZosblBbCLFys+luvkWU8nWrxESj\/GCJrvBAXHcFXOrUIz\/LvTMvahrTbAsBBeDkMclvP5C9QlDqU+mlCccmy\/pPMkYaK7esDJV5kldDol47w1ZEsSguDk0jTI7++EPC9f1bkSZpX9HDQrBOafVfCHzsL6ZJAMYU+3LurTccR0DdsKzGXcNwX2DApEBwOaGZTSznMlIa7JAG7d6tQlWClTuARR\/ZYQ5zV0jThMXXec\/cSEtmMwQtDIQSy\/8RY58RXIihAGS2RjWvQzLksTK8lWbgTVQhE9EtTbQViktTiX51cQDfYIYHML5hFZ2IdVOFgDKBYRF9ymRanSYE\/+2Mwmqdddfj+bu+10W1v8yaQ9NY0H18ibSDSQjv4\/5tyvhrQDLeUMd7Gufqp\/J0EwWXwJGZrwk0oYwSB+JFnqQoNArl5ZLmBhcSRG5VUPH0X+Nzuobn5yBezyD3tQpZfk\/W48JJYUDwGx0Sn073kLFICVaMqN769tXk9E7CawvNowR4Z+ICvVZuWAkChrfWRVlHXj4\/EaPJhMLjywovKNlwpLW0+FBINRdn1Aeh981UADbx+WzNlPX8dVdGUuiSVrrICsiNy99x\/vtcgIF\/OxMbIsLAO1eVI2aQ3QrvrW02iU4iPn0rsjo4+jJf2NgMGwaYPYDYDjKke3wlqGPR\/UHVly2opfVVeKeRj50H+flONBF2qGLhTpeXzLYGlTlOra76upPAor0Uy0+lkKcG4Q8jI+K2n8NExNdsnFoZ38DkNNK\/x8kB7Zn1ApaxMvEY\/l+MSkaB0O3vfNUamCvGcwbHXJpcL5\/jzWFzHIfMW9\/kMX51tEXf4vzJnC2ApExjWHyZp3jgJv8Oa1C97++1mg\/t8H1aNYl94yHnAYC\/tbWfLBdMzfexEtwcu6rJz9kPFphHI9MzDTFzx0pmr9\/SDK+PpkVjWi+NmhmIoZXC4jSIhZiELekdrse0DJM9yfZpvh6o9sssF3TM0aQwntDNCYQbmurM\/C+qZqtdPmQ5wG9Kk0mMpt7v12wNq+DUsupaF88pORFYvxgWQyv+pHvnQW7dT5kzb9vG56ezBF+i4OTs1Dp3Gy7psThEPv734+f0nHCEeLDxHzPE5n5hmPu5Qf9z39aSePREbp9cXee\/zXGsrHODQLyKICr6RF1PrH++ophbIaLsrHd\/uhZLTPMKxjMCqtl2GV+NjMBgtatCz9eCL0Sh+fD+rWHeOgVps\/pUQvIS9VaVmNxGizR4Q\/nbjXAYyd0eF15YiDm45JClYp8sesKbR9tevfrd5vb7IzE1+Ae0EL9VEh3Im9Lk+mvDWtPMG7ENGo2X4YRFrSBumrZP5ClX2Ri8Uzyx2YHt\/W1G7cDlUcOd0\/MAzeFXmud2EAPrEDWSz19meBwJ7FGUJuBjKdK6hnUmdnecit3tGFJJzRffp2N2Vp+6AUbRBob6Owuneis+nY4vXhvyz1dXtHH5TmNM+kBexqslodHDtpv59fg3lg8qmjRPSal\/cO4V5xGY0LsPdg343JA7TiKbm1M8wskh9rcKmrbm+6toTUmpIL8sLDWqgSi5PwJfduD+vR3zAPibyygdXnoTNSiCkQl2FtykvKWuQTTOydTZGY0KaurfExTesu6dLacBuDpnO3JSsNDdvgo9JwGqKKVso3jH5RHaKj2g\/g4Qh3RpW7sLXwONajykeyH8OpplvvEFb1jKfwC9rD5n6LCuIeWubzLe5XZ3\/KD6VTutPS5w8ya2PhEKDubfAXhiKCtWdkI\/WXb7KDKhTnC5ChoWKO9EwB+0V9pYTzpJMc4QJtmj66K9gmw2vtGtoHKsm1qb6b9c4gq0MFia+qkMAZ9HOLeYwFiF02kA5NuQaq6dwTgRP29YNT6uMiKxvSSQimRdDZas+AmTHTE4+7BXHQILKd8cfhqsuZaU3sKAXymr\/+GUFQYRan1GthUfd4b2rlkxKbHjnEKXAFswv9N3\/pn+c41Ww\/FToX0P\/Xewq08c5YMWjU6SOCP+WA4gBV9bdGQ5noOXY\/zA6I5macI9R8Iy8mjd9HrK37R+Fu+scXjBOXJXrN9VXC64WQi5hqDKWrzFPb3equDwHpbwuVr1mjUFlZ2u9Mb\/919ZW9UrtAfLEtqNRBj+v5YnYzc77LfvXQmRVCPc50nPaWBaBuAsmM0TRtKt4VKgS5SX4evVKDOxx7gIQcm+SAZi80K\/jlvfKsDf91Ix6gK0QpbJ+gO2ryGEOUEBQXuwToMt6dmpmluOcGxyohdc46dgzA\/U3JBw9PmSCTbd3lA8r8MB\/fuDiXL8k0jlIase8IK6wxzj+kgmUVrfcNK7f\/ZbnkINM8vtN7w5IVsZiL3BTU2NJh8HNHyIs2OyNC4CifGHhYW8+sJPVnq0x1kqRY\/Wllj67u5l1Or2DV4+NivMdA1lKNrhkt4iYzq57xHKgR6pdpTlLUZh+riE+bZjnvUIT1FmeOg1QibwsiSaoX+qCt0RzA3tgrF++JZA0FizRBwlq\/Aqm4soHn5yzEuFAyetvbwSSirx+8b2wI6TivT\/pG2Ys9uUieJKHUheIaCFJlhjgnMmn6a+6nFRovRzTAxWp+249t8o36xn5hjX3mRVT\/Vg47JQ2agm7bWitENEuQ0fo5xGy2yxSYTi5Q+MeFkkCy6y\/qzDUZUglE6u+6qb3hZLEcR39rKmpxgYNtobXghzhUpzjEbyFHqxKOihlZJ1RrFaw9dseSsWKMuctkOI14wzvgzBej4GFJpM6GN5RcfNFwsM+LkgT62XgCNzKY7Gic85Dn9hIQhMB15RgMEww","iv":"352d7759a02806983b668451fcd3d48c","s":"55457b06f8ff305e"}

Last year's financial losses in 2022 were most prevalent in wealthier regions including the U.S. and Europe, per the report. Image credit: UBS Global

Last year's financial losses in 2022 were most prevalent in wealthier regions including the U.S. and Europe, per the report. Image credit: UBS Global  The U.S. represents the majority of the UHNWI population. Image credit: UBS Global

The U.S. represents the majority of the UHNWI population. Image credit: UBS Global The top 1 percent of the wealthy population declined in wealth for the first time in 5 years. Image credit: UBS Global

The top 1 percent of the wealthy population declined in wealth for the first time in 5 years. Image credit: UBS Global Inflation is predicted to sharply decline in the coming years. Image credit: UBS Global

Inflation is predicted to sharply decline in the coming years. Image credit: UBS Global