Recent findings from Look Look, a marketing intelligence platform, point toward major changes in consumer shopping preferences.

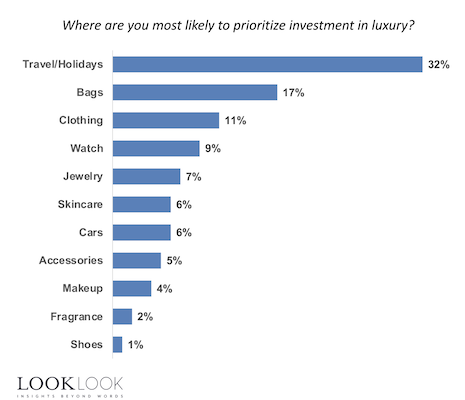

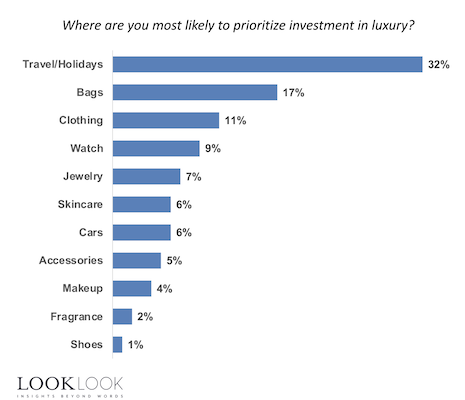

The firm's latest LuxuryVerse China Pulse Check looks at the mindset of female clients in China and the factors driving their current buying behaviors. Report data shows that less than one in five of those in the demographic are prioritizing the purchase of new high-end handbags; earlier in 2023, that figure was “nearly half” of respondents, suggesting women in the region are placing focus on long-term investments and memorable experiences, rather than splurging on personal luxury goods.

“Jewelry has long been considered an asset of value and a hedge in the Chinese economy,” said Malinda Sanna, CEO and founder of LookLook, New York.

“More recently, we have seen the value of branded jewelry rising in China due to the growth of luxury consignment there,” Ms. Sanna said. “Travel is surging domestically because of pent-up demand and the desire for uplifting experiences.

“Asian and European destinations are preferred right now because it is easier to get visas in most countries and Europe is considered safer than the U.S.”

For the report, LookLook sourced responses from 100 members of its invite-only LuxuryVerse community, which taps buyers to share insights into luxury products and experiences. Survey respondents are based in China, ranging in age from 24 and 42 and have spent at least $5,000 on luxury ready-to-wear, $1,500 on fine jewelry and $1,000 on beauty in the last 12 months.

The beauty of luxury

According to the report, women residents with greater means in China are opting to take trips or invest in timeless jewelry pieces with higher resale values, versus cutting spending in other categories.

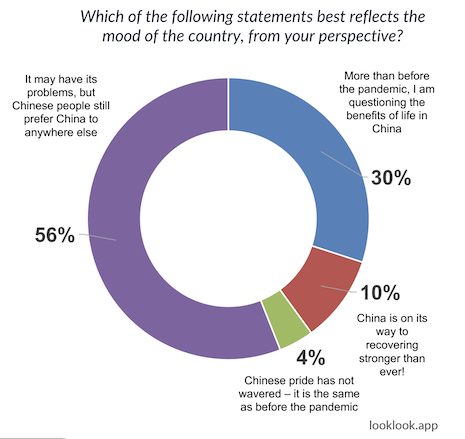

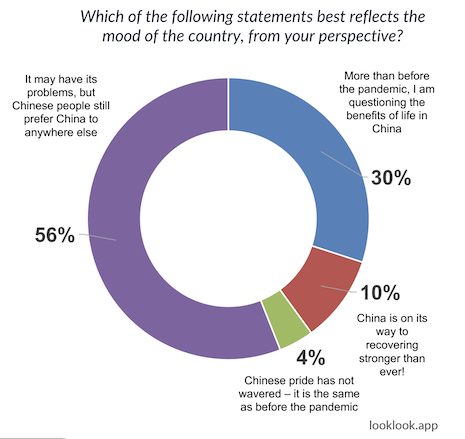

To help contextualize results, LookLook's research outlines the social and economic elements fueling the purchasing decisions of the surveyed group.

The participants’ attitudes about living in China, how they are continuing to travel and which brands they are drawn to are just a few of the topics explored.

Findings track the evolution of female shoppers’ mindsets from the start of 2023 to the year's end. One prominent theme impacting luxury sales appears to involve the growing support for homegrown businesses.

“There’s a growing interest in native beauty brands among the women in our LuxuryVerse panel,” said Ms. Sanna, in a statement.

Travel continues to be the most popular purchase area for luxury buyers in China. Image courtesy of LookLook

Travel continues to be the most popular purchase area for luxury buyers in China. Image courtesy of LookLook

“The Chinese luxury fragrance brand Documents is a favorite and rivaling Byredo and Tom Ford in terms of price,” she said. “Into You is causing a frenzy with its 'lip mud' innovation, while Perfect Diary and Florasis both continue to wow with stunning package designs that feature native visual themes.

“Our China LuxuryVerse study reveals that some of this is driven by a sense of superior price-value versus Western brands, but the real source of appeal is in growing Chinese pride.”

