New data from global consulting firm Deloitte shows that luxury experiences are having a moment in the sun.

Insights from the global consulting firm’s Global Fashion & Luxury Private Equity and Investors Survey 2023 reveal that 49 percent of investors believe that restaurants and hotels are the sectors that will grow the fastest this year. After a slow recovery from the COVID-19 closures and halt in travel, it seems that business leaders are betting on the industry’s rebound.

For the eighth edition of the survey, eleven sectors were considered, including apparel and accessories, cosmetics and fragrances, watches and jewelry, furniture, private jets, cars, electric cars, hotels, cruises, restaurants and yachts. Company financial reports and press releases, major media reports, Deloitte expertise, investor press releases, online surveys and interviews with C-suite executives and private equity funds’ senior members who are considered to hold “substantial knowledge” of the fashion and luxury industry were all brought together for the final report.

Hotel hopes

As people return to vacation mode post-lockdowns, luxury hospitality is experiencing a boom in business and investor interest.

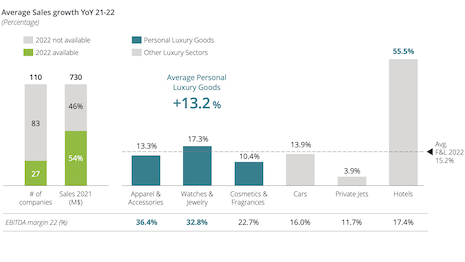

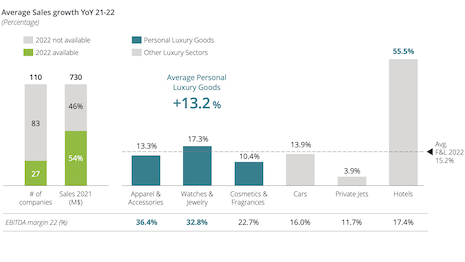

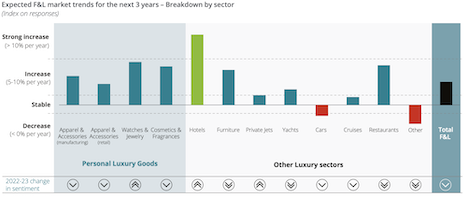

According to the survey, between luxury apparel and accessories, watches and jewelry, cosmetics and fragrances, cars, private jets and hotels, the latter saw the most growth year-over-year in 2022, revealing the strong momentum the sector is gaining after set-backs in 2020 and 2021.

Luxury hotel brands thrived in 2022, seeing more growth than any other sector compared to 2021. Image credit: Deloitte

Luxury hotel brands thrived in 2022, seeing more growth than any other sector compared to 2021. Image credit: Deloitte

This growth is reflected in the number of deals that the hotel business drove within global luxury in 2022, accounting for 33.6 percent of all mergers and acquisitions made. Ninety-eight total deals were made, an increase of 16 compared to 2021.

Other sectors in the hospitality category also saw bolstered deal numbers, with four more made in the private jets sector and eight more for restaurants. The sectors each make up 3.1 percent of the total luxury mergers and acquisitions made in 2022.

Total, experiential deals accounted for 41.5 percent of the luxury's total number for the year.

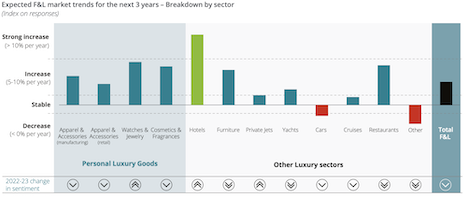

As investors reveal their faith in the category, Deloitte's survey participants picked hotels out of the eleven aforementioned sectors as that with the best-expected performance for the next three years, with most stating that they believe the industry will see more than a 10 percent increase in growth per year.

Business leaders are viewing hotels as having the highest potential of the luxury sectors. Image credit: Deloitte

Business leaders are viewing hotels as having the highest potential of the luxury sectors. Image credit: Deloitte

When asked about which sectors that were most affected by the COVID-19 pandemic will show the fastest recovery and grow the most this year, 28 percent of respondents named hotels and 21 percent said that restaurants would come out on top.

Cruises were ranked in third place, with 7 percent stating that it would grow the most in 2023, revealing that not only did experiential luxury outperform luxury goods in 2022, but the segment is expected to continue to thrive going forward.

Despite this overall endorsement of the hospitality and travel industries, in light of inflation, hotels were named as one of the least resilient sectors, placed above cars and below apparel and accessories. However, investors have more faith in other experiential sectors such as private jets and restaurants, ranked as third and fifth most resilient, respectively.

Exploration is exploding

Regardless of investors' interest and perceptions of luxury travel, in today's market, it packs quite a punch.

Vacations are multiplying for consumers, with leisure trips permeating all four seasons, rather than being confined to summer months (see story).

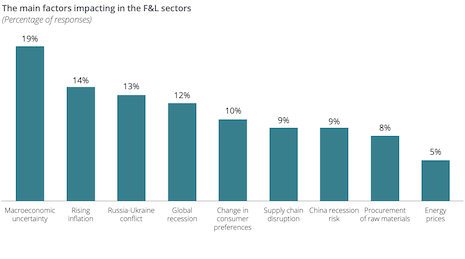

A range of conflicts are affecting luxury brands and companies around the world, yet consumers and investors alike continue to spend on hospitality. Image credit: Deloitte

A range of conflicts are affecting luxury brands and companies around the world, yet consumers and investors alike continue to spend on hospitality. Image credit: Deloitte

As people make up for lost time when they could not travel due to the pandemic, not only are they getting out more often than ever, but they are splurging at higher rates, opting for luxury vacations rather than luxury goods, a trend young consumers have especially sparked (see story).

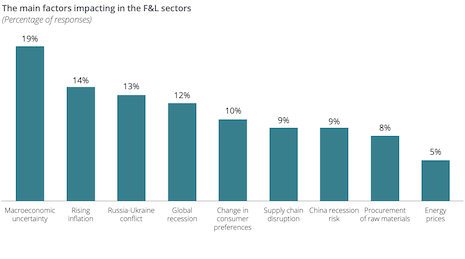

Whether because of a desire to post jealousy-inducing moments on social media or a shift in priorities post-lockdown, it is clear that luxury hospitality has staying power even amidst international war, inflation and supply chain disruptions.