More and more, companies are highlighting the nation's culture in product advertising. Personalization is also resonating with Chinese consumers.

Recent data suggests that luxury brands should integrate some level of local identity when advertising to women in China. Image courtesy of LookLook

Recent data suggests that luxury brands should integrate some level of local identity when advertising to women in China. Image courtesy of LookLook

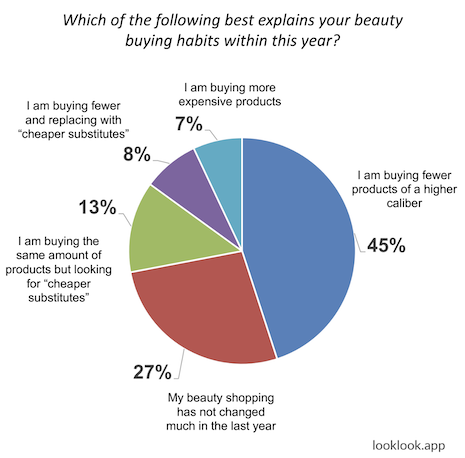

The global skincare industry is, for instance, responding to the unique concerns specific to local climates and customs, including skin sensitivity.

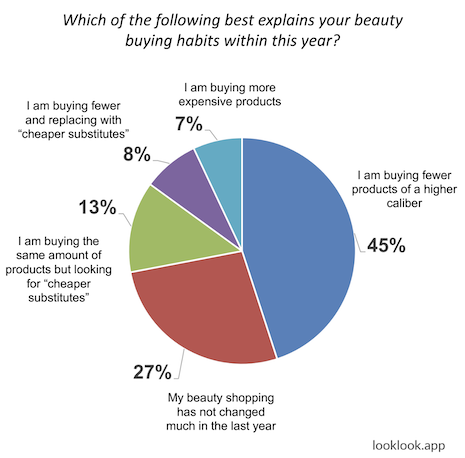

LookLook's data shows that beauty routines are also becoming more streamlined as those who can afford to buy more selectively at higher price points. Though the panelists stated that they are “buying less” in the personal care category, they state that they are doing so to “buy better.”

Research from alternative sources falls in line with these sentiments. Global managing consulting firm Kearney recently released estimates that Southeast Asia and India could garner luxury beauty sales of $7.6 billion by 2026, with sector growth projected to nearly triple over the next eight years (see story).

Most female shoppers report that they are streamlining luxury beauty buys in search of high-quality products. Image courtesy of LookLook

Most female shoppers report that they are streamlining luxury beauty buys in search of high-quality products. Image courtesy of LookLook

It appears that APAC countries are climbing among the world's highest-grossing luxury markets, making marketing that speaks to shared values and culture all the more important for brands that want to thrive in the years ahead.

Looking beyond bags

Wellness, freedom and serenity are three current priorities for women seeking luxury in China.

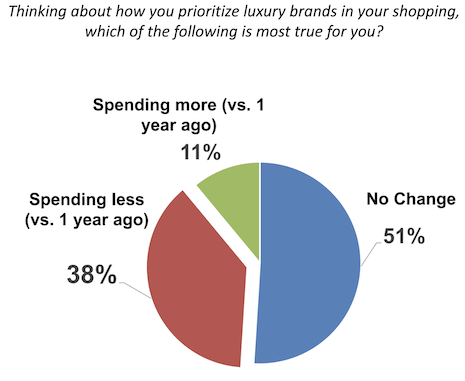

Many are predicting personal luxury goods spending overall will soften this year (see story) as travel and experiential offerings take off (see story).

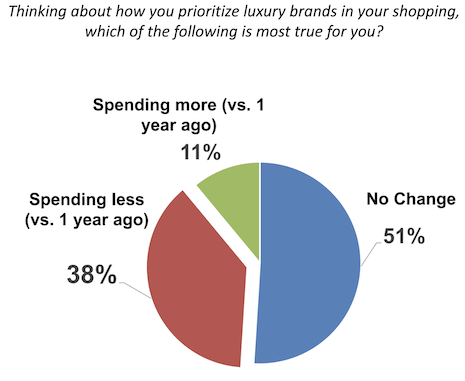

Though women in China are feeling cautious about the state of the global economy, half of the panel are still planning to spend the same amount of money on luxury as they have in recent years. Image courtesy of LookLook

Though women in China are feeling cautious about the state of the global economy, half of the panel are still planning to spend the same amount of money on luxury as they have in recent years. Image courtesy of LookLook

However, according to the report, although women in China are feeling cautious about the state of the global economy, half of the panel are still planning to spend the same amount of money on luxury as they have in recent years.

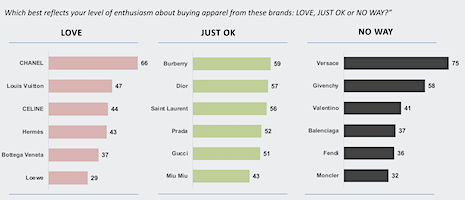

In 2024, these purchases will be selected “pragmatically,” based on what is determined to best hold its value.

In 2024, respondents' purchases will be selected “pragmatically,” based on what can best hold its value. Image courtesy of LookLook

In 2024, respondents' purchases will be selected “pragmatically,” based on what can best hold its value. Image courtesy of LookLook

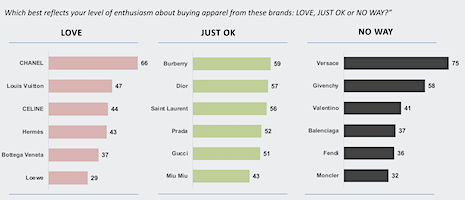

Pieces from French fashion houses Chanel and Louis Vuitton (see story) are among the most popular options, considered to be strong investments.

Female purchasers are additionally enthusiastic about jewelry and watches from Swiss maisons such as Rolex and Van Cleef & Arpels, which are also seen as timeless assets.

{"ct":"PPWHWHSWwIc42dzi6KvfJdhxZES9t4bA7Q8eH5LTh2I4D+tNH\/a9MciRtigAATjEGFXGBq1wCqeJR6QO7WETXCnKIj0s2MLKdJG6uhp7AK5eL5rUX7QHzSZYpsJAq\/LwfCWuQiiqWQ04HNQnwsaRwj\/itly3GpzMkZasgignn\/7nxM9KVoLFJKGMZrL7IfZbhr4Cej3Fub8rZHs7H5jSXpStfsxMUR7ZbwN83bhX1vCjokcZk8b4SkivuSpSXzU1HcSX8EP4eBcBnNnxobDnfB3ZwWtzy+Z1usl6Wl2BXta5Eb0WlkOAADbevRjWv4JbHkgG4d3\/wlaGxksFT4U8qcFjlbIJRMiC0bBn3lTfquHKbL1zgGyP7u2KAo8meK6a4MuvKWpMV2YmocP3cIiZTUactgV3RM5qMhN5vpip98\/gjyofv7DrkREOOzlA0qrfxkKDy75jzggvv11nPgen6z9+aLOv8qtnC1I4edWWE3gcuEF7rEnbgJ1QN4RDG2U4QF1VgCLmeJl2M\/N8akAClHJu5JSRTYD97VO9U+9ugl20ul4lfyyCaZCMRZgQVMderRnny8WjkUURGmUNPtDNoM6ZChKulYSTN7t1JRqn1i7ZAN2wERub\/HgOFFQHQi5iMngmEQJuxjZjn8dcuzMdvZVpIaNbe7MSF0mA5Ne049ldSD9iwYYuYsx\/ljxSYMzMR96SJyc\/aKaTEVyYRoTZiWcMU3l94Fbzas+sxCEYuZJbCRzE09gkw8RoDGUx7goGMuHgyyxrWUU2Q+y6QjBYBmUNZ5e6EEcy3MIqx61UQPL9Ax8VNimuR4sf7Pdd3THrDTWDopR2EOrTESvXZvfscTcm0QvJs7QMeI4t+7DUFc0cv8I5\/MEICmQTELYXkWOwMy77RFX7gHb5uj93ud4b5QrOE92l9WZ7ipoUaT7Ez2dxN+35N9weFfgHD0pxZHIcyBrFdNPm3acb7k7YnvWd8rG7hZwu1r0JUCoxy0SjJgEAonEalTDprg2FQ0NOF39V09FVrTLI1H+86p2ugO5fE7Z2OgB0tutew9fuDulc\/KMxU8dzFSNzAcWSNvJDgEnO0Md9l+gtIztmeKMRQCfdOchNz1H3xtjdatdZJR\/Vq3kb4\/ybDElWmLTgmQMJRT6xe6tRBMjuNgjSA\/8UthhqL6fUp0hai7YN3NdHDrcf6r8KSNSX3UcYTQeZM6eLJkiH4iq5cqA1w\/zwdJ++Vb1\/kCoVj7zVlmzfF8dt9jKA0e7fbJysTyngSlJYnkB4xuJuHPREK6MydemGxwbvHEczXy6vxldJGfzIwt7+fCdl2CafTS2Wc0s4JrZvaqYAqsOjz1LDfxj62WSmIeeXtjUcZW+t1nFgZm9tHbXCuBQ44y1Sr4gIlIbE2W4UMOLeKhalxPcGHEd0yPY3e7KyQJI57++Vd2dz1EqnrROj8A75\/ZfHL+5jYu2\/yaICQqavba42AdSq+r67+TTmJWnUMT68L9eesw3hgIHoChDUSm+I7E51\/cpRQW2FmiJy2W0jsi579hsjqu8TagE3I+LMyeNGaB0HR7bL3N\/dmJvWOgpDBAJtp7LwqqL3kvRCKnTxb4JLNfhA\/B3Ob\/FHNyVwFWs1b22WGdfzkzEGRvdsWRc0zu+WMkiClk2\/FZFZQIJGMqc3VhmQQSdT71fYZRId3GSFKAhDyXWdCRekDsF6KhmYlY\/doW0n9MyT4splbJ0DJv\/ENleMjH3CjhwJbiJNxIO03fzQ5aPM2JRhd+5fwwcDpbmiVx8wIV5g8K0p7WvoIvsBWj3JNelw01kGbLoSg3FaINaL0XnxV0DF9xxFDWouDY4WeoN3jOut+Y4TOp5VGWBsOi2uAg9oSyokp\/nS7f+tqLxu4HzJw\/a8hiaNMnaJvKqlCOFVAxqqEeQ0MpxjtGX6Bn8yivsRqaVITerbK25eN4