{"ct":"BNLskGtAPzUHOQgRXwB5uQ+gJfRieLe7LgPGDG+jR4Lr17iLKWrKrtzxVlVv9bHmOLq4PIv4gy5OeT2U2s+6Drx0BWUBys9UYNjXsCshBr4CfK1Naj1wNaLQIRQexG19D6zx0GnPBp1xOl4ZyTspfFhCbPlvfQDX8CVHCZOiq7o28vvBuxuTuWoHnZu4P6+gxsDSHqOetELdv0+TNZUJ48zb4Re9VG+ib3xvyKV02ieRyieNbG\/cZwgYkcMdrwiYoP07EEzfYVfUgQ8aMH5Uini1FStU3LdIF4bK5K57m9bzREE2aJ39j3pp\/TbbIGO70WUPK+kCcoxkXkHYGMFx6Dx9m1TBwlcigYCqcJv58rIbPqBp78n6TbcS+\/dXSXQghdMZeRtYjfIT\/q5m3GZCNQ+a4eggxghcL39HBRrs8wHDZ9r7SW8R0U8tMHZsHNl9OTlQQKSE8nLgm5dUTNFpiNcNKv938YLOLVLUVrobGGsU\/PwrgxzWenSXuS2z7ioRTNy98qu1KBwf2ZTj\/Jy6A+bGp+sHBPNB2h1Yy+1ox7EEbJJ+AIbM5kPOfDNCoJznPEaCVqB8H+uiNDBQ7ZOWBFYcmsPquQwi6x9TE+4A0+xzHoaoIkOC0W8qjGwQLQ9ESs4ZgS8d9nXveCmDdP2HlfLE\/48jL1ufYwzBoJm2NihNzVlLFVb4hepLge7hPRORXJRnndtcliQO\/WQNkTDPGQhwul7UTXa\/xtUDVCE1CCf7KCFihdxid\/tUb7y5YHuv3aAGjvLU39dJTeb9RQUrcwBo7vzSnyaX2qLOYeZnkPhVrgANvDrFjkrlkrabi4ECZwThTKVdrAif15r2coQ5AKER7k1ZKJGSyrVtO1Y\/iHkMx3B\/jQ0\/G0v9qoeLJIEjS\/PttXRVBXGEr1Cvua8y13AaBMHhQIxX2oCNqebPRgg3KsOHnN1CFpQ71ukb6pcG3D2fAFcEZO1DNxxSHE9z5AXV1tgCMvQqTinOZtEWJeBQnDoxMa2Dy+DmcFh0mvYeRg7ga1h8axhth2f2i4VkIQAvfekd5O5vVfOkXxW8GH1oK6nlNarx5KROdiKYTxKxLEXuiRQCxmGM4e9mLLVo4QK+ORu4E1+Q3MGwHI5Rc3Fq\/eGhD7D8x1nr7fAj93Jbyd4H6NPA9msr3VSgijIeXEtucJQ0qUJv+aJvL5\/Pg4cGCUYDorGt+q+dOGzYCPWI9sGbW7bLgtzAyPgq6E6kGcUI1GTJeFjjl6QY7iF+F\/o6g8WK2Ne\/YHe9C44t2NTRspxLEtv9zX6\/TtXRTNeXxhdiAs+82eTZVAfzr++340arSq+uDQqXecH5sbZGUzuJXRydJb0FX0noi++yXMNrF4IHktDJdkSN4rrmFktCUnGfBYNjaVmwN6DhjMD\/UV5PxubhqjyVnbF178GnaBe3oICgpn8OXl\/cv71v0aIH6B9lgyPbVpf3kXT0AvmHRpSDz3CqilxYfPuzfMjMeumVZ4cHWEGHDnrXIX7r8m8yjVjk6leZACt1qG1ic5ppiDDV96XwNmXVIR6IRkZ9N4ZT571ruYGUmx7cXVeNZcgzqaUFdLA8+huCjEjeysAtc9PEbi5e1LQB4NKajAnhDrnC4XsaWFqCBCqxGwI+kHc2KUs1cmGhSwWT\/o69H9wzbOVF0sY5PtrU0h\/wig5YkBU5xq\/25PaG7GVSREPQcpjzdzUOnfu7vIJOS\/tVzdaD8QLVKSnajqXBEuM0oag00Yx0tHBs9bUxyuznXj05pHG5IoAy13Fw9MLGNtFLgQHBrdAWj21zUCmBC9UwRqzHzAbOqZb6eJ2NTaDwzkWvoEUgdH43RU7qSNp2GE++sAEuF96ppNBX7KNTHwlEnAKJDeVl3QMDTuhSOiA9Rk0hbYK\/5dy3InQqVMWjx03r5ifR4nTz6Vvfsqyhr45WO35MVlGxtQC\/d6wEVq51D6WZJ76pvI8v\/AdqTREUFz4YCWoO7nBspYA79eDF3MTAoqg5\/F570ACBxke+v5DNntoOlzQg4qDXtWMOX22Q9IHdu5oTE1rUIopXbOypQxVZaIVkuO+rhzEhzef625Vvsiza5j22NGINwD8GF50LeD4O8J1+S0QQq\/Wet1JA8MEDmRwWkj\/8Czvj\/XjvMxCiCiKQm1QN8\/16gqe6vXHRB2R5ibXj7ayxAWJ7VuctE6MD7zdX4EscQIjcB93Gt2VXQMvLx\/hinEzqIRluDbULOlOjkZUzdFPqpPrlkWtvbOzPzZKpYIsTjYkSbCDfQ2Q19UYsWG5LY0M\/00UJAN+xTqS1RyPpfZIE6hRt\/HmGik5\/nn58Dr4GjS5gySozr5uGvqagGDmYj\/QgeYviBrKuIJH78t4Cg+rV9vrJCDwpTk4NIECLGymt2gn\/TiOLqopTYiIAgSTAkvugG6zYq44KnHIWbDJg8baxL+rkcgJH6pUtMFrbGmD2y+EyTf\/YlbmI+MeG9KvGDZFiMKQ5PstDXcfpF2V68q5QjC5MoF9yXfFMz7yQ1dqQ0eEwuLt6PobBR9fue67hr\/VN65UIK8LZym4Zx4vyQKZu6Yyvf0z80oYjHLBDHIuJks954hkOLc1Hwpwlm96amnM6rT\/B8TwzY5VDYfU115dv90crSlIdah4kimEh4DSShxgo3PfSYCFjlOn2bphuLi28Ap6Uh7KA8MABEzOEmNCsTpmedQSRop0qoaIBIYA8XvX5pijk1fYreckYga0WjjB6F1onBNa1t9w9sgfZCX9asQtEtwRMXwBRQWD2CcSurEc0nJKLOip6abYmsgIG9SnjhlqxBAE77uDXuHCL+ma5xdKid9pdgw\/w38tweaorTWywkBMHqqw0kk7UnfJWAB7kroF9mk4zFNX2cL0FGmnLh0mMRYGbBrI1trSM28eGJyI8CBQFXUZW4m++iV3yfFRy9q6R574h5Kgw4iTDURRuhhA7kF50Z4q+KjwYVwRXSHA+JAULNK1OxEJfKgI6y6KKTROibVd7PXFrYog34V5bK7i2buAKK9I28UKPyAnz6NBVHNUxs0US4Czh\/J6T5YPajj\/V83XyNYlm6bGECWyS7IBnypBp3IwsEiGQBdoGjLnCeeRYRg8f\/9fWO+uvfenKgmD3XDEjkAssAIBGI0DdSMjsuawoWXN9bHq3JfofHpPl2wZeX8+5ARVeZwB+05g7BGdIdm+Mf0AfZmCu5lcFxv5aGRgyjmLMKNLBl6lPCtePnABhFRv\/fLaDNet30Xpv4Ggfug6J5kh6JJOfC+XdrXQocwCsUjBj9WqJubNQQoSNNaBuRAS1LLygE5Yh7SpxuP3F26v54M4S58eGHiC6QiFAEhpK3868lXbmI4ezW4aUG5QzGBNhaXl6f9OiXrOoGghr0bT7EL58wmPFFONG9\/37RZyDPMIC3ddmri3HhIyZqgRrR2\/F1y3s7efpBgBymjKBRGecq7OELXa2AUbKoV0H8OtAkUv7zNZAJQVurkpCQt\/yr0RYCVhTEV+VTA+aT2IOYC0uYFbwz4rRHVGqrn2jiakucquYoidGvTGDOthR8YeL8+HHx308BHUHK1oEfTicrKVPqqnDUo0szkguqg7YAKHLO301JVkzCcQBQeJ8C5BNeQBotBEloxADMCKDB9lHqs7C769Y9tEWFNwIC1E9afYGR6vT7u4cEUmIAly26IMeodmaz7wIrikiSgdLcDf+lHhesvFebStMCgqMWTxZx\/PNhYVLEEgstwJqWxWxZP1AsHc7I+aThoeoX0iPxq647dHPAjLux3iR+VDanN765UvyQ3AkjoF\/PXh0S9Zd60k9me6\/jkg1TpqnAQYXsFATK+MPBL19BESNDq6BsSh1IqXcFtCsnBWSZXBh6