L\/CxpudtNhr3ILBYUT2R9KRlTDnxu2lVd4PlDN8GQoBv4b8j5reH770pRS1oZcD6VXMeY2I7h8pzPVGp5VKP64nbnagZwceSVWLi5dFxKbv\/MTuKuvP2jmqa4DwdzMbaOd6MEOyunVrFSMPob6cY29ONqKKNHXmJiwvAYjqAOBfS+h+fROV1WFvgV29dnFLy3J2DPxMJxHKoGpDfXVBKvnjlo\/1AeENPCfLH0MXp8aFYGqmm67MrvFia9DV8TjMp+Bb06BvJ1gE3O6by2MIB5gOhEfwLLCkoyvZ7BbNobpDap3aCgGesYZ+Eb4x3DjMjy27DVTrtM55kNcN\/69fYzZHnIVuQaB6\/A7bF84DwvJePNuW0gu8mhPsYQT949m2+tNNjlsohWdUwLhr5CPPL1C1sUtFEB05Lj7PNt2BTYF5lUbsSgwOjhy3H51bVDU2kwciS+MdjprBSGGWfQTnpsDzxvoIA1WB7MiKArQfJMWxIuV1HaHYFBoBFeCJy1ZHPgsZaWzPZFl9PXTkLWZaqYjv7+nRU7aek3r1KPwh+HAGTmkxgW8d2XUJJ\/1CLiGXZjlfDxuZA9H\/\/Ybh1IItLIuCxnynm7mwP3U4c881nq9wSr16L6bj6CZFoSb2d6mqM9+naID6w0UqRw4bsts9cat2gICM+TmKfIHwNb26AQHd29N+OA3fqxgiDHJNTGorlMYb4hsUpVEGa4s1pnhSW6MVthN0C8ir4aJoDtswlN5+2o8PdKa2GVf\/krA9MvT526s1aUMhL\/Uxc2LYzmAfl\/72um5eqtOk2lHJ9\/J3X0CtwJbg1YYa9ugrS38PJ1BEtQuIkrpf4V83sgG4M6JzjTwHYNSFTovth1S0MxNdkCiG+C\/Gg9sV8XKscW+JX48c3qK1bUltd\/j4PhTjkE35BuKsip5b5AMhLq3pTYobWKqIQY7lvvVjk9cjy\/pC1y2aIlqzvKP2H1qA7QgatyK5MFNKjcEK8d6\/FBn0TBbYQwMuKmfchlSFjfSW4wh77iuuWeEIohQr3Xsgn5P2Xd31VCpDsLG7DIEEypR++Mh8MthVpwHs8ZbNg4N+BbwERRPZzoq6vi+a\/EUFDub6KNaW89HqaLCeA7+mVsy1tAfZLbf7NmUJOw\/Ss0yIgOe6ju+g1vGxAgxrRuaoRiq3khLD6l3ovkN8QKbD4zRbh+rJZhEK3l+pGIK1733erwoxIdSjEtAFX9hhxYq2It1KznAWP3FWhdpB29lUQpN1NtbMZOels+8\/\/dgOzcbGe\/4LAJnY4tgCarIBTLDrgLpY4IkAJ+2u5sPR9M+sy56pMqYnGgOduY7wvjopJriWcKj9XOE1lHdlnJefue07Ks+BZ1KOAkuuIn\/jPAJ8U8tImAwzJOv1NF3G1JYEJURNVNmima3gPB\/sLYBuGzh84gs1UPs3hbGM+oOWx2LemeB8xUuEie4VV2TiOW1t8NJLqwLtsVOMY+36OejosM4IEGArNoqJP9CZEjBtLIvlWNbYlZ6Ma3TpD\/wXJmQqlUziyenC4tjbnWRPFj2WhKR40ECvLuNvVDN5AahYi812433smhEBkERmWDiaKATdIf2tHEVBgVC9eoFL5NuN4kUtbW4Ehsq4rv2N0rCuYpYTovtw+j\/1VtAwxa9ryDCXLBQfAvXIwmjRbbwg5Pi5zcWq9ua\/PTVXcsXg74b1un4lgBwCFhXicxmA4XdXu6v7YI+BM6rye6j\/N65D8cjGgDIN8rGlWi4tvER4H\/EL34xm4Be5MDC6TvGpl0EBzeAUnvAGOhYQXOQLsRrGaj1UReUMIukofmkpqn05ZKNG1BfHqsmkZ5JIGzcy8H+eWamTaRgk6ybgT\/bsI4u1spd21NhLMo00Faod1zHL2G1Bji2oxnaBQQuiuVz9\/hviz+wndcbfNG9F+\/4c93aXikj0x0zNwdSVNRgVte15mMa+eb0sYzXiEpyIciWZQq11BMSwOVVLNJUTC4dDCwvCWyAyNti5S2cVW\/jvyDtpUxd1KgB3YrOoQSyqfex+6mEf2kBLjgLvPC9DoDecoUzSE2UIV9Ngv3g9azJKgVjaVj7bwus2F06wSeDxVR4nPY\/Cz+BxKM0UM0NyiNz02WD+soETdqjRuJpNo\/+uzoAglshFNJAMiP4sJRI+WYJ30INGTr2UNYrhYUztFXhI+ZdpoW0AHG1WSme0bsZFnwpS6RU3lmreH7aY3keh1b4tqiaawAi1\/UIPpzJuKjiNgFteTy3SmwAvzqM2g4BeZRY6bnnEmbHn4aRmfaP7l\/Kmq+8u612wfj4vM2RmLewvYWbJL1lPfyGT2QofCmZh7iCHUgfIQTUNZbJzRrgxyZAHcsWzmDBv1wvFFbQVzYfG\/Urwoy1muDW2sczsf9JW6Z+UGSUmJPQSzxlaRkpE6c9DQcERtvknEV+23xgag9U5aGWEXUuIBS9Zt6mMjM5jenTeob44BV4FxGlztGorJ1idixVBqJbC+Dj6SfzHaOD8PjtqCiwQVxrd\/nn6rZp2WWRp6I3KzUP1h1FrhD2YlraQlvxN4pOZgYw8PMQUBsdkiAe+oLlM+tSTIPbTggNZfyW8425YTxXSTUyIpYuZSviyCyte1UzmCQaCZ277LXwgiG2wRaB4EseCOplJ6FT26xpYzDczE2iueiQ4cMZKhIN2ZeB51MexaQr3v5pFzp976KPL1xfl54GPRpVj39Epm6tP\/qSX099CM7Chb6k50DKCp2Y37lnzqNXYM37W2a3l3bh2YJ7mnVPi0yqqBUWiD0P7XmlBYq4F171C5KALKuQVJhbDyuixv2iNeZzwt3tRCrOFyq\/YSFI75twX\/zbd\/AgtNHajlBe0H9k9aK1iqtA906yc3ALkxUlXp4jSJl7aR5Q8YiZgl07AOo6OdKw+pzU254V55ZfKtY\/wdLFmlFj82sDrqgO8m7jpD9U5XSCdzT7RR2PZK1wIIHDUw1rNsnCxBTIHuOWzi880tpugDRWNabe9V\/P3G0OSTxjDdfDJC1VO3FlZVfj\/GmaC5Q5Ltj3wRgH0SkiMBigEHLkxelUSjSzlebGJhNgxD8t7wp8d2GYAtaaC9qoBHsWT0DkNplGTpu2X5os4pxQ1BTNyh6R+erFzk53MwAtf48sTdy4seSCeJOYkMIeoplVNprKMPfHWiCWhucJBB5CiwmCYORM4eQyNK1q4rUOMrtc\/LXBB7Qz\/qmNbvyy5ZQW8NByAuX\/OXZjGtJJkWO7njB8tVXP0BpZ4kxT3eaRrLY9l2NcYv56BRy9uZX+2ruKDQ4jmPlNoKSDO5awcVu3EQ1B87IO3sw8hlJtN\/ZhDkI2PVpv1lORgjnE001s\/e1RofmCL5biAeDWxE0sLCpBBIzWhFm+q+cIT6mrlAEV2NrqcIKbgOLjoEhWX9CBE64rCyRYBQ+5f\/ICwdSzFAjHlmBODXRn0LWuotqJtcd0\/VUHu6P7+EjPFcZ405tFGm7nILPkG6P5+rw++5HoZD\/Uygs1YO+71kk5MLR9cYClrdBVm5TD1W0jb+B3fJ+KhH3rwNC3AdYyxMfSzw5BNy0bdqHk9lE64NmiBoQ9LCY1B75pJI9VRCPg2nnKkXemzv3Z2Lp75BzbpHSEesNd0w9mPcUfXo5Dq2YFu7ERZWlR1an3h\/oTSxdP0Hz1bMgDsTXq6ifRHA60Zp7DskcPQrFM3WErz\/NAcpSWAssyi9rRAueq\/DsVVEU5cVd48G5+HdBJ8IAhyB9Fqwjl+2BpPG4HOWGH8fBtKArVHONl1GrJoACImCH3PLbA0LNlC3XvaFCQhjp014kSFhazgfVBsJyQVRseihrKqCiRXV283ftuizz9twUlQCKE39DNMU4HJQr6nEDuutzRY\/j\/+BZgghHMMGAlF5GPXPeqGLG1vJXYDz7dewmk57KIaUBqVubOT81jtBXKyijawCJ2dP0xNwHEPwferaSg71lEWTG21DYC2aGkMbn1plSADsbVOZIj4+UDyFkMwue7uawj5KobHIiD7potwC\/aZJB2puBT1b0F9n6Kk1vvBuZPHVQEr7OjiszJAxvkMpkusUAlsymZqZlw1oC8QfqhtwYkGOVYci4bLt1ausjm3rKymlHDYCAnzbGtXNOv7ytpkrkTXJYbgZv\/Lpo64hfoT9fP8P8SZfV1cnZ9n7JnoaBGhrbOu5NcsmSIfT26prnQFuIxRJDRgPRbOwdckEVC3WCSs25Zvos3faKJdMCUD9dcFRGpkS\/6d7Wy5nB8J5RPs4sXxixB79hlnAnnSwguHJPWIU2xGS5hKL6+s70N+xBnWpmlHyabMDvIH2wJQamzoe65ECGpytPGfb9+xLLrXKRVcl2D1FlxO8kZaDzx+NeKk337TRZUwHbXUfe9fjQ8QuTqqpNmhfc4+F2vQOvU8HXDAzO9Ek3LW3HjlqfzZaZoy\/qI7ukVkwH826KmM9RseIMSDjiheI0aKj8vH2VBYblyriONbjiXfldr4iZxy00LAJ9FBNhr9LottOheR8L\/vesYErx6odn5YQGHq6uhTkgpag\/42fj\/mlW8Kz9ICXEIKk64qtoH8YucaEkAGtRzzbo\/Lvj5LZH3qL2wlBSgq2Gi5Tw22ludnSTfbQVlgNKO60K3YL0avXSorWqFldSLOgSmjm6thSmqOQDzQGzfd\/Qd09lmSMeBRuZdnqsLr23g\/5WdF389QV98fBxZq9MoKqNXcVfRvhOHjy04WQ+8K2u6dTUEibVJ7zJ29+M6d1buV95yJghA8CWKFfHfulgM1J8V1OfHb8XHx8ARNDmmRojFqVtB\/\/mZE+Lx9kADPABI5HC5bJnQ1y1g6Fh6bRjHhA+SICmiEDR59nFp6cMTwgKtHKauKV13or199rygZ+AAnUyXrE9lBDHbUo4XStQWem+KPGiPrHwvrI\/OJhbEgwAXgV4ykMpdcUD8+ZkRMK8RLeBc85kUiYPndRFGSQOX+zabRbjBaxK97KkOE1UPbS2BOP4NdkGi\/H0bzndxfuaGN7BwlxUaa4jjVskqCNojdIbY8wBn9\/pCvCZCzB14VGlxU6NKohsSPgL2aUgY2w\/6rB9BNBOPaFcAZ6wCpshMOCi8vNUD35k+EaNJqzEH2yA+nxwaj5PG\/afMLVOdOrYLlWtIoWw6