lBBwWod4\/w+mNAvlrabh1DFrKNwoRcm8bxxg\/WdBrILHWs03VzEp5pLgY5zoFTiu9CBku3avndAC\/qKkgjPGVrVPEw0hK2wAGzpjgphg\/RLWP53FJmb6vWQt2T0j\/yx4j03CZlCEH85lght+cusF21PmD3MDyyyOtR\/ArjyGl9AJi6ZEp1NzihkbuIgQs1bV3djNhgaibMpa9lWSWKr\/wEnolccvsd6trzjTFCVlQNickIERAQlyU7WbOJqtiamEKgA\/1GPfR\/H24MfljhE5s0W8bDC90qMaGWwDZvmK\/TzA9tkTqb7KzS\/48dSM4abYxi47qfVD2\/AmD2bKpi9WEEWaE1+7WDmHIHHNicZFJBDEFMwOVF\/wcW0gNjILkjfSENk0F5UNYPXoFEaNtrLtq96VRlMR1PoKLdxKcRZiR8owYqBYCXRJTYLiA1IIFvKXKwvL131V\/5GmH4QGJi82426ohdvq5muW0jKvHOGI72F5AJfJ8i45hJPC3HhMm2oE55K39lhvjMFdcvgB3VGxf6yZSuSwewSGi895ZEUMM+HTffKapySt6VxddchaNoeejQkr8V2Onj6RHIjMJhNQ+vwFAKvsg4ivneaehAzv3w1FUyUUqa\/1VS7fQaqquwtEKppIWmK9ESjMFw8NWGketOC9VKfKp\/S\/a4ZYA7dMrHmCfh6erjEEYQPKhLerVlReLrwE\/oo98AnpHeCP3BnspIH+aqZ6AU5G9t2hhd5kUGecCzPEAowe+K+AGGLnpIzUvWtV6Wtt8CzPLkA2jgac\/KJAdcUrdbonHpzIZ\/UGhV7nN2X1kT9OwBZBTGKdwF98o94BQbG\/95nPqOvLb\/mSfRf2YB3LwERbxsviApQi2rw1GxJDdeSf3MwgyXwmcYuwu2ZXtT0RU9fT3WqKeGRocXcH6mnEanaCckGuje45qD2XDweUMMEwetN9xTo2lksq+rE9SOmOmvk+UJfBVY6MwFMQHBwf2NZ1tZ8\/QMFD3vQgffdG0c21Vr1ftKuq1Z5WyXHLId0XGIexdEiNchxGo0rT1x0ouF7gYmDycPaDNofNkp8CuOki1sFUfcmlfxESFsnl7Hl6wbEMGZpwDWqI\/j56Uao9YGbEm3dSwW74DRjYmIuonr4BvOsnGqSWaCufybBYzPugVZWQILL468XgokvLAyiZcAzW0RmlmsYBiefl5I1cnssO7L5YjCQtkinByfuTDA8r+Dc2GkhZgtKHFfYhseYC9CY0Yl8wsVaGG+ZsvfkQIbmUJVLYie9g3rXuKlut4CR8lbiUM1oBrDKiE7WdKy0K5CVALFfQ9a6MRwARjg7ZdwdFq51IhyX4ZydbJf88Xaio2o8wTkpPa+PjPYRjS0NwN4+Cc0jvxwo+AgGLYhKSLiS46rYBab1qyI\/Idm8qNyeSgBSv7GQuNZdpUWqN3ATSTllOk6KR2kTXBrvNc+FWIpqUpIkIneUFpci7B+InFgJ60GpFiimU9v5cFjEJHgev18GOcPXtZX56hHXfNmsDDD99qiZH9BMiuuZH\/Et2H+i5I50VXMLAA9AUb\/gzg1GnAX2tt7ZCrLW0XdUXJ2heP\/HErveIBzriyHD9FTKdq79+fIZJRjJH14DkqJJjb+ZqcWSygFP4rFSOd6OHdZOAhCZ6gs8ptXgvugf6B\/XHA33+rZiZsuFMMUsHewe6e96NtTOYc\/gUjwL2jvYcK7nax5tL07ptyMRk6kQy\/o6+K72yBbOUkemsLHHjnvrfBTzHLfyMrzOgn\/Bj2FCJMXq0VZeSgBa5CzFC\/F+Pml2uDaEzjvk5i6hcVESDskVVCdzB\/fHkNqnm3CcVN2KqgdFPIe\/cAhzHPeaYz2T0rpj5VGi\/Zwc5ylTZArqWeebXlpzj+i3yj0jjUzcspE2zWxAUkVIhDTyopW5+d62UUQN7