mEUxR01rniq3SWSGJyowKeOdHhWT2AficWh3cNtpnJbZXeUj7qc+7BAeAYwcZfLAacCTOUSCslf5+1+SqPz7dfjxid50JsoDwRQ99XYyG6Zr2IFCBLX7mqGBE2NYYsr8ezk89v\/om8BtxUIv8LrI7nOqHW2jynAzofxyN9SsXe6pBwpGoBE3hwEKXfZF1SBx3Ma\/PBhFaSt2\/GDGJRHJLvjsL+8SXCvkDP5l93bdhfSVFYr29vGgH6MsrGCAo38DC4gsSa8UlAw\/P9gTrDtLYx0RWatqubIJ58lj1\/QNqokJ35uHrrSc7ZR\/koRyBVKXWy0BE81WsYUt44w2DxmmWzW30LPRYITKEWauIIzkQkd1Ll9H74iRZBpnAZYuDij8WT2X1Yjac1aD7dqQ9qBAp58iGi5J+xbQiHfQIHm+ssqAdbsoeF4gpgOU1lVg4drqH2GMKevM38sc8SJMbYewntANxCqT8xzW1O6L\/slqNraGqy750c1zhgwuCmsb6WIyED9FwBl\/6Kn68RoFGUJJrAUYM3BPLEttN9PUhwnIV6EFjvnaIAEstTklCGL0aXGthZofXSxRCXuZkdYLj6KDDlTM583wmnBV3oFCiGvaeVxAQL2qKGKlhnY36nzq6Aw2wevy2C\/KbJFznEtIsNid9mjyiOj5MleZAFG6TJGGmjjPbbgycxkWwaDIyVNd0q4krV\/1zA+wcsZAaoKR\/btrTHClYoPR7nuhDKh3MnbjnUc8fDQdODSSsL6E\/sUJBWcCejiBVZB2qNOxIvJTU06Otx2vA9Zik2ZiLuUBvIRmhR7aYAz9mNT0XHLQ7lLV0KdtvvUwVhhzMkwXuoVT6scFt1vrWltvmPG\/a4LFYgYyTA6sQNAOwgOI778uwTva+jU5818g8JDfMyNRRoxKWsVi1oSPiTX5wDsh6L3if5yFwDYZmDTVwlSnd7lDAEwOvp7Gf2lj\/f7bMbAnijzuCT+cJC6pvZfmpzuDL5\/2WUL54wUeZqdVFnqNfT42EsLPWrRCG85BATlRKZoQRQm3CPO20KboJ29kqKUGKcx373IlzgGOvuliZxp6uaLYppW1fstIcGVtVfWW7NMW\/X9JNPrcOyEUU\/JDczQKESgdE428gEXslvHLcgwpMkID\/XX6VjmA+3VAaMW9majjAWrny8sDaG5zHXyqZDYxyDBB1CczilSMop\/60xHWstQj2D82LlZTyNQwtHWJ3ieFp8es3IEvTzG3drJn54Q6KitGdySp7+uESlKgi\/fADPqBL+\/RAHRPkoaNdBi4zUzgf3BezH7qQ28HFiRvE0VY1x5PgkNeSdxCqsUZoOOYLcDrQJC23\/UGZWt\/dJY86Yxiu9wYRB3TQ3xxEc22rvIq14b23tzXnPM7FxJu3wlze9OSgiwPnclYEw98xChX9IM4qbDtjw4IVVS68PjrGRax40Wk5OF7zKfn505OhkqgvvsEJoWxZJOaU+L7OxYL\/8C4PO+UMg8PvPJl1pSJCu\/WY+CwGNBw3KmQknMrHwg6UcxAg8g2g6QeGyuvxn1XQ\/MJJOWMXC2UKGVaAzQQHZ62JQ1cxmibChO8BjhbEs18Y9i8pRHjwmRX+z206G2SUqg5XL6M1Qv1jqKgvObUDQ86CVtpJpCWFM85o8QYvi2LsjGD98t4LVUU4I\/bh\/3yZpalas1kaX8gBerOWVFj0bCzcBdiVrlPc0F0U\/Zwq3mHpFmEO9xm\/+WNyVlm7F4D\/SpdZ8GCkHo+tU3iPYJmELsa0\/tOIwOH4ORxiouTK1WDQlGrhy4eqpmfYt4lLB2vzpjl42+FWDdZFxWW\/ER8Y6XYP7u05BpeKjrCA0hSMedSEVZxgXoGMCE9a0GcCKHNoqK\/wCWDMCaIemf3uMhY9Q3BPno9J1fwIoMxZB4gXSqszc1AHgByw2JK+NkMp1B5KmaQaFbCXmzTRDNGYFMrgz4+WJmu9JI4HzdoNCUMMu5CAreCuV3CbMUCZP3W8DolQj7uc\/m8HjAXLfgsq+WiRM8H0KBW8969Uc17+ue\/klFBKKMgqYfYRYrD\/mOuH7PwEUUiViwa02a7ULDslWNGjbo3CBsXftrtj1tWjvbaiodSEdV1Xcoz165QxAJrlbF9uh4v5F8HE2qW0IHEhs9vwERY\/9BGsuoqlqelM0Qlv3H44UI1p2j5\/X8j7KLLC8\/8zpIQ+BJoK4kz5SCrYIIwvkcJKTyZ6wzboULhQc79p\/vdZ5cDHnXkdanI8GPIVPul5jVVYW180w2H376uH\/u372cxGqhZlj5IZ01+dD68h+ytfoILBlBAC+CUFQ0+zaiTAOt4KbEgPnqxfml6McKWKKq3hYYlVkBwdo36TUMZ5tyQYRP5aaUvOPJ\/U932Av9yBBLM2v3KOwjw5IN+1yhsNi22wIvMIfkF+GZv7DmK3x2DRiVbRZ+DUGEAFS6GPIFqZ7OhUf6m9OexW2uNrE8DLE+oUbh\/ytGJb3iYg2z0g7xpwmnRz4LdSe7j1+zbEAftQ8umC\/yF4h61593o983ixwqLZxIYlK5ESA1xEBx0ob7cq3uuVJRT\/Pd36x8IM3zo8mLT5oYi0VgJ1P9MlFZ65KGoXnaWbkGJQ8NQ4LJd24VdrB7kr8PJ2fQVB5EaW+HDcLcfLqr0XRc3IpLQSyx6slqL5VFQZRZe2DiF5Vf5s3uYruLWOKisIfUzlv2aL9K6RVLOoySXpI77mclo8\/m6jR2fT\/0lwlSpia3a6sHnc0dTB\/s34bqHR6xabCpt9NXUriRkmPhZOxPzFHP6lyr14s5ZZaBrXtRJrP5TZ2XcPoOqC3IyK8awDPQAIKqIgVttfI0s2fKN36QyJcDl1QamrM9cYPK7GUbEM7ieNlClqA\/sFOD\/slsnkXIgorB6V854xEPSoVZeaXbbuhPFyDHdHoCXKTt6ziLOMD3EyCxhmC9w7WEze\/L8mQ4tF4HicU0JXjiVY5FB5r2zVqR3zC\/Xo57VxXXED5qfquIEmx5I4tWRW99a\/+X0PoxHxe\/y416SaYViuwHqBYbi1UsURGVfNO9LsFRMothMh5+ap2p7jAL80WIMor2BS9jUfSz66Nqc7W0O83OZ\/OeS3dDMt9KG7RPPIwcrmVBv5WRk2YkkQoD+UJqw0bFxqC3NYF8\/0x2aCUfNhqUNhlmbNjST0dJCJYvcXA\/5eNTPXpYbw2hgghUic+IzFaCxryXe8xxFGH66NaaP0Q31xtq6wMdDtSkmM6BdvHy2sJyo5z71bfBUGmYO4UH1dWGPEwTiVErt8LjwnoLGX5q4bI3Q\/Kg8yuVm54tO5aNumZc6VmWd32xsTmiYTatVr+qK4BxKrO5qpF8Y+KrV5Vq45SePxhPl5jCNyVbHNkZEhNs7sDltDBckIIsR1SxuUdIGYKuH9wyyl93EmnuNQRARp06HWdaZOlAlGL3OZvMXegbTnY8aBuMymxUEWjeuubFJi0q6MZYSWqENTi4aCm4ttFNN51U4EkVRWsu6ocspNJ+gvOxNr\/V8+Fn509nW0a5S1TBsn\/+Ka5X2R4dz8JKa\/oO2HLGiEWrNcwMBSTlsv367c41K57o0MPqH5iBfIcV9vi00wqaCkaq31+lPtNbEr+Gh5SQO+FSO0Y7EZj8AglI7JD6l3BYR\/tAaxhN1wQVZ1K\/Ttu7IR1XfDC8h1AtRGMEJtN1CNO9vKz+QoGq3YFaqgf5nV7MgmeHWAFmpDXRwInwX4YDEL40E\/MVybBRPPjpbWG69bgTWuXoGCQfrhOpq0URD+LughOkvqtcl+VNQIaI9FlgwDHrUX+eTSQRTk+kFM9QfCOHUYD1rAa98KmCbjrTHjO5zaNFmecoVeeI3LSScEPnkxxo9Hacwo3vRae8P9luEoD07MtkvC5qtOP46IBwY5msJ1yMcxSPiHZKTepaMyKuAQKEKzdFtmMMo6gocWzg\/BxggYB9nCDAFDWYsZV4bJSM9PyMXcyhPBDWZ\/22cBP91cmIUR+E5\/FUkSVPZTuNcfM5XFuXbdA5aYnTsqdGATck77YXXmlTa6TEUNy\/RgRp+z3TjSNPRdn6X6cqiWpLyy1yG\/3ebxhcwUvDRsEhlC9gbubNCTW++G1f05rADRYVf5pKM9Y+Mj9wtKMQF7jDyCS+xhj37fCkOody6W5am8zAc3QRn8cCY5ScoGLfihemqAZ4fXCGcEM3tl67c8gH0gZdgWXJKdaN1ZORaDrqeAKK4Pj2sbemr1ZJFZOWbKjkUJES5L\/KAAAF6lMEJB5sZ2Cug6RQtSKwzEriIVWP86IfDtcUM0oEl1k9f6zsupF1TGDNIln2BT63G4lPmkdm5Q7dXntaxRz+JnQxJMhig8tMoC9gt\/TvU18wC\/U4bmqn3p4jcPjKw70\/47nRk8QnfuswymhpZFjJG\/YkJutfCbv6DgTRqZ2XOY+CmfCLEJ8okByHZvFPoxKj3Z\/GBDrjlHDAExaK0E23aAlNAwFeOqpJNjITcNSwoAC7CxqBvb3UFCnEz4YmGbBjicc0J0hLvFzqDAfZx3\/jcBIu93093mjYeDXJ2YZ9HiWv05Hn\/CltTTuvDOmuxNaXmaMCUBX81kJodCAA\/duVcZndeIMa4gjrXQqzKOe5sQOSXPjGILyBpHxZqoYw4zvkagDfP9CzE3oJ9Xo1dbNZwiFRivoEpnF8NKLEoWPFubqlupjf+to6ZKBgo3DQ2+bJ2iu88B7tVm6nyGPcTOTYUQuWqj3wqIPXk8QLylssi5Yhnf81LhSZsGArYSH7+FqH1tz5aDYi9i4Y6v0qQbvNorkVZf8hCytoThQNnYIYorA9ITfZuqK4\/pGYnD80X+d614pPCELf2r6kTp9xeeS\/VeqvE0pPgZExT0Bpd\/NxsafLsg1HWE\/dtMj\/l09Dg5aXXvt+pHSif3iufZkMgZ6hRofyuchSYDpGwTp099yxX09Z\/44ZSCompQlwlNvR1J\/lHF\/eo+Y8w9Zt6CQp0qtwcSy32cp21cSO98H4z7uCg+SgZmy9FhcRMFDvsLR3G\/\/HaPm9ahBEle1hc4BZH61EheAyH5ev\/PkzJKhhdVA==","iv":"987d91af599d108aeb9a7e1c22a05b04","s":"4f70c0d0739df35f"}