ckeE4HNOkCVTbxuB\/2olXscIFZAoJmXWOsYgi+nmUbzE18U5tm\/atdX1FtzgTlikvnfeyozt1LMOXb+GWkUIPOQgFK9e+5ogc2yCyPDeBfHn\/05ii1aTnfrZmjmEh278imNUfbxtq6PK1xn9JnL\/rrHQMCauwaDruSxHQuqLLLvp\/PeOhUgmf8uJnvejhEtTxT7bRREKCGxzj9qAjeZCLZRznKqw7gVlVSQoHMKH5Q+ayoV6WvmRhC7YSywHSxoQvJmPMufvNaNq9wU1lkn0dnL3J0nRL1uSCzYOVg0tTJ7Ut3IGZBHN2UbF1949ZkDcx7JwSZYvi+7O0JqFL92eYNTsU6\/c+GUg8S36ZfAJ0KQvQyevsU4t8nkKP+3UJ+Bur5+XFZ+ebA3IWS68ZkvERwwwL98cBJ8OwxIFwUvjmMFmRZcnl+8aATZ6I+FLMquirb7IRRzTjlnYu\/LgFPvxY4UB9BKwOgK6Tv16\/WpBBtSKU9Rfcpj1PV7bhlXDIfbgzE1UV1Dg4nNlT1tzFQgJMrparUJGdYmbIGwdtkXzYTKdyXBTX+QG3nJIIvI8RSwiUNFA8eQg7TEcVT1ynjrllaQSKBJ8uSKOB6BFlgu6vyc\/45VBsZEvhbegDX6koA5P1YBydOTmcGaR6CL5PQALfoa4bSvZfv+afdO64IafmVjzai0T5b2WLmLX1WlCgdtv2ahisDUJHqWOSSjawFQrkVey52gpmxu+tD7AjCMSUieJpGsk5r9eFTHD2ZekbC44Qqtt1rv5\/9RNIPVv\/5LDEfFdBQcftd\/ViG\/towPnEZLVz6jtCTQ7+0iXrPWXRwDVPXg0lg0uk+J7udiXKmYxSPQXTt4Nl2Tdu5C8L6Mpagvg07p5mklxeV+iophVQKReT7YSRm6\/Dfm3Gg+S3JbDy71yD\/f1DB5ayqpW3wg8muEAFNv2YIAP2Oi+Y5YGND\/j6h5lBe3vF2bvuwPrlbeYKzuOjimpFyzSSVugjngEFiejwox8Wi3Bn9sd6vu0cj+Ucpues3OY0yW4SKjahknG2z07PCp8XYds1vvocrzmMoji5zPRFoqYr1VhCjtEKcGz\/idRCwf8z6N8tc+Bk25ynbVeu8G\/ZZg8z3JKvq6mBJy0AlGVt8w+hAKqnN3QnOdNTjICA4lnEoERFqlx59\/ac7jfrYCg5VtHlFN5F7WuKRgbrdpgE0WG2ZqyPUcuZC4BLIDIa0VkjOta2O8+K6JERC98t5FWtoY16Iy28mXvlweqS1i9mgfcK+axsPOM4dzXDBP39QHBBi68aGCkyP44OtwQKPCdc2bsyWQlHGCiOvgNZkNQwLjVfHFE6hdzN0B+sOm\/gfksvMiBikHoIQri7fh+Z3rgExCmKRqz2h3nlLCxv7MFbJAFwaARx\/0UaYJpZo8q5v+Qn+SFMFrBbWdiDwQJZCDA62aTuW\/rv3ngXGg8eaq1ZZ879SmePGVDK8xfZk4rn7ibyqtvo56gQqDMjvmhD11dR12J6bEo0rv5yW8AYzoyqFlfWtUEyBcQE3rMJFv\/g0SGSljMXS7GKWNc9XvNNnAePOOSdNsTJIBhyAX5BWD90mcD9rQabiUmFQtU3\/NxeIeQr6csHukiAC0BWa+KaY1uAJhTxBX\/dlmJAtfwduvpmTES8Dvf9NCWhZWuRrbzO9UD3c5p3p0oELwwHF2FbfFaNy6pwpjCcY0bZqbD0aWsAap0P7BIaz\/RMLnhO\/0qxcEL9LhaEVKU7MTzi1InNyoUJzD8ljpjVsL+gSfigtahP1\/cbOOfrPQADsCd8DlaWf4WOeiyPlmNEkqufyD5yo8S4Qa2bor5HvWXzQG5Fvjl5IMy8TUq2WT+yx6+8+qDF5hYcdwKoxt4DZMFUl9TxcEe\/TNRrG2Jq9\/BYwRMUiZHc8UpP9sZDoX5QEQ76BuvFEqHo5ggn8eryBLtG7d4kyszoMgPopOqPxazLcH++Px\/6OnRGnA2RN\/6T9R8GwSioRBH6AiiMHnMsqfi5JlKnbjho503KrsZ7kdG9dVNAyiX76oYD\/6xyNN\/73bfNCb8Or0tOPYfmN1B6pB6VVXGTN3je9vieosIOXoCViZsm2sUDQbSrACQOHAM0FT6RAfKPfod8bCdLjqiEsHxPV140DlNFo2DCPjLOMiYUoz+tXV2atQXbS1L8URpfOghnyuRXP2fRsAaAD2148zegkZy+Zfe+ZtEzdc4ocdC2HPq\/Ii6geQuMjjxsqmYGz\/eF3Fi8nTA\/+4ALhHfIuHoaMTESMBTJcls4d4nW7b+iRLbDw4sKHBlQ0DW4VfkO\/nYXpylXi1KefmkdRoYOYdliI+XaKVxg\/c54o1Z4mCMIP9ZAto504FywBViBZ2oAhrVsIlZXzmkpS24H7CYniOqzDyXm4R45h5Herrz8pqYHRejyWUjMboE+GCa53XiQ++ofcs1zdJkmhfDsGBy6TYBS1zqDh+0C5rWrNMivjYww+KChH6tyWIQCtJ6j6zoI9n0pTcnkvWmxry2JKldVQiS7EA5kU4t0Y4YKLsYa+vpaMH5t2n2BizcPgLCeN7udszaXWIJpQX5CR6Z5BUy58XTyhcFAf47krbHYnncowbmvQZTLeWdZXTd0P1xI3xn1CuRJdydXQmm4XsQ54yNvUmoIFmuWK3dGXQso+2IHZnifoufNsAmF4K2sV2HIihZw==","iv":"e20ed4421cb2fb00fbd2ed3508df7cc6","s":"c037b764121819c7"}

After a slow recovery from the COVID-19 closures and halt in travel, it seems that business leaders are betting on the industry’s rebound. Image credit: SHL

After a slow recovery from the COVID-19 closures and halt in travel, it seems that business leaders are betting on the industry’s rebound. Image credit: SHL  Luxury hotel brands thrived in 2022, seeing more growth than any other sector compared to 2021. Image credit: Deloitte

Luxury hotel brands thrived in 2022, seeing more growth than any other sector compared to 2021. Image credit: Deloitte Business leaders are viewing hotels as having the highest potential of the luxury sectors. Image credit: Deloitte

Business leaders are viewing hotels as having the highest potential of the luxury sectors. Image credit: Deloitte A range of conflicts are affecting luxury brands and companies around the world, yet consumers and investors alike continue to spend on hospitality. Image credit: Deloitte

A range of conflicts are affecting luxury brands and companies around the world, yet consumers and investors alike continue to spend on hospitality. Image credit: Deloitte