The LuxuryVerse China Pulse Check looks at the mindset of female clients in China and the factors driving their current buying behavior. Image courtesy of LookLook

The LuxuryVerse China Pulse Check looks at the mindset of female clients in China and the factors driving their current buying behavior. Image courtesy of LookLook  Travel continues to be the most popular purchase area for luxury buyers in China. Image courtesy of LookLook

Travel continues to be the most popular purchase area for luxury buyers in China. Image courtesy of LookLook Recent data suggests that luxury brands should integrate some level of local identity when advertising to women in China. Image courtesy of LookLook

Recent data suggests that luxury brands should integrate some level of local identity when advertising to women in China. Image courtesy of LookLook Most female shoppers report that they are streamlining luxury beauty buys in search of high-quality products. Image courtesy of LookLook

Most female shoppers report that they are streamlining luxury beauty buys in search of high-quality products. Image courtesy of LookLook Though women in China are feeling cautious about the state of the global economy, half of the panel are still planning to spend the same amount of money on luxury as they have in recent years. Image courtesy of LookLook

Though women in China are feeling cautious about the state of the global economy, half of the panel are still planning to spend the same amount of money on luxury as they have in recent years. Image courtesy of LookLook In 2024, respondents' purchases will be selected “pragmatically,” based on what can best hold its value. Image courtesy of LookLook

In 2024, respondents' purchases will be selected “pragmatically,” based on what can best hold its value. Image courtesy of LookLook